How Vendr used pricing structure to make it a no-brainer

How a former sales rep is transforming the way we buy SaaS.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Wednesday y’all,

It’s been a while! But I’ve been keeping busy…

My wife and I welcomed a healthy baby boy in late May and I’ve been on a bit of a digital sabbatical while on paternity leave. I appreciate your patience!

Today’s piece is a fun one because I got to write about an old friend whose new company could have a massive impact on SaaS pricing going forward.

Let’s get to it.

Almost ten years ago, I joined Hubspot as a BDR in the Cambridge office. As a green, entry-level salesperson, I looked up to the seasoned reps on the sales floor, many of them only slightly older than me. In downtime, they would share stories about the good old days, spinning yarn about some of the best reps at the company.

It's in that context that I first heard a name that had already become the stuff of legend: Ryan Neu.

In those days, Ryan was helping build Hubspot's Dublin office, but the reps that had seen him during his time in Boston were mesmerized. When I asked what it was that made him so great, one rep literally said, "it's his eyes."

Though he does have impressive baby blues, I think what this rep was actually captivated by was Ryan's energy. He's optimistic, confident, and the type of person that I could see actually whistling while he works. Simply put, Ryan seemed to enjoy sales, and he was very good at it.

That's why when he returned to the states, it was no surprise he was promoted to Sales Manager, assembling and leading one of the top-performing teams at the company. From there, he was tapped for a promotion to Director, leading the SMB team. After some time in that post, Ryan left Hubspot to lead Enterprise Sales at InVision - helping them layer an Enterprise Sales process on top of an accomplished bottoms-up motion.

Across these experiences, Ryan developed a wealth of experience buying and selling SaaS and started to form an opinion that feels especially contrarian coming from an experienced sales leader:

SaaS shouldn't be negotiable.

In the current landscape, this sounds impossible - most SaaS products require talking to a salesperson, which typically requires some level of negotiation.

Knowing it would take some time to arrive at this end-state, Ryan left InVision to start his own company, Vendr, with a more modest goal:

Save high-growth companies time and money by helping them buy and renew SaaS contracts.

I learned a lot in my time at Hubspot, but one thing that stuck with me is the power of a sales visionary who's hell-bent on changing the selling landscape. After all, that's what Brian Halligan did. I had the chance to catch up with Ryan about the past, present, and future of Vendr, and how they're shaping the future of SaaS sales.

The Seeds of Vendr

To explain how Vendr works, let's start with the typical SaaS sales process.

As a purely digital product, SaaS benefits from zero marginal costs. In the early days, this wasn’t always clear to buyers. In fact, a former colleague of mine used to tell prospects that we were “out of Basics” to increase the chance they purchase a Professional or Enterprise plan.

While most SaaS salespeople don’t go this far, they do usually exert some level of control over the price. With zero marginal costs, price can range considerably across customers depending on the strength of the negotiators on each side. Organizations that understand this often purchase at the end of the month, pushing for an aggressive discount knowing that the rep and company have numbers to hit. Organizations that are new to SaaS end up subsidizing these heavily discounted buyers, purchasing closer to list price.

In either case, buyers are typically working 1:1 with an Account Executive. Depending on the company and product, this individual may or may not be solely responsible for dictating price. Many SaaS companies require escalating levels of approval for higher discounts. Even if the Account Executive is the one dictating price, that's not how it's communicated to the customer. Often, sales reps will pin the pricing burden on the Finance team, whether that's actually the case or not. In the course of a sales call, this talk track might go something like:

"So, I talked to Finance, and here's what we can do..."

Regardless of whether or not the price quoted by the rep is actually the best offer, this dynamic brings a third party into the mix, makes the pricing conversation less contentious, and creates the illusion that the sales rep is working on behalf of the customer. Essentially, Sales is no longer the bad guy. Finance is the bad guy, and Sales is on the customer's side, doing everything they can to help out.

While some might enjoy this game of good cop-bad cop, I'd imagine most stakeholders on both sides would rather be doing other things with their time.

That's where Vendr comes in.

In short, Ryan and his team help their clients buy and renew SaaS products, saving time and money along the way. Vendr works on behalf of its buyers, aiming for the best and fastest result possibe for both sides.

The company was founded on two principles:

First, it’s a poor use of stakeholder time to be on the phone haggling about price.

Second, even if you have great negotiators on staff, you don't have the data, so you don't know if the price you're getting is good or not.

So far, their approach is working. As Neu referenced in a Hacker News post announcing Vendr, InVision saved more than $1.5M in their first year. This social proof helped them sign up more high-performing SaaS companies like Canva, GitLab, Brex, Drift, and HubSpot.

After being accepted into Y Combinator in Spring '19, Ryan and team raised $2M to bring their vision to light. Early success led to another $4M seed round from Craft Ventures in early 2020, then a giant $60M Series A this past March.

The Vendr Mission

On the surface, Vendr's mission looks like an affront to SaaS sales teams everywhere, but Ryan promises that's not the case.

As the company grows, he hopes to eventually become a distribution channel for clients. In other words, while Vendr’s current value prop is focused on buying SaaS for clients, the end-game is to help clients sell as well. As a former quota-carrying salesperson, the idea of a highly qualified new account falling into my lap with no effort is pretty compelling.

Before talking to Ryan, my perception of Vendr was that of a bad-pricing bounty hunter. One of the biggest learnings I've had at ProfitWell is that many SaaS companies have "zombie customers" that don't use their product. My assumption was that the Vendr team would sniff out those contracts, and help clients fix them.

Ryan quickly corrected me on this assumption. While Vendr may look like a negotiation shop, they aren't working on a project-by-project basis. Instead, Vendr partners with clients over the long term, acting as an extension of their team and managing all SaaS purchases and renewals. Their goal isn't to fix one bad deal, but to drastically simplify how their clients buy and renew SaaS.

Importantly, Vendr doesn't consider themselves a consultancy. They aren't looking through client engagements and highlighting agreements that they don't think are delivering value. If a client makes it clear that they aren't getting value, Vendr communicates that to the provider, but they never make that judgment themselves.

Vendr's Pricing Strategy

At the heart of Ryan's thesis is the idea that pricing should be variable, but not negotiable. In short, a small company should pay less than a large company for a SaaS product, but it shouldn't be up to the individual salesperson to dictate the price.

Ryan follows this approach at Vendr, anchoring pricing around two goals:

Tie price to managed SaaS spend

Keep pricing simple

This has taken some iteration.

The first version of Vendr's pricing included a monthly platform fee of $2,500 plus 20% of savings. According to Ryan, this model quickly proved challenging.

With one of our early customers, we saved $250,000 in the first month, so the first invoice I sent was for $50,000. I was pumped because I thought they would be excited. Unfortunately, they were not thrilled to get invoiced $50,000. They paid it, but basically told us it wasn’t scalable. I asked why - didn’t we just save you all this money? Their response was that they would just do it all in-house. Of course, they hadn't been making this a focus in house all along, and I communicated that, but the bigger takeaway was that I didn't want to have to fight to justify value when I thought it should be obvious by looking at the savings.

From there, Neu and team audibled, with a singular goal of making Vendr a total no-brainer.

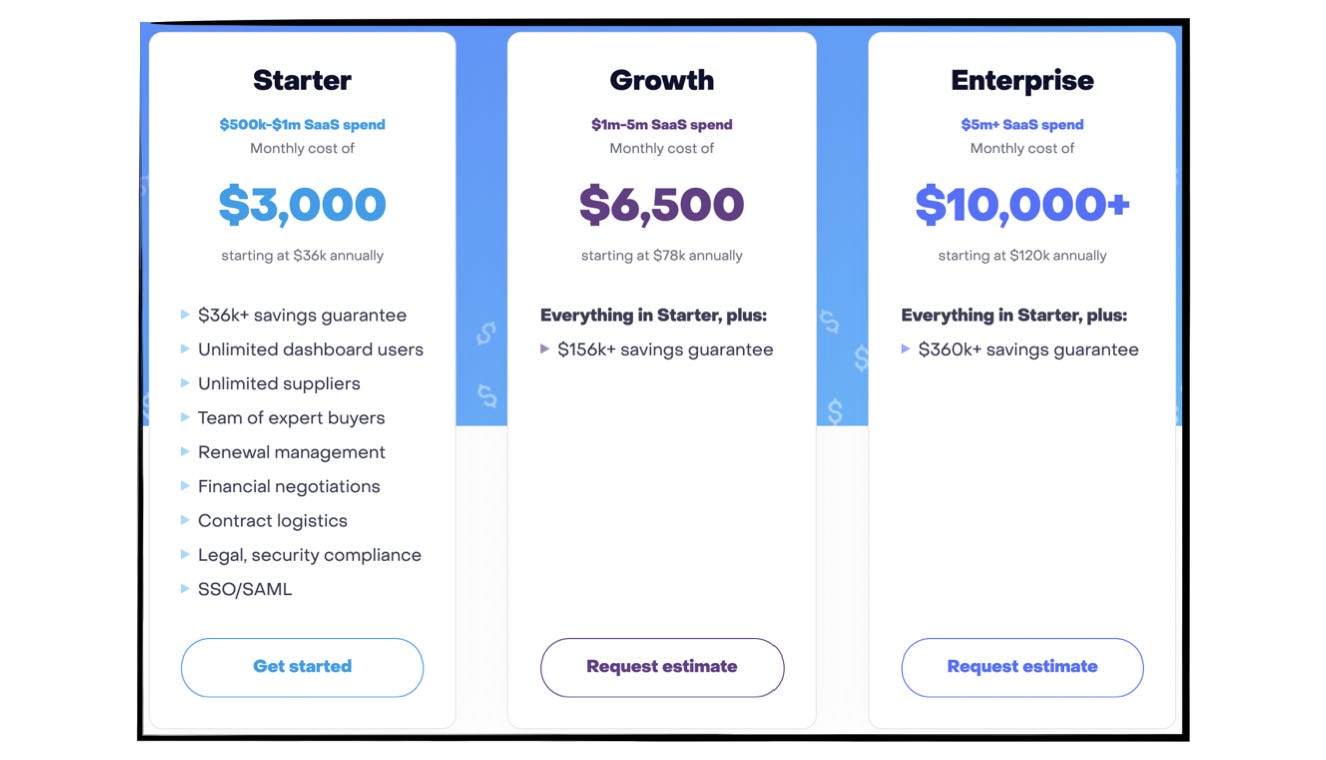

First, they got rid of the variable savings portion and decided to charge a flat retainer fee for all you can eat. This helped the sales team realign their pitch around speed and transparency instead of hard savings. To ensure price tied to value, they created three tiers, differentiating each with SaaS spending bands.

Neu says the Vendr team can usually predict SaaS spending within 10% just by knowing a company’s headcount. In this way, the SaaS spending bands act as a proxy for company size but give Vendr a value metric that’s more aligned to the service they deliver. This ensures that small companies with fewer SaaS applications pay less than large companies with tons of SaaS applications that require more negotiations.

The managed SaaS bands are wide, which is intentional. Neu and team have found that clients have a difficult time reporting exactly how much they spend on SaaS, and asking them to crunch the numbers slows down the sales process.

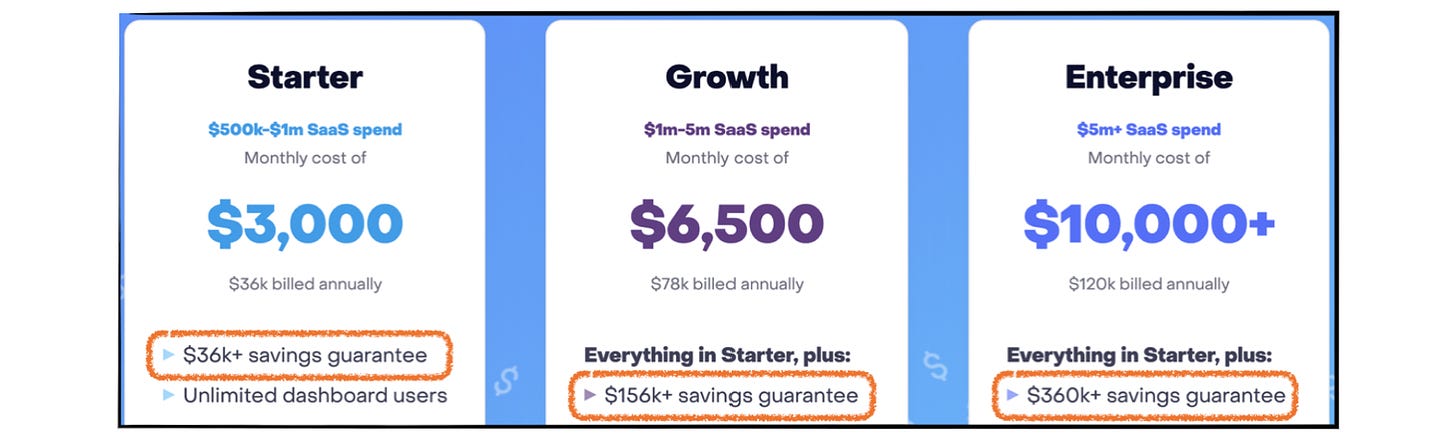

The other piece of Vendr's no-brainer model is their savings guarantee. With each tier, Vendr guarantees an exact amount of savings, increasing the multiplier with each subsequent plan.

With Starter, they guarantee savings of $36k or 1x the annual cost of Vendr. With Growth, they guarantee $156k or 2x the cost, and with Enterprise they guarantee $360k or 3x the cost.

Notably, these guarantees are conservative. Neu and team have found that their actual savings are usually closer to 5x-10x. While raising prices would lock in more revenue, it would also lower the savings multiplier.

Boardmember and former Oracle Executive Jeff Epstein influenced Neu's thinking based on his experience buying and renewing SaaS. At Oracle, Epstein made software decisions based on a 'dollar in, dollar out' mentality, closely tracking the ROI of each investment. Intuitively, products generating a 2:1 ROI would get de-prioritized compared to products generating a 5:1 or 10:1 ROI.

Keeping the savings guarantee low ensures the Vendr team doesn't miss it, allows them to exceed client expectations, and makes them a no-brainer come renewal time. Further, Neu realized that guaranteeing 5x-10x would probably feel disingenuous to potential customers. Besides making it more likely they miss the guarantee, setting expectations this high would lead customers to monitor every dollar saved - pulling their attention away from more important priorities.

The combination of tying price to managed SaaS spend, and guaranteeing savings allows Vendr to approach prospective clients with both cost and baseline ROI. Critically, if Vendr doesn't save a client more than they cost, they'll refund their money. While most SaaS sales processes require education and some level of evangelism, Neu wanted to hone a factual approach that leaves buyers with an easy decision. Along the way, he's also created a product that's equally easy to sell.

We tried to create the no-brainer model. As a Salesperson, I was trying to think what would be the best thing to sell? Something with a short sales cycle, high ACV, immediate ROI, and no risk. We got to the current numbers in a trial by fire, but we know that our actual savings are a multiple of what we guarantee, so the guarantee is very conservative.

If you look at their tiers, you'll notice Vendr doesn't differentiate with features - the only difference from tier to tier is the level of savings.

I asked Ryan if he ever expects to differentiate with features, and his response proved just how much he's invested in keeping pricing simple.

I don't know if we will ever charge on features. I want to be tied to managed spend. If you use more SaaS, and we're helping you buy it - then you pay more. I don't love feature gating, which is something I learned from Clark Valberg (CEO at InVision). He was really passionate about not gating features. His goal is to build the best design tool that can be used by the most people around the world. He didn't want to penalize someone for not being able to afford a specific feature. I feel the same way - I want to be able to offer the same level of service across all of our packages.

While I admire the commitment to keeping Vendr's pricing simple, and offering the same level of service for all customers, I asked Ryan if he ever felt concerned about tying price solely to SaaS spend. Since they're saving clients money on their SaaS spend, isn't there a perverse incentive at play where their success inherently works against them over time?

Ryan's answer was backed by data that they've collected while working exclusively with high-growth companies. Essentially, as these companies grow, their SaaS spend grows with them. As long as Vendr continues working with the best SaaS companies in the world, there will always be opportunities to help them manage their SaaS costs.

Vendr’s Flywheels, Challenges, and the Future

This ability to serve existing clients in perpetuity compliments a trio of flywheels that ensure Vendr has the ability to accelerate growth going forward.

First, as Vendr signs on more customers, they collect more data and gain a better understanding of what companies across the SaaS landscape are paying for each solution, and which levers to pull when negotiating with each provider. This helps inform their subsequent negotiations and ensures they're getting the best prices possible for each customer.

Second, with each new customer, Vendr is introduced to new SaaS companies that could benefit from Vendr's services. This organic lead generation is powerful and allows prospects to see what Vendr can do firsthand.

Lastly, Vendr has a unique hiring flywheel. In the course of negotiations, the Vendr team is often working with high-performing Account Executives and Account Managers at the best SaaS companies in the world. Until working with Vendr, these Salespeople likely didn't realize switching to the SaaS buying side was possible. Neu says, "We hire great salespeople to buy software." This approach ensures that Vendr has strong negotiators working on behalf of its clients, and also gives top sales performers a new challenge.

When you consider these flywheels, it starts to make sense how a $60M Series A comes together. Powered by data and experience, Vendr is getting better as they go.

However, their opportunity isn’t without challenges.

First and foremost, some companies would prefer to manage SaaS purchases and renewals in-house. These firms likely wouldn’t utilize Vendr at this point.

Next, Vendr’s current model is human-heavy. Negotiations are people-powered, meaning to continue their rapid growth, Vendr has to hire and train qualified buyers. Humans are inherently less scalable than a line of code, so until Vendr can productize elements of their process, their growth trajectory will be somewhat limited.

Lastly, the reality of working with high-growth SaaS companies means sometimes Vendr's clients are also the companies they're negotiating with. As they add the ability to help clients sell, this dynamic will come into play even more.

If Neu and team can address these challenges and execute their vision, the days of haggling for price may be numbered.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the like button up top, so I know which posts are resonating most!