Welcome to Good Better Best!

Hope 2025 is off to a great start for all of you. We have a great case study to kick off the new year — the Equinox of email: Superhuman (Note: the Superhuman team confirmed they see a New Years spike, so I’m sticking with the gym analogy.)

Superhuman is known for redefining email with its premium, user-focused product. In mid-2024, the team made the most meaningful pricing change in the company’s history. I was lucky enough to chat with Superhuman’s founding Growth Lead Gaurav Vohra (who has an awesome Substack) and current Product Marketing leader, Alex Rodrigues, who led the recent pricing project. A huge thank you to Gaurav and Alex for giving the inside scoop!

Let’s get to it.

Note: I want to do more interviews like this — if you are an operator working on pricing and down to talk about it DM me on LinkedIn.

🚨 SaaS Product and Pricing News

Calendly clarified positioning.

HubSpot adjusted the price of the Starter Customer Platform.

Zapier removed an Add-On from the Team plan.

UserGems added an AI Outbound agent to the Standard plan.

Jamf updated its Business price point.

Superhuman 1.0 [2016 - 2023]

When Superhuman launched, the email landscape was saturated with free or low-cost options. To stand out, the company positioned itself as a premium product that delivered a delightful experience in a traditionally boring space.

In the early days, the team looked at three vectors to determine the initial price point:

Competitive Analysis: Superhuman analyzed competitors’ pricing, mapping out the market to identify a premium position at $30/month. This placed them at the higher end of non-sales tools (e.g., Spark) while undercutting specialized sales tools (e.g., YesWare, Mixmax).

Willingness to Pay: Using Van Westendorp analysis, they identified 3 target personas: Founders, VCs, and Operators. They found $30 resonated with founders, VCs were willing to pay $45, and Operators leaned closer to $20. They split the difference with $30.

Gut Feel: Beyond data, $30 simply “felt right” as a signal of quality and value. Fun Fact: they originally priced at $29, but an intern named Cam Wiese took the executive decision to make it $30, and the change stuck. Note: I don’t usually suffer price points, but do appreciate a clean 0 instead of a 9 for a premium product.

One of the counterintuitive findings from the early Superhuman team is that the price point accelerated activation.

Here’s Gaurav:

In a weird way, our price drives activation because we charge up front — no free trial, no freemium. So, you slap down $30 sight unseen, likely going off referrals. It makes users activate better because they're like, "Oh, I got to get my money's worth now". So there was this positive reinforcement effect. The price is a reminder to the user that they are paying for the best and getting the best: the product is truly full of delight, and there’s all sorts of value and joy that you get from it. It's very similar to Apple and Tesla. Those are the comps we had in mind.

The early price point worked. In fact, it worked so well that Superhuman didn’t change their pricing strategy for years.

Superhuman 2.0 [2023 - 2024]

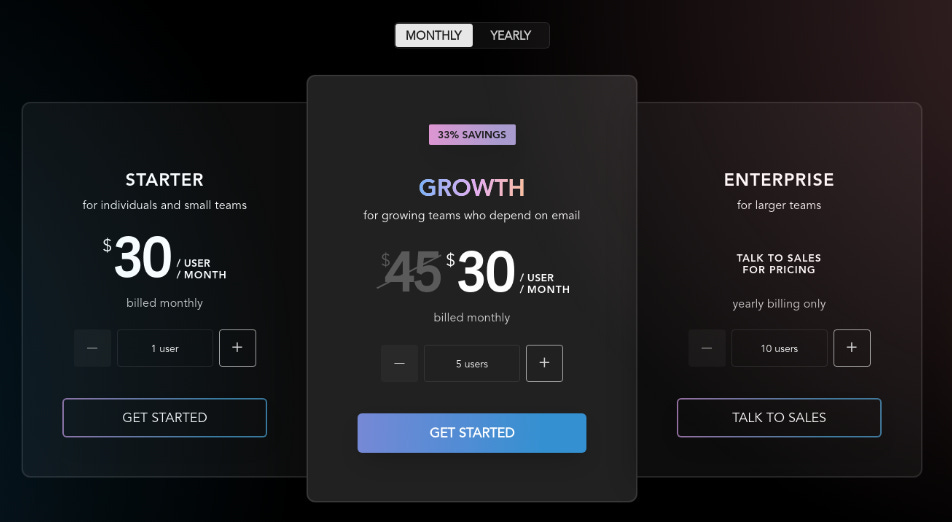

Superhuman 1.0 featured a single $30/mo plan with no pricing page.

The team knew it needed to evolve from single-SKU pricing, both because the business was selling to a variety of end-customers, and because the product outgrew the single SKU pricing model.

The team decided to tackle this evolution in two phases:

Phase 1: Acknowledge selling to consumers, prosumers, and businesses by creating price tiers, albeit with relatively little differentiation across them.

Phase 2: Add meaningful differentiation across tiers to align the packaging mix with user expectations and needs.

The result of Phase 1 was a 3-Tier model primarily differentiated by user minimums and light feature differentiation.

While this helped differentiate Superhuman’s plans for individuals, teams, and Enterprises, as the product became more complex, it became clear that more change was needed. Here’s Alex:

We needed a pricing structure that supported the product, but remained simple. A guiding principle for us is just overall simplicity, and we don't want our pricing to feel complex or burdensome. You see companies that have a menu of products, and you sit down with a salesperson and they're like, well, which do you want? That's not what we wanted. We wanted to have a very opinionated approach to how we priced and packaged that was easy to understand and made the buyer journey really clear and comprehensible.

Phase 2 would become the most meaningful pricing change in Superhuman’s history.

Alex broke the project down into three phases:

Internal alignment. The first priority was getting everyone on the Superhuman side on the same page. The executive team had a mix of older and newer employees, so it was critical to make sure they were speaking the same language.

Qualitative Interviews. Alex and team talked to a bunch of customers and prospects to get firsthand feedback on the pricing and packaging structure. They asked questions around whether or not it made sense to have persona-based fencing around pricing and packaging, and tried to gauge how far they could push toward simplicity while still capturing value in the GTM market.

Quantitative Research. After receiving qualitative feedback, they did a big quant study looking at price elasticity and willingness to pay.

Importantly, the project was conducted by a small working team. They regularly updated executive sponsors, but were given true autonomy to figure it out. Once they made a decision, the working group pulled in the Growth and Customer teams who were instrumental in introducing the updates to customers.

Gaurav and Alex both push back on the idea of a cross-functional pricing committee. Here’s Gaurav:

On the spectrum of 'full-on committee' to 'benign dictatorship', we were somewhere in the middle. We had this small group of people making decisions. My spicy take for the industry is, more startups should lean more towards benign dictatorship. When you talk about committees, you have to get the people around the campfire, you have to get the sales person, the marketing person and the product person and the CEO. And it's like, Do you need that or can you just give someone the power to do it? You would likely move faster if you did. I certainly keep an eye on some startups that change their price a lot, and are doing really great as a result.

Once the Superhuman team decided to act on Phase 2, they moved fast and made bold decisions when choosing how to roll out the new pricing model.

Superhuman 3.0 [2024 - Present]

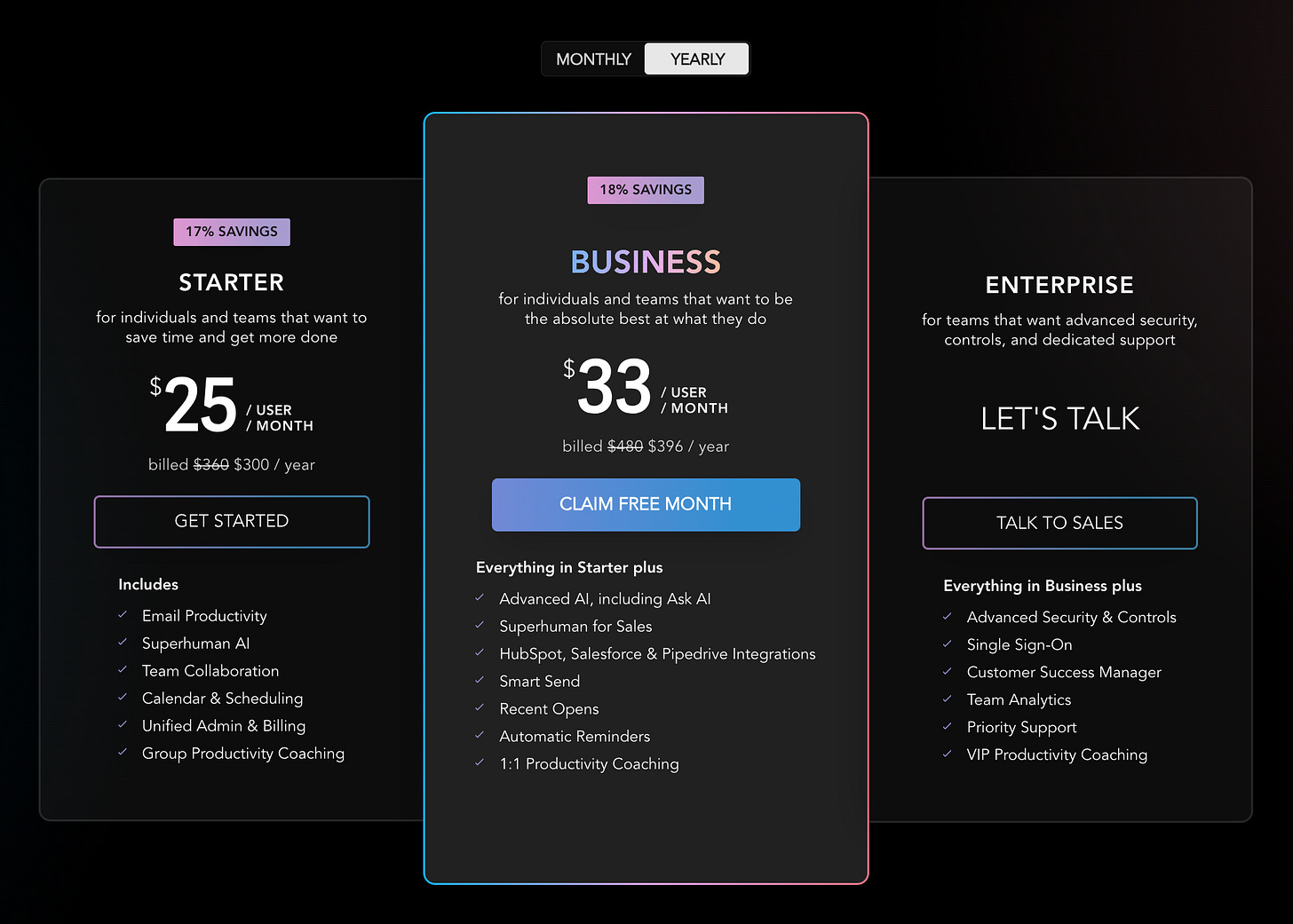

First, the new model. Superhuman introduced a true GBB offering with 3 distinct tiers:

The changes to Superhuman’s pricing and packaging were the removal of user limits, clearer positioning around each plan, and meaningful feature differentiation across plans. This was partly driven by a new persona mix.

Here’s Gaurav:

Our initial persona, Nicole, is the Founder/VC/Leader who just does a lot of email: everything from founder-led sales to recruiting to vendor comms to internal emails. They have all the needs. Meanwhile, the GTM professional, primarily the salesperson, but also the AM, CSM, and BDR, has become more of a focus in the last few years. We felt like, while we haven’t saturated founders and VCs, the big group of people in most companies that should be using Superhuman is the GTM team, specifically sales.

With that in mind, Superhuman updated the Growth tier, renaming it Business, and differentiating it with CRM integrations and other sales features, “Ask AI” for AI-assisted inbox searching, collaboration features, and productivity coaching.

These changes allowed Superhuman to align the packaging mix with user expectations across different customer segments while maintaining simplicity in its offerings.

A surprising finding since removing the user minimum is that a third of new self-serve users sign up for the Business tier. To capitalize on this, Superhuman doubled down, offering a Reverse Free Trial to start new users on the higher-tier plan.

After nailing the new pricing and packaging model, Alex and team had to determine how to roll it out.

Implementation: Balancing Transparency and Change

One of the big questions facing Superhuman was how to implement the change with existing customers. Alex made a conscious choice to retire legacy SKUs, but also gave customers up to three months to switch to a new plan, and the option to switch to annual billing to keep their existing price point for a year.

Here’s Alex and Gaurav on how it went down:

Alex: The technical implementation was pretty smooth. It’s built on top of Stripe with easy binary inclusion of features in different SKUs. The human side of the implementation was more complicated. We made a very intentional decision not to support legacy plans. So that means 100% of customers move to the new structure.

Gaurav: We had all these weird SKUs that people don't know about, like the COVID-19 SKU, the personal tier SKU, and more. There was a long tail that had to get cleaned up. God bless Alex and the team, who went through that long tail and decided the exact mapping table of old to new SKUs, and how we're going to get it all done in six months.

Alex: A key principle for us was being transparent, empathetic, and rewarding our existing customers. And that meant giving people ample notice and a generous grace period before any changes were made. The grace period helped customers feel supported. Another approach would be what Notion did when they rolled out their last change. They allowed legacy SKUs to exist, but if you wanted any of the new features, you had to switch. That makes the set of legacy SKUs smaller and smaller over time.

Overall, this approach allowed Superhuman to create a new structure to ship into, supported existing customers, and positioned the company for future scalability.

Key Takeaways

Superhuman’s pricing strategy reflects a thoughtful evolution from a single premium SKU to a flexible, tiered model that supports diverse user needs. By aligning pricing with product growth and customer expectations, Superhuman has built a foundation for sustainable success.

Waiting years to make a pricing change can be ripe with complications, but Superhuman did four things that other SaaS operators can learn from:

Empower a small group: Instead of a committee, give a small group autonomy to make decisions and move quickly.

Layer your research: Talk to customers and prospects to get qualitative feedback that informs your new model, then use quantitative research to validate price points and preferences.

Plan precisely: Migrating customers to new plans can be a headache. It’s tedious, but mapping each and every plan will save time on the backend and ensure a smooth transition.

Give a grace period: Allow customers time to transition to their new plan, especially if you’re retiring legacy SKUs.

Thanks again to Gaurav and Alex for offering a window into this evolution. If you haven’t, check out Superhuman, and subscribe to Gaurav’s newsletter for growth insights, founder advice, and spicy takes.

Thanks for tuning in! If you enjoyed this post, join the Good Better Best chat and share your favorite takeaways.

Thanks for the writeup, Rob! Cannot imagine how tedious this would have been had we decided to support all legacy SKUs; think there's a lot of value in proactively choosing to spin those down and migrate.