Pricing Roundup: Breakdowns for Ramp, Ahrefs, and Mixpanel

Plus: Updates from Superhuman, Linear, and Docker.

Welcome to Good Better Best!

It was a busy week in SaaS. Today, we’re doing a round up of recent pricing moves and announcements. Next week, we’ll wrap up the year with our favorite pricing moves of 2024.

We’ll be off the week of Christmas, but back strong in January with a deep dive on Superhuman’s recent pricing refresh (and commentary from the team behind it).

Let’s get to it.

🚨 SaaS Product and Pricing News

Bill.com introduced a discount.

Docker raised prices.

Linear raised the price of the Business plan.

Ramp reorganized the pricing page.

Superhuman added new features.

📋 Pricing Roundup

Over the past couple weeks there have been a number of moves by big SaaS names that I’ve been wanting to double click on. Some quick notes below.

Ramp reorganized its pricing page.

Ramp pulled feature categories into the main menu, listing specific features by category to show the full breadth of their solution. While this is more of a cosmetic move than an actual pricing update, it’s worth highlighting because moves like this can have a big impact on perception externally and alignment internally.

Previously, Ramp listed its feature categories as if they were features. Now, each category is bolded with related features nested underneath. This visual emphasizes that Ramp can replace multiple products, and is an all-in-one platform for finance teams. If these categories were hiding in the grid below, there’s a chance visitors might not realize the full scope of Ramp’s capabilities.

Internally, the pricing page can keep teams on the same page. The emphasis on multiple products is clearly part of Ramp’s product marketing, but this emphasis on the pricing page also drives it home for the GTM team as they chat through plans with prospects and customers.

Ahrefs adjusted the price for additional users.

Blink and you’d miss this one. You might need to squint at the gif above to see it, but if you do, you’ll notice Ahrefs adjusted the price for additional users across its core plans:

Lite went from $50 per user to $40 per user for up to 2 additional users

Standard went from $50 per user to $60 per user for up to 5 additional users

Advanced went from $50 to $80 per user for up to 10 additional users

This is one of those sneaky adjustments that can drive expansionary revenue and improve metrics like ARPU and ARPA.

Love that they lowered the price per additional user on the Lite plan to incentivize adoption on the low-end, while better monetizing their premium tiers. The increase for Standard and Advanced is an easy story to tell too given the added value from the features differentiating each plan.

This is a solid reminder that there are many levers to pull when it comes to growing revenue through pricing.

Mixpanel changed usage limits on the free plan.

Pretty big change here by Mixpanel. Previously they offered 20M monthly events on the free plan, a generous amount compared to competitors. They scaled that back to a limit of 1M monthly events. This would make it seem like Mixpanel is looking to drive free-to-paid adoption.

However, they also launched Session Replays earlier this month, and now offer 10k monthly Session Replays in the free plan. This combination gives Mixpanel users both quantitative (Events) and qualitative (Session Replays) data on how users are engaging with their product.

While there’s an argument that this addition made the free plan stronger, its worth noting Statsig offers 2M monthly events and 50k monthly Session Replays in the free plan. So even if Mixpanel did make the free plan better on one dimension, they’re less willing to delay monetization than at least one competitor.

🗣️ Announcements

A few highlights from this week include:

OpenAI introduced ChatGPT Pro for $200/mo

There were many takes on this move. Damian Amaya, who runs Product & Growth at ActiveCampaign dropped some solid perspective in the GBB chat:

I like OpenAI’s approach here. My assumption is their current paid customer base is a wide range of consumers, prosumers and business users, so making their Pro tier 10X more expensive will provide a ton of first-hand data on which ICPs are willing to pay premium pricing and which features those customers use the most. I’d bet we will see a mid-tier package in the near future that is informed by this exercise. Really like how they’re using fencing and skill level of models to determine pricing & packaging.

Figma announced an upcoming pricing change.

Figma will be raising the price of its core product, giving Admins the ability to add users to an account, and including both FigJam and Figma Slides access in all paid seats. Importantly, this change won’t go live until March 11, 2025. Kudos to Figma for giving customers 90-days to figure it out. Excited to break down the new pricing page when it actually goes live!

Great read on outcome-based Pricing.

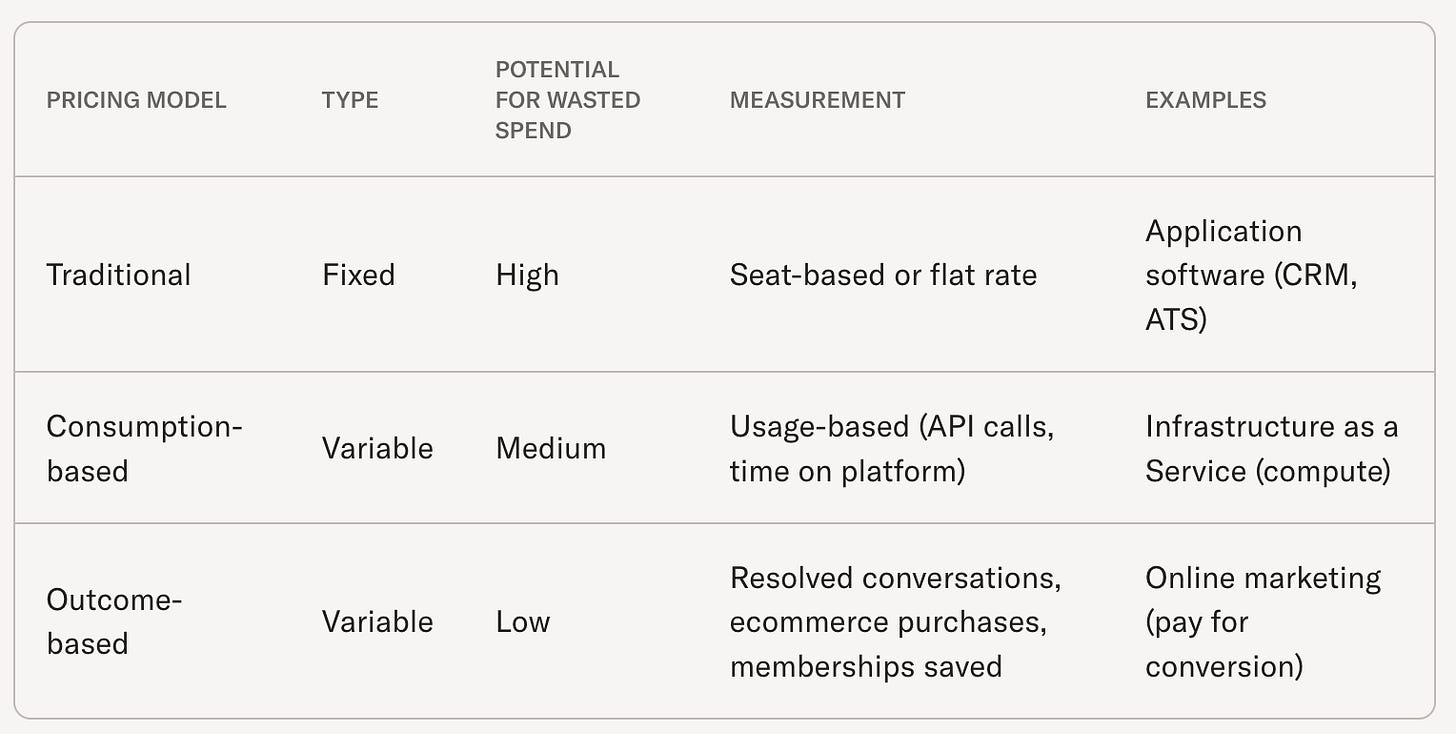

Sierra AI’s Elliot Greenwald wrote a great, short read breaking down how Sierra is thinking about outcome-based pricing for its AI agents. He also created a cool table comparing it to traditional SaaS pricing and consumption pricing.

Thanks for tuning in! If you enjoyed this post, share it with a friend.