Metromile: The (soon-to-be) SPAC Disrupting Car Insurance

A premature case study in disruptive pricing.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

Hope you’re staying safe and healthy. A couple quick things before this week’s case study...

First, a huge thank you to everyone who filled out the Good Better Best survey - I seriously appreciate your feedback!

For those that didn’t get the chance, I’m leaving it open for another week and would love to hear from you. I promise it’ll take less than 5 minutes, and your input will be hugely helpful in making this newsletter as useful as possible going forward.

Second, last week I was lucky enough to join the team at Notion Capital on the Pain of Scale podcast to talk all things pricing and packaging. It was a blast, and in 25-minutes we covered a wide range of trends and topics across SaaS pricing strategy.

Check out the episode here and give those guys a follow!

On to this week’s analysis…

Car Insurance rates can feel like a blend of art and science.

Most of us are roughly aware of what goes into our costs, but there’s definitely an element of ambiguity. Traditionally, providers use a variety of factors to determine premiums, including:

Car

Driving record

Usage (annual mileage)

Location

Age and gender

Credit history

For years, by bundling all these factors together, the industry has collectively pulled a fast one on a certain type of driver. Specifically, drivers that don’t drive much.

Metromile wants to change that.

Founded in 2011, Metromile offers the ability to pay per mile - targeting low-mileage drivers. In a 2014 profile in Fast Company, CEO Dan Preston explained their innovative pricing strategy succinctly.

We’re applying a curve so that the amount of margin per customer is equal across the board. It’s a much fairer way of doing insurance.

In addition to their consumer-facing insurance product, Metromile offers an AI-powered claims platform that they license to other insurance providers.

While this combination of insurance and technology is arguably their biggest asset, the tension between the two has historically been their biggest bottleneck.

However, last month the company made an announcement that could ease this tension a bit. With plans to go public via SPAC in early 2021, Metromile will use the ~$300M they’ll raise to expand from 8 states to 49 by the end of 2022.

Metromile may be on the path to a true disruptive innovation story that all started with innovative pricing.

Today, I want to unpack their path to success, including:

Why pricing is the perfect entry-point to disruption in car insurance

Why pricing is just one piece of a bigger story around connected insurance, and

Why I believe they have what it takes to be a SPAC success-story

Let’s start with their disruptive pricing.

The Power of Pricing

Internally, Metromile might consider themselves a technology company, but externally, they’re mostly known as that usage-based insurance company.

Not only does per-mile pricing give them a strong counter-positioning narrative, it also powers a story of true disruptive innovation. Here’s Clayton Christensen:

As incumbents focus on improving their products and services for their most demanding (and usually most profitable) customers, they exceed the needs of some segments and ignore the needs of others. Entrants that prove disruptive begin by successfully targeting those overlooked segments, gaining a foothold by delivering more-suitable functionality—frequently at a lower price.

Metromile’s usage-based pricing suits a specific downmarket segment - drivers logging less than 10k miles per year.

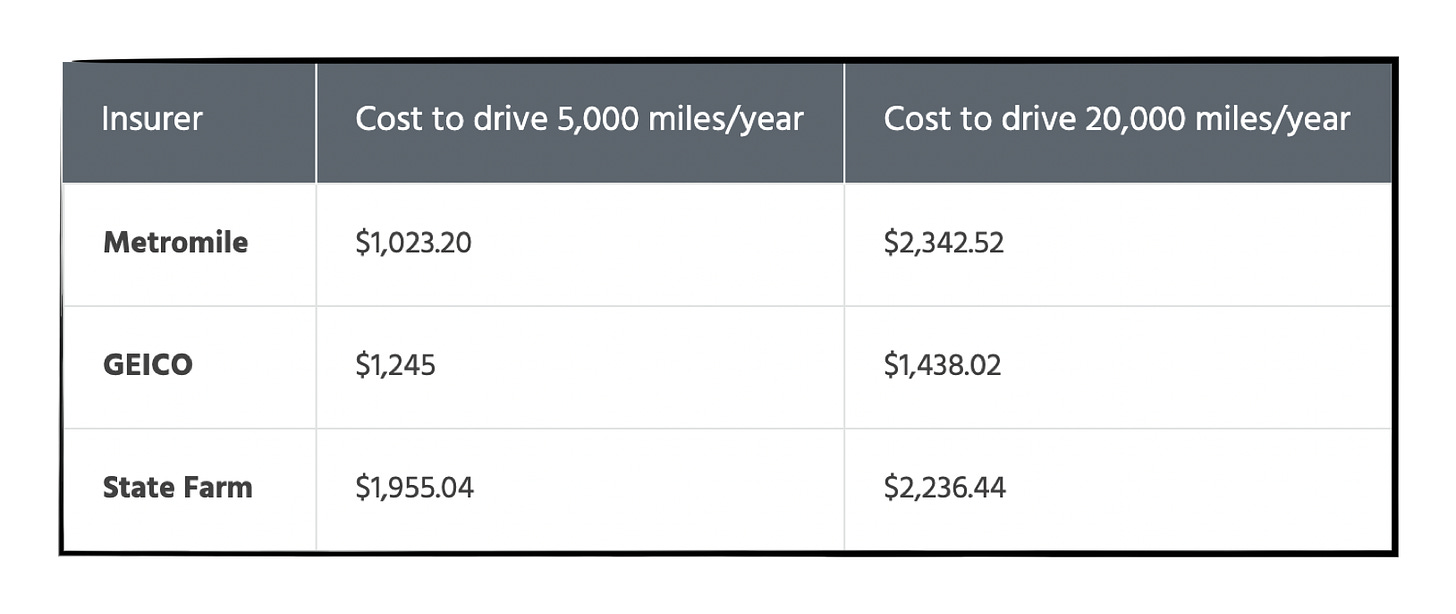

The team at MoneyUnder30 reviewed Metromile and compared quotes to State Farm and Geico for 5k and 20k miles per year. As shown in the chart below, beyond a certain level of usage - Metromile becomes more expensive than incumbent insurers:

While their model doesn’t help all drivers, for low-volume drivers, Metromile offers the one thing many of them care about most: savings.

To do this, Metromile fundamentally changed the way they calculate insurance premiums. Instead of a blanket fee that remains fixed from month-to-month, Metromile offers a base fee plus a per-mile fee (usually pennies) to calculate monthly costs.

While incumbents have flirted with usage-based pricing, none have fully embraced per-mile pricing like Metromile - likely due in part to the revenue cannibalization that would result.

Focusing on usage also gives Metrmomile an innovative acquisition strategy.

In October, they launched Ride Along, a program where prospective customers can download the Metromile app, drive as they normally would for two weeks, and get a quote to determine how much they can save.

While the app can help estimate rates, once drivers sign up, they no longer use it to calculate mileage. Shortly after signing up, new customers receive a telematics device in the mail called the Pulse.

The Pulse is at the core of everything Metromile offers, powering value propositions far beyond usage-based pricing.

The Power of the Pulse

The Pulse device plugs into a car’s diagnostic port (OBD-II), where it collects all sorts of data. Along with tracking mileage, the Pulse allows customers to check the health of their vehicle, alerts them to engine issues, and even uses GPS to determine if they’re at risk of getting a parking ticket.

The most powerful feature of the Pulse, however, might be AVA, Metromile’s AI-powered claims assistant.

AVA uses sensor data to reconstruct the scene of an accident, verifies claims in seconds, and accelerates the claim-filing process with automation. The downstream implications are huge, both for consumers and insurance providers.

For consumers, AVA becomes a virtual witness that also simplifies the claims process. For insurers, if the Pulse can track location, and AVA can re-create the scene of the accident - the chances of fraud decrease considerably.

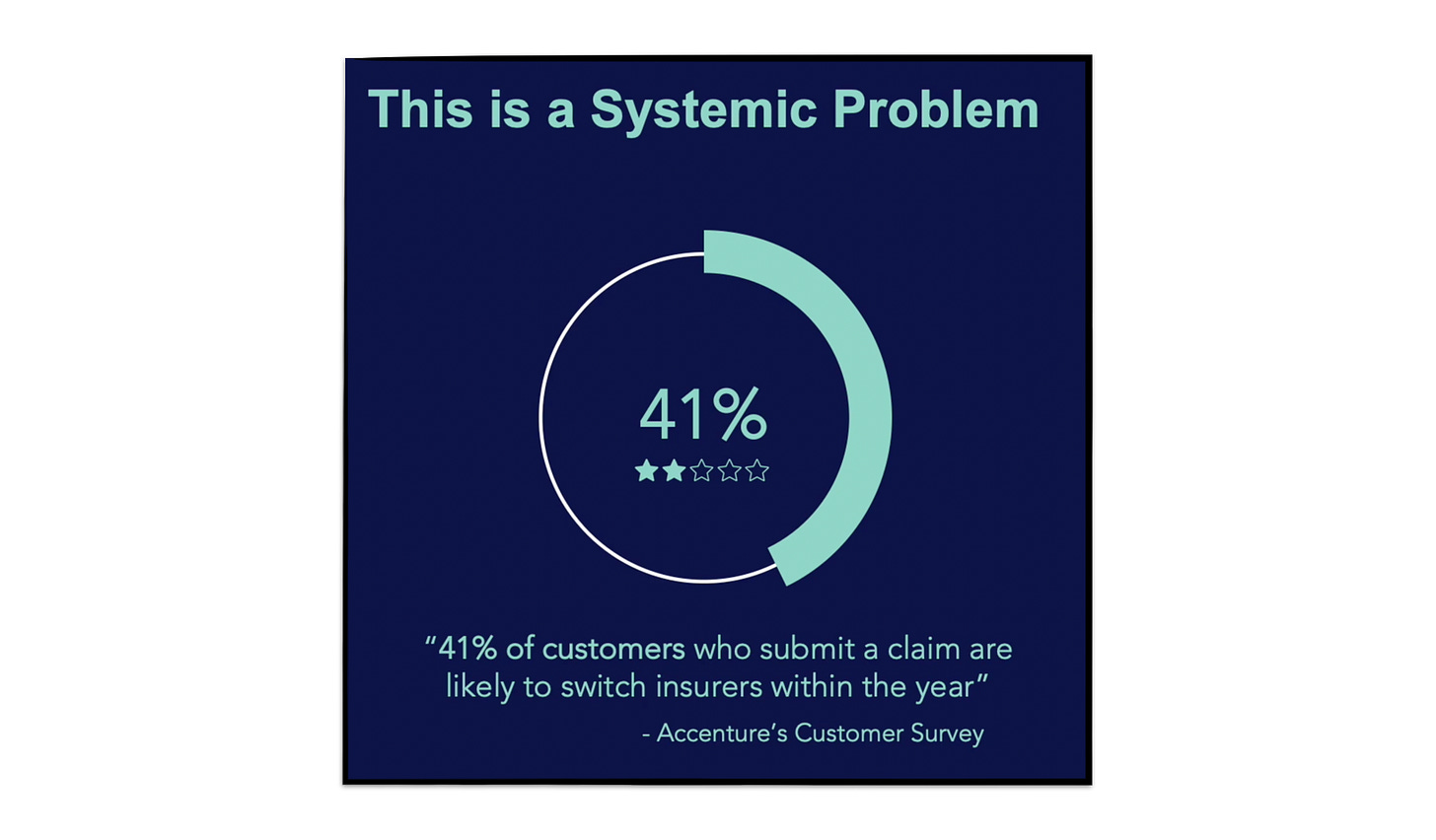

In a presentation at the Connected Claims Conference in 2019, Amrish Singh, the VP of Enterprise Product at Metromile, shared a slide highlighting the devastating impact poor claims experiences can have on customer retention.

Metromile’s pitch to insurers is that their AVA technology will help them retain more customers, which may sound funny coming from an insurance company, but sounds perfectly reasonable coming from a technology company.

This second revenue stream means Metromile can get their technology into vehicles even if drivers don’t sign up for their insurance.

This is important, since the benefits of AVA compound at scale.

The more vehicles on the road using AVA, the more likely the technology can prove it’s value at a given accident, and the more at-bats for the technology, the faster AVA’s AI and machine learning can improve.

In September, Metromile took another step to increase AVA adoption by partnering with Ford, allowing owners of eligible vehicles to connect to Metromile automatically, without needing the Pulse device. This gives them a third way into the vehicle beyond consumers and insurance companies, and it’s easy to see more of these partnerships evolving down the road.

As mentioned earlier, their pricing innovation gives Metromile an immediate market to target, and as their connected technology improves, they’ll have stronger value propositions beyond price that will help them appeal to high-volume drivers.

Whether through insurers, manufacturers or direct to consumers, once Metromile has their technology in a driver’s vehicle, there’s a world of possibilities for additional connected products and subscriptions as well.

That said, all of this speculation hinges on Metromile’s ability to execute at scale, which is something they haven’t really proven they can do yet.

The Right time to SPAC

2020 has been a volatile year for all of us, and Metromile is no exception.

In April, the company announced layoffs in order to achieve a 2-year runway. Eight months later, with the news of their forthcoming IPO - their runway looks a lot longer.

It’s a gross oversimplification, but one of the biggest challenges for Metromile over the last decade has seemingly been balancing their budget between the two sides of their business. It’s just one example, but a review from a former employee on Glassdoor offers supporting evidence of the tension caused by their identity crisis.

While landing ~$300M in funding doesn’t guarantee they’ll spend it wisely, it’ll at least allow the team to stop worrying about money and focus on executing.

Another reason to be bullish is their investors, which include Mark Cuban and Chamath Palihapitiya, who said the following about Metromile’s prospects:

Metromile’s technology sets them apart, driving huge advantages that will deliver significant and profitable growth for decades to come. I expect them to be a generational business. In addition to saving consumers considerable amounts of money, the Metromile platform has been built from the ground-up as a technology company, reshaping how an insurance business operates. No industry should be more impacted by digitization than insurance, and Metromile is leading the way.

Both Chamath and Cuban are savvy at using social media to market their businesses, and at the very least, Metromile has two hyper-intelligent advisors and marketers in their corner.

After nearly a decade of struggle followed by one year that felt like ten, Metromile finally has the chance to make their disruption story a reality. While money doesn’t solve all problems, it might be just what they needed all along.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the like button up top, so I know which posts are resonating most!

If you have feedback, I’d love to hear it - hit me up on Twitter.

Very interesting and timely. With so many people working from home and generally just not going anywhere these days, there are lots of cars that are barely being used. I bet a lot of people will be rethinking their auto insurance premiums after reading this.

https://negativegoodwill.substack.com/p/metromile-insurtech-and-spac-dreams