GBB Digest 17: Fortnite Crew, YouTube Music & Squarespace Member Areas

A mixed bag of field notes on subscription pricing and packaging.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

Hope everyone is settling safely and comfortably into the holiday season.

I have a quick favor to ask of you this week…

Starting and growing this newsletter has been a blast this year, and heading into 2021, I want your perspective on how I can make it better.

The ask?

If you’ve found any value from Good Better Best, I’d be so grateful if you took 5-minutes to complete this survey so I can learn more about you, what you’re looking for, and what I should do to make this newsletter as useful as possible.

Honestly, I think 2-3 minutes is more realistic, and if you can carve out the time, I’d seriously appreciate it.

As always - I would love to hear any feedback outside the survey. Feel free to hit me up on Twitter or reply directly via email.

On to this week’s analysis…

Fortnite Joins the Subscription World

Last week, Fortnite announced a new monthly subscription called Fortnite Crew, which is essentially a bundle of 3 things:

Battle Pass: Fortnite’s seasonal offering that allows players to unlock in-game extras as they progress in the game.

1,000 V-Bucks a month: A monthly stipend of Fortnite’s in-app currency.

Crew Pack: An exclusive outfit bundle that changes monthly.

There’s a lot to love about this subscription, but two things stick out as particularly powerful.

First, the Crew Pack gives subscribers something to look forward to every month.

Fortnite’s season-based model already gives players something exciting to look forward to every couple of months, but the Crew Pack offers that same sense of novelty within an even tighter window.

The Crew Pack also gives Fortnite a recurring digital drop-strategy, fueling marketable moments that can drive new subscriber growth and keep the subscription fresh for existing subscribers.

Also worth noting - exclusive outfits are a sign of status within Fortnite. Players wearing free skins/outfits often get bullied into spending money to avoid being called defaults. As Blake Robbins of Ludlow Ventures tweeted, many will likely subscribe for the status perks of the outfits alone.

Secondly, and perhaps more importantly, every component of the bundle encourages usage. Battle Pass, V-Bucks, and exclusive outfits all function to drive subscribers to spend more time in-app.

More time spent playing means more in-app spending, which translates to higher ARPU, and that’s before you even factor in the sunk cost fallacy that comes with a paid subscription.

The YouTube Music Paradox

YouTube Music is a sleeping giant in music streaming.

Flying under the radar at 30M paid subscribers, they have half the subscribers of Apple Music and about a fifth of Spotify’s subscriber base.

With the sunsetting of Google Play this month, they’re officially streamlining music efforts under one app: YouTube Music.

A recent profile in Protocol highlights the factors that make YouTube Music such an interesting dark horse in music streaming. The most interesting, in my opinion, is how YouTube can combat the commoditized nature of music.

While streaming competitors are limited to the same ~60M songs, YouTube Music can tap into the broader YouTube catalog. Along with music videos, this includes an endless list of versions, covers, reaction videos, and cultural commentary for each song, adding a different level of context to the music.

What’s tricky is that pretty much all of this content is available on YouTube for free, making it difficult to justify monetizing it as a paid differentiator. This brings up an even broader question: how can they incorporate YouTube’s massive content library into a dedicated music app?

This is the YouTube Music paradox. Their biggest strength is also their biggest challenge. The dilemma rests in the fundamental difference in user experience between YouTube and YouTube Music. Put succinctly in the profile:

YouTube, which is mostly a lean-forward, search-and-recommendations experience, can intermingle all these things mostly successfully. YouTube Music, where people mostly just want to press play and go about their lives, can't.

YouTube already consolidated their music offerings into one app, and the end-game might be further consolidation between YouTube Music and YouTube Premium (the paid subscription for YouTube proper).

YouTube Premium is $11.99 per month and includes YouTube Music, which lists at $9.99 per month. Given YouTube Music’s challenger status, further consolidating both subscriptions at the $9.99 price point could make some noise and drive adoption from new subscribers.

While competitors are differentiating with exclusive podcasts and content, an ad-free YouTube experience across the board (not just music) at the same price point, is an intriguing differentiator with wide appeal.

Member Areas: Squarespace’s New Passion Economy Play

Squarespace recently launched Member Areas - their answer to the emerging passion economy. With Member Areas, creators can monetize their content by adding paywalls to specific content on their site.

This functionality puts Squarespace in the conversation with Patreon, Substack, Pico, and Memberful (owned by Patreon) as products that enable creators to monetize their talents. That said, Squarespace won’t really compete directly with all of them.

Patreon and Substack offer creators a way to monetize their content without having to build a website, meaning those creators are less likely to be tempted by Member Areas.

Memberful and Pico, on the other hand, both integrate with Squarespace and other website builders, appealing to creators that have their own websites.

Memberful is fully dedicated to memberships and has a reputation as the market-leader with top-tier creators like Ben Thompson of Stratechery, Shane Parrish of Farnam Street, and Kottke.org.

Pico is an up-and-comer that’s tapped into the passion economy, powering membership programs for Wait But Why, Defector Media, and The Generalist.

Squarespace’s advantage lies in distribution. As one of the first stops for creators when they set out to build a website, Squarespace gets “first look” at offering membership functionality. In this context, Member Areas is an add-on. Only a niche segment of Squarespace customers will be a fit, and those that are can add to their existing subscription for an additional monthly fee.

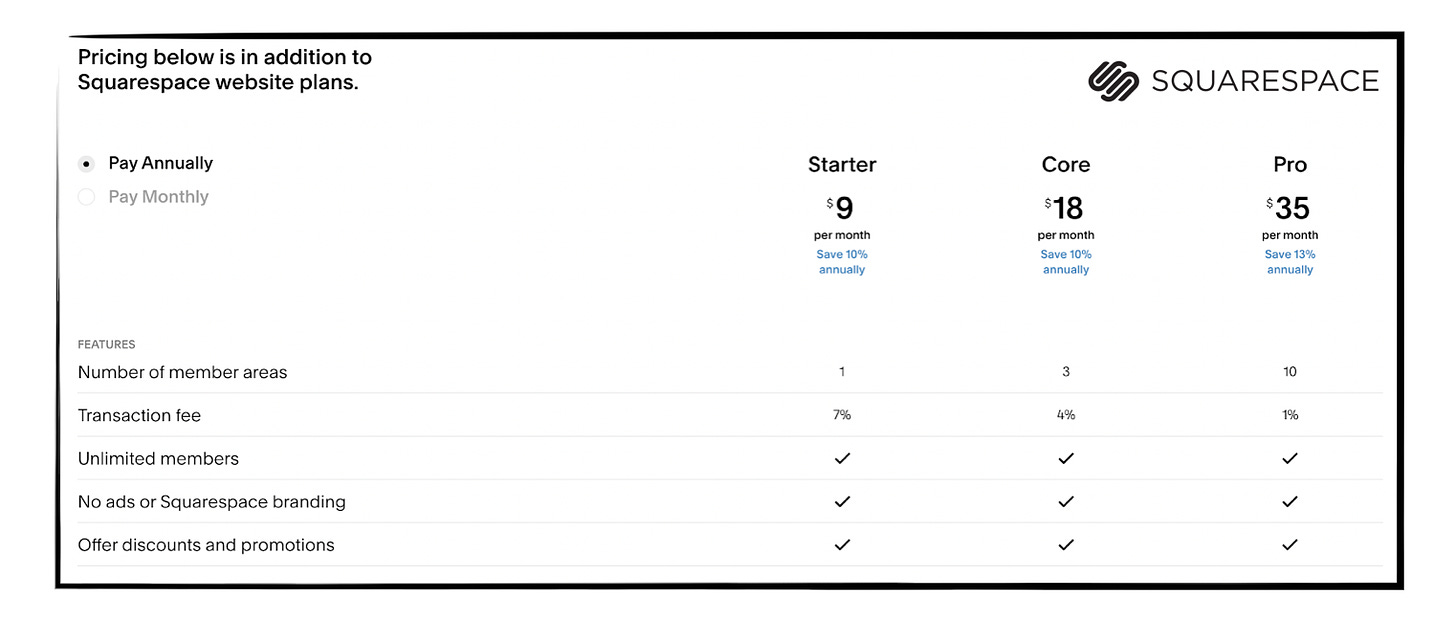

Specifically, Squarespace is charging a monthly subscription fee that increases with each plan and a transaction fee that decreases with each plan.

This pricing structure makes a lot of sense in a vacuum - the decreasing transaction fee incentivizes customers to upgrade as they grow, and the rising subscription fee allows them to monetize added capabilities for sophisticated creators.

That said, their Starter plan feels tone-deaf relative to Memberful and Pico, whose low-end options don’t include a monthly fee.

Memberful has a similar model to Member Areas, but their Starter plan is free with a 10% transaction fee. Mirroring Substack’s “skin-in-the-game” pricing strategy, they only make money if their customers make money on the low-end.

Pico, on the other hand, has no monthly cost and only a 5% transaction fee until a customer reaches 500 subscribers, at which point they start charging $5 per month per 500 subscribers.

Both companies optimize for easy adoption from early-stage creators, who are likely to be price-sensitive until they build a subscriber-base.

As it stands, Member Areas’ pricing is most compelling for established creators, but I worry those customers would rather pay the premium for a dedicated solution anyway.

While the 1% transaction fee on the Member Areas Pro plan would likely save them money, I suspect established creators would rather have the breadth and depth of features offered a fully-focused membership solution like Memberful or Pico.

Rather than try to compete head-on with Memberful and Pico on the high-end with sophisticated features, Squarespace should consider adjusting the price point on the Starter plan to drive adoption on the low-end.

This will not only make them competitive within a more appropriate customer segment but also increase adoption, giving them usage data they can leverage to further improve the Member Areas product.

After all, one of the biggest benefits of Freemium is product feedback…

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the like button up top, so I know which posts are resonating most!

If you have feedback, I’d love to hear it - hit me up on Twitter.