SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

I’m fascinated by Twilio’s acquisition of Segment for many reasons, but one of the biggest is how they’ll package and price their combined offering.

This week I wanted to unpack the high-level rationale behind the acquisition, then dig into the nitty-gritty of how each company currently packages their solutions, and what it may look like when they officially offer an integrated solution.

I would love your feedback! If you enjoy this post, do me a favor and click the “like” button up top (the heart). That way I’ll know which topics are resonating most.

On to this week’s analysis.

Earlier this month, Twilio acquired Segment, a platform that helps companies collect, clean, and control their customer data. I love this acquisition because it’s so ambitious.

Unlike Twilio’s acquisition of Sendgrid in 2018, which fit perfectly into Twilio’s wider communications-infrastructure strategy, Segment’s strengths lie on the complete opposite end of the customer experience - eliminating data silos to understand customers better.

While I doubt Twilio CEO Jeff Lawson’s decision to acquire Segment was rooted in Chinese cosmology, I imagine the complementary nature of their products was key.

Put simply, the acquisition of Segment opens up a bigger-picture strategy for Twilio, allowing them to offer customers the dream of a holistic platform that can help them both understand and engage with their customers.

I’m particularly curious how Twilio will package Segment into their current offering. While both companies price their product based on usage, their pricing models and value metrics differ, presenting challenges to packaging a unified solution.

First, I want to dig into the promise of an integrated Twilio/Segment offering, then, how they might package it.

Seeking Balance ⚖️

Jun Shan, Chinese Culture Expert, and head of CSymbol describes the Yin and Yang as such:

The balance of yin and yang is important. If yin is stronger, yang will be weaker, and vice versa. Yin and yang can interchange under certain conditions so that they are usually not yin and yang alone. In other words, yin elements can contain certain parts of yang, and yang can have some components of yin. This balance of yin and yang is perceived to exist in everything.

While Jun almost certainly wasn’t thinking about this concept of balance as it relates to customer engagement strategies, there are parallels…

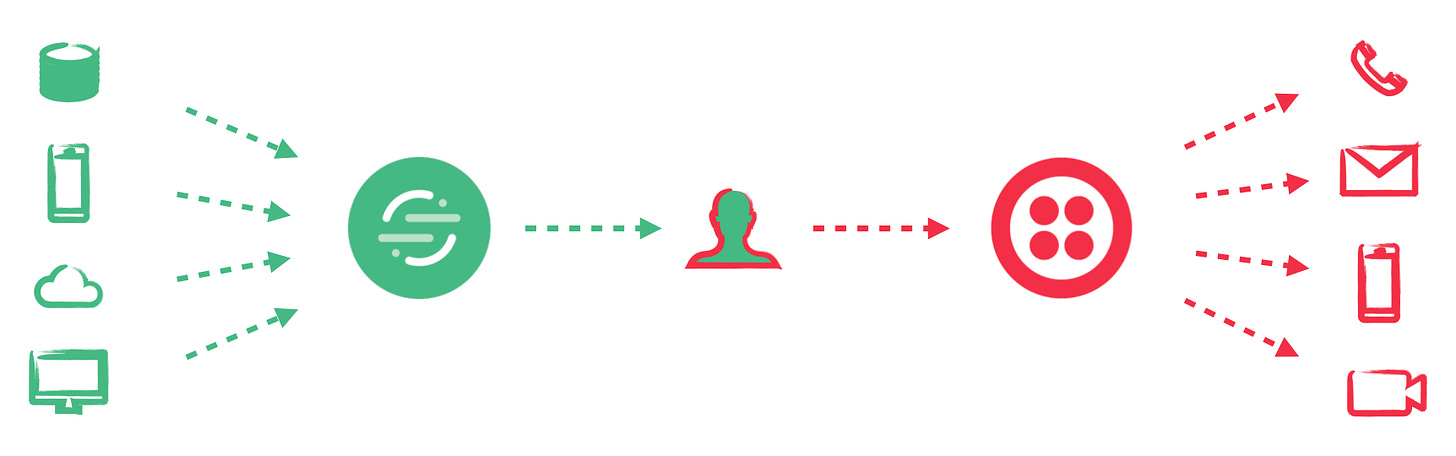

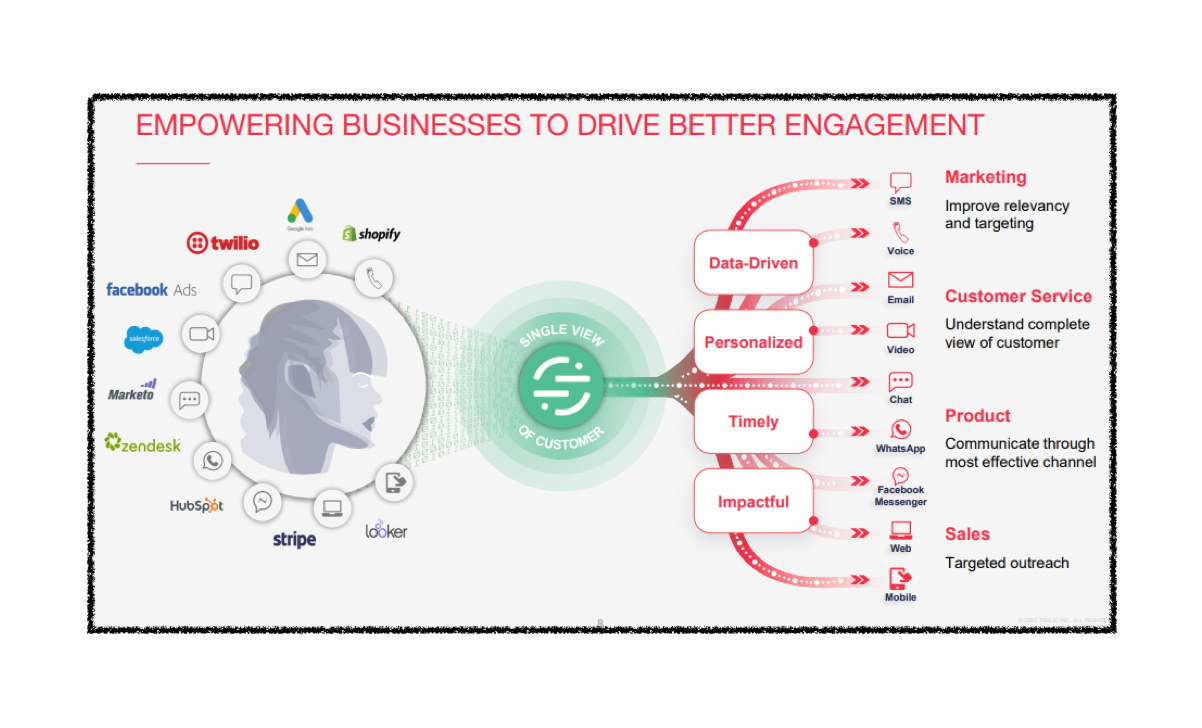

For the unfamiliar, Twilio’s tools allow customers to streamline external customer communications, offering messaging APIs (Application Programming Interfaces) that allow businesses to communicate with customers through voice, SMS, email, video, and mobile channels.

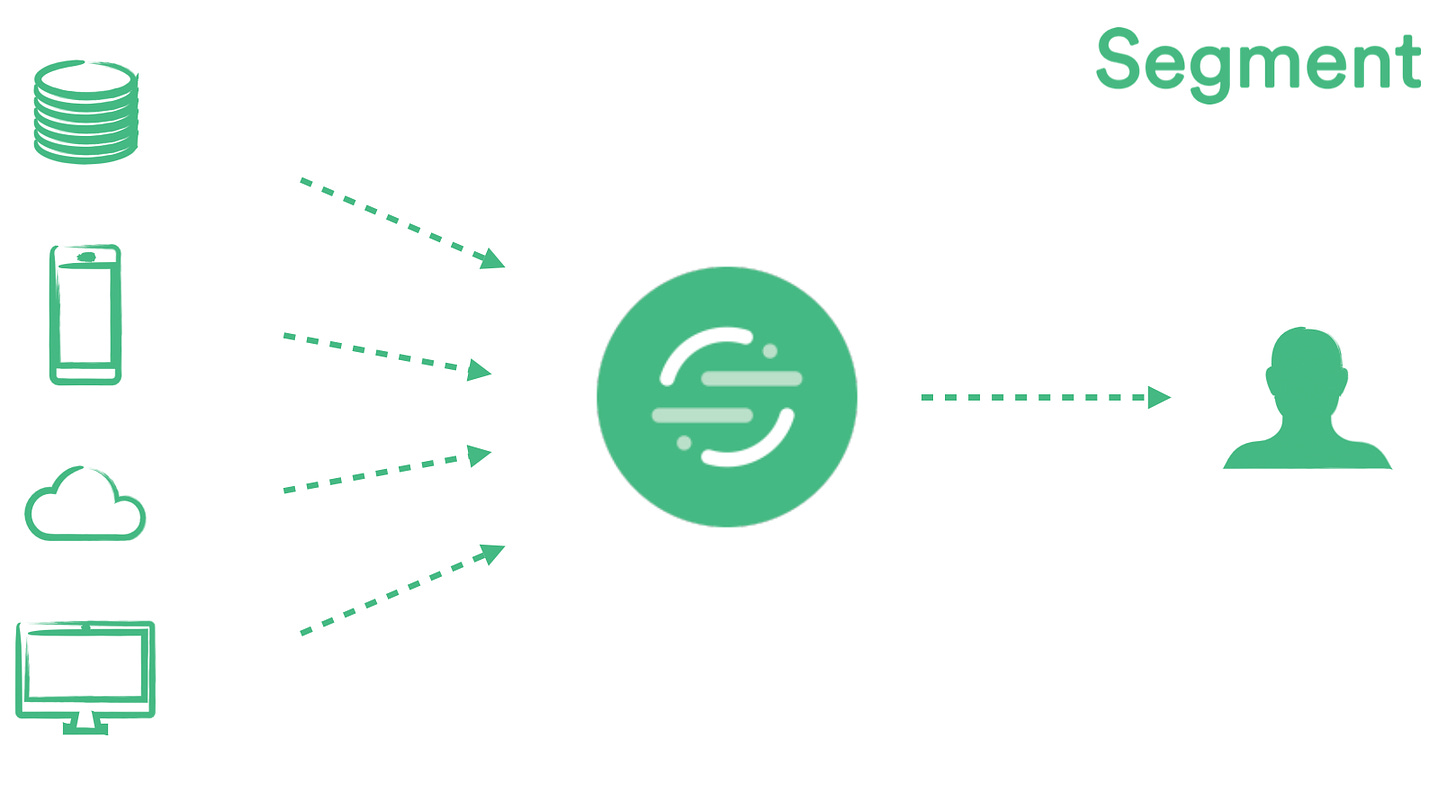

Segment, on the other hand, is almost entirely focused on internal customer analysis, wrangling the chaos of customer data across many sources and making sense of it.

Looking at each solution in isolation, it’s easy to see how balance can fall out of whack.

If an organization is spending all their time analyzing customer data, they’re likely spending too little time acting on the insights and communicating with customers.

Alternatively, if an organization messages customers without analyzing the results, there’s a good chance they’re sending irrelevant messages and missing opportunities to refine their strategy.

In an interview with Ben Thompson following the acquisition, Lawson spoke to the idea that Segment and Twilio are approaching the same challenge from different angles.

“To build a relationship really needs two things. First, it needs an understanding of your customer. Who are they? What do they buy? Why are they your customer? What are their preferences? And then the second thing is it takes engagement. Reaching out to the customer, talking to them, having them talk to you. Historically, we had always done the latter. But we never actually had a part in the, well, why are you reaching out? Who is this customer? What content should you send? When should you send it?”

Importantly, both sides influence the other, meaning it’s critical to think of understanding and engagement as two pieces of the bigger whole.

Again, from Lawson’s interview with Thompson:

“What you really need is the full picture of all the touch points you’ve had in order to solve these problems. That’s why it is such a good combination to bring these two together so that you don’t think of them as separate problems.”

Lawson’s contention that these are not separate problems positions the Segment acquisition as more than just another product in Twilio’s toolkit. Marrying the two allows Twilio to pitch customers a holistic solution to manage customer relationships.

That said, if they bring Segment into the fold as an independent offering, Twilio risks making their holistic pitch look like lip service. If offered as separate products, customers will likely continue looking at each solution as serving two different needs. By integrating pricing for the combined solution, Twilio can make a stronger case for the unified whole.

Inputs and Outputs 🔄

Along with serving opposite sides of the customer relationship, Twilio and Segment have fundamentally different pricing structures as well.

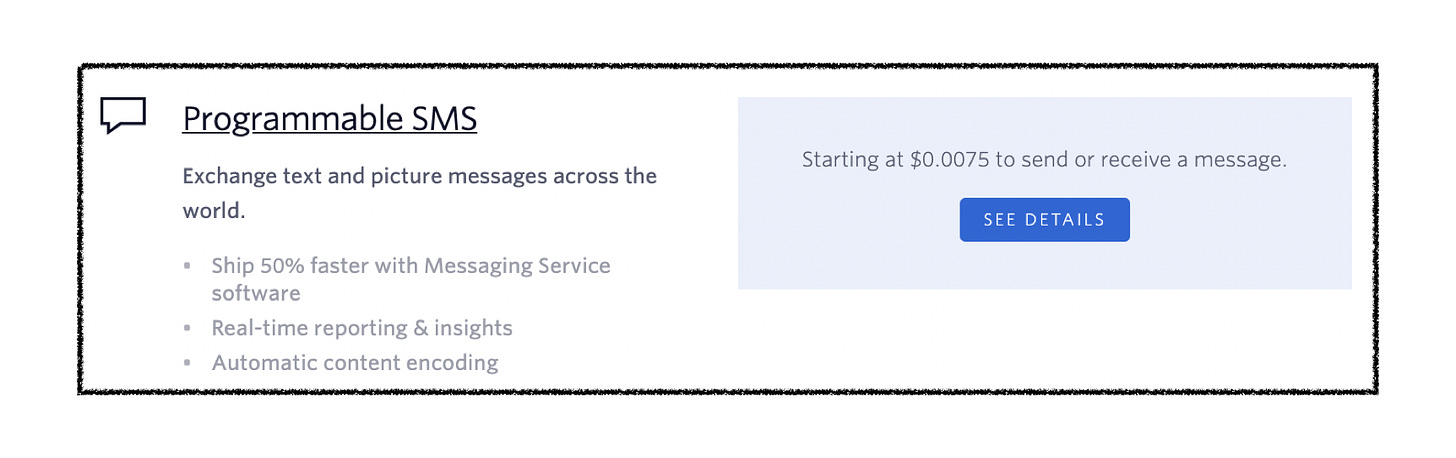

It’s worth noting Twilio offers a wide range of products, and their pricing model can be more nuanced with some offerings, but their core functionality is charged on a linear usage model as shown below.

This pricing is straightforward and rooted in transparency. Customers pay a marginal cost per message with scaling volume discounts as they send or receive more messages.

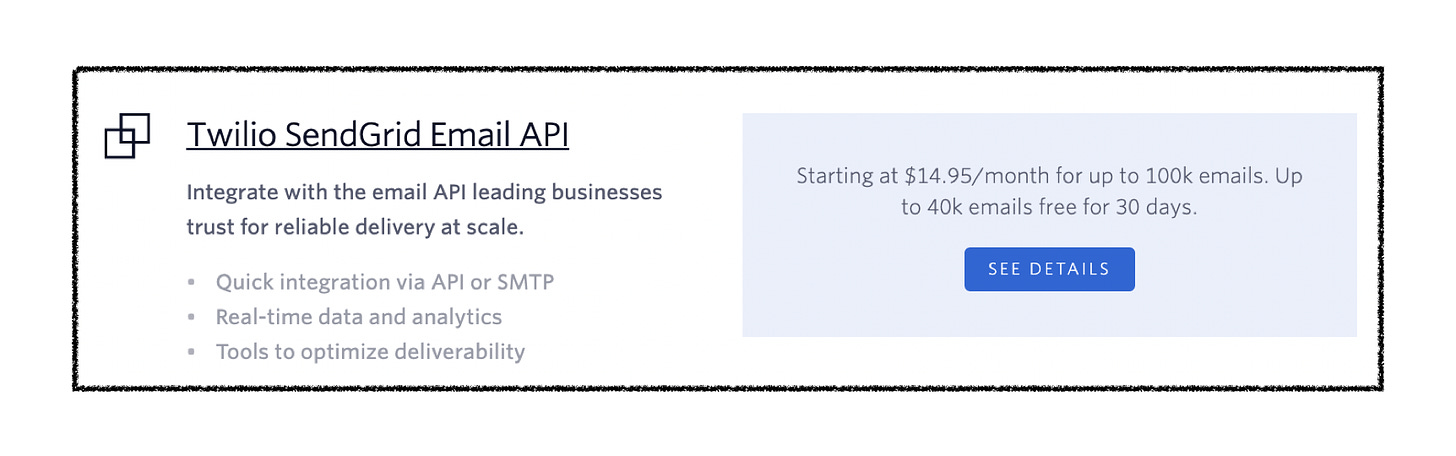

They also offer committed-use discounts, where customers lock-in discounts by committing to a specified usage volume. For example, their SendGrid email API starts at $14.95 per month for up to 100k emails.

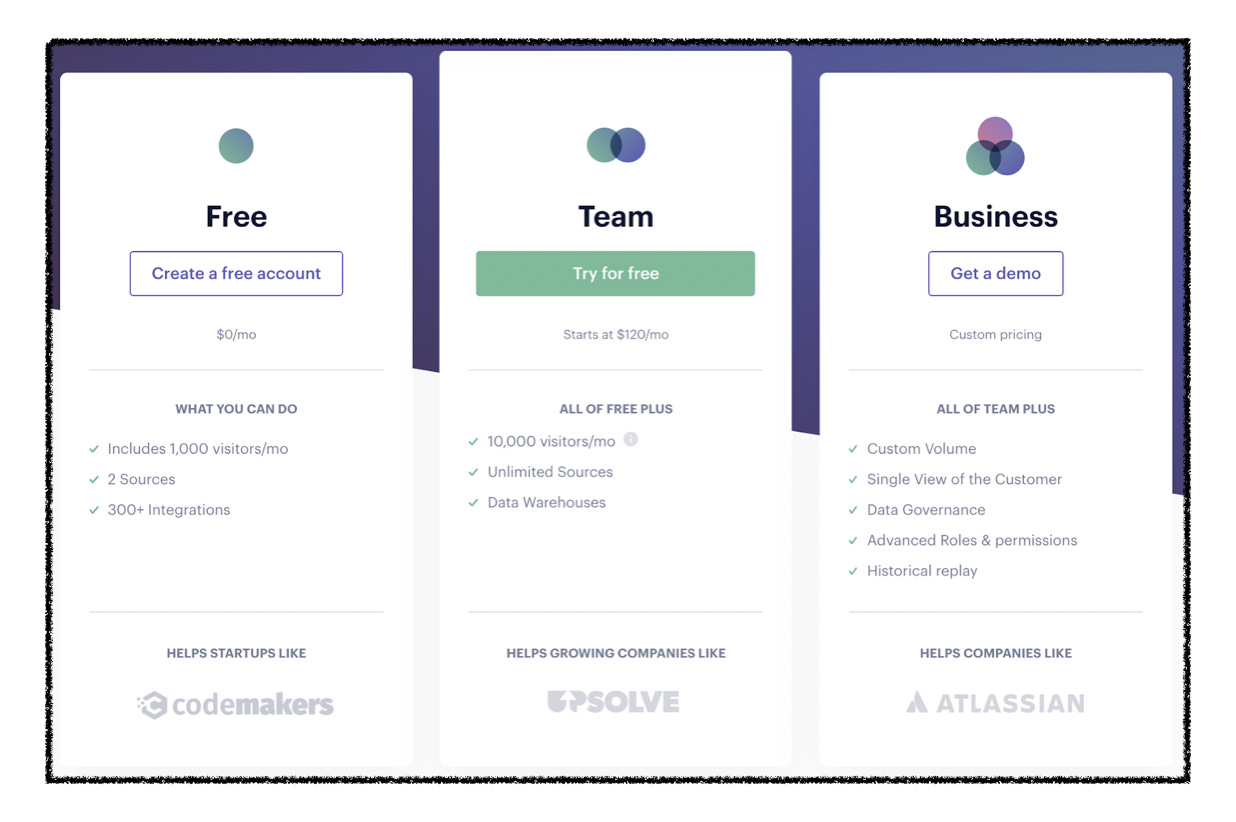

Alternatively, Segment packages their plans in a classic Good Better Best model with a 3-Part Tariff pricing structure, meaning they charge a platform fee for a base-level of usage with marginal costs as usage expands.

The primary unit for measuring usage in Segment is MTUs, or, Monthly Tracked Users. This is a combination of logged-in visitors and anonymous visitors that Segment tracks on a monthly basis. Beyond MTUs, Segment also differentiates plans with other usage-based variables like Sources, Seats, and Data Warehouses, in addition to features.

From a high-level, Twilio employs a pure-usage pricing model, while Segment has a value-based pricing model that’s common in SaaS - differentiating plans with usage limitations and features.

Thinking through what a combined offering might look like, there is a company that offers an all-in-one solution for understanding and engaging with customers: Hubspot. Just look at how they categorize the value of their Starter plan on the pricing page:

This combination of data ingestion and engagement is almost like a microcosm of Twilio/Segment.

As discussed in Hubspot’s Shadow Value Metric, Hubspot charges by marketing contacts and email volume, which are tied together by a ratio of 10 emails per contact. This approach allows Hubspot to elegantly price for both inputs (contacts) and outputs (emails).

Upon analyzing Twilio and Segment, one might consider a similar strategy. However, an interesting wrinkle emerges - Segment’s Monthly Tracked Users include anonymous visitors as well as known contacts. It’s difficult to construct a ratio of Communications-per-MTU when many won’t be receiving any communications at all.

It’s also hard to imagine a Good Better Best packaging structure that combines the full scope of Segment’s differentiation with Twilio’s communications channels layered on.

Despite these roadblocks to a conventional packaging strategy, Lawson doesn’t seem worried about it. During the acquisition presentation, he commented on Twilio’s pricing approach.

We give power developers the best infrastructure, and break down what historically had been monolithic systems into more flexible, agile building blocks so that they can get started very easily. And then as they expand, allow us to share in the success when our customers succeed in using our products. And I think that's how we will continue to execute for the foreseeable future. And I think Segment has a similar pricing and building philosophy that we do.

The idea of flexible, agile building blocks is powerful and should be essential to the way Twilio eventually structures an integrated offering.

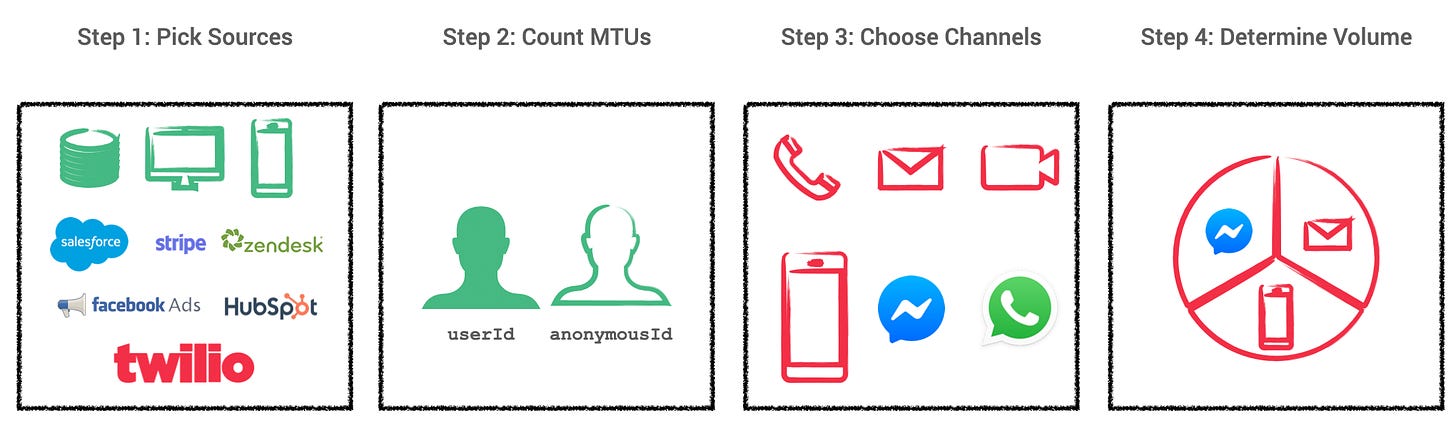

In fact, I believe there’s a way to sustain the transparent pricing Twilio is known for, capture the value of Segment, and help the Sales team tell a cohesive story in the process. The combined entity would be priced in a build-your-own model along four axes, structured along an intuitive sequence.

Here’s how the steps would play out:

Pick the Data Sources you need to ingest.

Count your Monthly Tracked Users.

Choose your communication channels.

Determine your send volume.

These four steps break pricing down into the most critical building blocks across each platform. They also give the sales team a salient narrative to align pricing with the customer journey.

Determine where customers are coming from.

Understand the differences between customers, known contacts and unknown visitors, and the nuances within each group.

Choose how you want to engage with customers and known contacts.

Determine how and how often you want to use each communication channel.

The cool thing is, Step 4 intuitively leads back to Step 1, as Twilio’s communication channels also function as Data Sources, proving Lawson’s point that they truly are solving two sides of the same challenge.

Conclusion

Of course, not every customer will want to use both Segment and Twilio together. No doubt, they will continue offering both solutions separately to some extent.

However, if they do plan on offering a holistic platform, as the visual below would suggest, it would feel a bit janky to cobble together pricing from each entity separately.

With the sequenced process above, Twilio can formalize a thought-process for using Segment and Twilio together, making the combined platform easier to sell, and easier to buy. The sequence is simple enough that they could even include a calculator on the pricing page so prospects can estimate what their investment might look like, maintaining the transparency that’s always been core to Twilio’s pricing strategy.

However they end up doing it, determining how to package and price their unified offering may be the first challenge Twilio and Segment end up solving together.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you shared it!

If you have thoughts or feedback, I’d love to hear from you! You can find me on Twitter here.

Really enjoyed this, thanks for sharing. (I work at Segment and we shared internally)

I really enjoy your pieces, Rob. It's something that I make time in my busy day to read.