Pricing Examples from Notion, Slack, Databricks, and More

Plus: The Q1 2024 SaaS Pricing Trends Report

Welcome back to Good Better Best!

I’ve been very offline the last couple months thanks to a new addition to our family. Between time with my real family, watching my other family (the Boston Celtics) cap a dominant run to Banner 18, and New England summer in full swing — I am in a very good place right now. Hoping you can say the same!

I also come bearing gifts…

For the past year I’ve been moonlighting on a SaaS data product called PricingSaaS. Earlier this week, we launched our first trend report, and I couldn’t be more excited about the results.

Today, I’m sharing a high-level summary of the report. The best part is that we included actual examples from the 442 companies in our sample.

If you’re already sick of me and don’t want to read any more — I totally get it. Click the links below to skip ahead:

For a primer (and a very generous offer from our sponsor), read on…

Sit Down with a True Pricing Expert

Today’s post is brought to you by Blue Rocket, a boutique pricing consultancy that works with some of the biggest players in SaaS.

Blue Rocket is led by Jason Kap, a SaaS pricing veteran who spent 12 years leading pricing and licensing at a little company you may have heard of called Microsoft.

Jason has been generous enough to offer his time to let GBB readers:

Share specific pricing challenges and desired goals

Get feedback from someone who has transformed pricing at scale

Learn more about Blue Rocket’s pricing transformation philosophy

Having seen Jason’s work firsthand, I can’t recommend this enough.

I. Q1 in Review

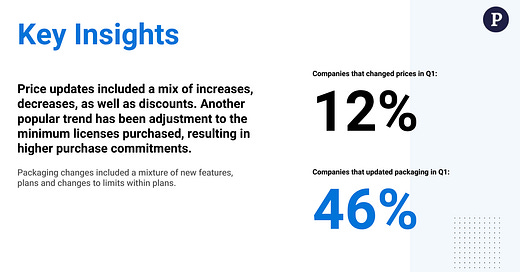

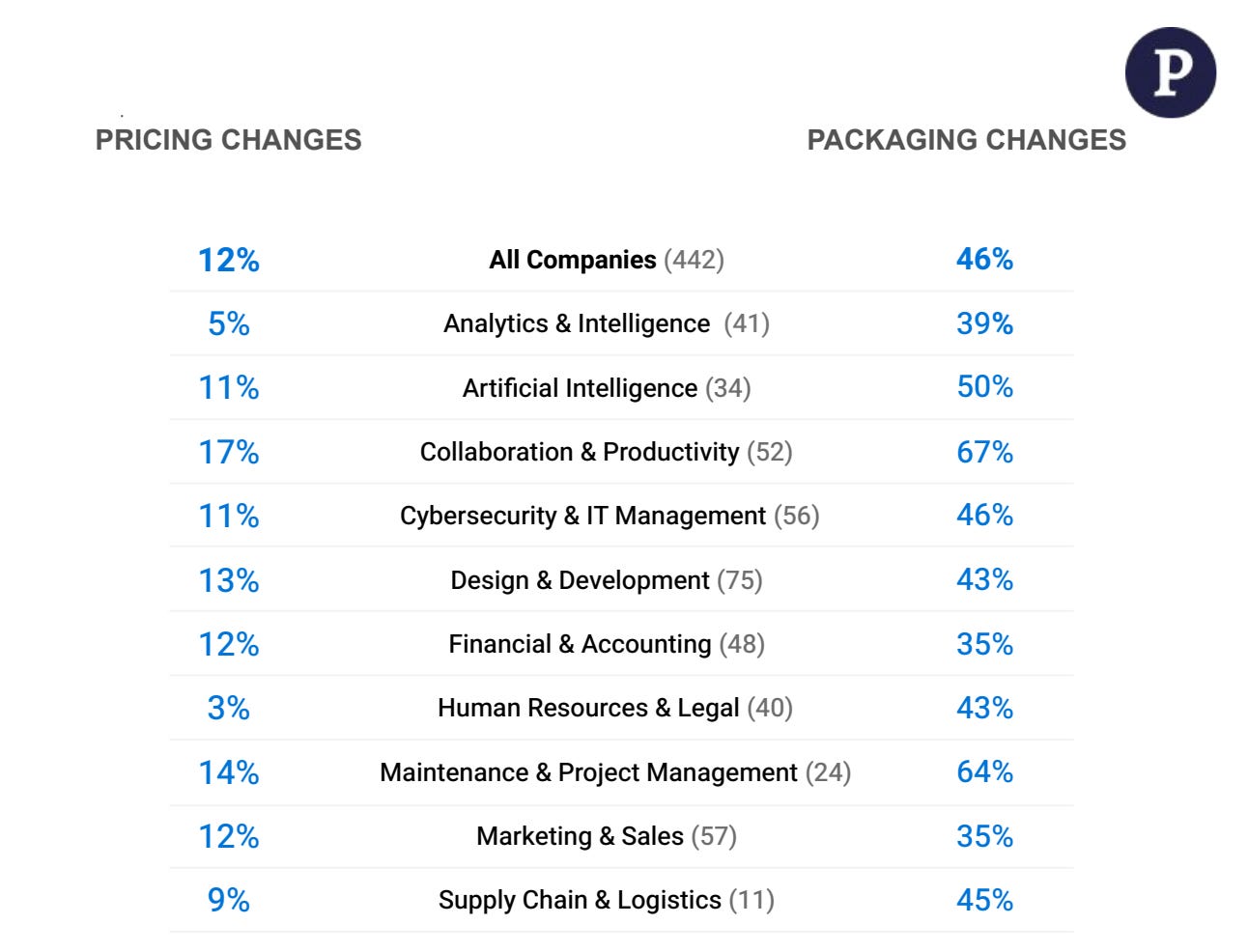

One of the unfortunate things about the way ‘Pricing’ is used in SaaS is that packaging changes can often be bucketed into the pricing category, even if they have nothing to do with actual price points.

At PricingSaaS, we track thousands of pricing pages, and tag changes by their true category (e.g., Pricing, Packaging, Pricing Structure, etc).

When looking back at Q1, packaging changes far outnumbered changes to price points. We found this trend held across a wide range of SaaS categories:

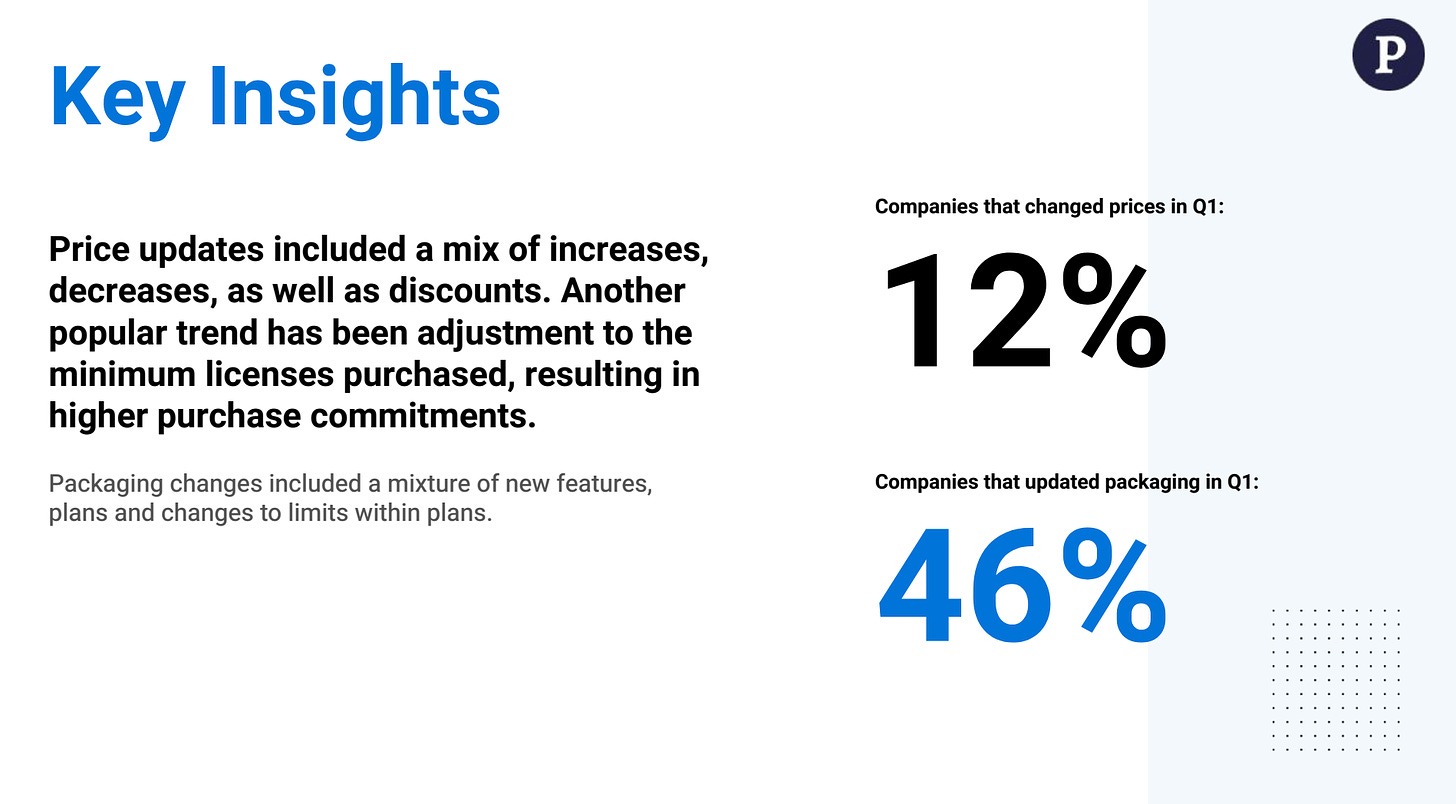

II. AI Monetization

Unsurprisingly, the rise of AI is still going strong. From the beginning to end of Q1, the number of companies who mention AI on their pricing page increased 7%.

We’re seeing a range of pricing models for AI functionality, including tiered differentiation, usage-based models, Add-On seats, and Outcome-based pricing. Check out the full report for specific examples from real SaaS companies.

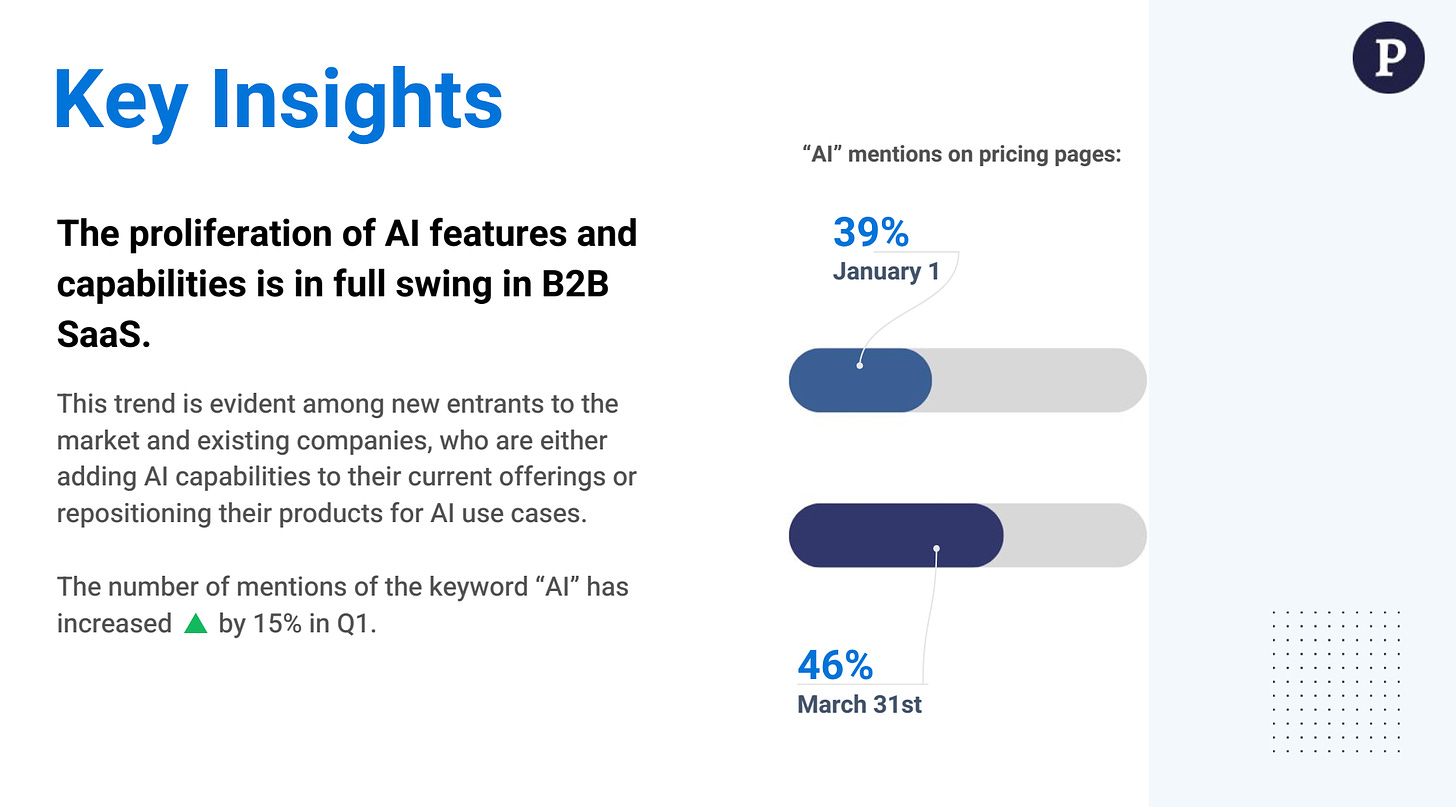

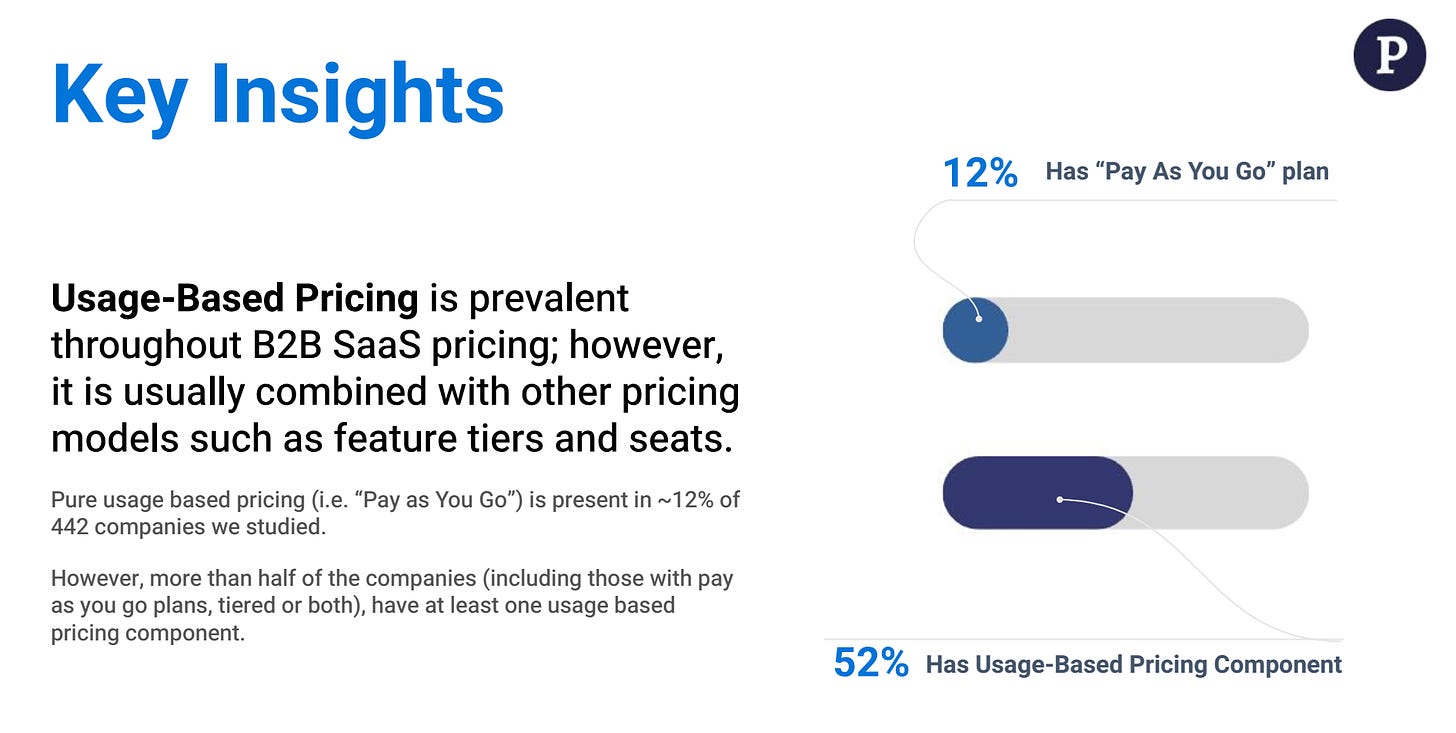

III. Usage Based Pricing

Lastly, we investigated current trends around usage based pricing. Often, when folks talk about usage-based pricing, there’s ambiguity. Are they referring to pure usage—based pricing, or usage limits within a tiered pricing model?

We wanted to dig into the differences here to understand the state of usage in SaaS pricing. Unsurprisingly, we found there are far less companies with true consumption pricing (Pay-as-you-Go) than those with a usage limits in their packaging model.

Again, grab the full report for specific examples from SaaS leaders.

That’s it for this week. Shoot me a note if you have feedback on the report, are looking for pricing help, or want to discuss the greatness of Payton Pritchard with me. See you next time 👋🏼