Welcome to Good Better Best!

Before we get to today’s breakdown — a quick ask:

We’re building a pricing data product, and would love your input. Please take this quick survey (seriously, Typeform estimates 45 seconds) and give us your unfiltered feedback.

On to today’s post, where we’re breaking down the pricing strategy of Statsig, a one-stop platform for any product builder.

Let’s get to it.

🚨 SaaS Product and Pricing News

Softr updated the data sources that power each plan.

Sketch added a 30-day trial for the Standard plan.

Monday updated the default team size.

Gusto changed CTAs, updated features, and pushed Add-Ons into each plan.

Klaviyo reformatted the pricing page, and added detail to the Email+SMS plan.

Do you have a pricing philosophy?

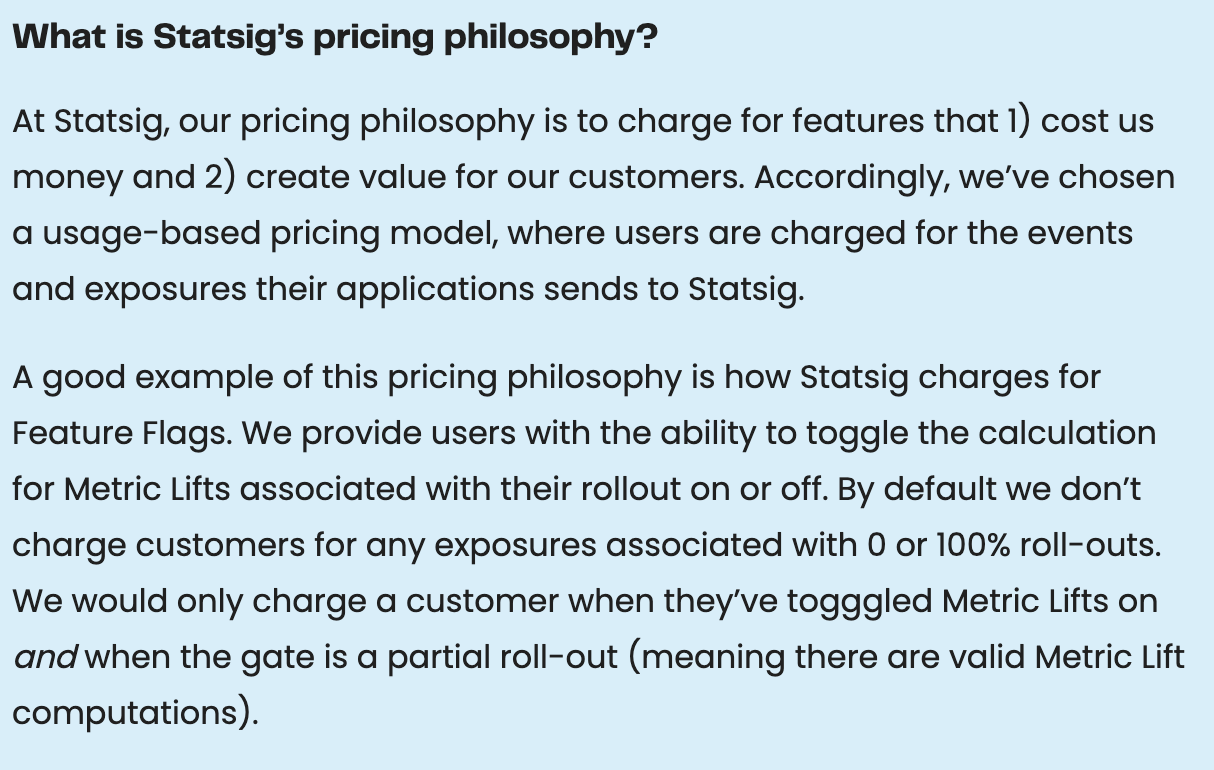

Not only does Statsig have one, they share it publicly on the pricing page. It’s the north star guiding their pricing strategy. Here it is:

In short, Statsig only charges for features that:

Cost them money

Create value for customers

This is a generous approach to pricing, and has clearly played a role in Statsig’s explosive growth.

If you’re unfamiliar with Statsig, their goal is to help any company run product experiments like big tech. I highly recommend reading

’s breakdown for a deeper dive, but to summarize a few key points:Statsig was founded in 2021 by Vijaye Raji, a VP at Facebook, who realized their experimentation tooling was a secret weapon.

They had a hard time finding customers until a former Facebook colleague joined Headspace, saw what they were building, and committed. Within a year they hit $1M ARR, within 2.5 years they hit $10M ARR, and today they’re doing more than $25M ARR.

Experimentation is just the entry-point — Statsig wants to build a one-stop-shop for product growth.

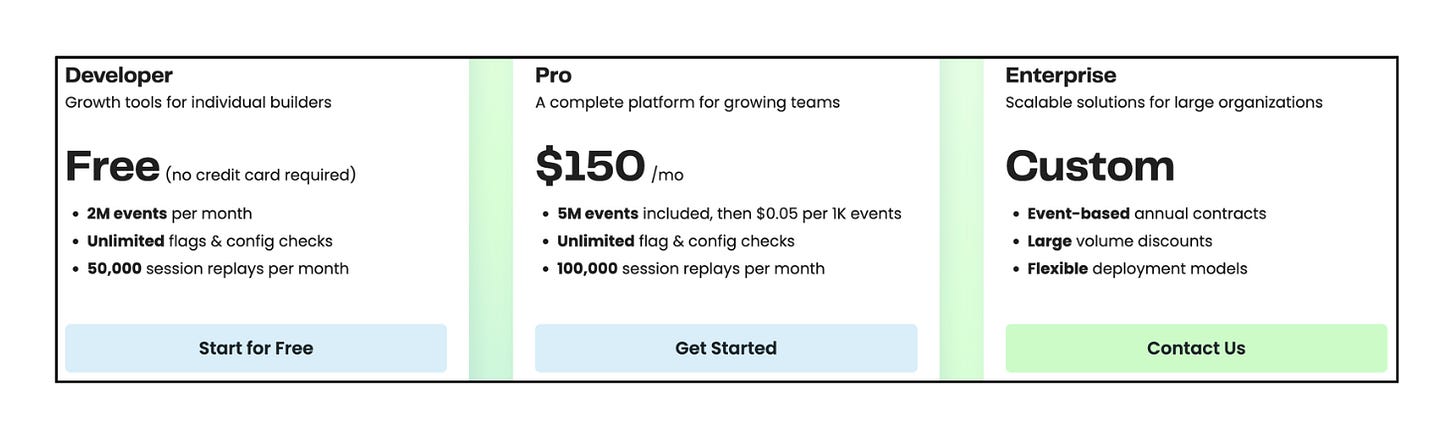

Last month, they made an adjustment to simplify pricing further, merging the Enterprise and Warehouse native plans into a single Custom plan:

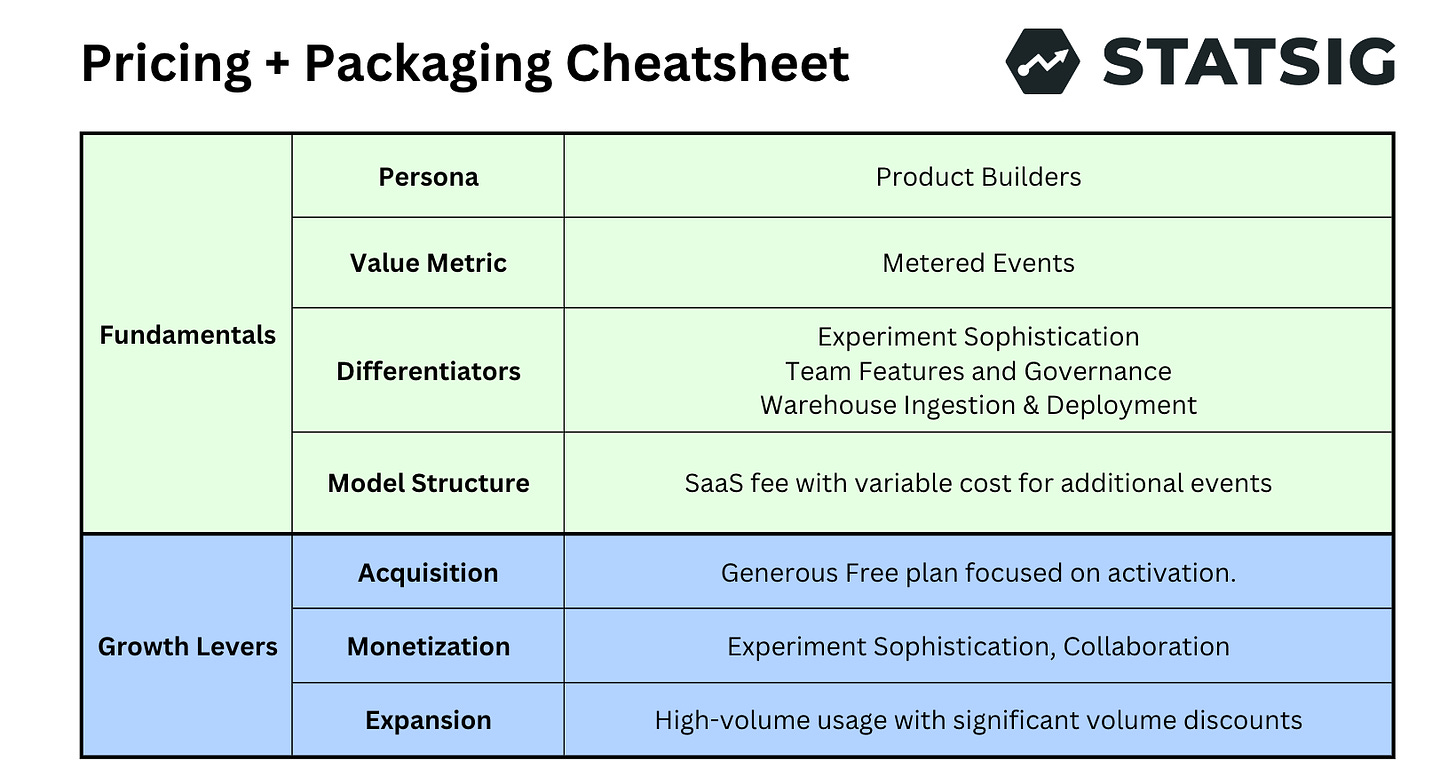

Below, I’ll break down the four fundamental components of Statsig’s pricing strategy, as well as their approach to the three key growth levers: acquisition, monetization, and expansion, all of which are anchored by the Pricing Philosophy noted above.

The Fundamentals 🧱

Buyer Personas

Statsig makes it immediately clear how its pricing compares to competitors. Just look at the hero copy of the pricing page:

You immediately understand that Statsig is more affordable than comparable tools. An immediate concern as an Enterprise buyer might be that Statsig could not scale with usage — but they do a good job handling this objection with social proof:

As for the actual plan mix, Statsig has an intuitive model with plans for Individuals, Teams, and Orgs — calling out each persona in the description for each package.

From the pricing page, a visitor gets a clear understanding of who the product is for, how it can scale, and how to get started.

Value Metrics

Statsig’s primary value metric is events, specifically Metered Events — which they describe as a subset of events that power analytics or metrics workflows.

Additionally, Statsig deploys three secondary usage-based metrics to differentiate plans:

Session Replays, which is when they record users on a customer’s website and allow customers to watch those sessions.

Data Retention, with Pro offering 6 months and Enterprise offering 12 months.

Projects, each Pro subscription applies to one project, so users with multiple projects need to sign up for multiple licenses or upgrade to Enterprise.

Importantly, Statsig offers unlimited Seats and Feature Flags for all users, which makes activation seamless, and aligns closely with their Pricing Philosophy.

Feature Differentiation

Statsig has 3 plans: Developer (free), Pro, and Enterprise. As previously mentioned, the plans are tailored to users at different levels of scale: individuals, teams, and organizations.

Statsig’s differentiation strategy aligns closely with this maturity curve:

Developer (free) offers a lot of value and core functionality across all product categories. Importantly, free users get all the analytics features Pro and Enterprise users get.

Pro includes advanced experimentation tools, improved support, Data Warehouse Ingestion, and change reviews and approvals.

Enterprise includes Warehouse Native deployment, outgoing data integrations, premium support, advanced governance features, and generous payment terms with large volume discounts.

Overall, this differentiation makes a ton of sense. As you add more projects, increase usage, run more complex experiments, and connect more applications to Statsig, you need to upgrade to a bigger plan.

Model Structure

Statsig’s pricing model is a 3-Part Tariff driven by event volume. This means there’s a base fee that includes a certain level of usage, and variable fees for usage beyond that point.

Statsig views itself as an all-in-one platform for any product builder, pinning them against Feature Flag platforms, Experimentation platforms, and Analytics platforms.

From the pricing page, they share price comparison charts across all 3 categories at different levels of scale:

Overall, it’s clear that if Statsig is not the cheapest option, they’re close. They’ve built a pricing model that allows companies at any scale utilize their product at an affordable cost.

Growth Levers ⚙️

Acquisition

Statsig has a generous free plan that’s focused on activation. The plan offers all core analytics features, a generous events limit, unlimited feature flags, and seats. In other words, Statsig makes it very easy for users to test their product for free.

Monetization

Statsig monetizes both usage and feature sophistication. Once a user surpasses 2M events per month, they need to upgrade to Pro. On the feature front, Statsig uses experiment sophistication, team features, and data warehouse imports as differentiators from the Developer (free) to Pro plans. The Enterprise plan is for customers with needs for additional usage, security, support, and experiment complexity.

Expansion

Statsig’s expansion is largely driven by events. It’s unclear what the monthly fee is for Enterprise customers at different tiers, but it seems there is definitely a point at which it makes economic sense for a customer to upgrade from Pro to Enterprise to take advantage of volume discounts at their event level. Importantly, Statsig seems very aware of these situations, and actively encourages upgrades so customers can save money and get more value.

Recap ☑️

In summary, Statsig is attacking several competitive markets with a great product and compelling pricing. The playbook is working because they are laser-focused on activation, and only monetize when they believe it makes sense.

It’s also very clear that Statsig takes pricing seriously. Not only have they outlined a Pricing Philosophy, but they also incorporate their relative cost into the hero copy on the pricing page, and break down competitive comparisons in the FAQ section. This level of detail goes beyond price transparency, and allows potential users to understand how pricing will scale as they grow.

Thanks for tuning in and see you next week! If you enjoyed this post, share it with a friend. Big thanks to Ian Ito (writer of the great SaaS Weekly) and the Statsig team for taking a look at an early draft and offering feedback.