Welcome to Good Better Best!

In today’s newsletter, we’re breaking down the pricing strategy of beehiiv, a SaaS platform that helps individuals, businesses, and organizations to build, grow and monetize newsletters. Beehiiv was founded by early Morning Brew product leaders, and has since become one of the most important hubs for the Creator Economy.

Let’s get to it.

2024 SaaS Pricing Benchmarks

Last week, we published our latest SaaS benchmarks report, featuring pricing trends from 400+ SaaS companies. It’s jam-packed with examples, and even got a write-up in Kyle Poyar’s Growth Unhinged. Get the report.

🚨 SaaS Product and Pricing News

Loom introduced a new AI plan.

GitHub added a Data Residency feature.

Grammarly added features and changed user limits.

Wistia shifted webinar-focused features.

Squarespace tweaked pricing on the Basic and Plus plans.

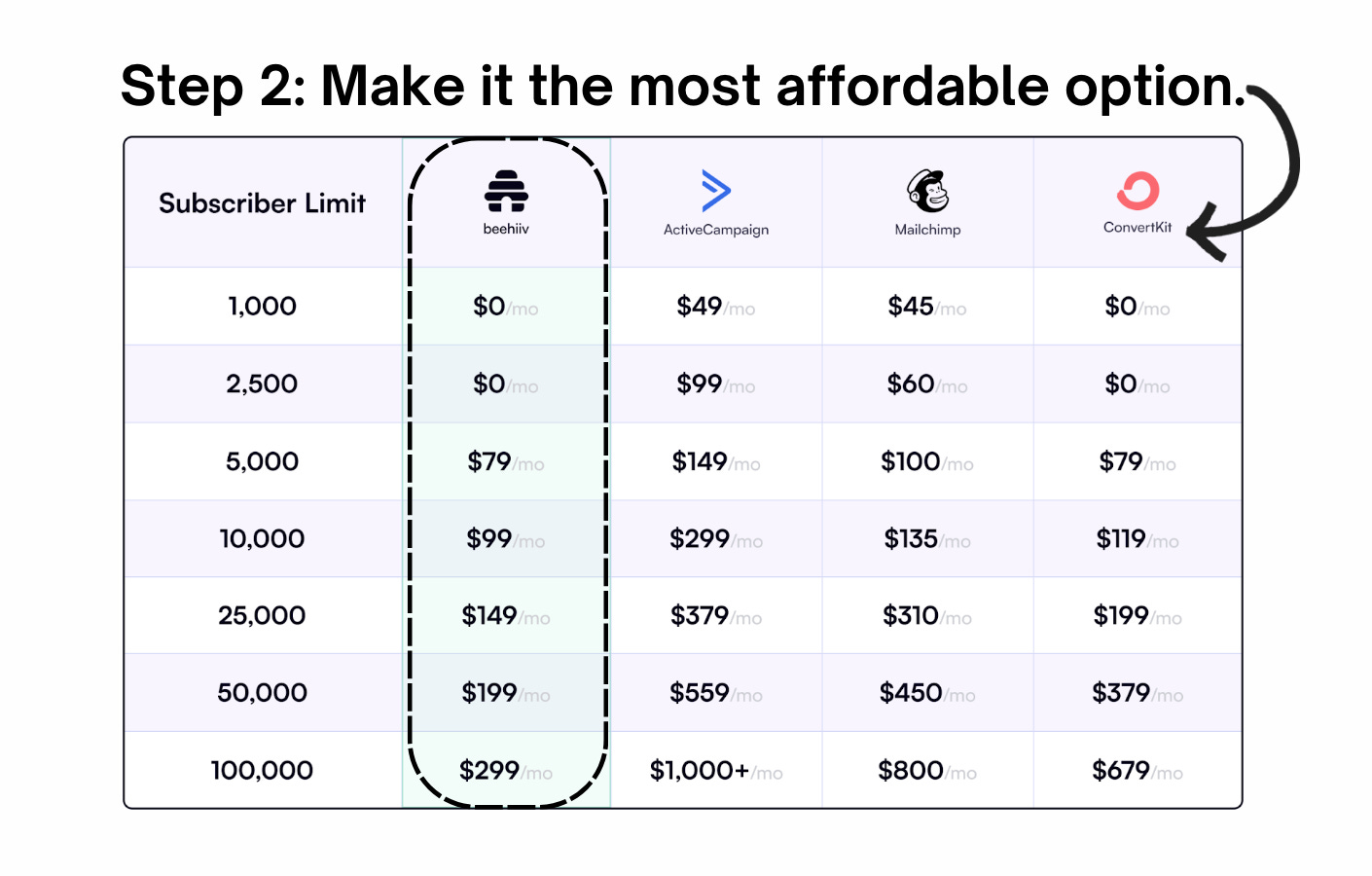

In the past few years, beehiiv has quickly become one of the fastest-growing companies in SaaS. The formula for their success is simple, and can be boiled down to two steps:

The second chart is a little deceiving, because Substack is free if you don’t have a paid subscription. However, Substack doesn’t offer any ad infrastructure, and if you do charge for a paid subscription, Substack’s 10% take rate is steep.

Either way, beehiiv has built the most purpose-driven solution for newsletters, and is pricing it more affordably than the competition.

When you have this combination working for you, the granular details of your pricing strategy don’t matter as much. In short, beehiiv is an a no-brainer if you’re starting a newsletter business.

Earlier this year, the team overhauled their pricing with the following updates:

Added value to the Free plan — adding 3 new features that were previously only available on paid plans.

Lowered the price of the Scale plan — this is beehiiv’s lowest paid tier, and includes features like the Referral Program, Boosts, Ad Network, and Automations.

Added a new Max plan — allows users to remove beehiiv branding, launch up to 10 publications, receive priority support, and access the NewsletterXP Course (which previously sold for $999).

Rolled out tier-based pricing — which ties price to the subscriber volume bucket a customer falls into.

According to CEO Tyler Denk in the memo for this pricing update:

In total — nearly 70% of our users are either receiving a discount to what they were previously paying, or now have access to more features while keeping their monthly billing the same.

This dynamic definitely makes a pricing update easier.

At the same time, pricing went up for roughly 30% of beehiiv’s customers. They deserve credit for pushing these customers to the new model rather than allowing them to stay on legacy plans, something many SaaS companies do that can cause a chaotic SKU mix down the road. To ease the transition, beehiiv gave them a multi-month buffer to transition to the new plans and price points.

The result of this price update is a classic Free-Good-Better-Best packaging model where the monthly SaaS fee is determined by your plan and subscriber volume.

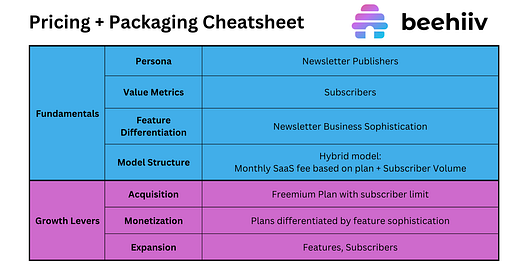

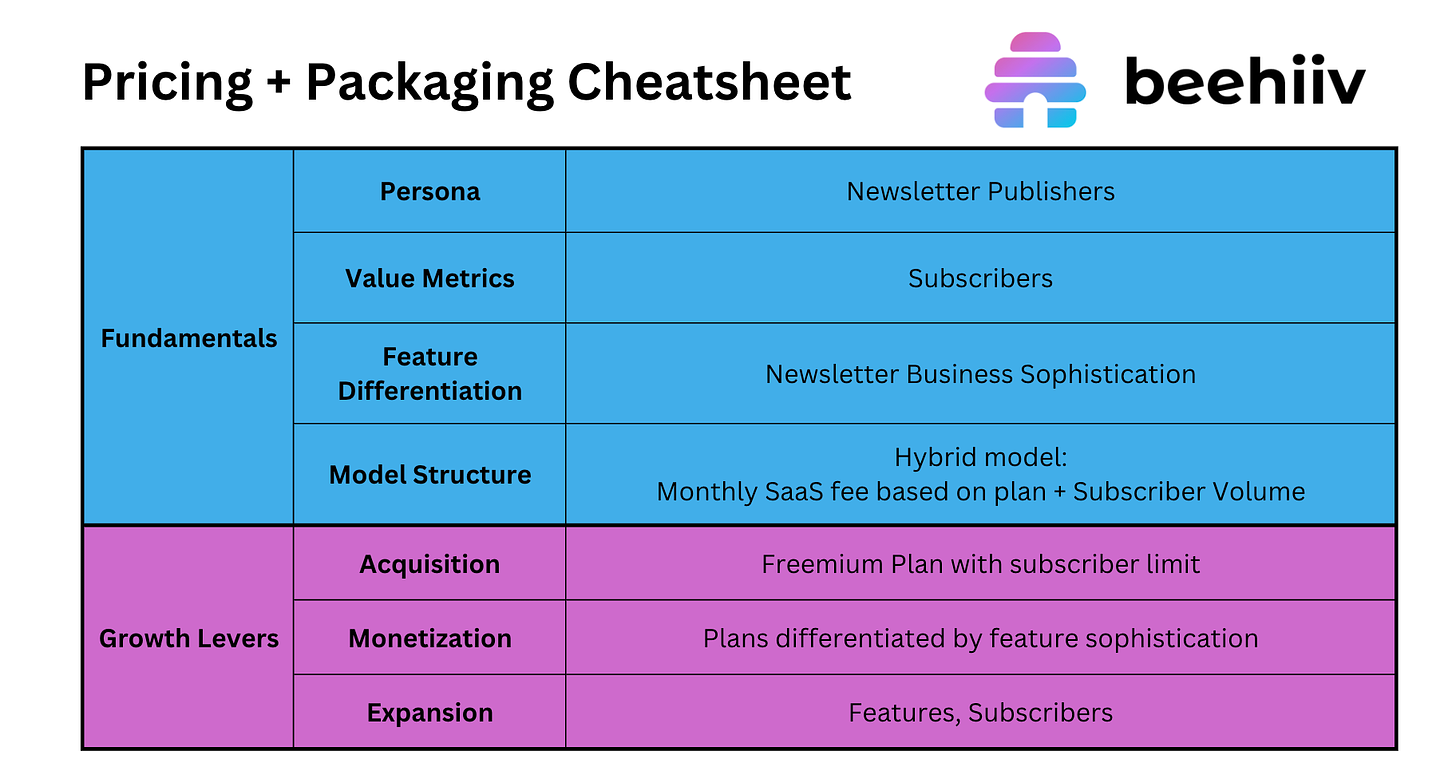

Below, I’ll break down the four fundamental components of beehiiv’s pricing strategy, as well as their approach to the three key growth levers: acquisition, monetization, and expansion.

The Fundamentals 🧱

Buyer Personas

Beehiiv doesn’t go out of the way to call out different personas on their pricing page. They keep it focused on the end goal, helping users create, grow, and monetize newsletters. That said, they do have a dropdown menu on the website that highlights some of the topics where they host popular newsletters:

And a banner with social proof from some of the biggest newsletters in the creator economy:

This is solid social proof, with an obvious takeaway: if you want to grow your newsletter, beehiiv can help.

Value Metrics

Beehiiv’s primary value metric is Subscribers, which determines the monthly SaaS fee for each paid plan. Importantly, beehiiv has two subscriber limits that bookend it’s plans:

Free users must upgrade to a paid plan when they exceed 2,500 subscribers.

If you have more than 100,000 subscribers, you need to upgrade to Enterprise.

Between 2,500 - 100,000 subscribers, customers can choose either the Scale plan or the Max plan, which are primarily differentiated by features.

Beehiiv also has two secondary value metrics:

Users: The Free plan only allows 1 user, so you need to pay to add multiple users

Publications: Free and Scale allow 3 publications, Max allows 10 publications, and Enterprise allows Custom publications.

The user limit is smart, and a tactic you’ll see often with free plans.

The publication limit is interesting as well, and could be utilized as another axis for monetization (e.g., charge a scaling add-on fee for various buckets of publications). However, this would complicate beehiiv’s pricing model — a challenging proposition for a solution that serves a consumer ICP, rather than B2B companies.

Feature Differentiation

Besides the low and high-end subscriber limits, beehiiv uses features to differentiate its four plans: Free, Scale, Max, and Enterprise.

While they don’t provide much color on who each plan is for on the pricing page, beehiiv did release a guide when they updated pricing in April. In short:

Free allows users to grow their newsletter for free until 2,500 subs.

Scale is for growing newsletters that are ready to monetize and accelerate growth.

Max offers premium features (e.g., remove beehiiv branding, premium support) at an affordable cost.

Enterprise is for newsletters with over 100k subscribers, and offers unlimited sends, publications, a dedicated IP address, early feature access and Concierge Onboarding.

Overall, the plan mix makes sense. I’m not totally convinced the Max plan needs to exist, but the alternative would be offering those features as add-ons or restricting access to Enterprise, and I’m not convinced either is the right move.

I do think there’s an opportunity to slide some features around to tell a better story with plans. Specifically:

Move the Referral Program feature from Scale to Launch to help users hit 2,500 subs ASAP. This plan should be all about growth.

Move Subscriber Tagging and Audience Segmentation from Launch to Scale. The Scale plan should be all about audience development and monetization. There’s rarely a need to segment or tag subscribers on a list of less than 2,500 subs.

Move NewsletterXP (Beehiiv’s newsletter course) back to an Add-On so anyone can buy it. I’ve never seen a course used as a feature and it feels misplaced. Would also lower the price compared to what it used to be ($999) to make it more accessible. I’d even consider making it free. A company with beehiiv’s ARR (prob ~$20m at this point?) shouldn’t be using this course for monetization, but to drive customer success, which would indirectly influence recurring revenue.

Model Structure

Beehiiv has a tiered model that’s differentiated by features, with the exact price points determined by subscriber volume.

One thing I think beehiiv does very well is space the subscriber buckets far enough apart that it doesn’t feel like they’re nickel and diming customers, which is something not all newsletter platforms can say.

Subscribers are the widely accepted value metric in the newsletter world, so it makes a lot of sense for beehiiv, but it’s worth mentioning it’s not perfect.

Beehiiv offers lots of tools to help users grow subscribers, which is great, but one of those tools, Recommendations, has been scrutinized for opting subscribers into newsletters that they never meant to sign up for (to be clear, Substack and ConvertKit do the same thing).

Downstream, this can have a negative impact on list hygiene, and even further downstream, on email deliverability. I bring this up because one of ConvertKit’s biggest competitive positions against beehiiv is email deliverability.

Beehiiv CEO Tyler Denk contends they made an infrastructure update in April 2024 that impacted deliverability for 2-3 weeks, and that ConvertKit blew it out of proportion. Further, beehiiv is built on Sendgrid, the same email infrastructure as ConvertKit. That doesn’t mean they have the same deliverability metrics, it depends on lots of factors, but it’s worth noting.

Either way, a big flex for beehiiv’s product team would be to release list hygiene tools or even email verification features (a la Kickbox) to nip this in the bud.

Growth Levers ⚙️

Acquisition

Beehiiv has a great Freemium plan. The 2,500 subscriber cap offers room for growth, and the plan is packed with features to help a newbie grow fast. Again, I’d recommend they drop the Referral Program feature into Launch to accelerate growth further.

Monetization

Beehiiv has a solid monetization strategy between subscriber tiers and feature differentiation. Importantly, their team ships features at light-speed, which means they are constantly pushing features down to lower plans and adding value for all customers. You love to see it.

Expansion

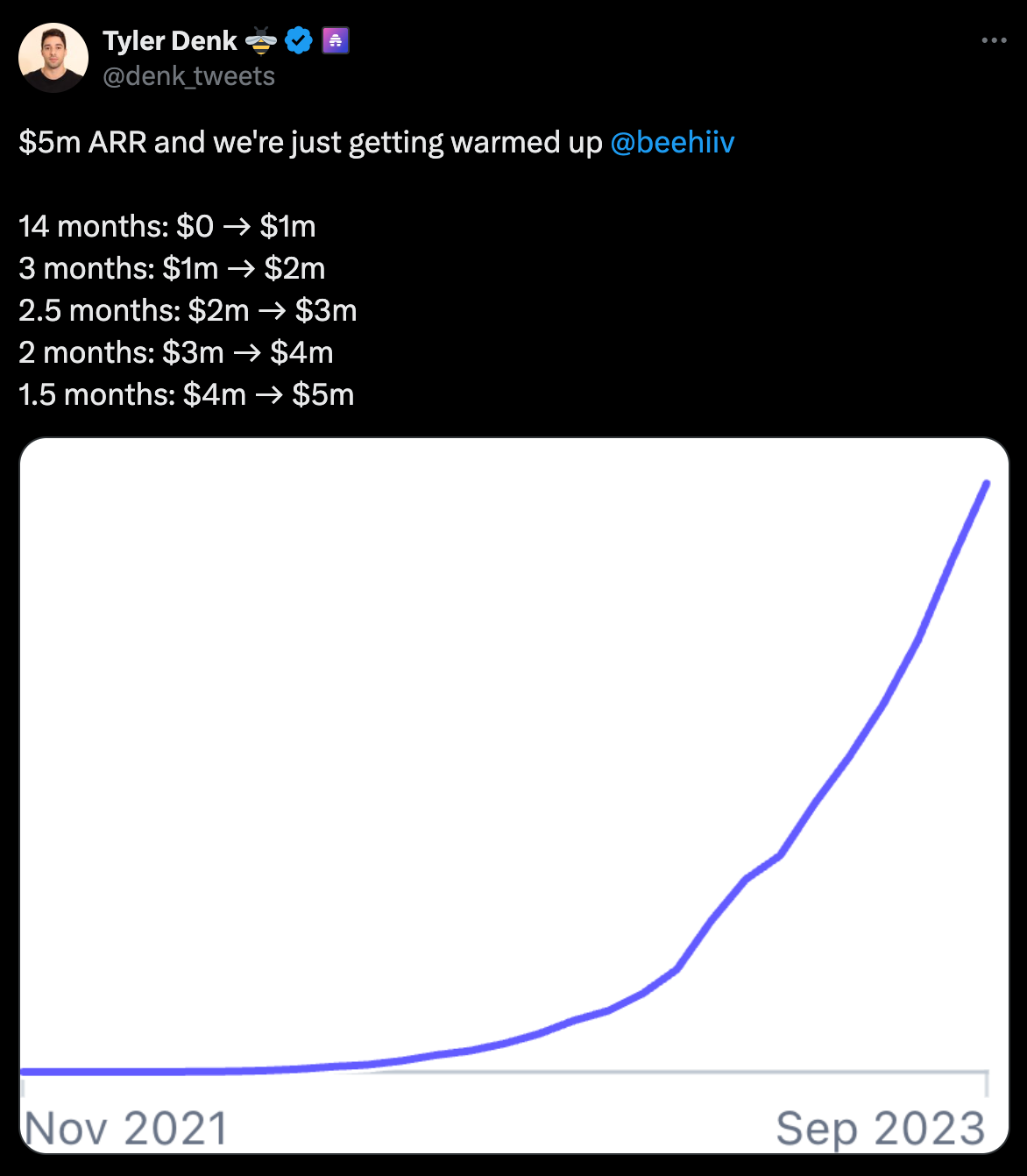

The slope of the line in the graphic below tells you all you need to know here:

Beehiiv is well over $10m ARR now, and has clearly built a product that helps its customers grow. This is where all of those native growth tools really pay off.

Recap ☑️

In summary, beehiiv has a solid pricing model.

Is it perfect? I don’t think so. But the fundamentals are powering a rapid growth story. Like I said in the beginning — when you build a better product than the competition, and sell it at a lower price, you don’t have to be perfect.

From an outsider’s perspective, it seems everything beehiiv does is at a rapid pace, and candidly, I respect that they don’t seem to overthink things. Instead, they let it rip.

Thanks for tuning in and see you next week! If you enjoyed this post, share it with a friend.