GBB Trend Report: Q1 2021

A shortlist of pricing ideas that caught my eye over the last 3 months.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Hey y'all,

It's been a little while! I hope this finds you healthy and hopeful for a return to simpler times.

Back in January, I wrote a post called 5 Pricing Trends for 2021 and people seemed to really like it. I’ve wanted to write more posts like it ever since, and this week’s post is my first attempt at a follow-up. As always, I would love your feedback. If you’re seeing any of these trends or others on the front lines, I’d love to hear about it.

Before we get into it, I wanted to introduce a newsletter I’ve been digging lately called Wonder Tools. I recently met Jeremy Caplan, who writes it, and love what he’s doing.

Wonder Tools is like The Wirecutter for sites and apps. Every Thursday, Jeremy shares a new tool, and how he uses it. If you’re into productivity, or just enjoy trying out new apps, it’s a no-brainer. Hit the button below to subscribe.

On to the three pricing trends that have caught my eye so far in the new year.

1. Using Freemium to Drive Habit Formation

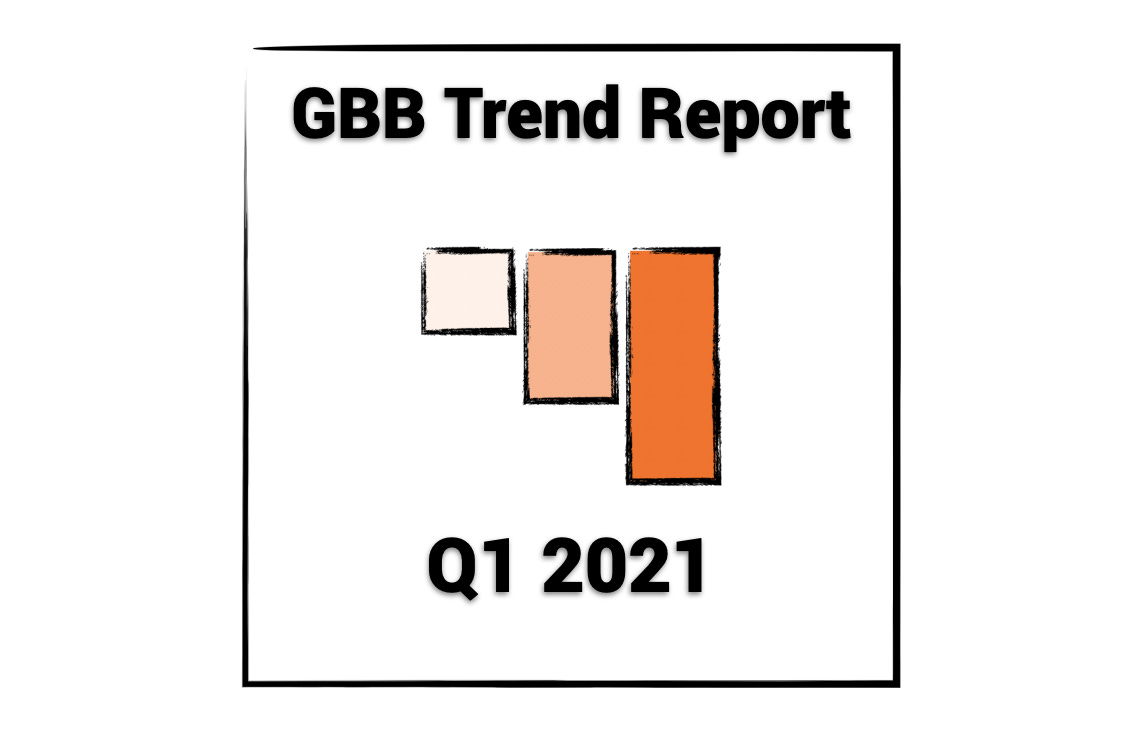

In January, Okta released their annual Businesses at Work Report for 2021, highlighting the tools organizations are using to be productive.

In the Growth category, there are 3 products that stand above the rest: Amazon Business, Miro, and Figma. While Amazon Business is a genius service, I want to double click on the other two, Miro and Figma, and how they've used strategic pricing to drive rapid growth.

First, for the unfamiliar, Miro is a virtual whiteboard platform where teams can collaborate visually. It's easy to attribute much of Miro's 300% year-over-year growth to the shift to remote work. If more workers were in the office, you would think some of their time spent in Miro would move to physical whiteboards. While that may be the case, physical whiteboards have an inherent downside - you have to erase them.

I've taken pictures of many-a-whiteboard, referring to my phone later to transcribe notes from a strategy session. While I do expect people to continue using physical whiteboards, digitizing the experience feels like a habit that's going to stick long after people return to the office.

Habit formation is something the Miro team is keenly aware of. One of my favorite pricing posts is Elena Verna's The Hidden Freemium Advantage. In it, she highlights six indirect benefits of freemium, one of which is habit formation. As a Growth Advisor at Miro, Elena has seen their rapid rise firsthand and says offering a freemium plan has been critical to cultivating habit formation among users.

According to Elena, if you only offer a paid version of your product, and a user doesn't develop a strong usage habit quickly, they become a significant churn risk. Offering a free trial solves this to some extent, giving users a defined period of time to learn the product before paying. However, freemium is even better. Simply put, a freemium plan gives users time to learn a product at their own pace. According to Elena, this is exactly what happened at Miro.

A lot of people want to try Miro, but it takes some time to understand all the different ways you can use it. If Miro charged for product use right away, a lot of people would churn quickly. Instead, the free product (which gives users 3 free boards) helps build strong user habits, so by the time a user converts to paid, they are much more likely to retain longer since their habit is stronger.

Specifically, Miro offers a faux-free Freemium plan with unlimited users, but a limit of 3 boards. This approach, offering unlimited users with limitations on another usage axis, has become popular. The idea is that more people using the tool will lead to a team blowing through the other usage constraint quickly and seeing enough value to upgrade. For Miro, if a team is getting value, they'll want to expand beyond 3 boards pretty quickly, at which point they’ll upgrade to one of the paid plans.

This idea of using freemium to build user habits is powerful and opens the doors to far more opinionated software design. Simply put, if you offer a version of your product for free, time is your friend, and gives users a longer learning curve. Of course, there's probably a natural limit to how long that learning curve should be, but in general, it means your users don’t need to master your platform immediately. It also puts pressure on competitors to either offer a free version or have a shorter learning curve.

2. Aligning Pricing Strategy with Company Mission

Right behind Miro on Okta's list of high-growth companies is Figma, the collaborative design platform. I was already planning on writing about Figma after hearing their CEO, Dylan Field, on Invest Like the Best. One takeaway that stood out from his interview is the idea of aligning your strategy and tactics with your company vision.

Figma's overarching mission is to spread design beyond designers. This isn’t just lip service. One reason Figma exists in the browser rather than a standalone app is to make it easier for stakeholders across Marketing, Engineering, Product Management, and Sales to engage with design for the first time. In this sense, Figma’s company mission is fundamental to the product experience.

In the context of using design tools, there are Viewers and Editors. Many of these non-design stakeholders do not edit design assets themselves but need Viewer access so they can review designs and offer feedback. When Figma was getting started, most design tools differentiated between Editors and Viewers, and charged for both.

With this in mind, Field and team looked out at the market and made the decision to make Viewers free across all plans. This decision has 3 big implications:

First, it gives Figma a competitive advantage. With most competitors charging for Viewers, Figma offering access for free gave them amazing optics. As Figma started gaining traction, they forced competitors to follow their lead or struggle to meet changing buyer-expectations.

Next, this strategy gives Figma a massive expansion engine as Viewers convert to Editors and start taking part in the design process themselves. Figma's tiers are primarily differentiated by features, so Viewer-to-Editor conversion gives them an important usage-driven expansion lever. This ensures that they'll always have a way to grow accounts even if customers don't upgrade to the next tier.

Lastly, this idea of giving non-designers the tools to communicate visually is core to Figma's mission. The fact that their revenue is directly tied to how well they execute on that mission ensures they're working towards the right goal at all times. This gives Figma a much stronger growth narrative. As Figma grows, instead of just saying that more people are using their platform, Figma can genuinely say they are growing the importance of design. This is a powerful narrative that makes their mission bigger than the company. Much like Hubspot grew alongside the rise of inbound marketing, Figma will grow with the increasing importance of visual communication.

3. Usage-Based Pricing FOMO (and a Framework)

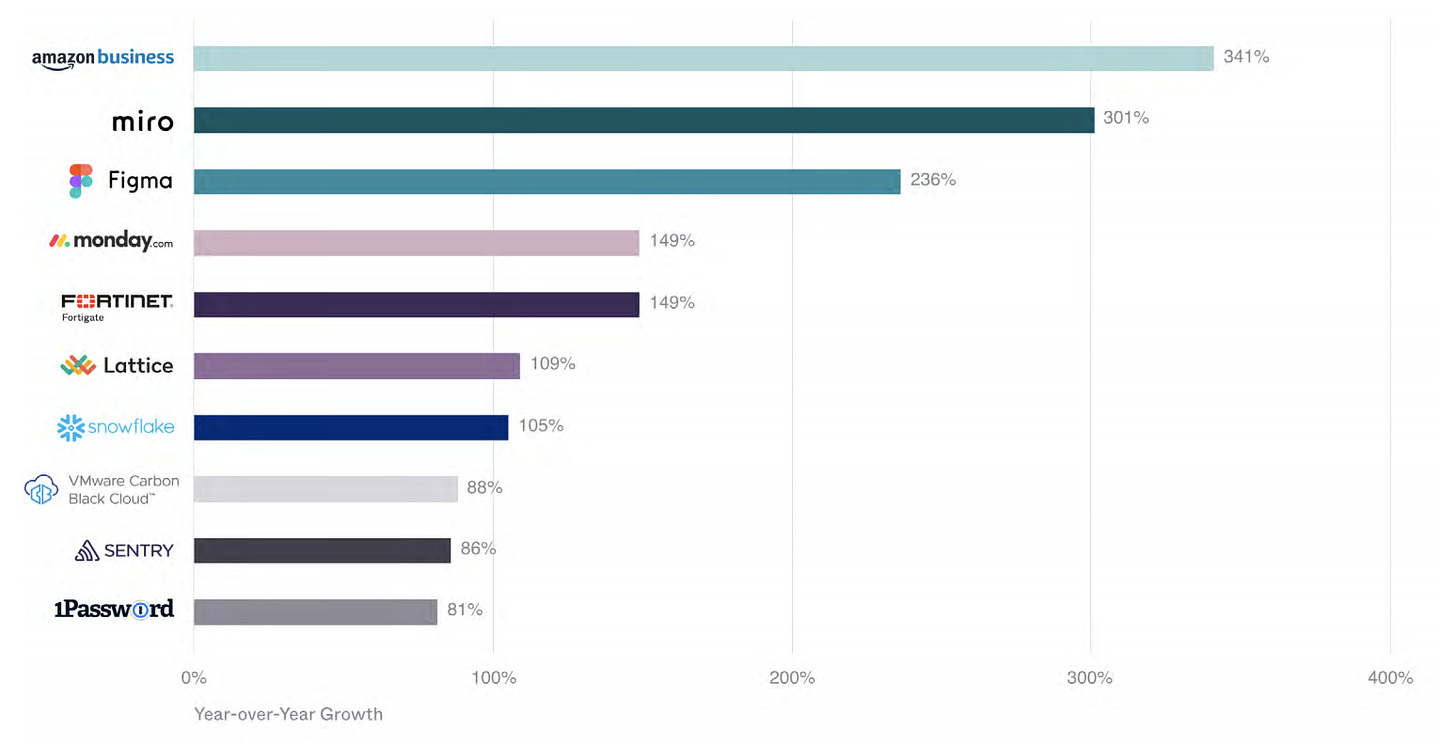

In January, OpenView published their Usage-Based Pricing Playbook, providing a treasure-trove of data on usage-based pricing strategies. The report highlights the benefits of usage-based pricing, comparing SaaS companies that have usage-based pricing strategies to the broader SaaS index.

As you can see, usage models correspond with better year-over-year revenue growth, net expansion, and continued growth at scale. Inevitably, these numbers make SaaS companies that aren't offering a usage model want to change their strategy.

We've seen this first hand at ProfitWell over the past few years as companies with a traditional SaaS model have come to us looking to add a usage lever. Sometimes it's a fit, but sometimes the shift doesn't make sense given their competitive dynamics.

At the very least, every situation is nuanced enough to warrant serious investigation before making a change. While the context may vary depending on the market and competitive landscape, the broader question remains topical for SaaS companies of all types - should I pursue a usage model?

If you've been reading this newsletter for a while, you know I'm a sucker for simple frameworks. One of my favorite slides from OpenView’s report is a flowchart that helps organizations evaluate their market and think through a usage-based pricing strategy.

In addition to the simplicity of the flowchart, I love that it leaves you with an actionable next step. While the action items remain high-level, the flowchart helps operators answer two critical questions:

1. Should I pursue a usage-based pricing model?

2. If so, where should I start?

That’s it for this week! Again, I would love to hear your feedback, especially if you’re seeing these trends or others in your domain.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the like button up top, so I know which posts are resonating most!