Welcome to Good Better Best!

This week, we’re taking a break from case studies and breaking down how some of the top players in SaaS create pricing power through acquisitions.

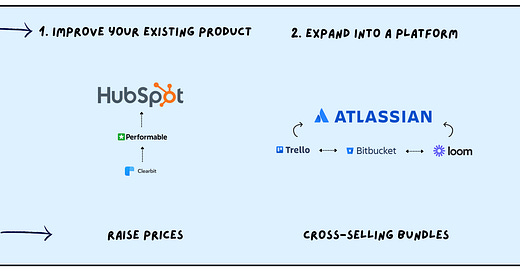

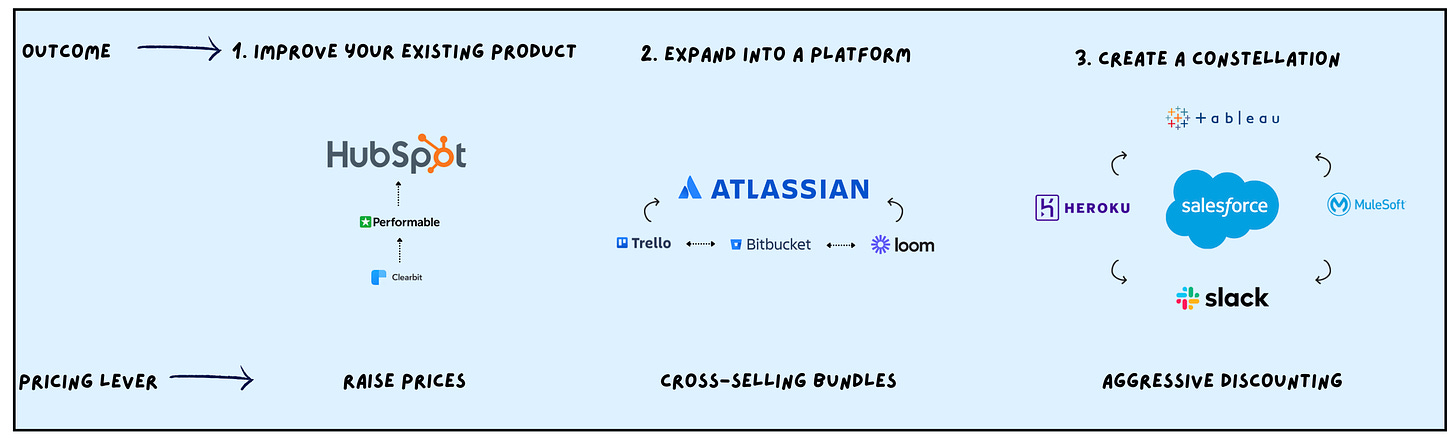

Using examples from HubSpot, Atlassian, and Salesforce, we’ll cover 3 types of acquisitions, and the pricing levers they create.

Let’s get to it.

Join the Good Better Best Chat 💬

I’ve been loving Substack’s Chat feature. I plan to use it to share pricing news, get feedback on market trends, and allow you all to start your own threads to tap into the wisdom of the Good Better Best audience. Join the conversation below.

🚨 SaaS Product and Pricing News

Grammarly added features to the Pro plan.

Beehiiv lowered starting prices and added features.

LaunchDarkly reintroduced the Guardian plan and updated usage limits.

Netlify introduced new features and add-ons.

Veed added a Slides-to-Video feature.

As one of the primary ways for a SaaS company to exit, acquisitions are a juicy topic. It’s always fun to theorize which acquisitions make sense, and speculate on the downstream implications.

Generally, I’ve found 3 ways to utilize acquisitions in the world of SaaS. Each way creates pricing leverage, with the specific lever depending on the desired outcome of the acquisition.

Below, I’ve expanded on each type, and the pricing lever it creates.

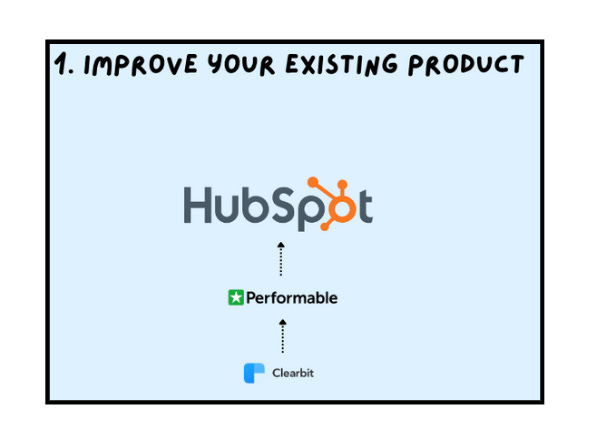

I saw the impact of an acquisition on an existing product firsthand. Before I joined HubSpot in 2012, the company acquired Performable, a marketing automation solution started by David Cancel and Elias Torres who later founded Drift. I joined after the acquisition, but worked with many people that had been at HubSpot before it happened. The consensus was that the difference in our product was night and day.

Prior to the acquisition, HubSpot was primarily an Inbound Marketing solution, helping customers leverage SEO and Social Media to attract visitors to their website and convert them to leads. Performable allowed HubSpot to offer stronger middle-of-funnel tools like audience segmentation, email nurturing and analytics. This was a key milestone in HubSpot eventually becoming an all-in-one marketing solution.

At first, HubSpot offered Performable as a standalone solution as they transitioned the team to HubSpot, but quickly, Performable’s tech (and team) were integrated into HubSpot. HubSpot also ran the same playbook with Clearbit — offering it as a standalone product in the short-term before integrating it into HubSpot, in this case as Breeze Intelligence.

⚙️ Pricing Lever: Raise Prices

Acquiring a product and integrating its functionality into your existing product is a strong reason to raise prices. Any time you make a price increase, it helps to be able to point to all the value you’ve added to your product over time. Often, that can be ambiguous, since the discrete value of a new feature is often unknown.

With an acquisition, there is hard evidence of the value — the product’s previous price point. It makes the value equation easy to explain, and should allow you to raise prices with confidence.

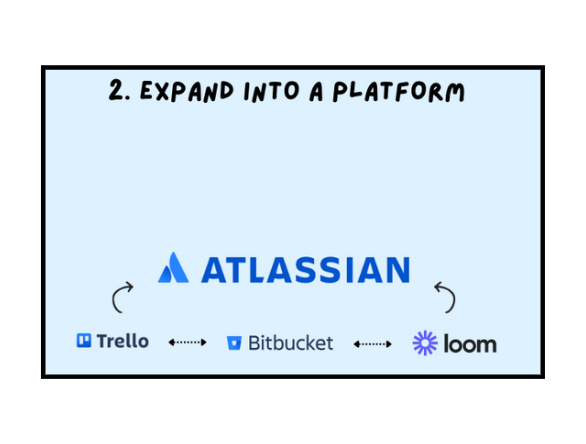

II. Expand into a Platform

Next, you can use acquisitions to expand into a platform. Atlassian built a solid business with homegrown products like Jira and Confluence, then started expanding through acquisitions. Notable purchases include Trello, OpsGenie, BitBucket, and Loom. A couple years back, Toplyne estimated that Atlassian’s acquisitions made up 50% - 60% of their market cap.

Importantly, all of these products are geared toward work management, which helps Atlassian strengthen their value prop as a “teamwork solution for high-performing teams.” Another very cool aspect of Atlassian’s strategy is that all (or most) of their products have a free version, which gives prospects many pathways into their funnel.

Another cool example of this strategy is Dropbox, which is acquiring its way into a doc management platform with acquisitions of HelloSign, DocSend, and Formswift.

⚙️ Pricing Lever: Bundling and Cross-Selling

Since Atlassian’s products all align with work management, they’re ripe for bundling and platform positioning. This is exactly what Atlassian has done — positioning the platform as a suite of tools that solve for collaboration, ITSM, DevOps, and more.

Until recently, they offered a bundled Work Management solution called Atlassian Together, which included Confluence, Jira Work Management, Trello, and Atlas. These days, a visitor to the Platform page is directed to Contact Sales, where they have honed a strong cross-selling motion.

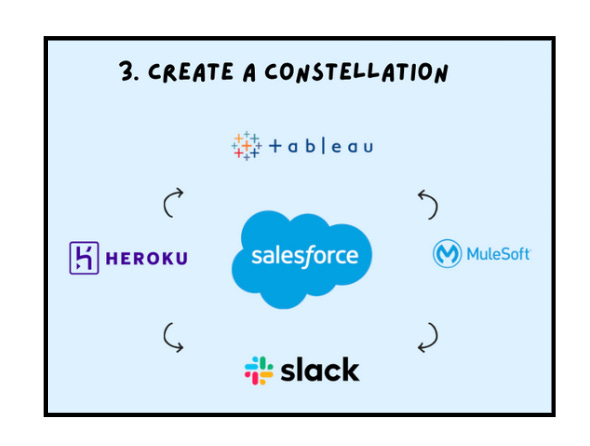

III. Create a Constellation

At the largest scale, SaaS leaders can acquire companies that don’t directly align with their core offering. A great example of this is Salesforce, which has made numerous acquisitions that don’t directly relate to CRM, including Slack, MuleSoft, and Tableau.

To be clear, these solutions have plenty of cross-selling potential, and there’s likely a decent amount of overlap between their customer bases. But a bundle of CRM, Slack, and Tableau doesn’t evoke a convenient theme like Atlassian’s Work Management platform.

Notably, Salesforce has employed both previously mentioned acquisition strategies, improving their own products (ClickSoftware was integrated into Salesforce Service Cloud), and expanding into a platform (ExactTarget and Pardot helped shape Salesforce’s marketing platform, Salesforce Marketing Cloud).

Importantly, Salesforce reps don’t typically try to cross-sell all of their products — it would be an impossible sale, incorporating cross-functional budgets and tons of stakeholders. However, Salesforce reps do work strategically to expand accounts across products as they learn more about usage and needs.

⚙️ Pricing Lever: Extreme Discounting

The wildest part of this strategy, is that Salesforce can be way more aggressive than other companies in competitive deals.

Back when I was selling HubSpot’s Marketing Hub, I was involved in several deals where Salesforce straight up gave away Pardot, their marketing automation product, for free. You heard that correctly — not an aggressive discount — for FREE.

Their scale and margins meant they did not have to play by the same rules as everyone else, and the breadth of their solutions meant there were always opportunities to monetize those customers with another product down the line.

Recap ☑️

In short, acquisitions are a powerful way for SaaS companies to create pricing leverage. Your desired outcome will likely determine which lever makes the most sense:

Improve your product → Justify price increases by integrating new value.

Expand into a platform → Enable bundling and cross-selling opportunities.

Build a constellation → Use extreme discounting to win competitive deals.

Importantly, these strategies aren’t mutually exclusive, and there’s no reason (other than capital) you can’t mix and match with multiple acquisitions.

Thanks for tuning in! If you enjoyed this post, share it with a friend.

This is good Rob. Really good. 😊 Might be a pricing consulting category all of its own 🤔

I believe that saas companies that keep adding features and raising prices are making a mistake. Not every user wants your new feature, so they aren't going to see "value" in it..