The Past, Present, and Future of ESPN+

Is ESPN finally willing to commit to their flagship digital subscription?

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

ESPN is one of those brands I can’t help but love. I don’t spend as much time on their properties these days, but it’s such a staple of my childhood that the brand will always hold a special place in my heart. I’ll never forget mornings spent watching SportsCenter, finding an issue of ESPN The Magazine in the mailbox, or reading Bill Simmons on Page 2 in the early days.

I hope you enjoy reading this as much as I enjoyed writing it. If you do, I’d be thrilled if you share it with someone who you think would dig Good Better Best!

On to this week’s analysis.

Throughout childhood, I would consider ESPN one of my life-defining brands.

Up until high school, I watched SportsCenter in the morning with breakfast, and, assuming I didn’t have practice, regularly watched Pardon the Interruption and Around the Horn after school.

My first dream job was to be a SportsCenter anchor. I clearly wasn’t alone. ESPN made a reality show, literally called Dream Job, where the winner actually became a SportsCenter anchor.

ESPN has flirted with direct subscriptions for years, but it’s always been an afterthought to their cable business. A recent announcement suggests that might be changing...

Starting this week, all articles on the ESPN website that are focused on insight and analysis will be gated behind the ESPN+ paywall. This includes pieces from ESPN’s most popular voices - top talent like Zach Lowe, Rachel Nichols, and Matthew Berry.

Notably, breaking news and investigative pieces will remain available for free on ESPN’s website. This makes sense, since breaking news is available for free on Twitter, a better forum for it anyway, and investigative pieces should have the widest distribution possible.

Beyond that, ESPN is taking a hard line. If it’s not breaking news or hard-hitting investigative journalism, it’s going behind the ESPN+ paywall.

With the new push, ESPN is banking on their talent to drive subscription growth. This is a risky proposition that would have been even riskier if the paywall gated written content alone. Importantly, ESPN+ is more than sportswriting - it’s a sports bundle.

In light of this move, I’d like to unpack why it took so long for ESPN to commit to a direct-subscription product, how ESPN+ has performed so far, and what they can do to accelerate paid subscriptions in the future.

ESPN’s Subscription Tightrope

ESPN has a good reason for hesitating to move to a direct subscription model - they make a killing off indirect subscriptions, or in other words: cable.

Cable providers like Comcast and Dish Network pay affiliate fees to content providers to carry their content. ESPN has the highest affiliate fees in cable, and it’s not close. As a result, the fees make up a massive piece of their revenue puzzle.

Here’s a look at how ESPN made money back in 2013:

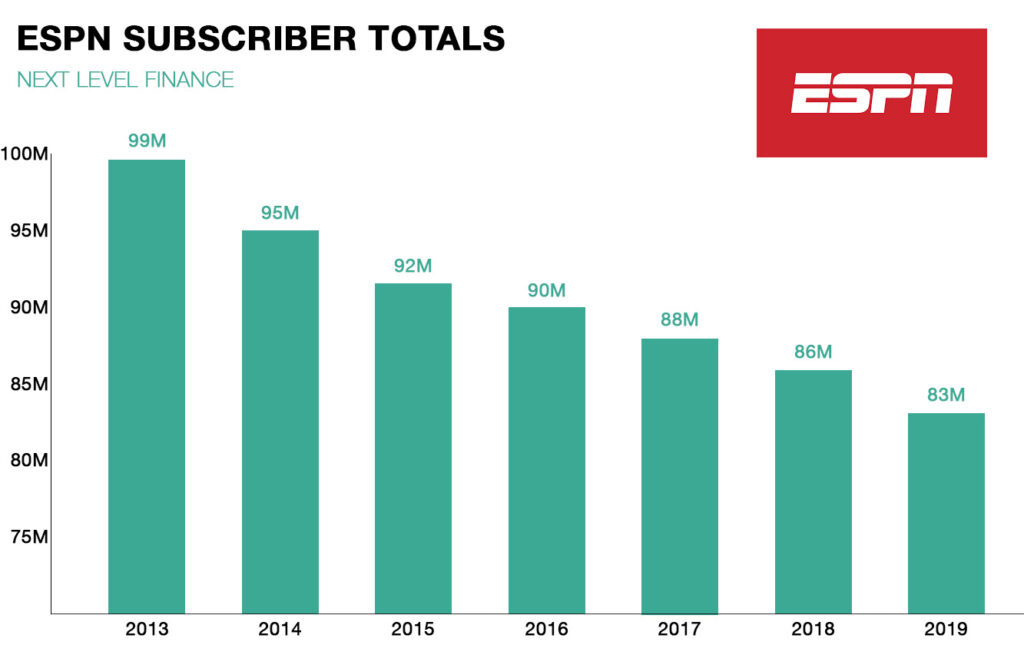

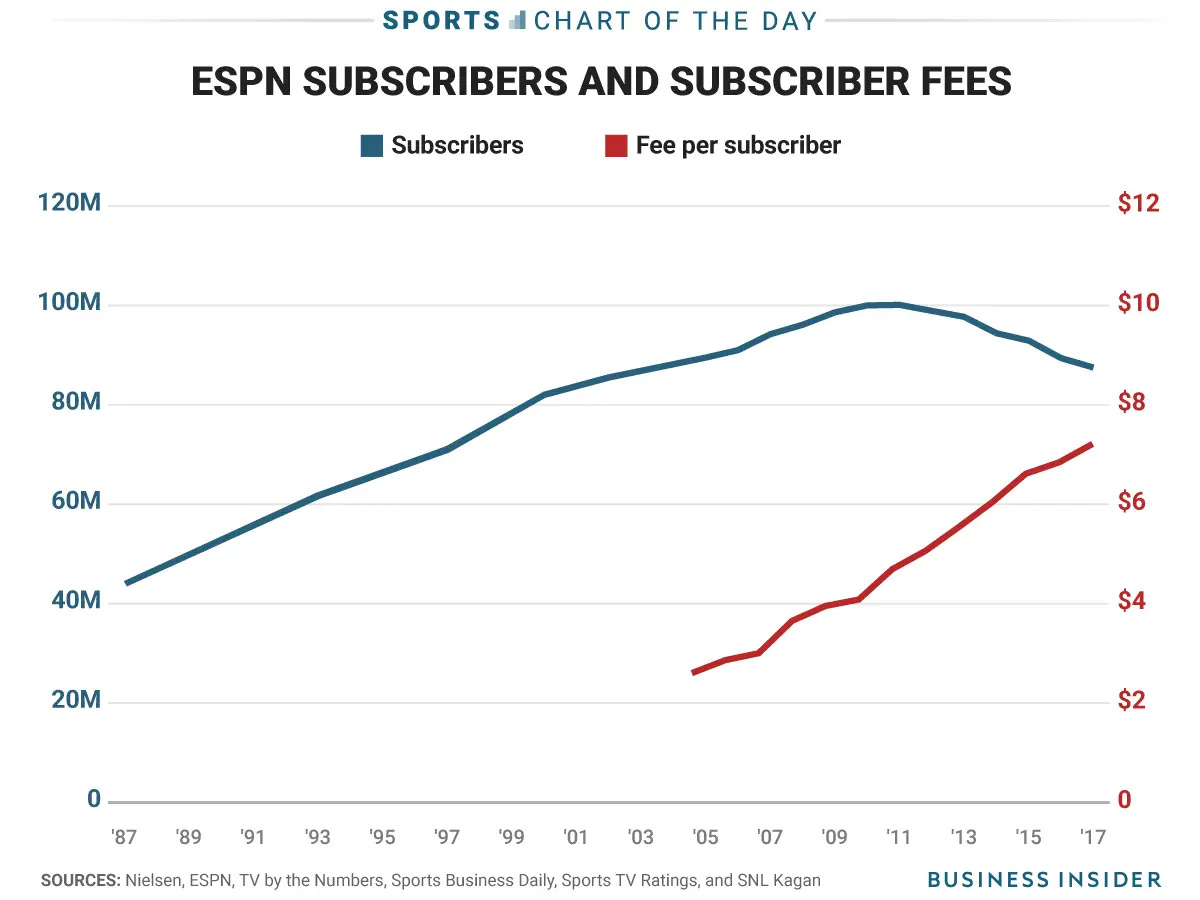

Since then, ESPN’s subscriber numbers have consistently dropped year over year with the emergence of streaming.

While obviously troublesome, this downward trend hasn’t been as devastating to their bottom line as you’d expect, a direct result of their pricing power with cable providers. Simply put, as they’ve lost subscriber volume, ESPN has been able to compensate for the losses by raising their affiliate fees.

While most channels charge under $1 per subscriber per month, ESPN currently pulls in over $9 per subscriber per month across their family of networks.

Their pricing power is perhaps the clearest distillation of the influence of live sports. In The Sports Lynchpin, Ben Thompson argues that sports are the only thing keeping the cable bundle together.

“Because sports are consumed live, with significantly higher advertising load and viewer retention, sports are increasingly the only viable place for mass-market consumer companies to reach customers at scale and fight off niche e-commerce companies slicing off their customer base … This effect is magnified by sports’ role in preserving the cable bundle, which keeps more channels — and thus more inventory — viable.”

It’s in this context that ESPN has been slowly and awkwardly building a direct subscription product. While it’s easy to pay lip service to companies seeing the future and disrupting themselves, ESPN is a live case study of how hard it can be when there are literally billions of dollars coming in through the old model.

That said, ESPN is no stranger to direct subscriptions.

The Subscriptions before the Subscription

In 1998, ESPN entered the direct subscription game by launching ESPN The Magazine as the hip, edgy alternative to Sports Illustrated.

As a day one subscriber, and cover-to-cover reader for years, I can say without a shred of doubt, ESPN The Magazine was the shit.

The magazine tapped on-air personalities for ongoing segments like Two Way, where Stuart Scott (RIP) answered reader questions, and Outtakes, where Dan Patrick interviewed athletes about non-sports topics. Even in the early days, ESPN wanted to create a cross-channel experience with their talent.

That same year, ESPN launched Insider, a digital subscription offering access to exclusive content, primarily centered around analysis and predictions.

Both ESPN The Magazine and Insider functioned as “add-on” products for ESPN’s cable subscription. Both subscriptions targeted passionate niches within the world of sports fandom.

ESPN The Magazine targeted sports fans that wanted deeper dives into their favorite players and quality long-form sports journalism. Insider catered to number-junkies and fantasy players that wanted deeper analysis and tools.

Initially, an Insider subscription was $4.99 per month or $40 per year, but as consumption moved online, ESPN eventually made Insider free to their 2M+ print magazine subscribers to drive more engagement with the website.

Insider remained ESPN’s premier digital subscription product until 2018, when it was merged into ESPN’s new subscription offering, ESPN+.

In the face of cord-cutting and cable attrition, ESPN+ launched as a complimentary subscription where fans could stream games and access content outside their cable subscription.

For the same monthly price as Insider (the monthly price has since increased by $1 to $5.99 per month), subscribers got access to the same analysis, along with the following:

A daily MLB game (180 throughout the season)

More than 180 NHL games

Over 250 MLS games

Assorted games across college sports, golf, cricket, rugby, and tennis

As you can tell, from a live sports programming perspective, ESPN+ launched as a bit of an island of misfit toys. However, subscribers also got access to ESPN’s exclusive video content, including the 30 for 30 documentary archives, Detail with Kobe Bryant (RIP), and other original programs. In short, ESPN+ gave the worldwide leader a single digital hub for fans to dive deeper into their favorite sports content.

Meanwhile, running a print magazine was getting harder and harder.

After scaling production from 26 issues a year down to 24, then to 12, in September 2019, ESPN discontinued ESPN The Magazine. The staff, many of which had already been producing stories for the website, were officially absorbed into ESPN’s digital fold.

Notably, at that point, and up until today, the majority of ESPN’s website content has been available for free. The coming paywall push is likely the biggest disruption to content availability in the history of the website. Before speculating on the impact this move may have on subscriptions, let’s take a quick look at the growth of ESPN+ so far, and the moves that have had the biggest impact.

The Road to 12M Subscribers

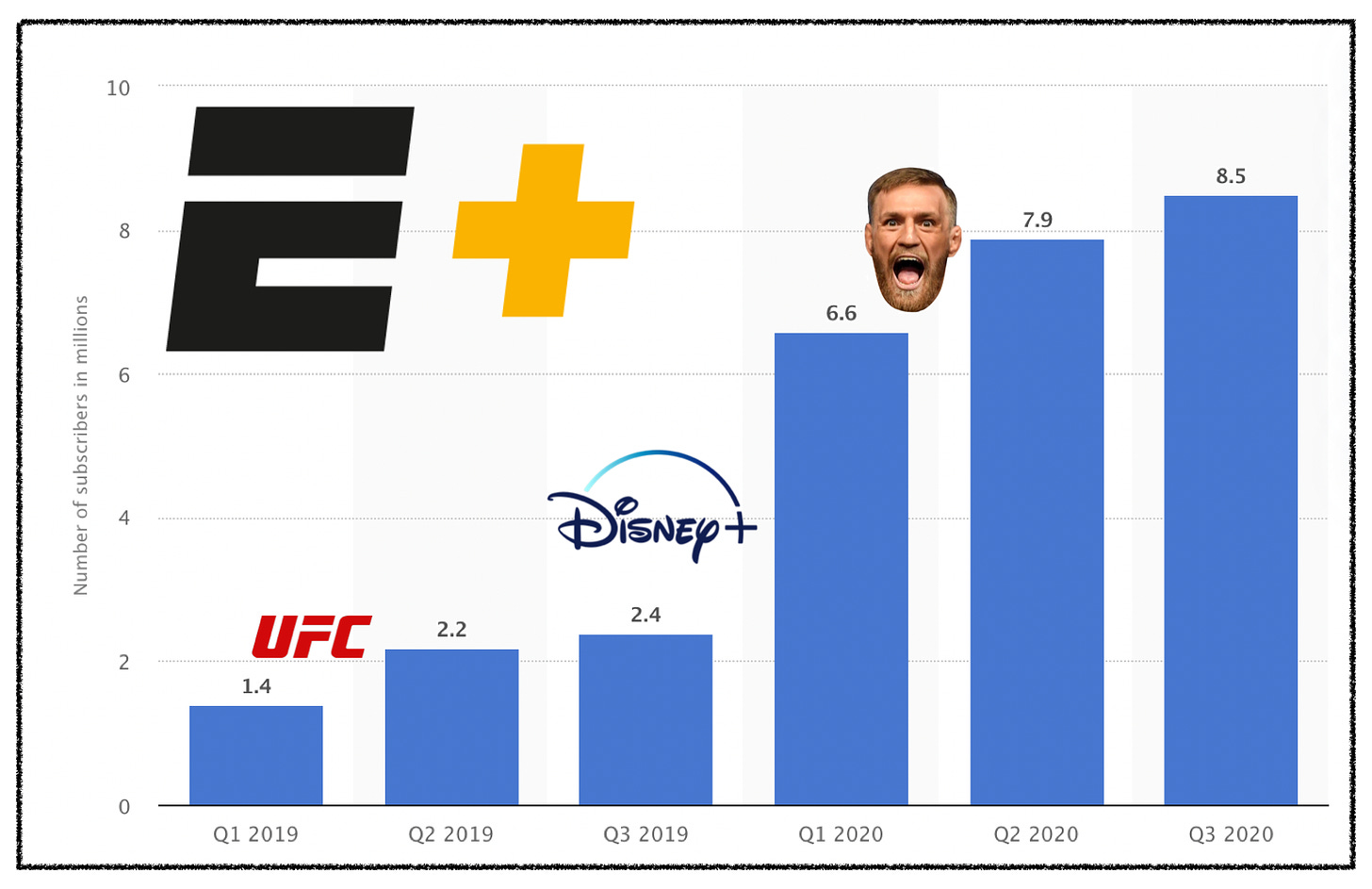

In 2019, Disney leadership forecasted 12M ESPN+ subscribers by 2024. Their growth so far suggests they’re on track to reach that goal even sooner. On their Q3 earnings call, Disney announced that ESPN+ had 8.5M subscribers. According to Statista, subscription growth has progressed as follows:

With these numbers in mind, it’s fun to look back and tie spikes in growth back to specific events. Let’s start from the top…

When ESPN+ launched back in September 2018, writer Ryan Glasspiegel was curious how many subscribers migrated from Insider, and how many were net-new. In doing so, he found a 2012 Ad Age article where an ESPN executive went on record saying Insider had 670,000 subscribers, with ~400,000 being digital-native and not tied to a magazine subscription.

When Glasspiegel went on to tweet his findings, ESPN’s Director of Communications, Paul Melvin, responded promptly that the number was not only wrong, but old, and that the vast majority of ESPN+ subscribers were new.

Glasspiegel points out that if this is the case, it means ESPN lost a sizable portion of Insider subscribers between 2012-2018, which is troubling in its own right.

Regardless, it’s safe to say Insider had some impact on the initial subscriber numbers. From there, the biggest jumps in subscriber growth have had clear ties to distinct events and announcements.

First, in January 2019, ESPN+ hosted its first UFC event, and also offered a one-month trial for new subscribers. The result, as reported by ESPN, was 500,000 new subscribers.

The next big jump came in Q4 2019, when subscribers nearly tripled. This ties directly to the launch of Disney+ in November 2019 and the announcement of Disney’s 3-way bundle with ESPN+, Disney+, and Hulu for $12.99.

The following quarter, subscribers grew another 1.3M. While some of this growth was likely the after-effect of the Disney+ announcement, 500k of the new subscribers were a direct result of Conor McGregor’s return to the octagon.

Tying it together, this growth illustrates the importance of marketable moments to drive subscriptions, but it also highlights the power of bundling.

While their biggest growth spike ties directly to the launch of the Disney+ bundle, their UFC-assisted growth is also likely a result of their UFC-Pay-Per-View bundle. Specifically, prospective subscribers that purchase a UFC Pay-Per-View event get a year of ESPN+ for $20, a great deal at $30 off list price.

Their recent paywall push is a different animal, and it’ll be fascinating to see how ESPN’s own talent can move the needle in terms of new subscriptions.

The Future of ESPN+

Broadly, I expect the paywall push to have a considerable impact on subscriber growth, but I don’t expect it to happen right away. While there may be an initial bump, I’d be surprised if it matches any of the events noted above. Simply put, there’s not as much urgency to subscribe for exclusive content as there is for a one-off event like a UFC title fight.

That said, I do have some ideas for ESPN to drive free-to-paid conversion without relying on one-off events and announcements.

Make ESPN+ truly ad-free. While this may be difficult with live sports programming, at least remove advertisements from in-article videos. ESPN is the only website I visit where I regularly find myself waiting 30 seconds for an ad to finish before watching a video. Unsurprisingly, it’s frustrating. Both Spotify and YouTube Premium have been successful using ad-free as a paid differentiator, and I could see it making a meaningful difference for ESPN+ as well.

Offer free teasers of serialized content. Netflix has been using this strategy to let prospective subscribers get a taste of their exclusive content without cannibalizing their paid plans with a free trial. ESPN+ already has original programming where they can do this, including OJ: Made in America. This strategy is equally relevant to written content as well. If, for instance, Zach Lowe were to write a series on the 50 things he’s most excited about heading into the coming NBA season, ESPN could release the first installment for free, but require a subscription to read the rest.

Lastly, add a sense of community. One thing that’s amazing about The Athletic is their writers are active in the comment section. It feels pretty cool when a writer you read regularly responds to your feedback thoughtfully. The biggest fear of comment sections is offensive language and harassment, but with a paid subscription, you’re likely weeding out a lot of the people who would do that. Adding comments and giving subscribers more direct access to ESPN’s top talent would be an incredible perk that would likely increase willingness-to-pay and retention.

If ESPN can incorporate some of these strategies, and continue leveraging one-off events, I like their chances of hitting 12M subscribers much sooner than expected. Regardless, it’ll be fascinating to watch what they do as they continue investing in their business model of the future.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the like button up top, so I know which posts are resonating most!

If you have thoughts or feedback, I’d love to hear from you! You can find me on Twitter here.

Great post!