Pricing insights from Shopify, AMC, and Magic Spoon 🥣

A medley of pricing perspectives from the past couple weeks.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

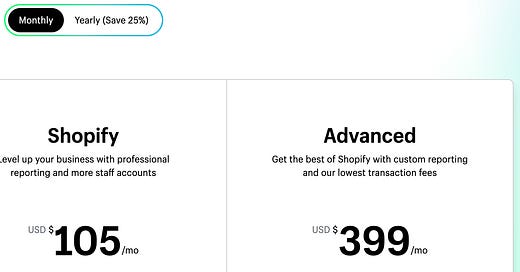

Shopify made its first pricing change in 12 years a couple weeks back.

The upgrade reflects a 33% increase across the board, but merchants can still lock in the old pricing by signing up for an annual plan.

Twelve years is a long time to go without a pricing change. While there are probably several reasons Shopify hasn’t raised its prices til now, a big one is that they didn’t have to.

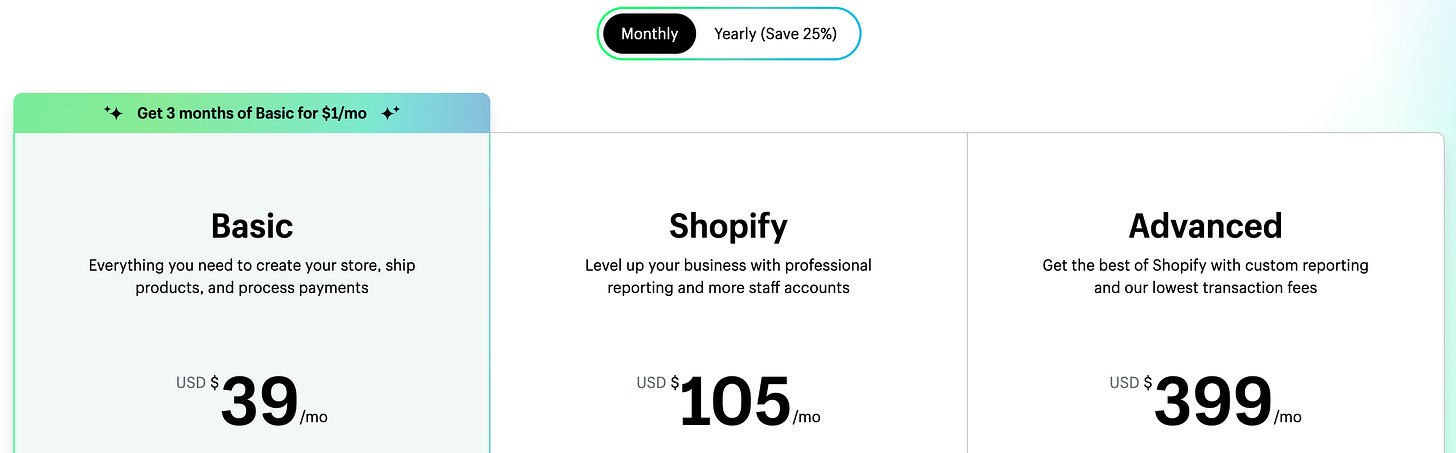

While subscription were their biggest revenue stream when they went public in 2015, that’s no longer the case. In their last earnings report, Merchant Solutions (fees from payments, shipping, etc.) accounted for ~73% of total revenue, compared to 27% for Subscription Solutions.

Simply put, Shopify’s revenue mix has become less dependent on the number of merchants using its platform, and more influenced by the volume of transactions merchants are pushing through.

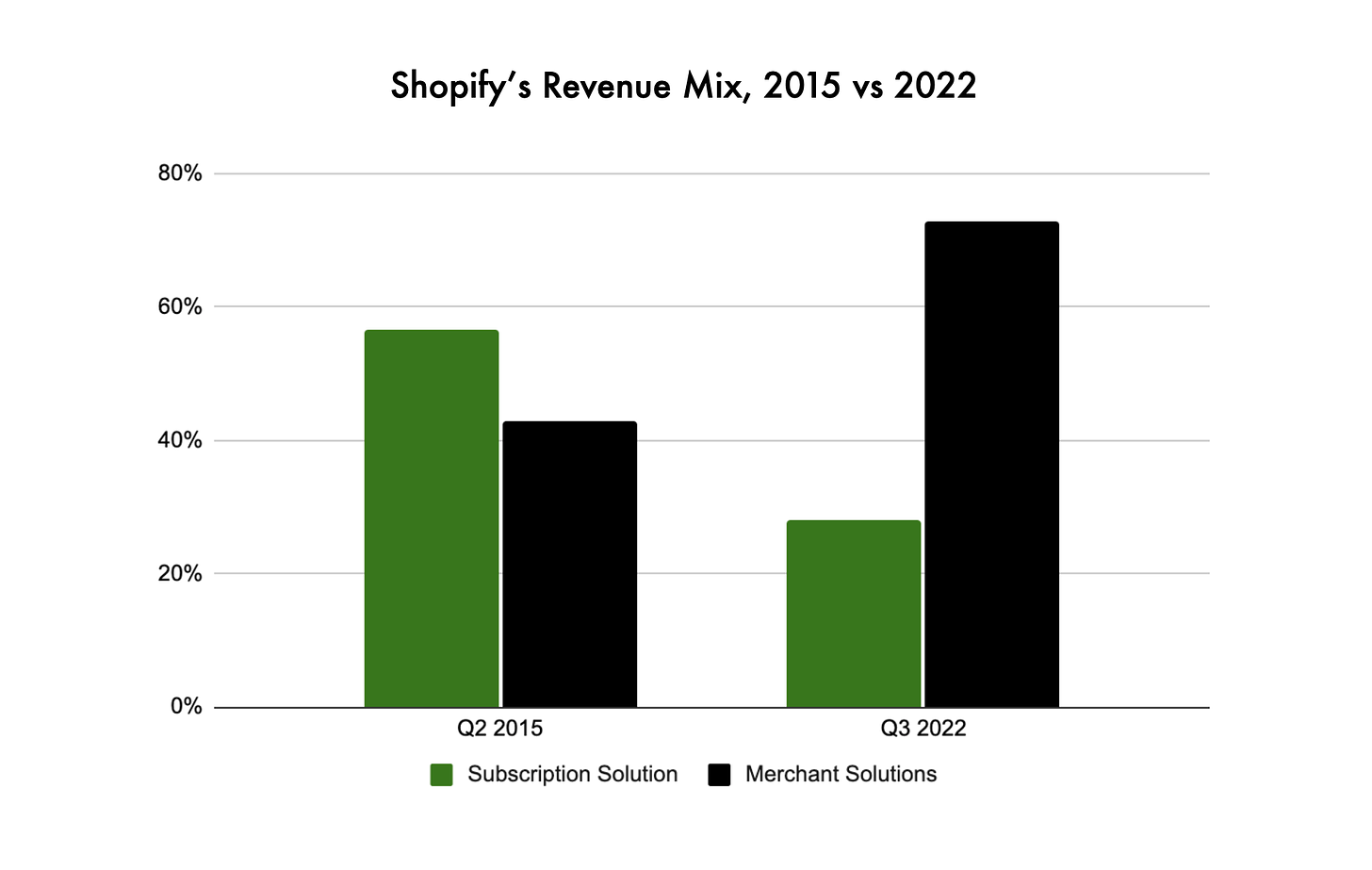

Plus, holding their price gave Shopify positive optics relative to competitors. For years, the prices for their low-end tiers matched BigCommerce exactly.

Now that BigCommerce has positioned itself as more of an enterprise solution, there’s little risk in Shopify raising it’s downmarket pricing. Most merchants know it’s the best solution for small eComm businesses.

Want more?

One of the coolest parts of Shopify’s monetization strategy is how they use transaction fees to make their platform stickier for merchants. Check out my breakdown on Shopify Payments below.

AMCs new pricing and the future of movies 🍿

Last week, AMC got a lot of heat for a pricing experiment they’re running.

If you missed it, the theater chain announced variable pricing, with seats in the middle and back of the theater getting $1 to $2 price hikes, and seats in the front row getting a $2 discount.

Much of the scrutiny compared this ticket pricing to concerts or sporting events, which have long offered variable pricing.

While I was initially dubious, I’m starting to come around on the idea. Here are three reasons this move makes sense.

First, variable pricing only makes sense if there is a difference in value inherent to the product. If you’ve ever arrived at the theater late and had to sit in the front row, you know this is inherently true — some seats are better than others.

Second, based on attendance trends, it’s starting to make sense for movies to be treated as an outing similar to a concert or sporting event.

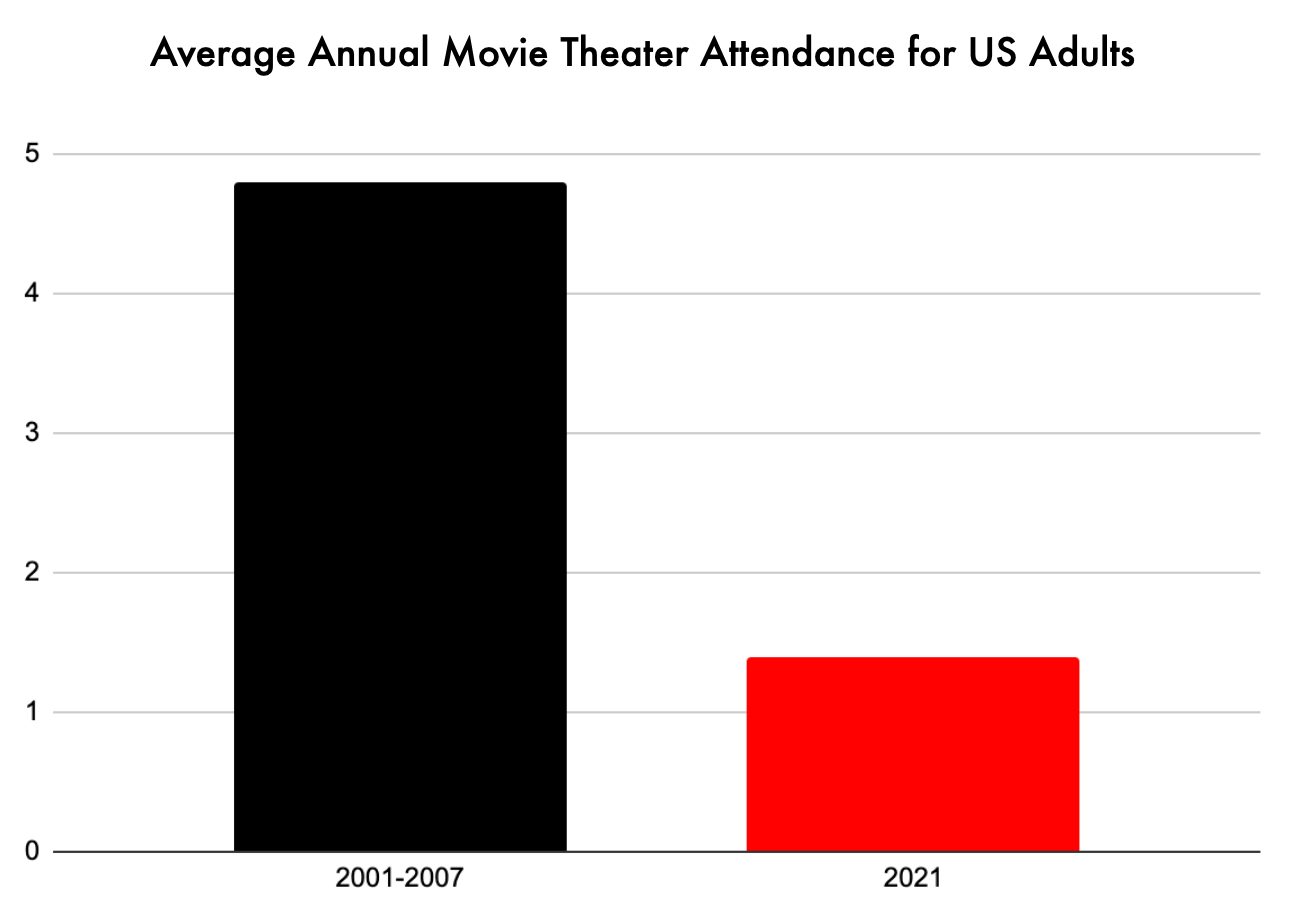

In the last twenty years, the average number of movies a US adult sees per year has fallen off a cliff.

This infrequency, paired with the increased framing of “event movies” that dominate the box office has made going to movies feel like more of an outing than it used to.

Going forward, it seems like box office attendance will continue to follow a power law with big releases like “Top Gun: Maverick” and “Avatar: The Way of Water” being the titles viewers deem worthy of a theater visit, while indie films and comedies will increasingly be viewed at home on streaming platforms.

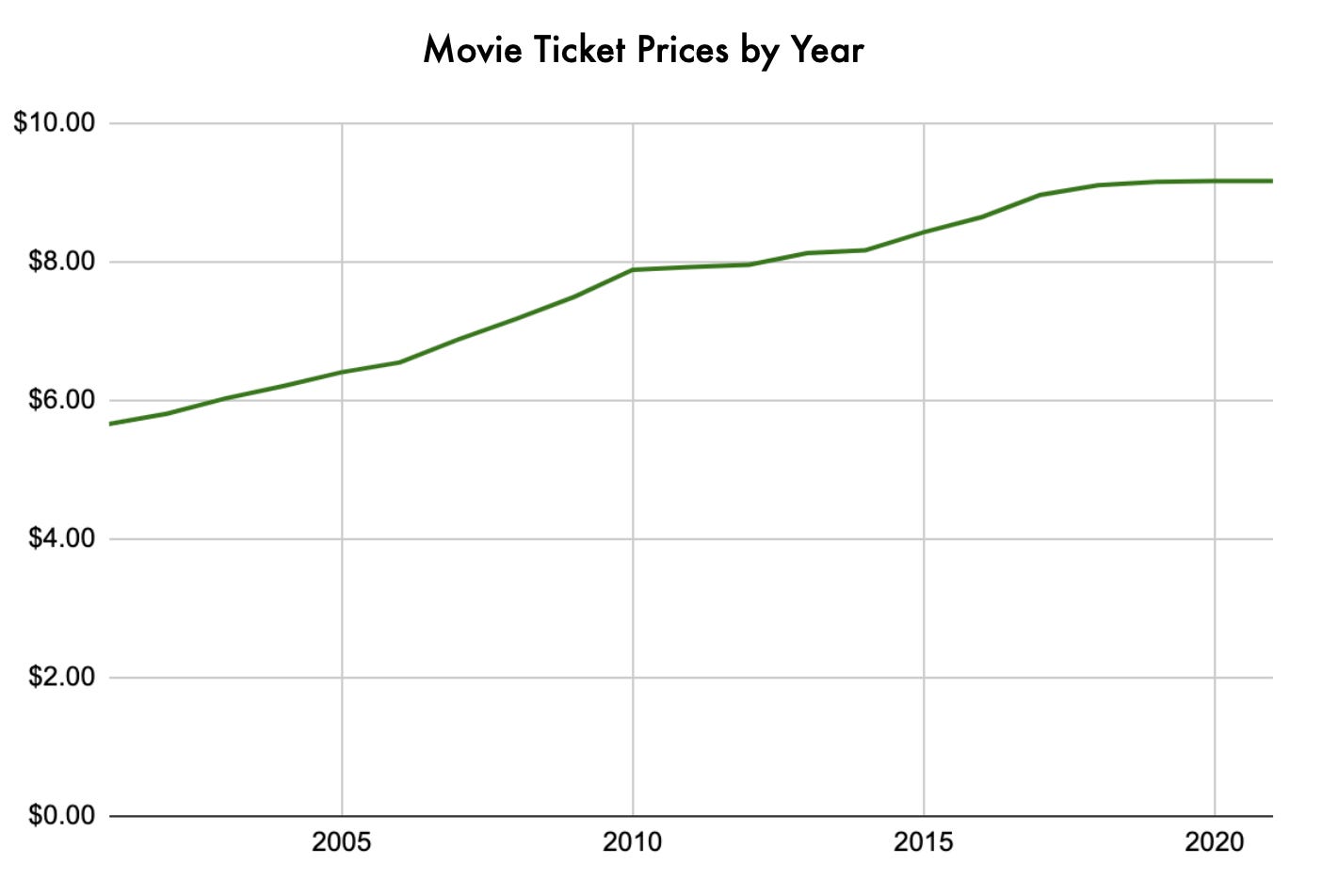

Lastly, while nowhere near as expensive as concerts or sporting events, movie ticket prices have been rising for years. Since 2001, the average ticket price has jumped from $5.66 to $9.17.

All of these factors put more weight behind a trip to the theater, making it less casual than it used to be. In that sense, variable seating might be only the beginning.

Some theaters already offer food and beverage service, and there’s a world where on-site merchandise sales could make sense as well.

The new kid in the cereal aisle 🥣

Last week, Magic Spoon announced they're expanding to ~7k grocery stores nationwide. This begs the question -- how did a cereal upstart go from a D2C pipe-dream to national grocery distribution in under 5 years?

Let’s take a step back.

If you’re anything like me, your childhood mornings started with a huge bowl of cereal while watching SportsCenter.

Turns out we weren’t alone. One estimate claims the average American eats 100 bowls of cereal per year — which includes people that don’t eat any!

But as Americans have become more health conscious, cereal has drawn scrutiny — a bowl full or carbs and sugar isn’t how the aspirational American starts their day.

That’s where Magic Spoon comes in.

In 2019, the company launched with the goal of disrupting this “stale, but massive category,” by offering cereal that’s gluten free, sugar free, and packed with protein.

You may be wondering how much a box of this cereal will run you, and that’s where it gets interesting.

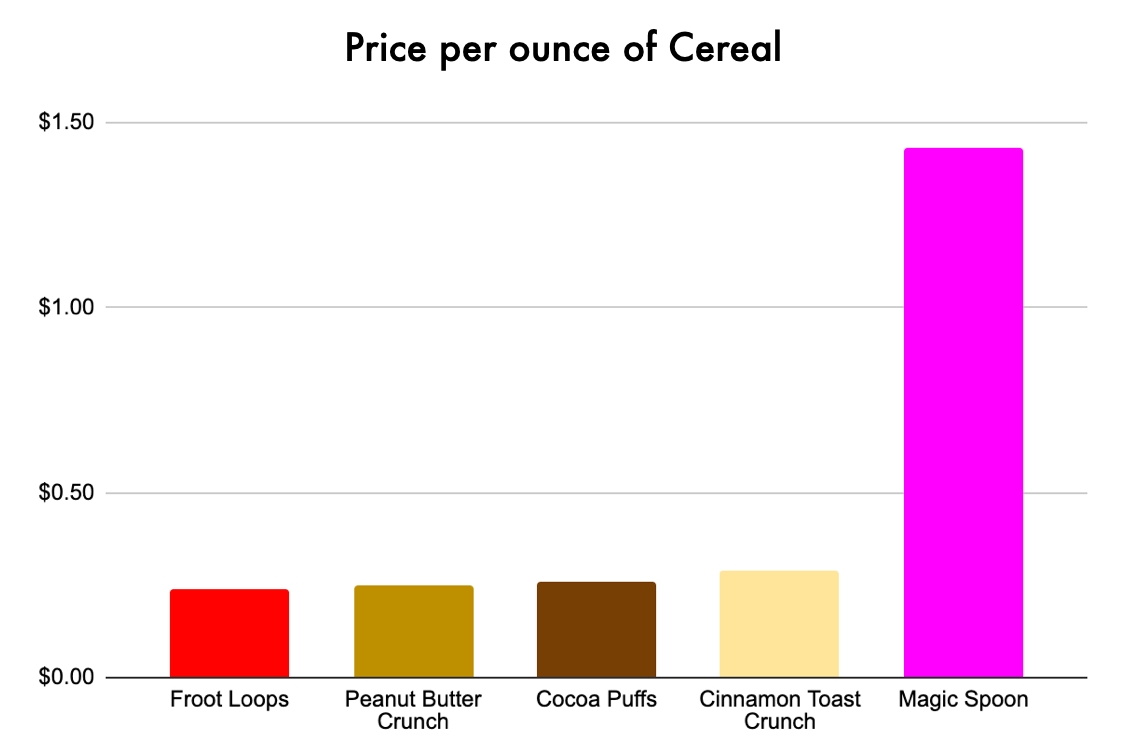

There’s a concept in pricing called “competition-based pricing,” where a company sets prices based on competitor’s rates. Magic Spoon did the exact opposite.

In an effort to separate themselves from the rest of the cereal world, Magic Spoon charged $10 per box, and required customers to buy a minimum of 4 boxes at a time.

The craziest part?

More than a million people have pulled the trigger on a $10 box of cereal, giving Magic Spoon the confidence to take their act to the grocery aisle.

What did Magic Spoon get right?

Product: Customers widely praise the taste of Magic Spoon’s cereal, which is key. If it tasted like cardboard, none of this would have happened.

Marketing: With cartoon-laden branding, Magic Spoon capitalizes on the nostalgia of its customer base, making them feel like kids again.

Pricing: Recognizing their product is aspirational, Magic Spoon used pricing to distance themselves from existing options, charging more than double the price of the typical box.

Now, they’re bringing it to the masses, fueling a new wave of cereal nostalgia, but without the sugar crash.