GBB Digest 16: Peloton's Children, Disney's Bundle & The Athletic's Acquisition Mix

A mixed bag of field notes on subscription pricing and packaging.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

It’s been a little while, but we’re back to a digest this week.

For what it’s worth, I’ve been meaning to make digests more the norm, but keep stumbling down rabbit holes I want to go deep on. This week’s post touches on competitor-based pricing, bundling, and a mix of acquisition strategies.

I’d love to hear your feedback! If you enjoy this post, do me a favor and click the “like” button up top (the heart). That way I’ll know which topics are resonating most.

On to this week’s analysis.

Peloton’s Children

As pioneers of connected fitness, Peloton has created an aspirational product with a cultish membership.

Unsurprisingly, after they validated the market, several “similar, but different” connected fitness companies emerged in their wake.

In September, Joe Vennare highlighted the enthusiasm around digital fitness during COVID-19, tweeting a summary of recent funding rounds:

Connected fitness is well-represented with Tonal, Tempo, Hydrow, and Ergatta all offering hardware-plus-membership combos. This funding happened alongside Lululemon’s acquisition of Mirror, another player in the connected fitness space, back in June. Simply put, connected fitness is hot right now...

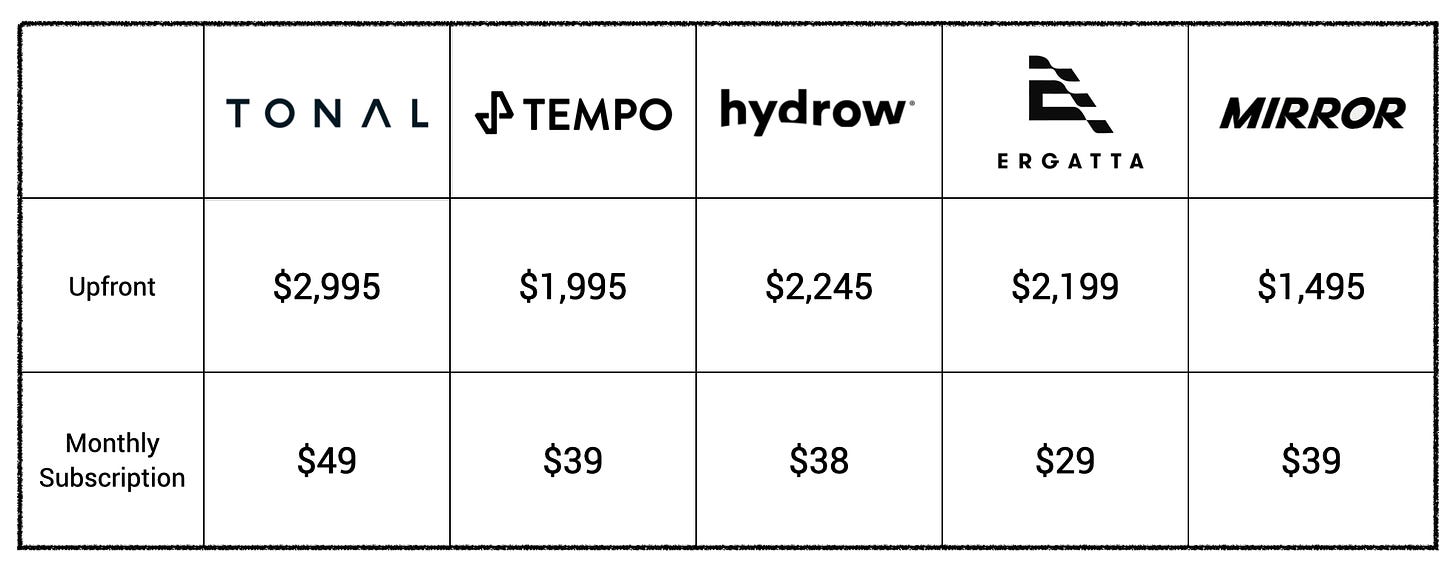

Digging deeper into each company, it’s easy to see the influence of Peloton’s pricing and packaging strategy. The Peloton bike costs $1,895 upfront, with an ongoing membership of $39 per month. With this baseline in mind, it’s fascinating to look at the uniformity in subscription costs across the rest of the market:

While upfront costs vary, not a single membership subscription falls outside $10 of Peloton’s monthly price. In fact, Mirror and Tempo charge the exact same monthly rate, and Hydrow’s subscription is $1 cheaper.

This is classic competitor-based pricing, which, as explained by ProfitWell, has pros and cons. The pros are that it's simple, low-risk, and in commoditized markets, can be an accurate pricing strategy.

In this case, I’d agree with the first two - simple and low risk. For instance, if a fitness enthusiast visits the Hydrow pricing page, they immediately see the same pricing model as Peloton. Instead of having to make two decisions - how they want to exercise and how much they want to pay, they only have to decide between rowing and biking since the difference in cost is relatively negligible over the long run.

Considering the current appetite for connected fitness, optimizing for simplicity and low-risk might be the right approach to drive acquisition at the moment.

However, as a nascent market, connected fitness is far from commoditized. It’s up for debate whether these prices are accurate or if these companies are leaving value on the table. This brings to mind the cons of competitor-based pricing: missed opportunities, herd mentality, and short-term thinking.

Following Peloton’s model reduces friction in the short-term but might be leaving money on the table in the long run. Take, for example, customers that know they would rather do rowing workouts than biking.

Rowing is objectively more niche than biking, and due to its Ivy League history, often associated with affluence. Hydrow and Ergatta could likely take advantage by increasing their membership rates well beyond Peloton.

Or how about customers that value other aspects of the fitness experience, like access to a virtual trainer?

Broadly, there are three alternative strategies that I expect to see as the connected fitness market matures:

Going premium: Subscription costs closer to $100 per month that include services beyond classes (e.g., access to a virtual trainer who can help contextualize individual performance).

Full-subscription: Run the WHOOP playbook and bake the hardware cost directly into the monthly subscription. Financing with Affirm or Klarna helps with this, but optically, the hardware and membership are still differentiated. Peloton CEO John Foley has noted full-subscription is where he expects the market to go.

Differentiated Subscriptions: Currently all of these companies offer one membership price for access to classes, but what if they offered multiple tiers or the ability to tie in add-ons? For instance, the aforementioned access to a virtual trainer for an additional $30 per month? Or quarterly merch delivery for $50 per month?

Again, given the current demand for connected fitness, keeping it simple might be the move right now. That said, pricing and packaging is an area where differentiation can go a long way, and I expect these membership models to evolve in the coming years.

Disney’s Bundle Dynamics

Last week I wrote about the Past, Present, and Future of ESPN+, but left an idea on the cutting room floor that I couldn’t stop thinking about.

In The New York Times’ Bundling Strategy, I referenced Shishir Mehrotra’s Four Myths of Bundling, which I highly recommend as essential reading on bundling. The post presents the idea that good bundles minimize SuperFan overlap, and maximize CasualFan overlap.

For a quick refresher, Shishir defines a SuperFan as someone who is both willing to pay retail for a product and has the activation energy to find it. A CasualFan is someone who is missing one of these two criteria.

Shishir insists that to minimize SuperFan overlap and maximize CasualFan overlap, bundles should contain diverse products rather than narrow ones.

With this in mind, I believe the Disney bundle is on the right track.

Disney+, Hulu, and ESPN+ are three truly diverse products with a high degree of CasualFan overlap. Combining this with the high-profile launches and events inherent to their products creates a dynamic where each subscription can draft off the others’ marketable moments.

For example, Hamilton brought Disney+ ~3M new subscribers. If 10% of those new subscribers chose the bundle rather than subscribing to Disney+ alone, that’s 300k new subscribers for both ESPN+ and Hulu.

The same dynamic applies to Conor McGregor’s return to the octagon. While he drove 500k new subscribers for ESPN+, if 10% of those subscribers signed up for the bundle that’s another 100k subscribers combined between Disney+ and Hulu.

Last week I wrote about the importance of marketable moments and launch events to ESPN+, and this is an underrated benefit. Essentially, ESPN+ can get a massive boost in subscriptions for something that has little to do with their product or even sports in general - a huge perk of being in the Disney family.

The Athletic’s Acquisition Mix

The Athletic has never been shy about discounting. I originally signed up after receiving a 50% discount coupon at the end of my free trial. I recently unsubscribed and was promptly hit with a series of win-back emails like this one:

Beyond discounts, I’m interested in two other tactics they’re using to acquire new subscribers: bundle partnerships and podcasts open to non-subscribers.

First, the bundles…

They recently announced a bundle with Bloomberg that offers two promotions:

New Bloomberg subscribers who sign up for an annual subscription get a 6-month trial of The Athletic.

New Bloomberg subscribers who sign up for their 3-month introductory offer get a 3-month trial of The Athletic.

The Bloomberg partnership comes a couple months after The Athletic launched a partnership with T-Mobile, offering their new customers a free one-year subscription.

I love that The Athletic is experimenting with two different plays here. The Bloomberg partnership is more focused, targeting like-minded readers with a high willingness-to-pay for online media (Bloomberg traditionally charges $40 per month and their subscriber base is “well into the 6 figures”).

The T-Mobile play is more volume-driven. T-Mobile regularly adds 1M-2M new subscribers per quarter, meaning The Athletic will have exposure to a huge pool of new readers.

Combined, these two partnerships feel like an A/B test of sorts that could influence their long-term partnership strategy. Beyond driving subscriber acquisition, these partnerships will boost readership, and enrich The Athletic’s data with tons of insight into what content converts readers most efficiently.

Lastly, The Athletic has been tinkering with a fascinating free to paid podcast strategy. When they initially started podcasting, all of their podcasts were gated behind the subscriber paywall - staying true to their subscription-only ethos.

Last year, they shifted to a hybrid strategy opening up some podcasts to non-subscribers and, notably, monetizing with ads 😱.

Since opening up podcasts to non-subscribers, weekly downloads have reached 7-figures, which bodes well for their ad business. What’s cool is how they differentiate for paid subscribers, who get access to exclusive episodes and an ad-free listening experience through The Athletic app.

Between aggressive discounting, free trials via partnerships, and their podcast conversion strategy, The Athletic is keeping their acquisition mix diverse. However, I wonder if all the free and discounted content may be lowering the market’s willingness to pay and working against their idealistic subscriber-only approach.

They’ve already dipped a toe into advertising with podcasts, and I bet a similar strategy could work with written content as well. If I were them, I’d go all-in, even if it means going back on the original “ad-free” brand-promise. As long as subscriber feeds remain clear of ads, they won’t have anything to worry about.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the like button up top, so I know which posts are resonating most!

If you have feedback, I’d love to hear it - hit me up on Twitter.