Welcome back to Good Better Best!

Today, we’re digging into why PLG leaders are acquiring startups.

Before we get there, we launched a free new tool called Plan Name Agent. If you’ve worked on a pricing revamp, you’ve inevitably debated plan names. The Plan Name Agent uses AI to mine the PricingSaaS database to help.

Check it out for free and let us know what you think.

On to this week’s news and analysis.

🚨 Monetization News

Intercom added monthly pricing, lite seats and a pricing calculator.

Clay added a Freemium CTA and optimized the pricing page for conversions.

Miro adjusted plan positioning to be more focused on specific segments.

Carta added a new product called Carta Total Compensation.

Quickbooks added a new plan selector based on team size.

Metabase updated plan positioning, and promoted the Free plan.

🔎 Insight: PLG Leaders are making Acquisitions

Acquisitions are coming.

PLG leaders with tons of users are scooping relevant startups.

It makes a ton of sense.

Take Dropbox. 700m users, but 98% don’t pay for the product.

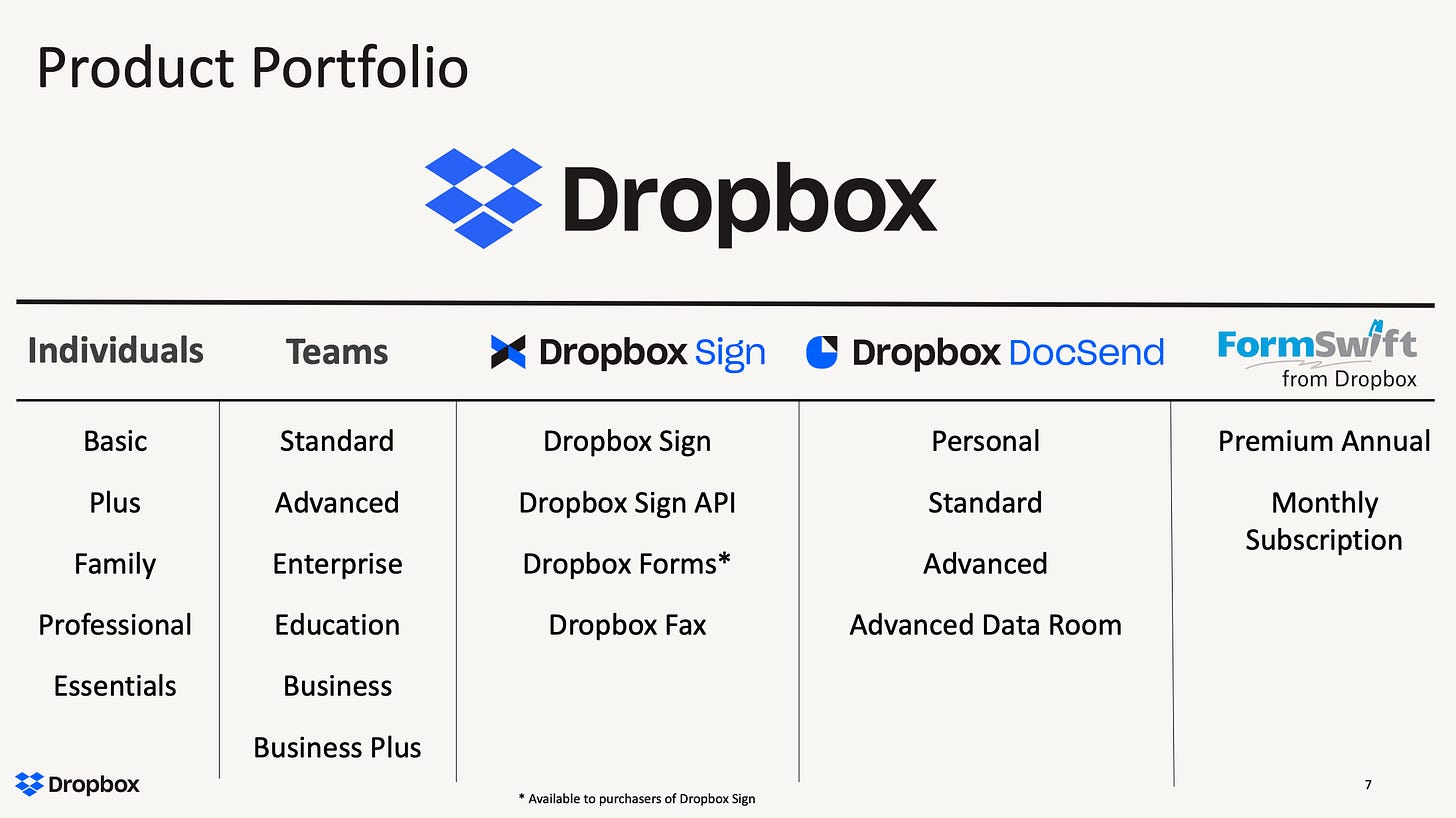

Since 2019 they’ve spent $500m buying relevant doc management startups:

HelloSign for e-signature ($230m)

DocSend for document sharing ($165m)

FormSwift for form management ($95m)

Each has solo and team plans that Dropbox can promote to its 700m users. It’s smart for two reasons:

More paths to monetization. A free user might not upgrade to a paid Dropbox account, but they may need a paid e-signature product.

A platform story. Dropbox can start to position themselves as a portfolio of doc management products (and did just that in their Q2 earnings call).

Seems to be working.

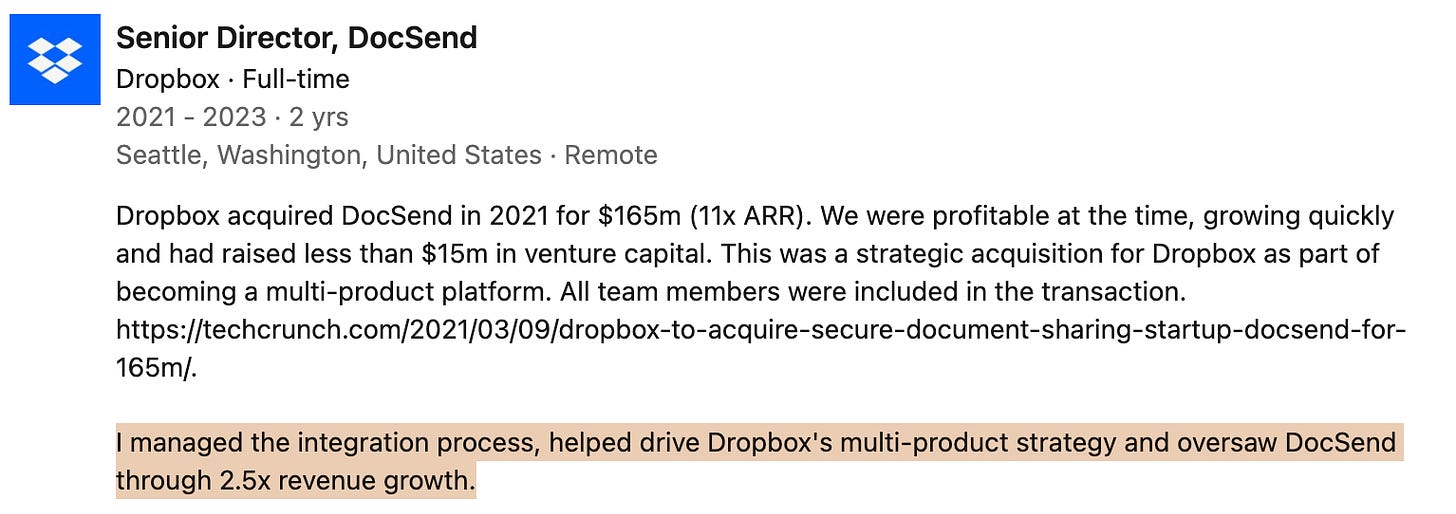

According to DocSend’s founder, Dropbox was able to more than double DocSend’s revenue within two years of the acquisition:

Why it matters: Dropbox isn’t alone.

Notion acquired a calendar app (Cron)

Canva acquired a complementary design suite (Affinity)

Calendly acquired a scheduler for recruiters (Prelude)

Acquisitions not only create new paths to monetization, but help these companies expand their value prop and reach new customers:

Notion: Productivity Tool → Productivity Suite

Canva: Design for Beginners → Design for All

Calendly: Horizontal Scheduling Tool → Horizontal and Vertical Scheduling Tool

The Bottom Line: PLG leaders with ginormous free-to-paid ratios will turn to acquisitions to monetize, strengthen value props, and serve new customers.

Thanks for tuning in and see you next week!

Good Better Best is a weekly newsletter that reaches 5,500 SaaS leaders, operators, and investors. Shoot me a note if you are interested in reaching our audience.