🔺 SaaS Pricing Moves 🔺

⚙️Apollo pushed “integrations with all email providers” to its Basic plan.

🆙 Monday raised prices across it’s Basic, Standard, and Pro plans.

🖥️ Zoom drastically simplified the list of features in each plan.

🧠 Jira added a new AI feature called Atlassian Intelligence.

👀 Algolia shifted it’s Premium plan copy to highlight simple, usage-based pricing.

PS. I spotted these updates using PricingSaaS. Try it for free to track competitors and stay ahead of the curve.

Happy new year! I hope 2024 is off to a great start for all of you.

Over the past year, I’ve been more active on LinkedIn. I do a lot of digging on SaaS companies, and my strategy with posts is to create simple visuals with brief write-ups that capture the most interesting takeaways I’m finding. Some of them have gotten a decent amount of engagement. Today’s post is a collection of 3 of those visuals.

If you enjoy it, follow along here. On to this week’s post.

PLG is Hard

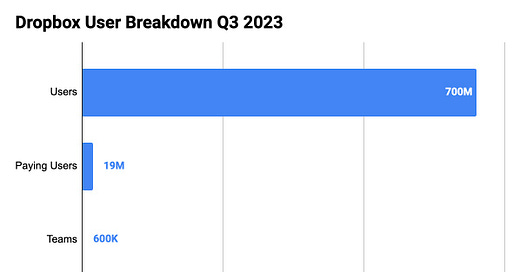

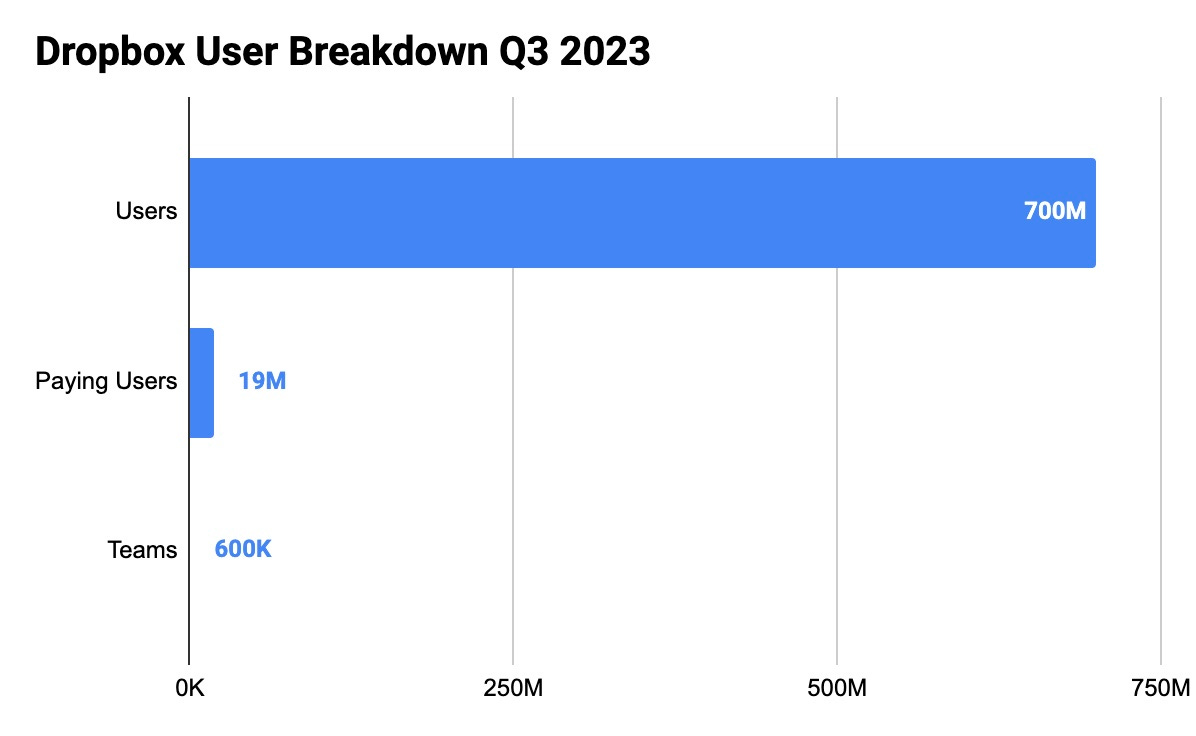

Dropbox is one of the biggest PLG success stories. Their latest numbers exhibit just how hard it is to layer a sales motion on top of PLG to convert free users.

As of their latest earnings report:

👉🏼 2.6% of users pay for the product

👉🏼 .91% of users are on a business license (less than 1%)

To summarize -- 97.4% of users are on Freemium plans, and 65% of paid users are individual consumers.

Dropbox skews more consumer than a lot of SaaS companies, but I would imagine companies like Notion and Canva have similar ratios.

Friendly reminder that “we can monetize later” are famous last words for many SaaS founders.

Adobe’s AI Premium

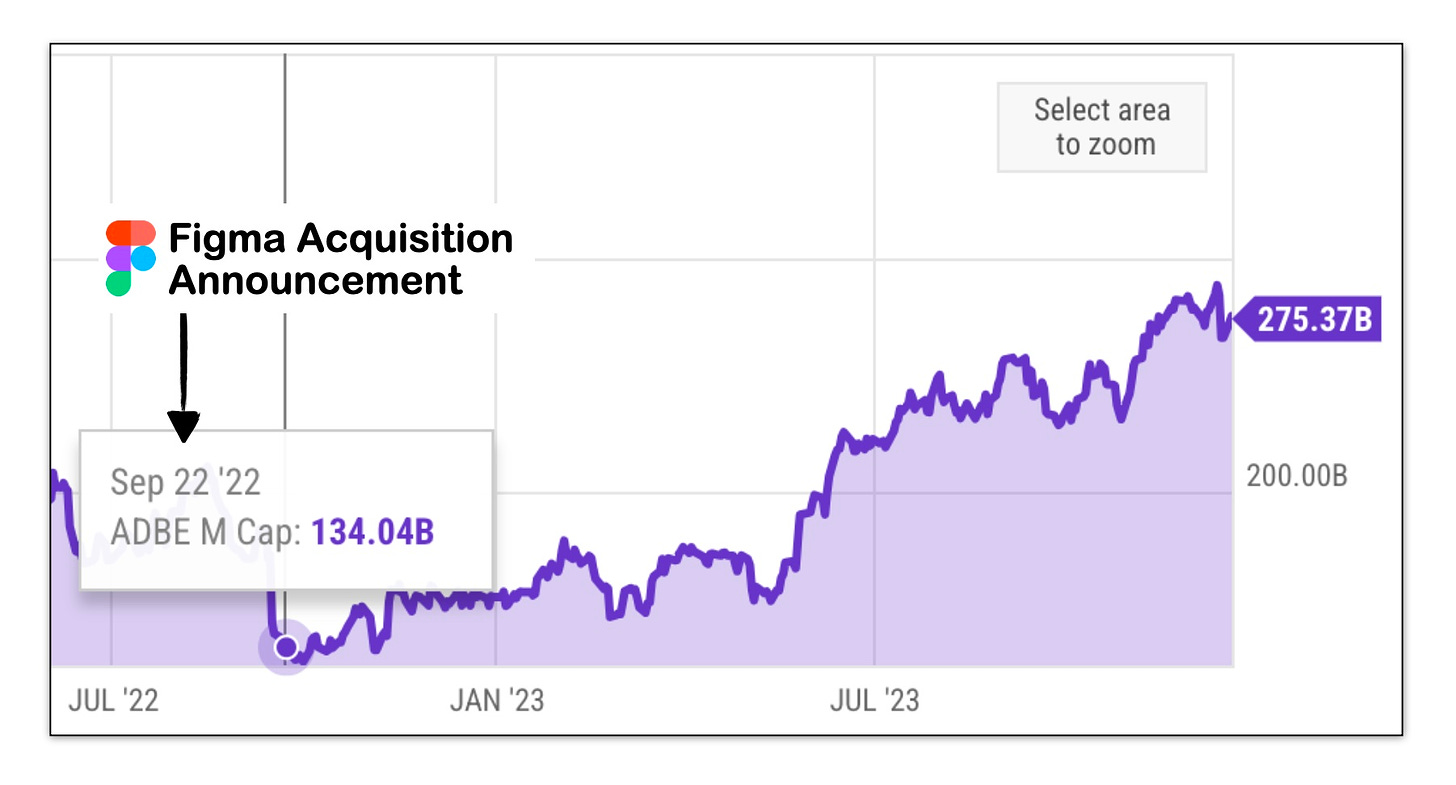

When Adobe announced it was acquiring Figma for $20B in September of 2022 many expressed sticker shock. The day of the announcement, Adobe’s stock fell ~17%.

Last month, Adobe and Figma called off the acquisition after pushback from European regulators, which pushed me to do some digging to see how the landscape had shifted since the original announcement.

To my surprise, Adobe’s market cap had DOUBLED.

In 15 months, they gained $141B on the heels of AI excitement and a rising market, making the $20B price tag for Figma look like downright affordable — not to mention the $1B breakup fee they owe now.

Adobe stock was up 77% in 2023, a clear benefactor of the Generative AI boom. This has shifted the focus away from the reason for the acquisition — Figma’s web-native interface is way better for collaboration than anything Adobe has built.

For it’s part, Figma grew revenue 40% in 2023, impressive considering the inevitable distraction of a massive windfall for many employees. Now they get another $1B from Adobe to pour gas on the fire.

The SaaS ETF Hiding in Plain Sight

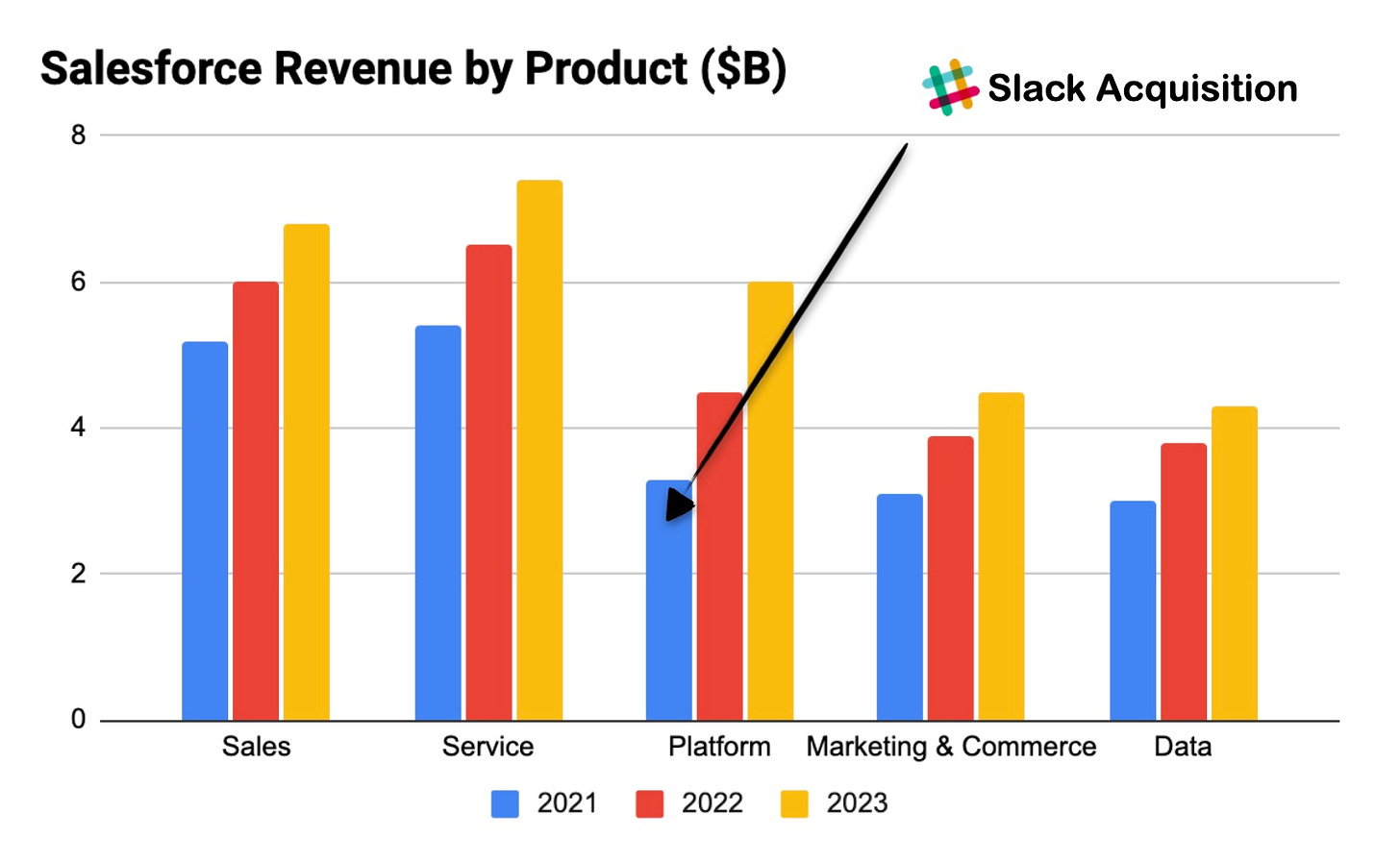

Salesforce might as well be a SaaS ETF at this point.

The numbers are nuts:

→ $62B spent on 59 acquisitions that map across 5 different product categories.

Some surprising findings:

Sales Cloud isn’t the top revenue generator! That would be Services Cloud.

Revenue from “Platform & Other” has popped since the acquisition of Slack in 2021 and is the most interesting one to watch IMHO.

My personal favorite — all 5 categories do $4B+ in annual revenue 🤯

Insane diversification for a company many still think of as “just a CRM.”

A Word from our Sponsor

You could spend a lot of time and money on an internal billing build…that you’ll need to redo in 6 months. Or, you could trust Orb to do it for you - once. Need to experiment with pricing? Orb makes it simple. With Orb, high throughput teams build on core competencies and on the products we know and love rather than on billing.

Want to learn more? Get in touch with our team here. GBB readers get a free trial by mentioning “Good Better Best.”

Whenever you’re ready, there are a few ways I can help you:

PricingSaaS Software: AI-powered pricing alerts for PLG SaaS companies.

PricingSaaS Services: Rapid research and ongoing support for growing SaaS companies.

Free Pricing Consultation: Schedule a call with me to talk through your pricing challenges and determine the best course of action.