Welcome back to Good Better Best.

We’re gearing up to launch our Guide to AI Pricing next week. In the meantime, we’ve compiled an index of 100 SaaS companies with AI pricing. Check it out for free, and stay tuned for the full guide next week!

On to this week’s news and analysis.

🚨 Monetization News

Coda ran pricing page design tests.

Bitrise raised prices and renamed the Teams plan.

Nulab added new features (“Follow Mode,” “Code to Graph”)

Bill.com lowered the price of the Essentials plan from $45 to $19

ExpressVPN promoted a 2-year plan to lock in a lower price.

🔎 Insight: The Good and Bad of Canva’s Price Increase

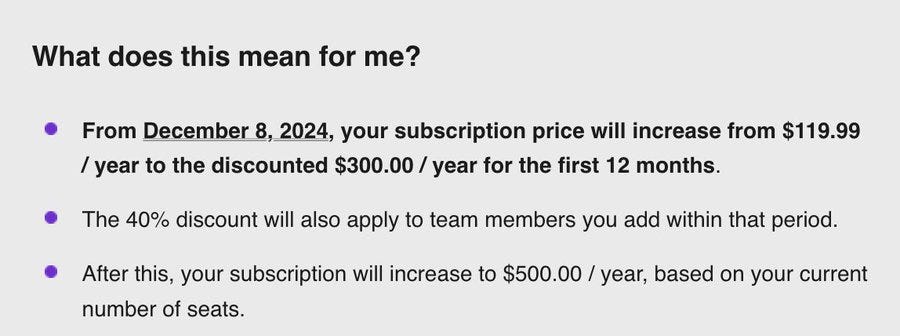

If you missed it, Canva announced an aggressive price increase on its Teams plan. Including an excerpt from the announcement below:

As I understand it, this increase only affects legacy customers who were on an old pricing SKU. The wider update for non-legacy accounts has been in effect since earlier this year. The announcement noted a subsequent increase in late 2025.

Between the lines: Canva is reportedly readying for an IPO in 2026, and pushing for higher ACVs in the meantime. Recent moves include:

Announcing new AI features at Canva Create in May

Acquiring Leonardo AI in July (a Generative AI design startup)

Shifting SSO and other features from Teams to Enterprise earlier this year

All these moves differentiate their paid plans. The AI features specifically helped justify the magnitude of this recent increase.

While I’ve seen some users note that Canva is still a great value at the new price point, the majority of commentary I’ve seen is negative.

Generally, I’m a fan of raising prices, especially if you’re continuously adding value like Canva. But it’s not great for a customer’s price to go up 3x YoY, especially if there’s no consumption component driving that increase.

The bigger picture: One way to interpret this price increase is a tax on existing customers for Canva’s inability to convert free users to paid accounts. Canva, like Dropbox, is a PLG titan with millions of free users but far fewer paying customers.

According to LinkedIn1, Canva’s workforce is roughly 11% Sales and Business Development compared to 22% for Adobe and 19% for Figma.

By investing more in Sales, or continuously increasing prices rather than locking in legacy pricing, Canva could have avoided negative optics.

Why this matters: The biggest challenge facing freemium SaaS is free-to-paid conversion. It’s why Dropbox, Canva, and Notion are acquiring adjacent products. Aggressive price increases like this are hard on customers and Account Managers. However, Canva is one of those companies where it might just prove their pricing power.

Thanks for tuning in and see you next week!

Good Better Best is a weekly newsletter that reaches 5,800 SaaS leaders, operators, and investors. Shoot me a note if you are interested in reaching our audience.

LinkedIn isn’t perfect, but it gives a ballpark.

Superb pricing information 👍