How to sell against free 💼

Plus: Uber's underrated pricing power and Apple's services behemoth.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Uber’s Pricing Power 🚘

An underrated perk of Uber’s diversification beyond ride-sharing is that it actually gives them pricing power within ride-sharing.

Let me explain…

When Uber and Lyft were strictly ride-sharing companies, the choice between the two often came down to price. Other factors matter (wait time, driver safety, etc.), but all else being equal, many consumers choose the cheaper option.

Now that Uber offers food and grocery delivery, it changes the equation, and gives them leverage:

They can offer deals on rides for Uber Eats users

They can offer deals on Uber Eats for Uber riders

They can offer deals on both products to their most loyal users (which they’re doing with Uber One, a $10/mo subscription)

Most importantly, Uber’s product is stickier now. If a rider is using any of Uber’s other products, they’re far less likely to churn — allowing Uber to escape the race to the bottom in ride-share pricing.

This strategy is one reason the gap seems to be widening between Uber and Lyft, it’s closest competitor.

How to sell against free 💼

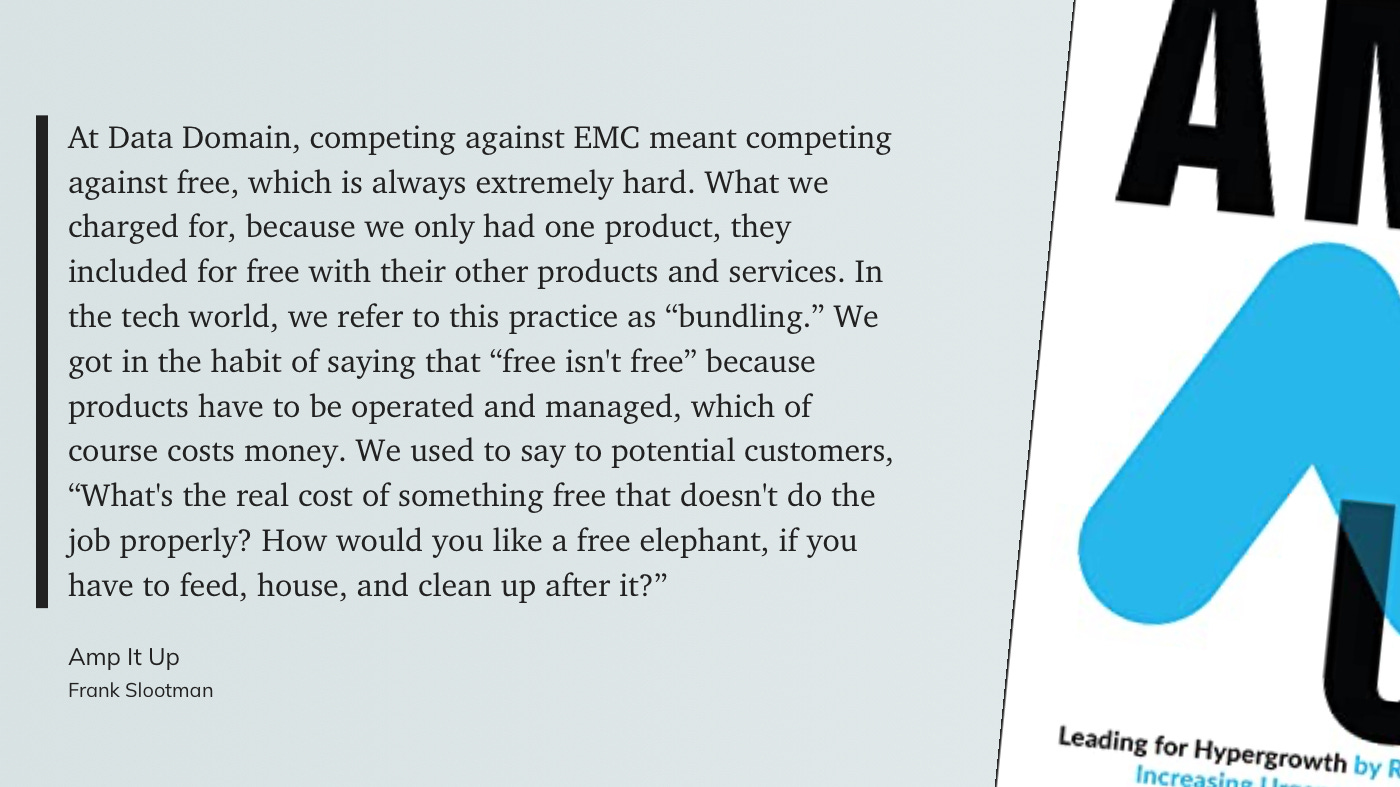

I recently read a book called Amp it Up, by Snowflake’s CEO Frank Slootman. While the title may sound silly, his track record is not.

As CEO, Slootman has led three SaaS companies to successful exits:

Data Domain, acquired by EMC in 2009 for $2.4B

ServiceNow, IPO in 2012 and reached $20B market cap under Slootman

Snowflake, biggest software IPO of all time in 2020

Most of the book is about managing high-performance teams, but naturally I was struck by a passage about pricing during his tenure at Data Domain:

I love this narrative because it opens the conversation far beyond list price. The “free elephant” analogy is goofy, but reframing the conversation to reveal the hidden costs of free tools is exactly how to contest a freemium competitor, and bring a new perspective into play.

While I no longer carry a monthly quota, it was stuff like this that always made part of me love sales. The storytelling and framing required to change a potential customers’ mind is addicting, and nothing I’ve experienced at work matches the rush of closing a deal.

Of course, the nature of free products has changed since Slootman was running this playbook at Data Domain. Many free products offer great support and near immediate time-to-value, a challenging proposition for opposing sales reps.

Apple’s subscription behemoth 📲

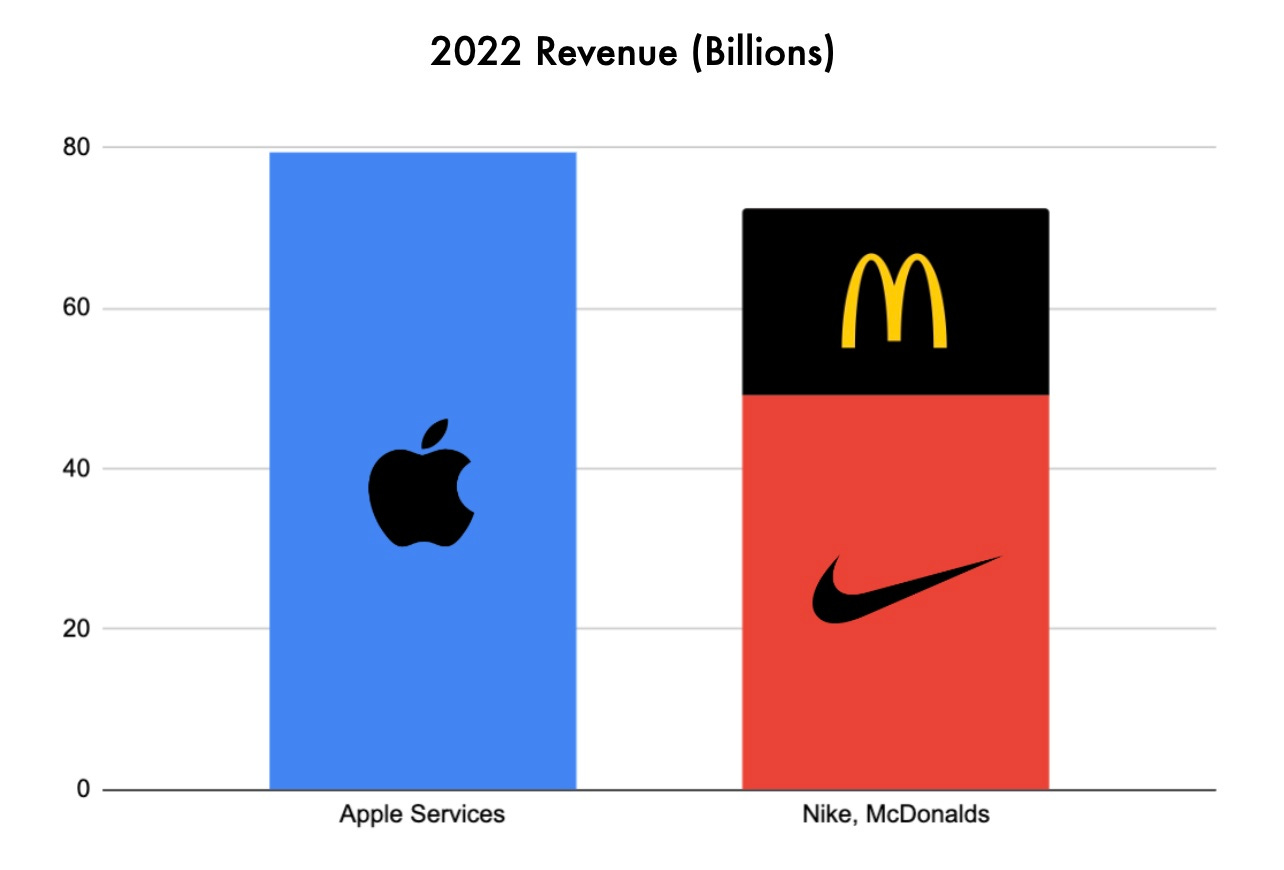

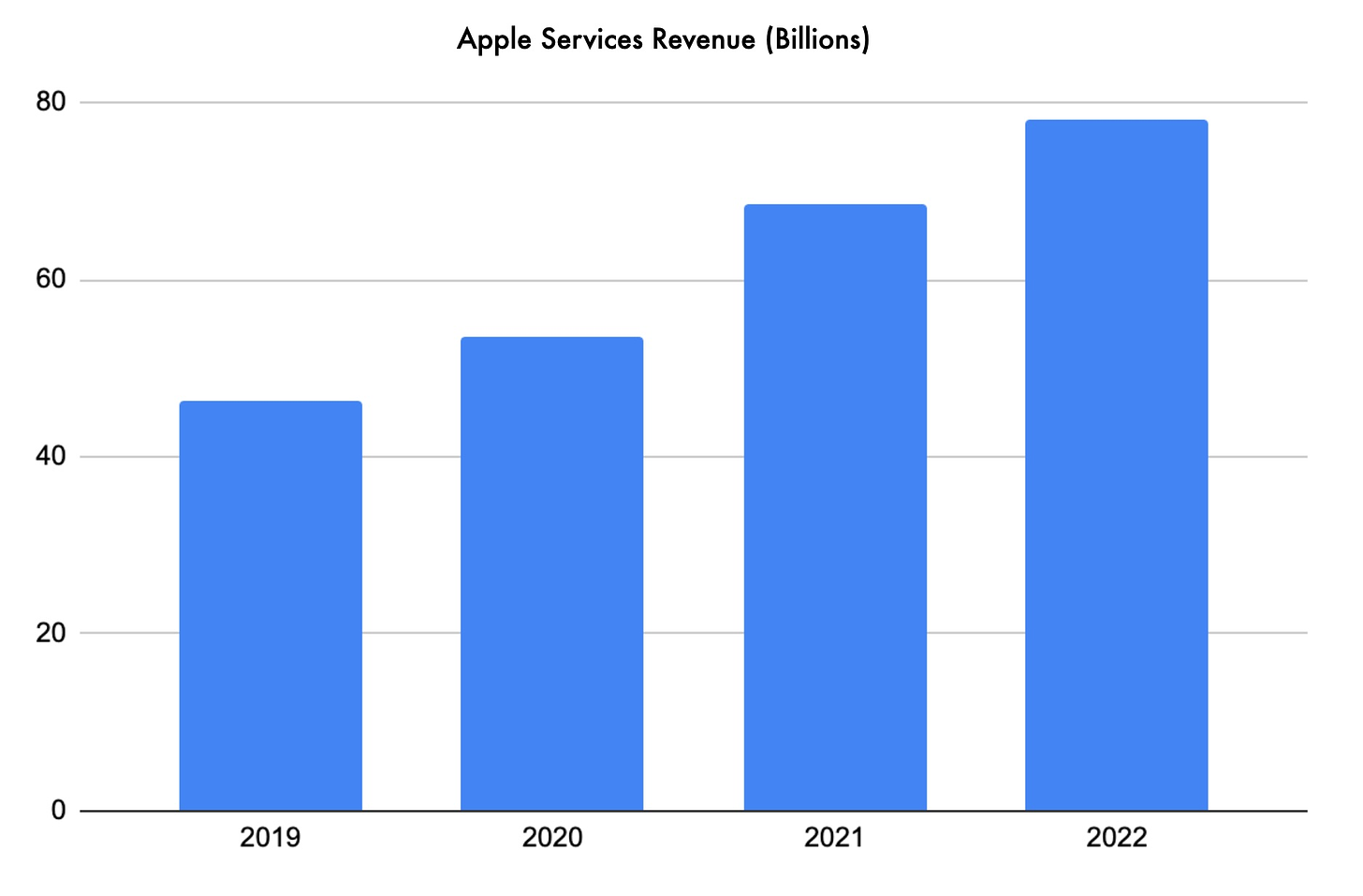

Subscriptions are nothing new for Apple, but given the company’s reputation for hardware, it’s always shocking to see the scale of its services revenue.

The latest reporting shows that Apple’s services division brought in more revenue than Nike and McDonalds combined in 2022.

Apple services includes revenue from advertising, the app store, and subscriptions. While antitrust concerns have threatened to cut into it’s app store take rate, Apple’s advertising and subscriptions businesses are thriving.

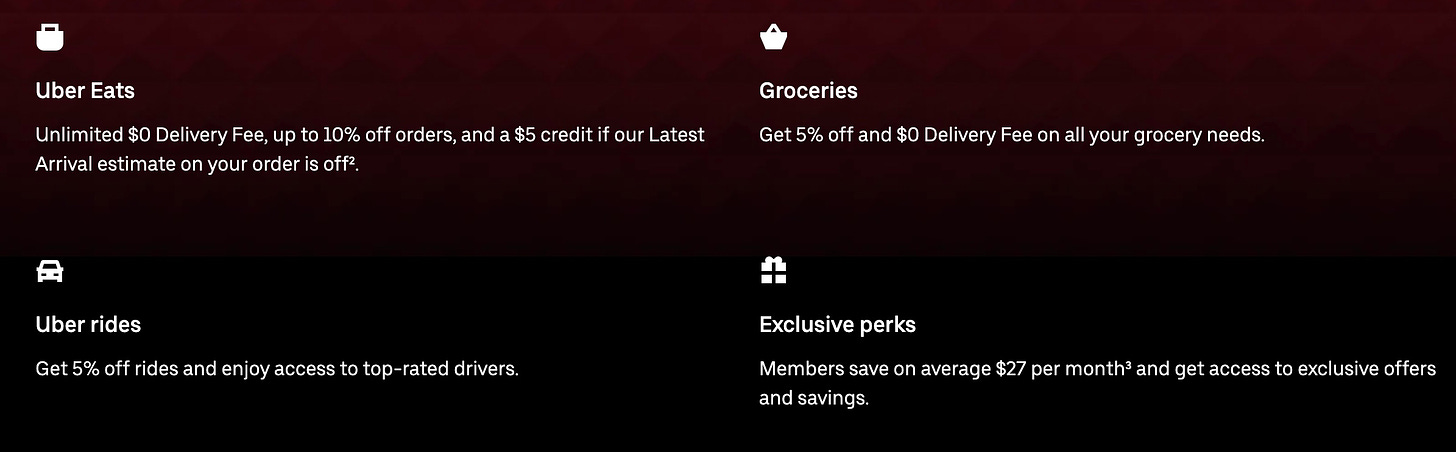

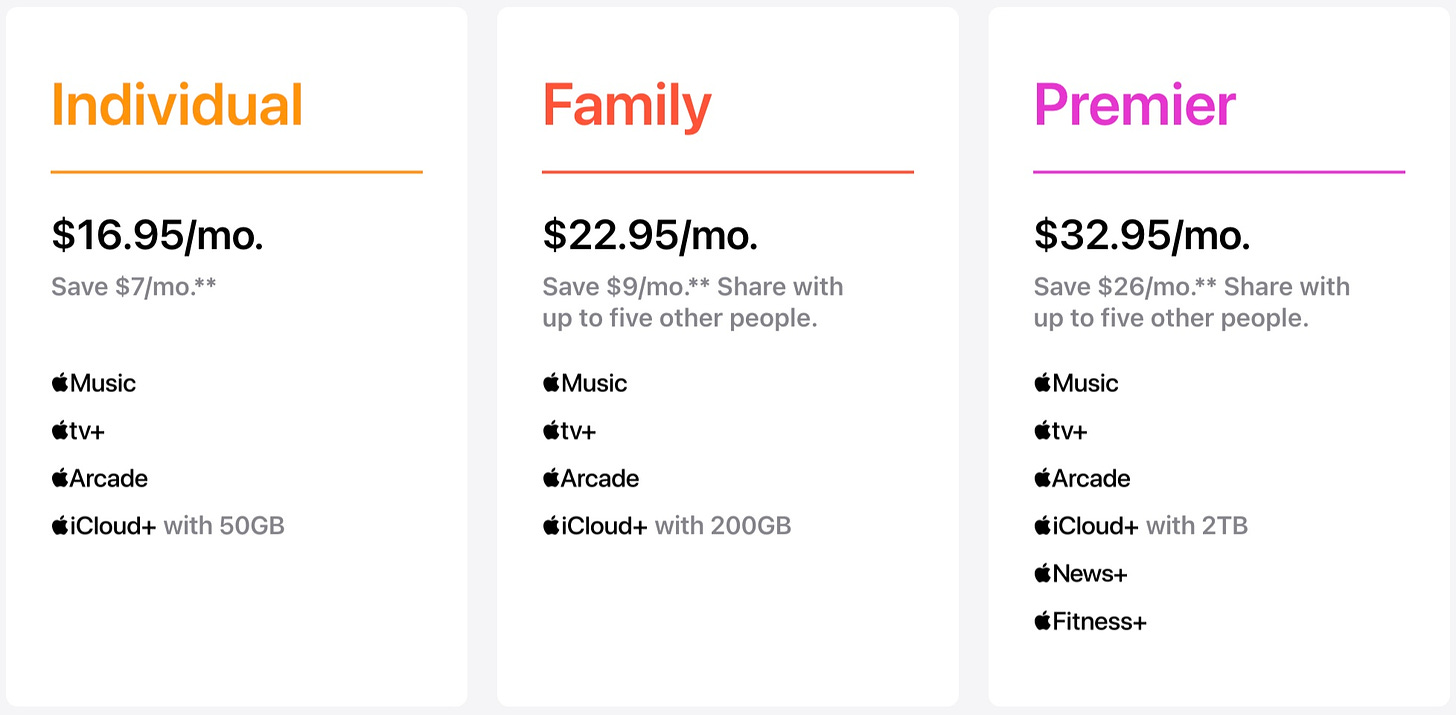

On the subscription side, Apple launched the Apple One bundle in 2020, with a generous family plan:

The scary thing is how much market share Apple can still capture. While Apple Music has been around for years, Apple TV+, Arcade, News+ and Fitness+ are just getting started — a scary prospect considering Apple’s on pace to double their 2019 services revenue in 2023.