SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

Before getting into it, we're currently looking to hire a Strategist to join the Pricing team at ProfitWell.

This role is a crazy learning opportunity - you’ll get to work with executive teams at startups up to the Fortune 500, helping them tackle their biggest monetization challenges. Having been in the role for the past couple years, I can honestly say it's the most fun I've ever had at work. If you or someone you know might be a fit, check out the job description, or shoot me a note directly!

This week’s post goes deep on Drift’s recent pricing page update, where they removed price points for their paid tiers. While I don’t think this strategy would work for everyone, I think Drift is uniquely positioned to succeed with it.

I would love your feedback! If you enjoy this post, do me a favor and click the “like” button up top (the heart). That way I’ll know which topics are resonating most.

On to this week’s analysis.

Briefing 📋

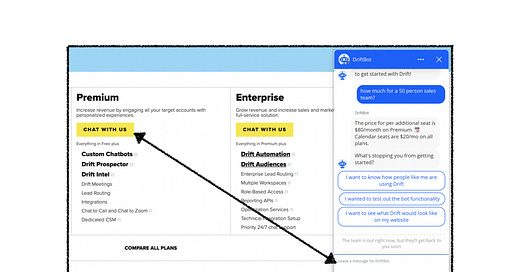

Product-Led Pricing: A few months ago, Drift had a pretty conventional SaaS pricing page. That changed when they removed the price points from their paid plans. Now, visitors must chat with Drift’s bot to start the pricing conversation. This allows new visitors to use Drift firsthand, and envision how it might work for their own organization before they know how much it’ll cost them.

Personalized Pricing Conversations: This move ensures every customer has a personalized pricing conversation. By understanding their team size, use case, and current technology stack, Drift’s sales team can position themselves as truly consultative, and use context to tailor pricing to the prospect’s specific situation.

Bringing Legibility to every Pricing Event: Lastly, this move will bring legibility to a cohort of visitors that would have otherwise looked at list-pricing and left the site without converting. This will give Drift far more feedback on pricing than ever before, allowing them to adjust their strategy as necessary.

Drift’s Pricing Page Pivot

If you spend time in the world of B2B SaaS, you’re likely familiar with Drift.

Inspired by the wave of messaging apps infiltrating our personal lives, founders David Cancel and Elias Torres applied the ease and informality of messaging to B2B chatbots. The result, in a term they coined, was Hypergrowth.

One reason they’ve been able to grow so fast is their product team’s relentless shipping schedule.

In a 2017 blog post, Torres explained that at Drift, they don’t focus on competition, because they’re too busy focusing on customers. Critical to that focus is delivering new value consistently. To do that, Drift publicly committed to shipping a new product every month, an example of what they coined “Marketable Moments” to increase their accountability and drive demand for new features in advance.

In the post, Torres highlights an insight that feels prescient in a world where no-code tools allow teams to move faster than ever:

The bottom line: Speed is going to eat software. Moving forward, we’ll brag less about shipping daily to production and we’ll realize we don’t have time to code like before.

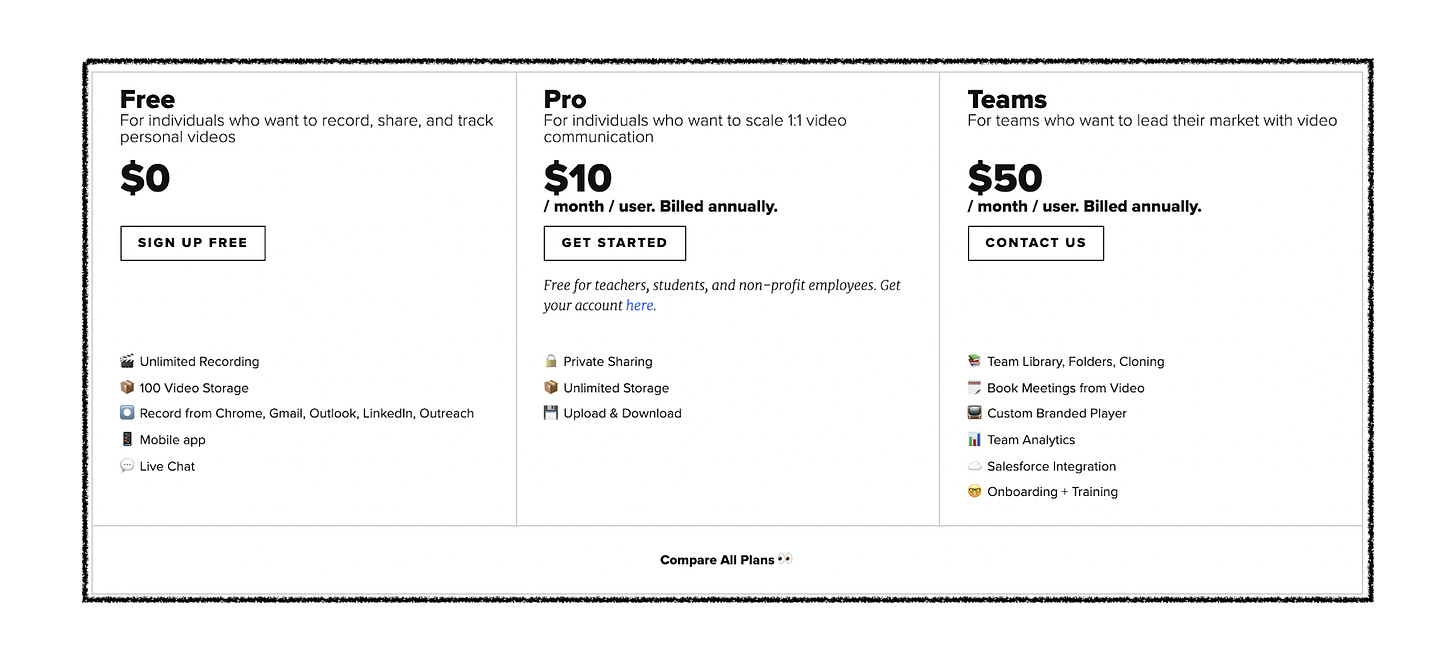

While relentless product development helped Drift gain an edge on competitors, it also expanded the capabilities of their solution to the point of being truly multi-product. Along with chat functionality, Drift has email and video products, charging separately for each. Though multi-product strategies are great for driving expansion and fostering retention, they can also complicate pricing. In Drift’s case, that’s exactly what happened.

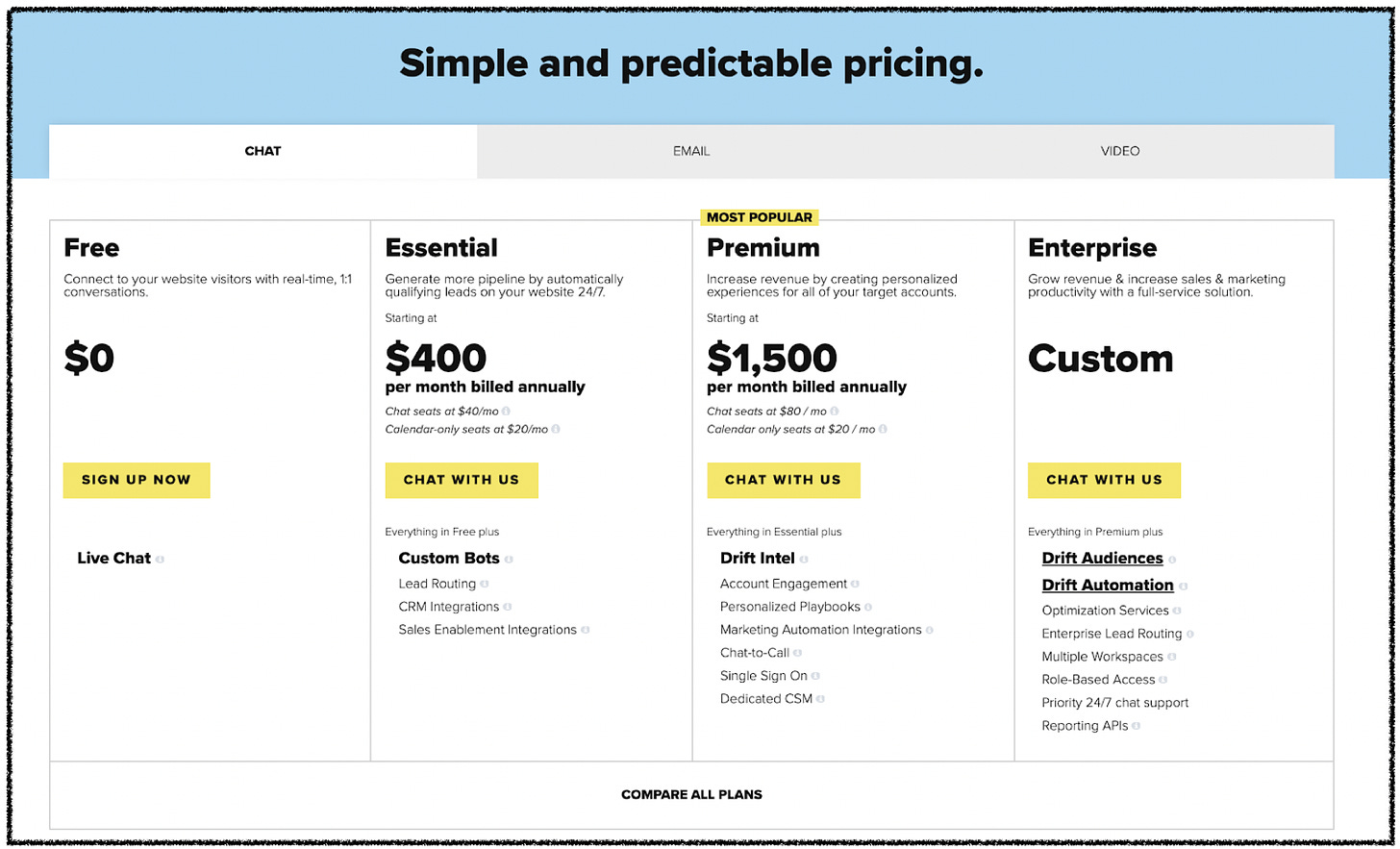

Back in June, they offered a classic Good Better Best model with a 2-Part Tariff and a perpetual Freemium plan for their chat product.

A 2-Part Tariff model means each tier has a base platform fee with a marginal cost for each additional usage unit. In this case, the usage units are two different types of users: Chat users and Calendar-only users. Here's what that looked like:

The irony of the old pricing page is the contrast between the hero copy, which references "Simple and predictable pricing", and the reality that when looking at the plans without the help of a salesperson, it’s neither simple nor predictable.

Along with a value metric that includes two different user-types, many features have Drift-specific language. Also, this pricing was just for Drift's chat product. Adding email and video, the equation becomes even more complicated. Simply put, it’s hard for a customer to calculate pricing without knowing the product in and out.

To be clear, Drift likely knew this. Their paid plans aren’t self-serve, and the accompanying call-to-action directs visitors to their chatbot, which helps gather context before routing prospects to sales.

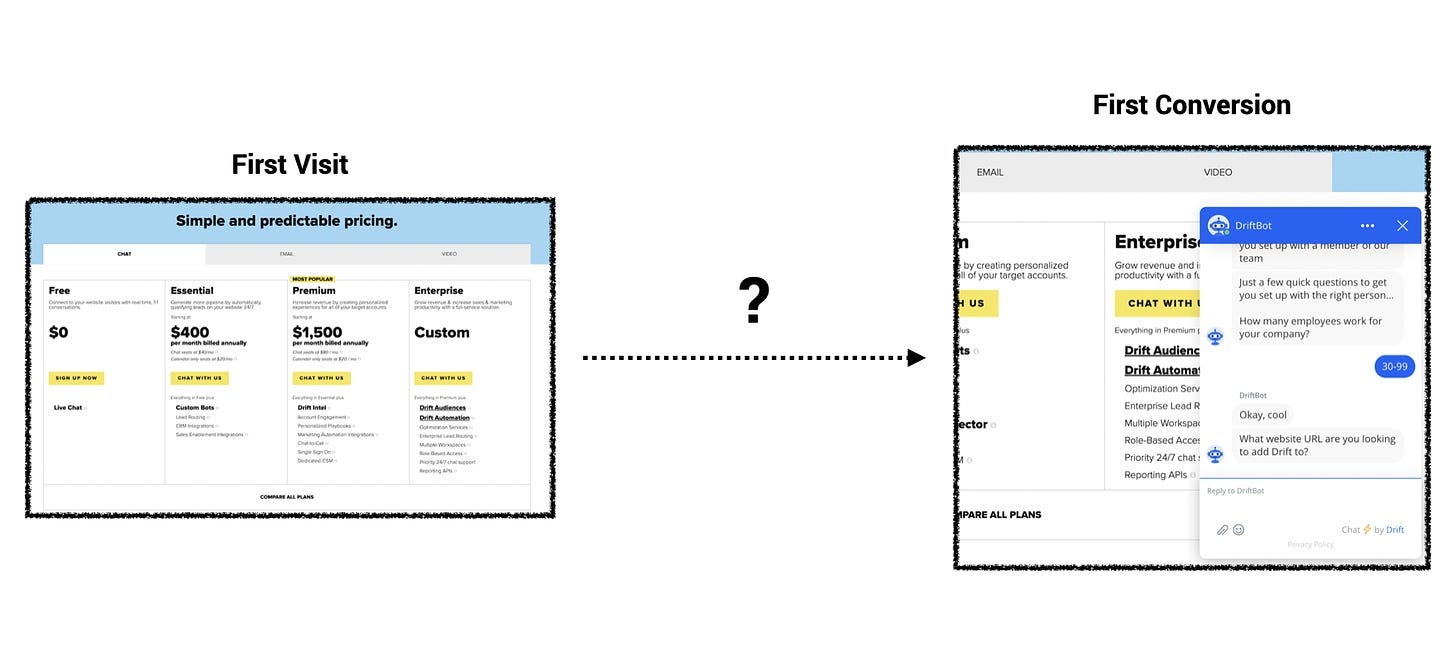

Like many SaaS companies, visitors would get to Drift’s pricing page and see the price before experiencing the value of the solution. This allowed them to make their own judgement on pricing before using the product, leading to a dynamic where Drift’s sales team had to justify the value of the solution throughout the sales process.

Not anymore.

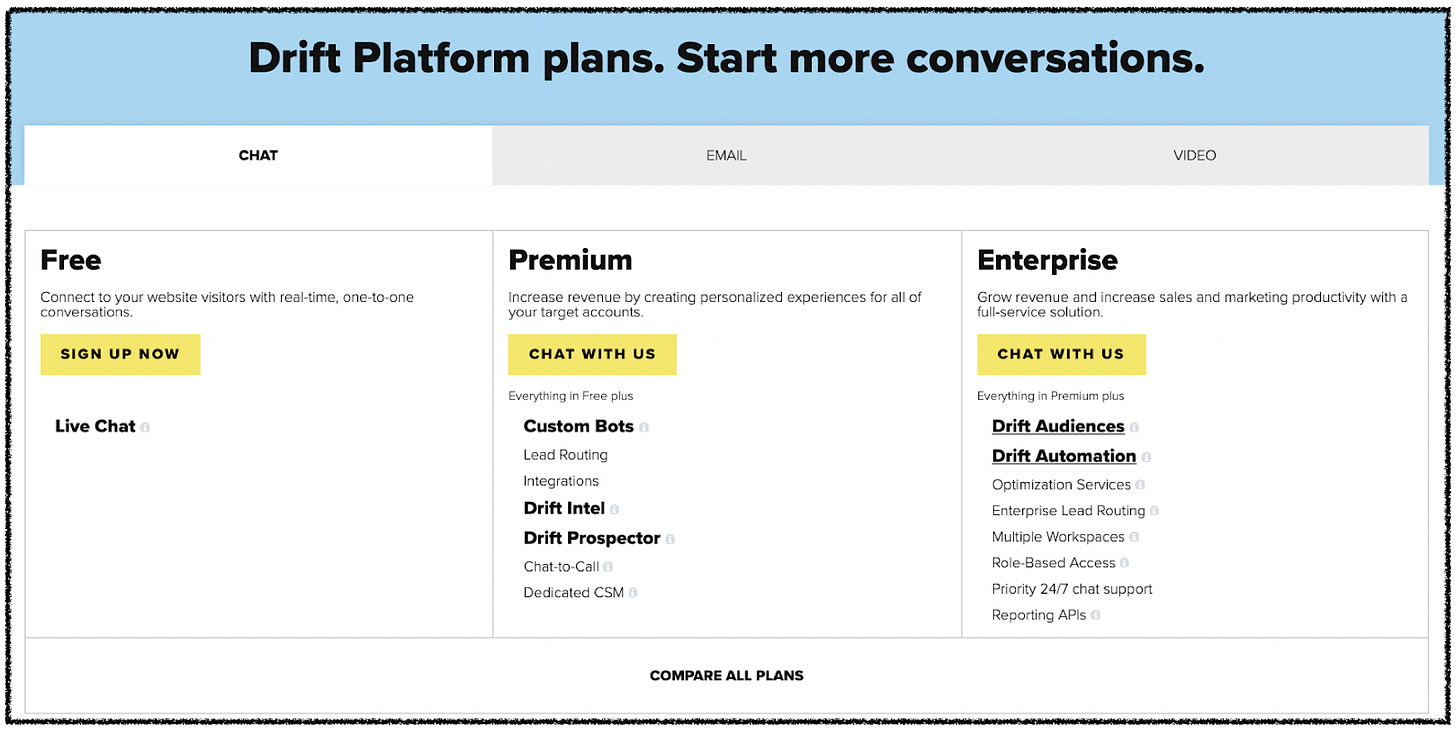

Drift's new pricing page doesn’t allow prospects to come to their own conclusions about cost because they no longer list prices for the paid tiers.

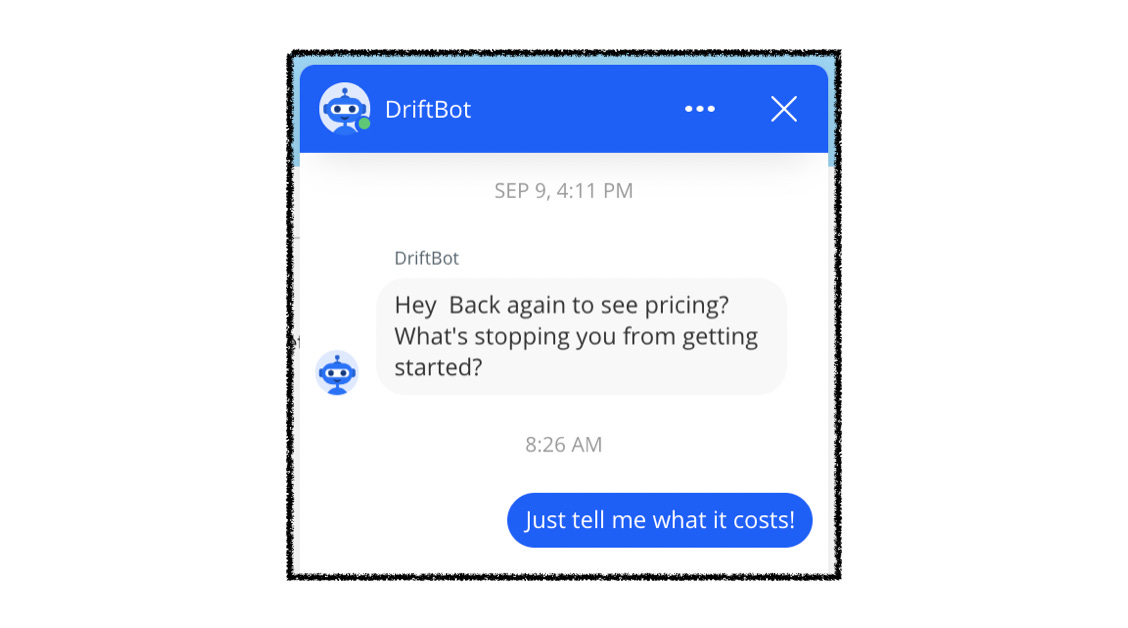

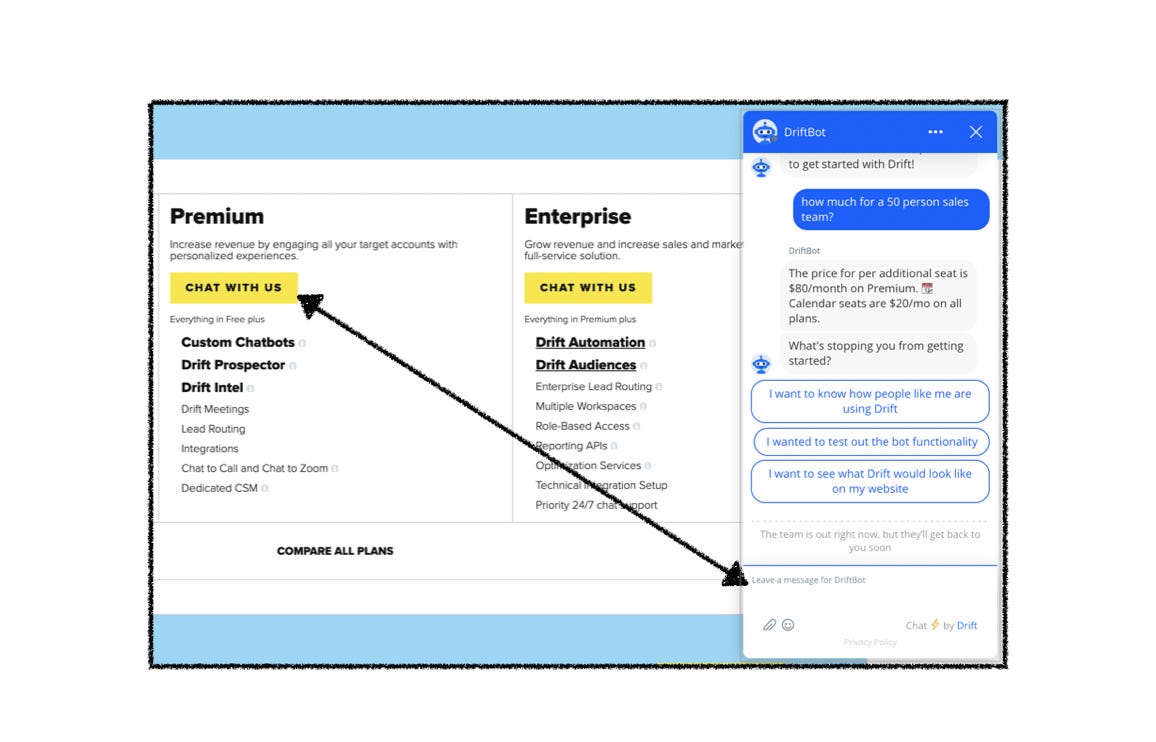

This new strategy reverses the order of the price-value equation. It forces visitors to use the product, and get a sense of the value before seeing the price. This is an aggressive shift, and not every company can get away with it. It may even lead to exchanges like this…

However, I think its a worthy experiment for Drift for 3 reasons:

It forces visitors to use their product before getting a quote.

It makes every pricing conversation feel personalized.

It brings legibility to every pricing event.

In this post, I want to unpack each of these, and discuss why Drift is uniquely positioned for success with this unconventional pricing page strategy.

Product-Led Pricing

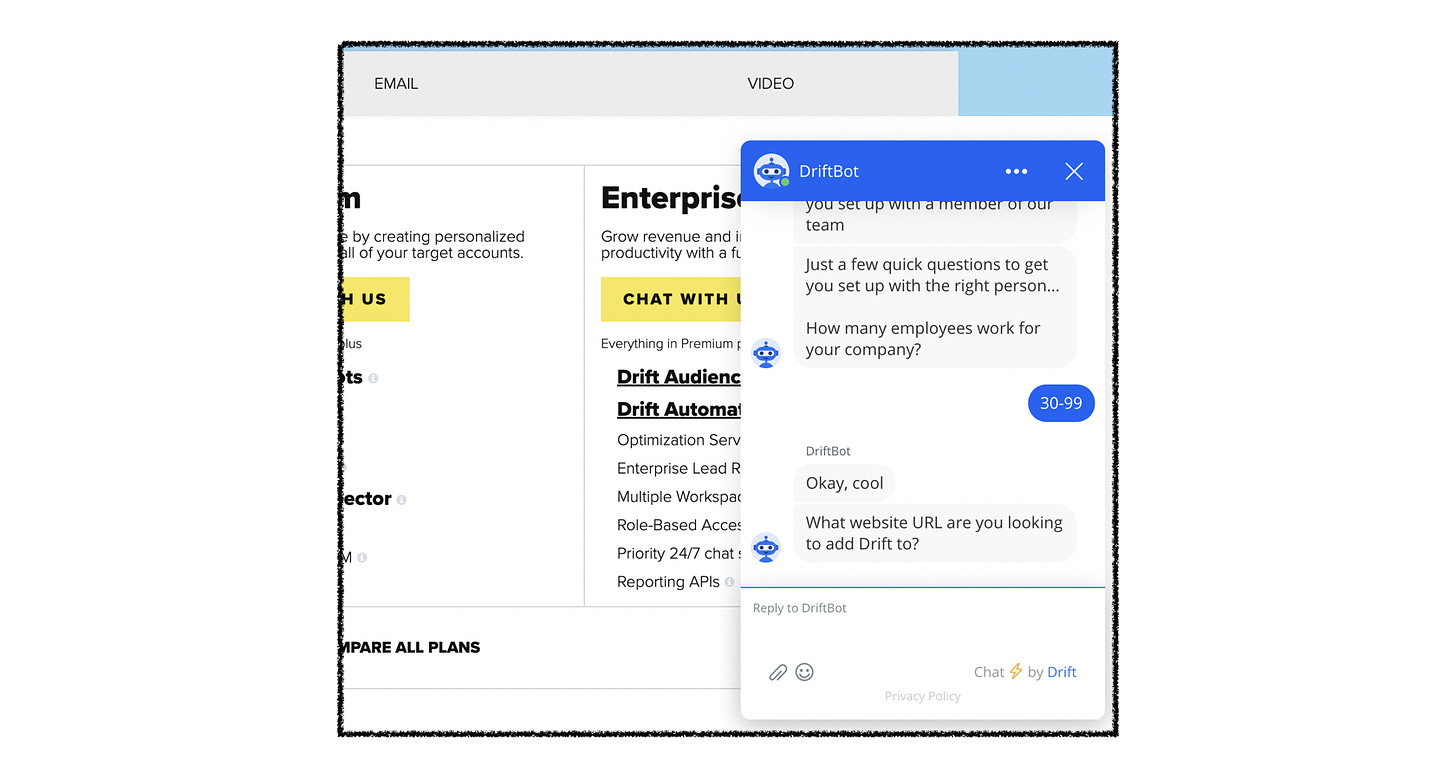

Rather than risk confusing visitors with their pricing, the new pricing page pushes visitors to use Drift’s chatbot, which helps set up an appointment with a member of the Drift team.

This gets Drift’s software in the hands of prospects without them even signing up for the free plan, serving two key functions.

First, it allows visitors to envision how Drift will work for them. As they go through the DriftBot flow, prospects can start conceptualizing how they would use a chatbot on their own pricing page. It plants an aspirational seed for companies that aren't using Drift, and gives them a sense of the possibilities using the solution.

Second, this gives Drift’s sales team a baseline to build from when discussing the product with prospects. They can reference the prospect’s experience with Drift, and expand on the features and functionality that will help solve their specific challenges. Since the prospect will have the foundation of using the product, they’ll have a much easier time imagining how other features fit in. It takes a pitch that would have been abstract, and ties it to real-life experience.

Lastly, this creates a self-fulfilling sales pitch for Drift. In Write of Passage and Packaging Inception, I referenced how Hubspot was their own best case study for inbound marketing, and how that created a powerful positioning statement for the sales team. In this case, if prospects dispute the merits of conversational marketing, Drift’s sales team can reference the prospect’s own experience with the product, and how that led to a more personalized conversation than would have been possible otherwise.

This leads to the second benefit of this strategy - tailoring each pricing conversation to the specific prospect.

Personalized Pricing Conversations

Since Drift removed price points for their paid plans from the public website, there’s no longer a list-pricing that visitors can look to when comparing vendors. This is particularly important given that they’re multi-product now.

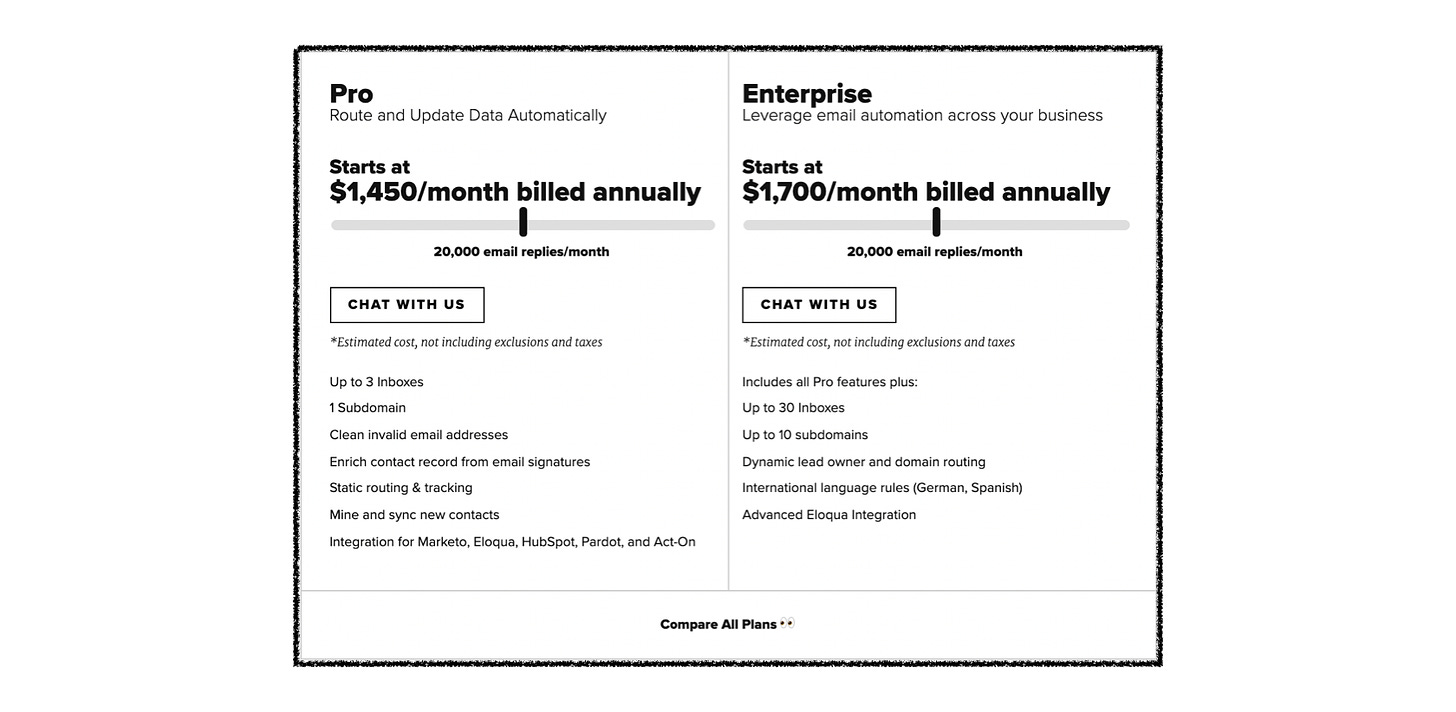

Along with having two types of users for their Chat product, Drift’s Email tool adds complexity to the pricing equation. A visitor now has to think about how many email replies they need per month, along with how many subdomains and inboxes.

Then there’s video, which is charged per-user.

Between the varying tiers and usage levels for Chat, Email, and Video, there are a lot of variables to consider when evaluating Drift. It’s also not immediately clear how each of these tools works together.

By directing visitors to their chatbot, Drift can learn more about the visitor, their organization, how many users they need, what use-cases they’re considering, and what they’re struggling with. This provides critical context, allowing their sales team to position themselves as consultants rather than transactional order-takers.

One critical factor to recognize is that Drift is uniquely positioned to do this as the market leader in conversational marketing. If a company is considering adding a chatbot to their website - it’s unlikely they’ll go through the process without talking to Drift. This plays into the consultative sales process, and allows Drift’s team to reiterate their origin story and market leadership.

The chatbot also shortens the sales-cycle by forcing visitors to engage rather than visit, leave and visit again. While Drift does have some Business Development Reps, DriftBot also does much of the work a traditional BDR would do, essentially digitizing the discovery call.

While shortening the sales cycle and improving the sales process are important benefits of Drift’s new approach, perhaps the most important benefit is allowing them to gather more data on pricing than ever before.

Bringing Legibility to every Pricing Event

With any pricing page, there are bound to be thousands of pricing "events" that a company doesn't know about. Prospects visit the site, scroll around the pricing page, and may or may not convert. If they don’t, what they do in the meantime is essentially a guessing game.

While platforms like Hubspot allow companies to use cookies to retroactively track a visitors’ journey on their website, just knowing a pricing page visit happened doesn't tell you everything. In fact, when I was at Hubspot, we would build lists of users that visited the pricing page, and use it for inbound prospecting. Some of those conversations turned fruitful, some didn’t. At the end of the day, a pricing page visit can be a legitimate sign of interest, but it can also just be an individual contributor feeding their curiosity.

While some pricing page visitors will eventually take action and request a demo or contact sales, many won’t. It’s the folks that would otherwise leave the page that Drift can now gather context on to provide a fuller picture of pricing sentiment across their prospective buyers.

By removing their price points and forcing visitors to chat with the Drift team, they're bringing legibility to every pricing event.

While there's still a chance that visitors will leave the site without chatting, if they're actually in the market for a conversational marketing platform, they'll want to know how much Drift costs. Additionally, Drift can capture all sorts of additional context on the organization much earlier in the sales process than they otherwise would have.

This gives Drift more insight than ever into how their pricing resonates with different market segments. They’ll have visibility to price sensitive customers that otherwise might have seen list pricing and never returned, they’ll catch prospects earlier in the consideration stage to help them vet their use case, and, as previously mentioned, they’ll be able to shorten the sales cycle with qualified prospects that need an extra push to start the buying conversation.

Overall, this new strategy is a Data Scientist’s dream. Drift is closing the loop on customer pricing sentiment, and can use that data to make quick adjustments as they learn more about prospective customers.

The Downside

Along with the positive implications of this strategy, there are definitely risks. The biggest, in my opinion, is optics.

There’s a bit of a smoke-and-mirrors vibe to a company not sharing pricing publicly. It’s usually considered a more acceptable practice for high-end Enterprise solutions, not so much for companies like Drift that target SMBs and mid-market companies as well. This move could erode trust in the market, and make prospects wonder why Drift isn’t as transparent about their pricing as competitors.

It’s critical for Drift to nail the messaging here, and ensure their sales team can establish themselves as trusted advisors as they help prospects evaluate costs. If not, this could create a negative brand perception.

There’s also the competitive risk. I imagine Drift’s competitors have already added this to their sales battlecards and are training prospects to view it with suspicion.

That said, I still believe it’s worth the risk. As a market leader, Drift will usually be in consideration. As long as that’s the case, prospects will get to experience the value of their solution before they see the price. From there, their success is in the hands of sales, who will be well-equipped with all the context they need to position Drift appropriately.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the “like” button, that way I’ll know which posts are resonating the most!

If you have thoughts or feedback, I’d love to hear from you! You can find me on Twitter here.