SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Pricing Trend 🔮

Last week, I wrote about companies getting rid of freemium plans. This week, PricingSaaS revealed a trend that takes that sentiment to its extreme — companies getting rid of their pricing page altogether.

In its place, these companies are leveraging “Request a Demo” and “Contact Sales” CTAs. While this may sound extreme, there are definitely reasons this can make sense:

Complex Pricing: If a prospect needs context to understand how much they would have to pay, a public pricing page may just confuse them.

Multiple Products: If you offer multiple point solutions independently that can be mixed and matched, depending on how you charge for each it might make sense to push website visitors to a sales conversation.

Enterprise Persona: If your target buyer is an enterprise decision-maker, and your solution comes with a high price tag and high-touch sales process, a public pricing page might not have much of an impact.

There’s plenty of overlap here, but in all three cases it can be difficult to communicate price without context. If that’s the case, having a public pricing page can hurt more than help. You don’t want to lose a potential customer because they make an incorrect assumption about your pricing model.

Disagree? I’d love to hear your thoughts in the comments.

Pricing Tactic 📋

Last week on LinkedIn I wrote about balancing explicit data with implicit data — something I discussed often with clients at ProfitWell.

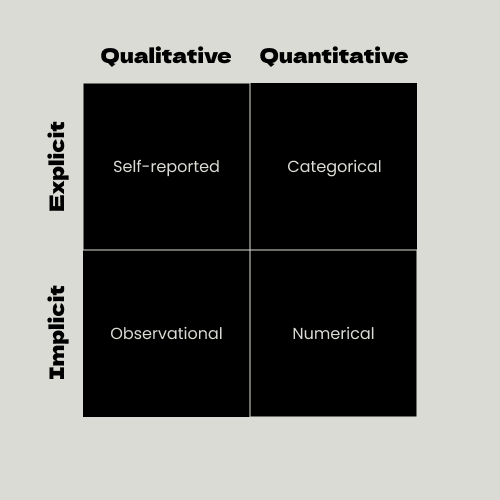

GBB reader Kyle Ludwig and I traded comments, which ultimately resulted in a cool framework that Kyle put together summarizing types of the data that can inform your pricing strategy:

Here’s a quick summary of the four boxes clockwise from the top-left:

Self-reported: This is data that is both explicit (directly provided or stated) and qualitative. An example here would be a long-form answer to a survey question.

Categorical: This is data that is both explicit and quantitative. An example would be a survey respondent providing their company size from a drop-down.

Observational: This is data that is both implicit and qualitative. An example would be a customer’s usage habits with your product (e.g., which features they use to get the job done).

Numerical: This is data that is both implicit and quantitative. An example here would be the number of times a user logs in to your product every month.

I’m not sure these are the best definitions, or if this framework is helpful beyond me and Kyle 😂 but the bigger takeaway is that there are a lot of data points that can influence pricing strategy. I’d often encounter clients that had tunnel vision for surveys or customer usage data, but ultimately, I’d recommend balancing both.

Pricing Tool 🧰

Last week, I met a couple of the cofounders from a company called Togai, a pricing implementation platform that helps SaaS companies offer data-driven pricing models.

They just dropped a FREE tool called Metering.ai that allows companies to rapidly offer usage-based pricing. It plugs directly into Stripe, and literally takes 3 clicks. If you’ve been considering testing out usage-based pricing, give it a try.

Don't think I agree with killing the pricing page because you have a complex product. You'd kill the top of the funnel of PLG if you do that.

If it is hard to communicate your product value to the customers, you probably hasn't reach product market fit.