Digest // 14

Field notes on EV Value Metrics, Snowflake’s Pricing Philosophy, and Google Tables

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

Sending this as the Celtics push me closer and closer to the brink of my sanity...

That said, it’s been a good week! Earlier this week, the newsletter hit a small milestone, crossing 1,000 subscribers 🎉

When I started in January with a list of 45 family and friends, this felt a long way off. Huge thanks to all of you who have helped spread the word!

As always, I would love your feedback. If you enjoy this post, do me a favor and click the “like” button up top (the heart). That way I’ll know which topics are resonating most!

On to this week’s digest.

Briefing 📋

Electric Vehicles and Value Metric Evolution 🔌: There’s a shift happening in how EV-owners pay for charging their cars. In the beginning, many charging stations charged per-minute, thinking it would be easiest to understand for customers and would help drive adoption. As the market has grown more sophisticated, companies are offering per-kWh (Kilowatt Hour) pricing, which is more aligned with customer needs.

Snowflake’s Pricing Philosophy ❄️: Snowflake’s usage-based pricing strategy is geared to ensure customers only pay for what they need. Perhaps the most compelling case for their future prospects is their net dollar retention. Simply put, customers only pay for what they need, and end up paying more and more for Snowflake year over year - a testament to the power of Snowflake’s product.

Google Tables: Aggressively Free 🗂: Earlier this week, Google launched an Airtable competitor called Tables. As you might expect from a tech titan like Google, they’re not super concerned with immediate monetization, giving customers multiple options to get started for free.

Electric Vehicles and Value Metric Evolution 🔌

I've written about value metrics before here, but it's worth a quick refresher. A value metric is what and how you’re charging for your solution. For example, per user is an old staple for SaaS companies. At ProfitWell, when working with clients, we reference 3 principles for a suitable value metric.

A good value metric must:

Align with customer needs

Be easy to understand, and

Grow with the customer

Value metrics are fascinating and it's especially fun to see them in the wild, outside the world of software. Earlier this month, Electrify America, one of the largest charging networks in the US for EVs, announced that they'd be changing their value metric from per-minute to per-kWh (kilowatt-hour) in available states.

For context, per-kWh is the closest comparison to paying for pure fuel (e.g., gas for a non-EV). Alternatively, per-minute pricing refers to the time spent charging, and leaves room for ambiguity, as several factors, including weather, can influence the time it takes to charge an electric vehicle.

For what it’s worth, Elon Musk has always said per-kWh is a more fair and equitable fee structure than per-minute pricing, and Tesla already offers per-kWh where possible (they’re working relentlessly to lower costs further, too). The hurdle to full per-kWh adoption is that it’s not available everywhere. Certain states don't allow it, and in those regions, the only way to charge is per-minute.

What's interesting, is how per-minute and per-kWh compare when evaluating what makes a good value metric. Both options should inherently grow with the customer, but when considering the other principles of an ideal value metric, they diverge.

Back in the early adoption of EVs, consumers weren't as familiar with the concept of paying per-kWh, which is one of the reasons charging networks charged per-minute. This optimized pricing to be easy to understand which makes sense in a nascent market where the goal is to drive adoption and make new technology approachable.

However, the market's matured. There are more EVs on the road than ever, and with that influx of new customers comes a better understanding of which value metric is most aligned with customer needs - hence, the shift to per-kWh.

Alongside this value metric evolution, it’s fascinating to see how key players in the market utilize subscriptions and up-front costs as an incentive to offer customers better charging rates.

Electrify America and EVgo utilize a subscription-approach to offer lower prices for loyal customers. Electrify America charges $4 per month for their membership program, which gives customers a 25% discount on per-kWh pricing.

EVgo charges $7.99 per month for membership, and while they haven’t made the switch to per-kWh pricing yet, members get a 10% discount on the guest-rate, and their first 30 minutes of each month free.

Then there’s Tesla. Along with being the earliest proponent of per-kWh pricing, Tesla Supercharge stations offer lower rates than the top fast-charging networks. Of course, the barrier to entry is you have to buy a Tesla to be able to use their stations.

Snowflake’s Transparent Pricing Philosophy ❄️

Snowflake has been the talk of tech for the last few weeks, and with good reason. They secured a rare investment from the Oracle of Omaha and had the biggest software IPO of all time.

Curious, I wanted to understand how Snowflake's pricing and packaging strategy influenced their growth, and what, if anything, we can learn from it. After going down the rabbit-hole, there's a lot to learn and a lot to love.

First and foremost, Snowflake has a usage-based pricing model. In 2019, CEO Fred Slootman famously said he doesn’t like the SaaS business model, citing that it’s not equitable for customers.

In that vein, it makes sense that Snowflake got rid of several costs that have traditionally been included in data-warehousing:

Near zero management costs during setup

No fixed charges per user or CPU - all charges are based on usage

No hidden quotas or price bumps

If no queries are running, you can suspend charges

The first thing to understand about Snowflake is that they itemize pricing for data storage and data computing. Historically, storage and compute have been tied together, and it’s only with the advent of cloud computing that separating the two has been easily achievable.

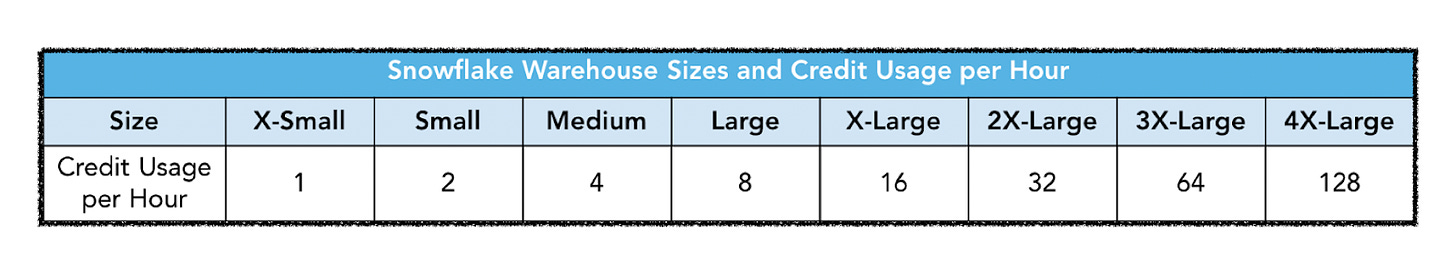

From there, Snowflake offers a monthly fee for storage and a credit-based model for compute. Compute refers to the querying and analysis that makes Snowflake such a powerful platform for data engineering. The credit-based model is offered in “T-Shirt Sizes” allowing for varying levels of credit usage per hour. To simplify, a bigger size grants you more credits and more horsepower to analyze your data.

On the surface, their model may look complicated, but this complication is a downstream effect of offering transparent pricing.

As a result, customer education is critical to Snowflake’s success, and a key reason Snowflake has a large salesforce. Specifically, of all public SaaS companies, Snowflake spends the most on Sales & Marketing as a percentage of revenue at 70%. Further, Snowflake has a top-down sales motion, opposed to the product-led bottoms-up approach that’s fueled early growth for companies like Zoom and Slack.

This consultative sales approach ensures customers understand their usage needs. The last thing Snowflake wants is to have a customer sign up only to realize they need less credits than they signed up for. To mitigate this possibility, Snowflake offers a trial, a pay-as-you-go model, and the ability to purchase credits upfront.

Unlike most trial experiences, Snowflake’s is quantifiable. Since usage is measured in credits, and credits are tied to a specific dollar value, Snowflake has the ability to tell customers exactly how much the trial is worth: $400.

This is cool. It feels like Snowflake is handing you a $400 check upon registration. This also ties back to Slootman's quote about not liking the SaaS model. Many SaaS companies utilize value metrics that serve as proxies for the value a customer is getting, often obfuscating the true value. Snowflake wants nothing to do with that.

The trial, which in many cases, is a company's first experience with Snowflake, gets them familiar with a transparent value equation. After the trial, Snowflake gives customers two options to pay for storage and compute: on-demand or upfront.

On-demand means you pay for what you use after you use it, while paying upfront locks in a level of usage credits at a significant discount ahead of time. A common workflow for Snowflake customers is starting with on-demand pricing to gauge their usage needs, then moving to upfront payments once they understand how many credits they’ll need.

Through this lens, it’s fascinating to look at their net dollar retention. Their most recent six month period showed a net retention rate of 158%, meaning that even accounting for churn, customers spent 58% more than they did in the same period in 2019.

Since customers only pay for what they use, and have been increasing their spend by more than half year over year, it means they’re finding new ways to use the product, and are more than comfortable with the increase to their spend.

This is a huge testament to the Snowflake product. Essentially, customers get hooked on the data, and expand their usage as they find new use-cases across their organization.

Google Tables: Aggressively Free 🗂

Earlier this week, Google launched Tables, a work-tracking tool that will compete directly with Airtable, the no-code platform that just raised a $185M Series D at a ~$2.5B valuation.

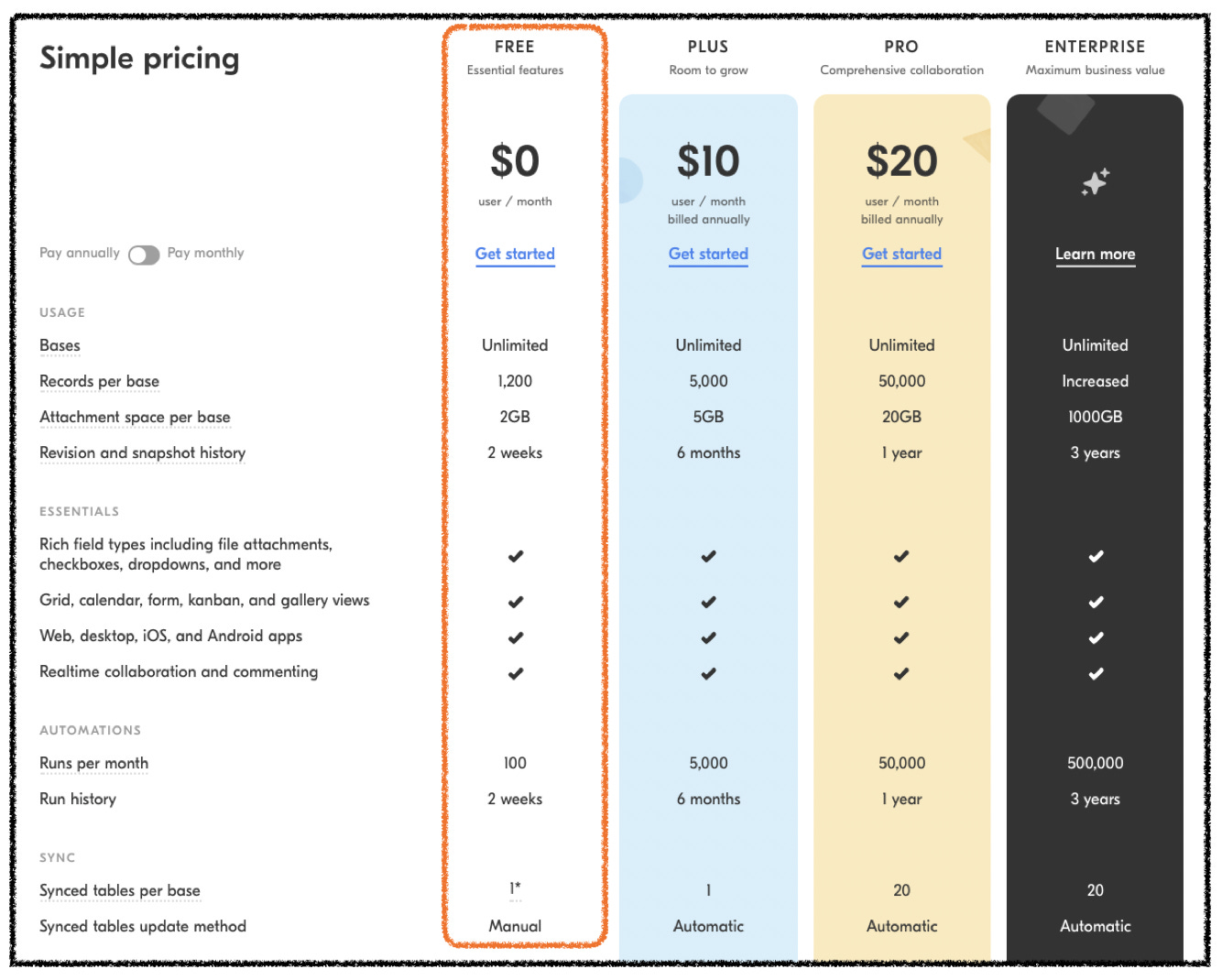

Airtable offers a Freemium plan with 6 different usage-based limits.

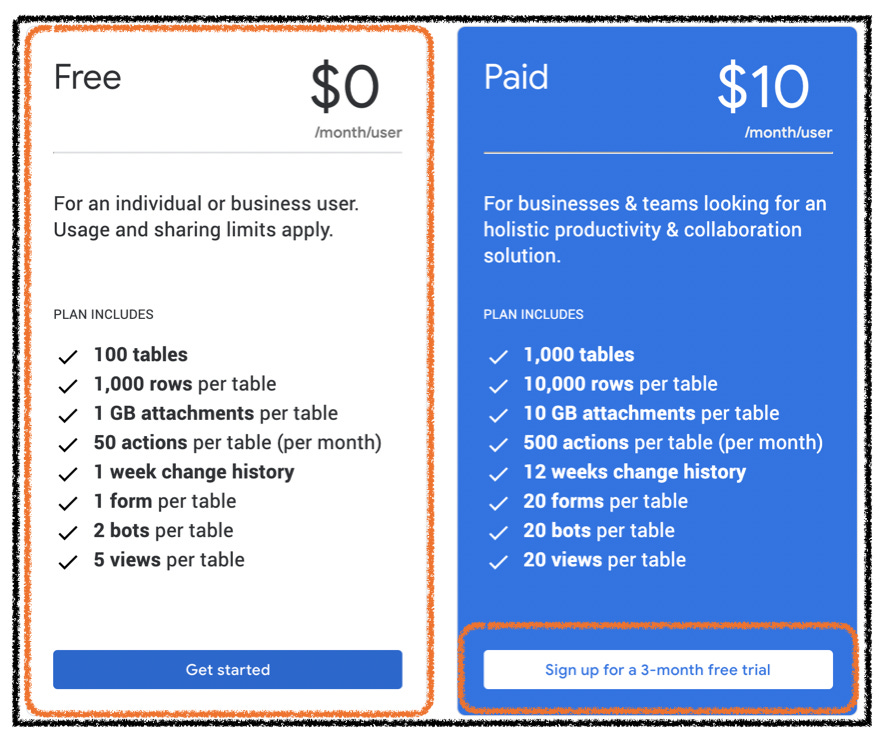

With this in mind, I was eager to see how Google priced and packaged their Tables product. Predictably, Google not only offered a comparable Freemium plan, but also a 3-month free trial of the Paid plan.

Free trials are great when there’s a level of loss aversion to leaving the platform, and works particularly well when a solution stores critical data that customers won’t want to lose. For Tables, 3 months gives users time to not only build up a ton of valuable data, but also expand usage across different users and teams within their organization.

The result is that after three months, Google will likely see free to paid conversions with higher ACVs than they would with a shorter trial.

This is exactly what Google should be doing, and reminds me of Microsoft giving away Teams to fend off Slack. To be clear, I’m not overly worried about Airtable, and generally trust a specialized approach, especially in a world with seamless third-party integrations. That said, Google is giving G-Suite users that have been considering Airtable a compelling reason to hold off for the time being.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the “like” button, that way I’ll know which posts are resonating the most!

If you have thoughts or feedback, I’d love to hear from you! You can find me on Twitter here.