Roundup: Google Gemini, "Service-as-a-Software" and A New Era for SaaS Margins

Plus: Updates from Miro, ZoomInfo, and Postman.

Welcome to Good Better Best!

It was a big week in SaaS pricing with updates from Google and Microsoft. Aside from that, I’ve been thinking about AI Agents, and the “services-as-a-software” trend thats beginning to emerge. It’s never been more exciting to study SaaS pricing.

Let’s get to it.

🚨 SaaS Product and Pricing News

ZoomInfo reoriented its sales product around AI.

Fireblocks overhauled pricing.

Avoma updated its plans.

Miro tweaked AI credit limits.

Temporal updated its pricing model.

Postman shifted user limits.

Google’s Gemini Power Move ✨

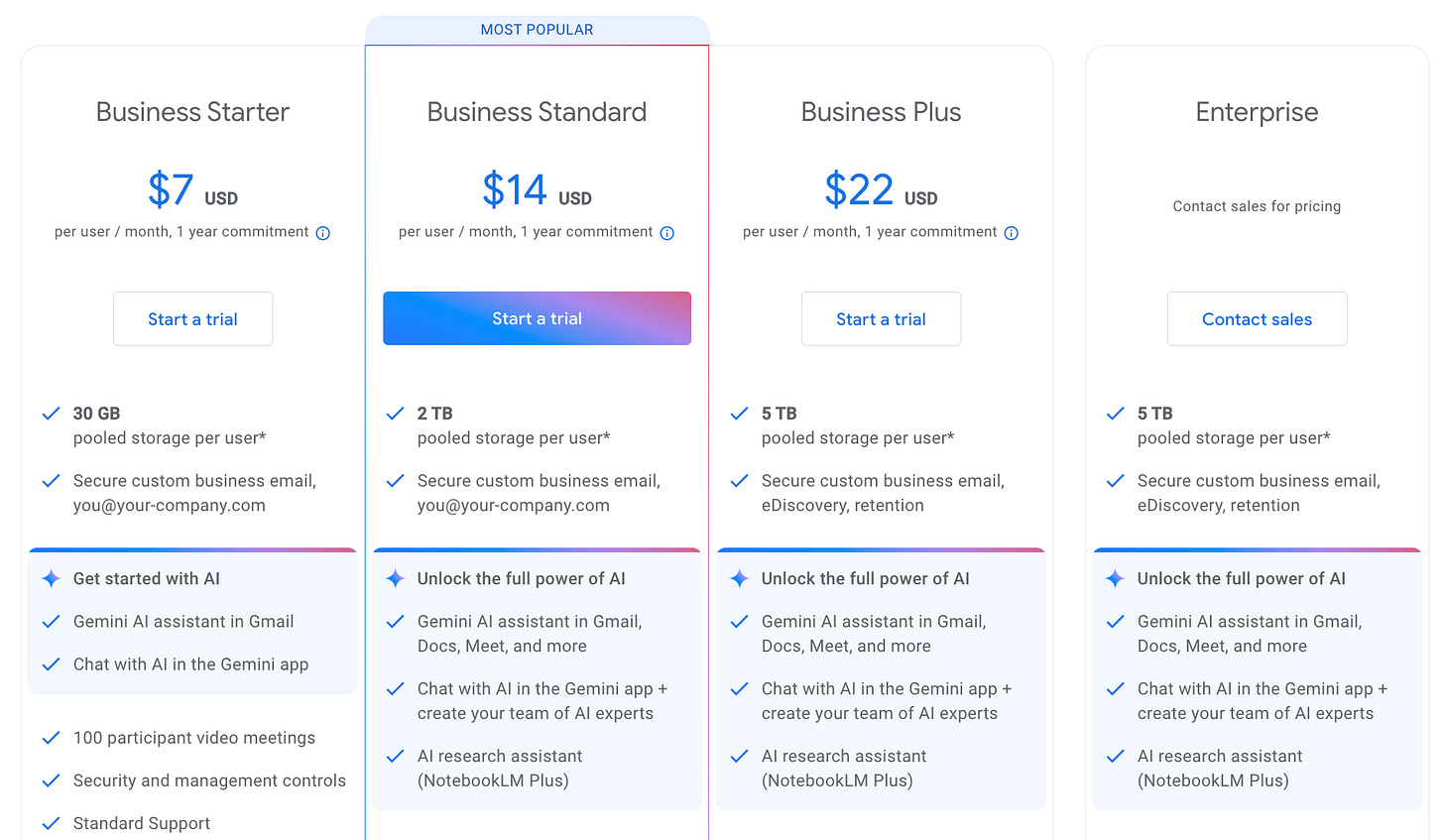

The big news this week is Google’s decision to bundle Gemini into Workspace plans rather than charging for it separately. From the company’s announcement:

We believe AI is foundational to the future of work and its transformative power should be accessible to every business and every employee, at an affordable price. That's why today we’ve decided to include the best of Google AI in Workspace Business and Enterprise plans, bringing the latest generative AI capabilities to our business customers without the need to purchase any add-ons.

This is an aggressive move that almost certainly leaves a lot of money on the table. Take an example that was shared in the announcement:

For example, a customer using the Workspace Business Standard plan with a Gemini Business add-on previously paid $32 per user, per month. Now, that same customer will pay just $14 per user, per month — only $2 more than they were paying for Workspace without Gemini.

As pointed out by Sam Lee (VP Pricing at HubSpot, and a must-follow on LinkedIn), the same day, Microsoft announced consumption pricing for 365 Copilot. These two strategies are fundamentally opposed, and I thought Sam’s analysis was spot-on:

The key problem that both Gemini Workspace and MSFT 365 Copilot need to solve is adoption, as well as people looking for killer use cases and AI work patterns that stick and resonate.

MSFT's model will likely face some challenges with initial adoption. The crux is how much "free" are they giving away? I have yet to see the actual rate card of what and how they charge.

Google's model is heavily geared toward adoption. The challenge with this approach is that it will likely require Google to raise prices frequently if usage picks up to maintain profitability (or this would become margin-dilutive in the long run) and also limit the type of AI services made available via this approach.

By "hitching a ride" with users, they're (Google) tying their monetization to user growth, limiting the type of AI services that can be monetized this way.

Both approaches have merits and risks. MSFT's approach has more runway to allow it to seamlessly monetize new AI services over time. Google "might" get a faster adoption curve, but it risks devaluing AI in the market (anchoring on $2/user) and is harder to pivot in the future.

My take: Google is betting on MSFT getting expensive, and that users will favor predictability. It’s aggressive, but I like it. Google is one of a few companies that can afford a margin hit on AI products, and this strategy will almost certainly drive a lot of Gemini adoption.

Human Support will determine the winners in AI 🤝

In a world of AI agents, human support will be a huge value driver. Thinking about how I use ChatGPT:

I share a prompt

ChatGPT returns results

I finesse the results into what I need

ChatGPT saves me a ton of time, but it doesn’t do everything for me. It’s a back and forth. I expect a similar dynamic to take shape as companies release “services-as-a-software” powered by AI agents. (Kyle Poyar had a great LinkedIn post this week breaking down the “service-as-a-software” trend).

In this world, some action (machine or human initiated) will kick off a job, but unless it’s an extremely simple one, it will likely kick off nuanced tasks that require human intervention.

The question becomes, which human handles them? The user or the software provider?

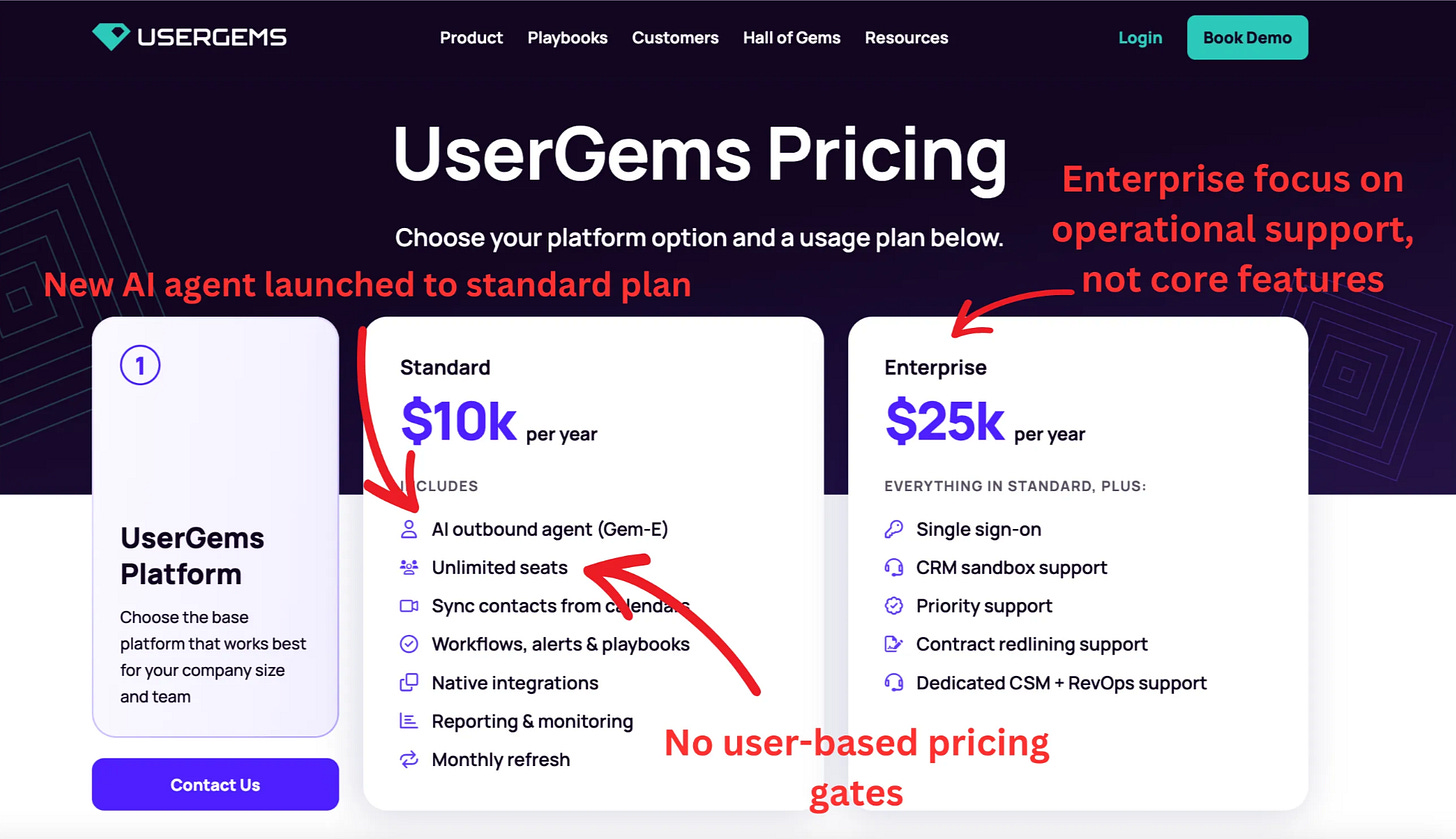

We’re already seeing examples of the latter. For instance, UserGems is giving all customers access to its outbound sales agent, Gem-E, and differentiating the Enterprise plan with various levels of Support (CRM, redlining, RevOps).

AI is making features table-stakes. If we’re moving towards outcomes, then it makes sense to differentiate based on the complexity of the job. That’s what we’re starting to see here with UserGems.

In the short term, supplementing the agent with human support will be necessary to complete nuanced workflows. In the long term, training agents on jobs done really well by humans will help remove humans from the mix.

Ironically, human support will be key to the winners of the AI agent era.

What We’re Reading 📖

A few great, short posts that I came across this week:

⏱️ The Last Mile of Pricing by

TLDR, your pricing strategy is only as good as the sales reps putting it into action. Loved this framing by Mark: Sales = The Last Mile of Pricing.

📊 The Margin Party’s Over and the Innovation Game is Just Beginning by and

Super clear breakdown on the future of SaaS, the math companies now need to do, and how pricing will determine the winners of the future.

🏗️ Debug 003: Validating A Pricing Overhaul by Ben Williams

Awesome breakdown on how to validate a new pricing model. Particularly love the idea of a “Shadow Launch” to keep the stakes low. Recommended this with any pricing change to get a sense for early feedback before going all-in.

Thanks for tuning in! If you enjoyed this post, share it with a friend to get access to our Pricing Link Library.

Note: Ibbaka has its pricing page back up, with a new package and more detail on supporting solution packages. https://www.ibbaka.com/saas-value-pricing

Should we say Service as a Software or just Service as Software. I went back and forth but used the latter in the Ibbaka Report on AI Monetization in 2025.