Welcome to Good Better Best!

In today’s newsletter, we’re breaking down the pricing strategy of Clay, a SaaS platform for GTM teams that is taking over the world.

Big thank you to Varun Anand and Zona Zhang, Clay’s COO and Growth Lead respectively, for being kind enough to weigh in on my analysis, answer questions, and offer valuable commentary. Let’s get to it.

New Data Drop: 2024 SaaS Pricing Benchmarks

Last week, we published our latest SaaS benchmarks report, featuring pricing trends from 400+ SaaS companies. It’s jam-packed with examples, and even got a write-up in Kyle Poyar’s Growth Unhinged. Get the report.

🚨 SaaS Product and Pricing News

Beehiiv made AI support its default, and human support Premium.

Jira raised prices.

Evernote merged plans and added an Enterprise edition.

Plaid removed the starting price from its Custom plan.

Statsig simplified its plans.

Recharge removed the Grow plan and streamlined its plan mix.

ExpressVPN changed its default subscription terms.

Clay has quickly become one of the hottest companies in SaaS.

Seemingly every time I log into LinkedIn, I see a video of someone walking through their Clay workflow. Naturally, I became curious about Clay’s monetization model, and after a closer look, I wasn’t disappointed.

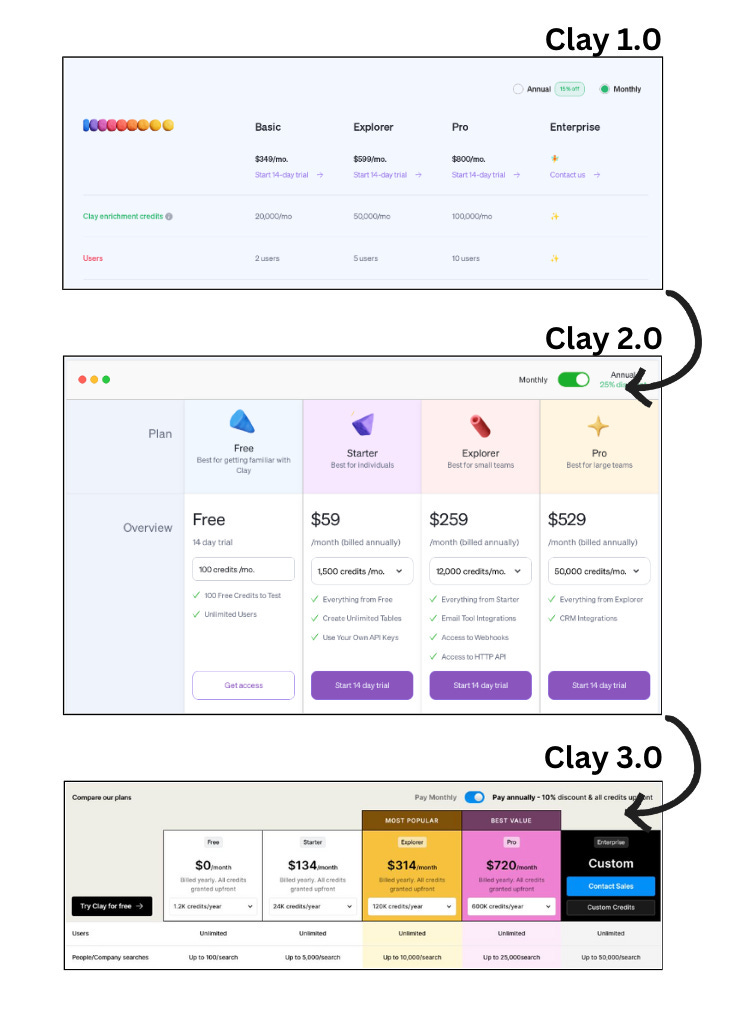

In the last year and a half, Clay has revised its pricing strategy twice. Each time they published a detailed memo explaining why (here and here). This is a leadership team that takes pricing seriously, and has already committed to an iterative approach.

In version 2.0, Clay made a sweeping update that included:

Adding a Free plan (as part of a reverse trial)

Introducing a cheaper entry-level tier

Gating features to differentiate plans by workflow sophistication

Introducing multiple credit tiers

Removing seat limits across all plans

This update almost certainly resulted in a flood of new usage. Between opening all plans up to unlimited users, and introducing two plans to serve the lower end of the market, Clay opened the acquisition floodgates. In addition, they created an intuitive plan mix tailored to users at different levels of sophistication.

In version 3.0, Clay held this model intact, but made two updates to its credit policy:

Credit Rollover: If a customer doesn’t use all of their credits in a given month, they can roll them over to the next month (up to 2x their monthly credit limit)

Credit Top Ups: A customer can purchase additional credits at a 50% premium at any point during their billing cycle.

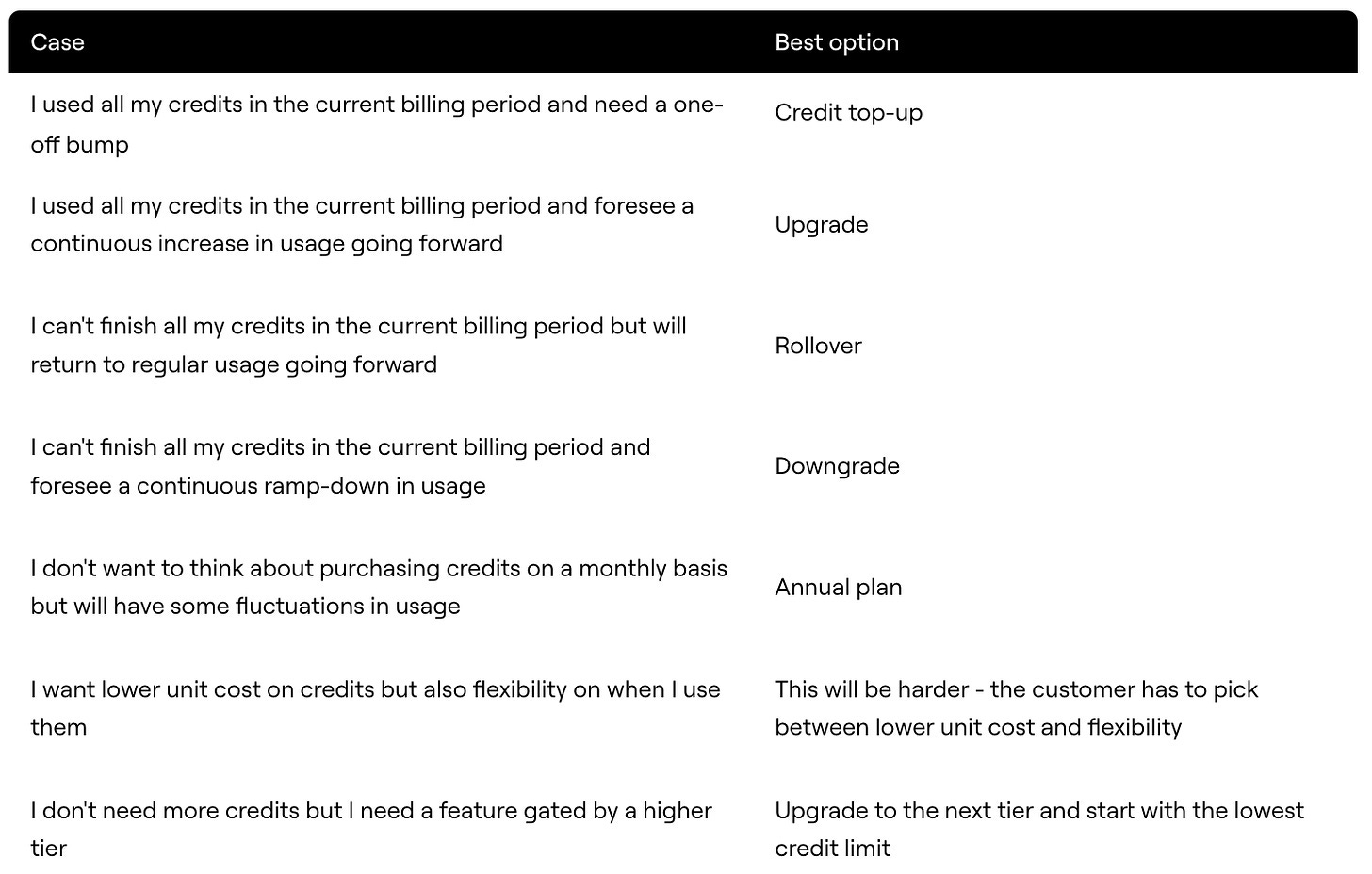

In the memo introducing these changes, Clay included a table outlining what a customer should do in various credit scenarios:

The table clarifies the thinking behind the new credit policies, helping customers and Clay CS employees determine the right play given a particular situation.

The result of these iterations is a thoughtful and intentional approach to pricing, and a flexible, customer-focused credit model. Below, I’ll break down the four fundamental components of Clay’s pricing strategy, as well as their approach to the three key growth levers: acquisition, monetization, and expansion.

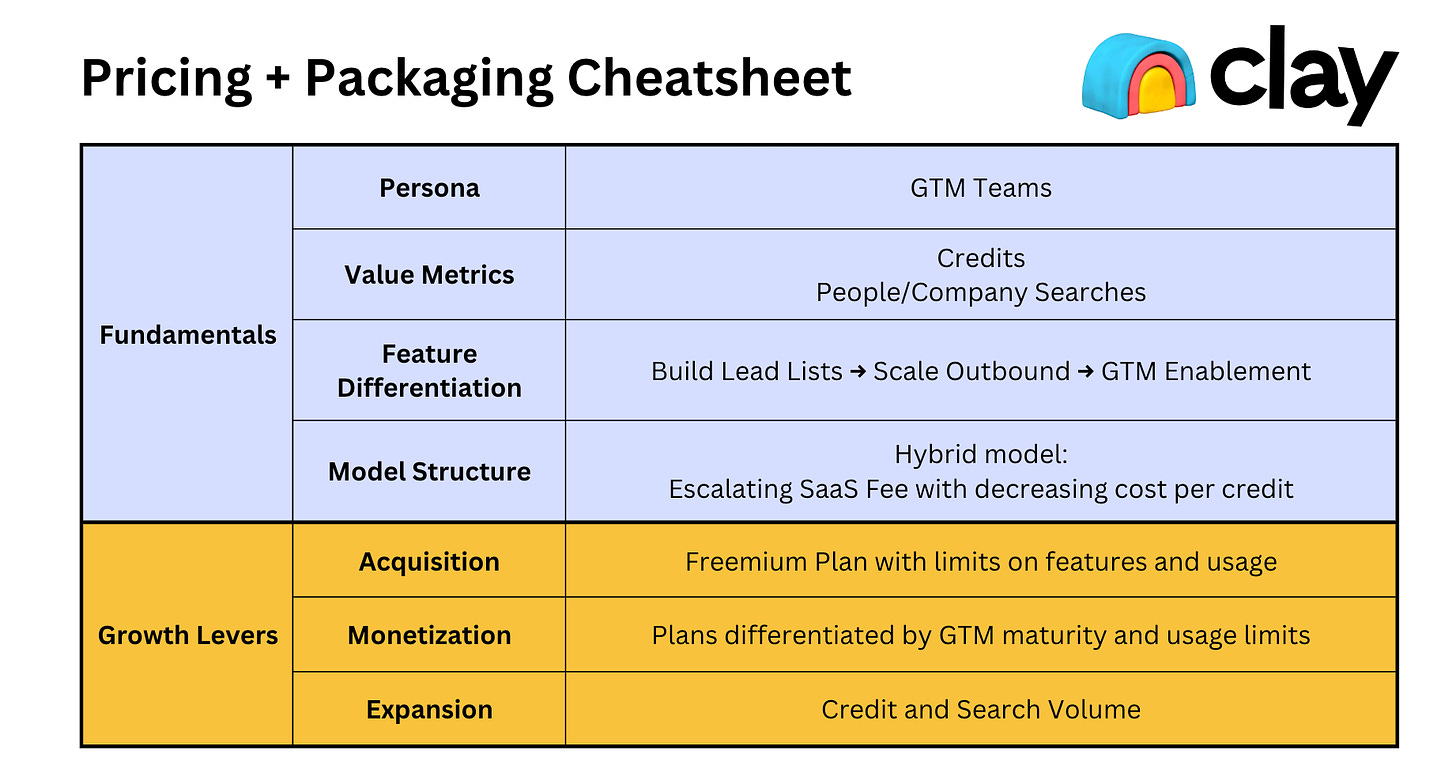

The Fundamentals 🧱

Buyer Personas

One of the first things I look at when analyzing a pricing page is how it speaks to different buyer personas. In Clay’s case, they haven’t gone overboard in tailoring each plan to a specific user. Instead, they use social proof to signal who Clay is for.

This is a clever way of showcasing that Clay is designed for GTM teams without having to explicitly list out personas in the pricing copy. This method lets potential customers infer that if these big names trust Clay, they should too. It also assumes that pricing page visitors know what Clay does.

Value Metrics

Unlike many SaaS platforms, Clay does not use a “per-user” model.

According to Co-Founder Varun Anand, this is very intentional, and caught people off guard initially since all other GTM tools at the time charged by seat.

Anand says It’s because Clay is a tool meant to drive efficiency. They want a handful of technical ops or growth people to use Clay on behalf of a whole company, not every single person. If every person had to use it that would defeat the purpose, and a seat-based model would create a perverse incentive.

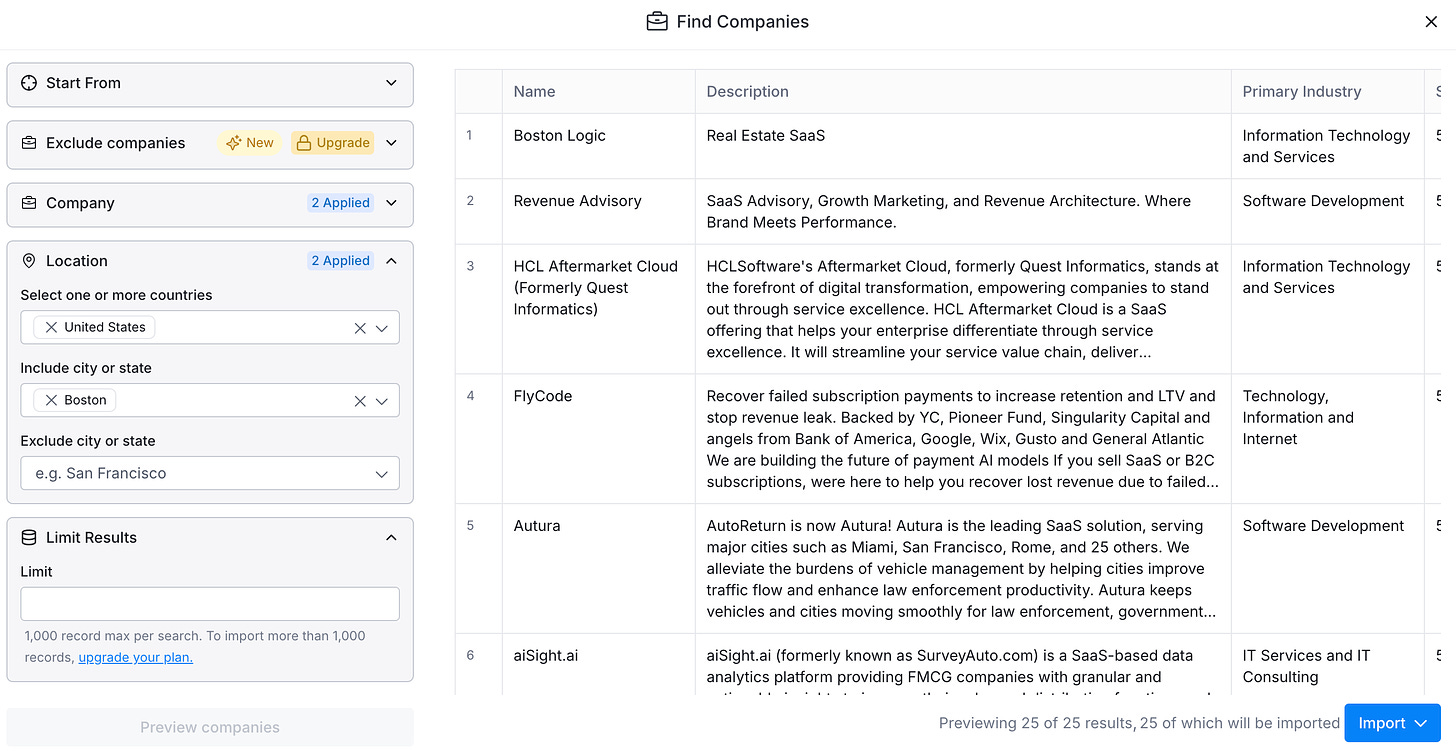

Clay’s value metric was originally Rows. In a Clay table, rows indicate the Companies or People that a user is searching for:

In January 2023, Anand realized that Clay’s main value comes from the columns, or the data enrichments for those Companies and People, not just the rows. Credits are calculated by taking the columns you add multiplied by the rows you have them for.

Each plan comes with a credit allowance, and credits are the core metric used to drive monetization. Each plan also has a Company/People search limit, but it's very much secondary to credits. Here’s how the two usage metrics work together in practice:

Searches: When using Clay, you can search for people or companies. The limits of your plan determine how many results you will see.

Credits: Once you have your list, you’ll enrich the data with fields like email, phone numbers, domains, and LinkedIn profiles. A lot of this data is free, but Clay integrates with a wide range of data sources, and some of the enrichments require credits. The number of credits is based on the agreement Clay has with each specific data provider (e.g., Pitchbook is 3 credits, Harmonic is 4 credits).

Seemingly, these numbers should scale together. The more results you generate, the more enrichments you will likely need.

It reminds me of Hubspot’s pricing structure for the marketing platform, which incorporates both contacts and email sends. This dynamic allowed our sales team to have a consultative sales process. We would forecast both contact growth and email volume, and recommend starting at a higher contact volume to avoid a mid-year upgrade.

Lastly, Clay’s decision to avoid per-user pricing is intentional. In the memo from Clay’s sweeping change in 2023, Anand explained that they want to encourage usage across teams, and gating users would inhibit that. By focusing on credits, Clay ensures that teams can scale their usage without worrying about adding more users, making it easier for organizations to adopt Clay across multiple teams.

Feature Differentiation

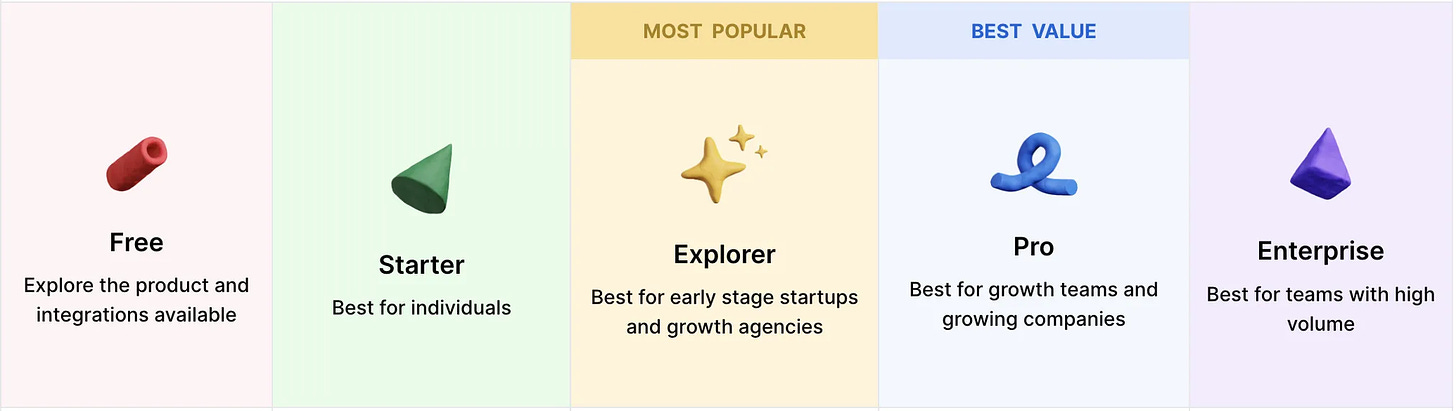

Besides usage limits, Clay uses features to differentiate between its five plans: Free, Starter, Explorer, Pro, and Enterprise.

While Clay doesn’t provide much color on who each plan is for on the pricing page, they do in the FAQ section:

With these user profiles in mind, each successive tier contains at least one gated feature that aligns with a more sophisticated workflow.

Free serves as a teaser, offering just enough functionality to give users a feel for the platform while limiting usage through credits.

Starter adds Phone Number Enrichments, making it ideal for individuals looking to build lead lists.

Explorer adds Email Sequencing Integrations, allowing small teams to scale their outbound efforts.

Pro adds CRM integrations, allowing more established teams to streamline GTM enablement efforts across their sales force.

Enterprise adds customization, security, and advanced support, necessities for larger organizations.

Overall, this creates an intuitive flow that matches the tactical needs of the personas laid out above.

Model Structure

Clay’s hybrid pricing model combines usage limits and feature differentiation.

With each successive plan, the monthly SaaS fee increases, while the cost-per-credit decreases, incentivizing higher usage customers to upgrade when appropriate.

Clay’s introduction of Credit Rollovers and Credit Top Ups offers additional flexibility for its customers. Zona Zhang, Clay’s Growth Lead, says Credit Rollovers aim to absorb some month-over-month usage fluctuation, while Top-Ups ensure users don’t feel they are forced to upgrade for a one-off bump in usage.

One last note on Clay’s pricing model is their emphasis on annual plans. Clay offers substantial discounts for annual commitments, encouraging continuous usage of their platform. This creates an educational element for their Sales team, where they can tout the benefits of consistent prospecting rather than prospecting in batches. Aligning customer incentives with best practices helps make this an easier story to sell.

Growth Levers ⚙️

Acquisition

Clay’s update in 2023 went a long way in driving acquisition. The Freemium plan was launched as part of a reverse trial, where trial users could either upgrade to a paid plan or downgrade to the free plan after the trial term. The free plan also functions as a teaser, giving a team enough access to see how it works, without cannibalizing the value of paid plans.

Additionally, offering a monthly option for the low-cost Starter plan allows users to de-risk the purchase if the free plan isn’t enough.

Monetization

Clay’s plans are thoughtfully tailored to personas at different stages of GTM sophistication. The feature alignment makes sense given those use cases, and enables Clay to reach a wide range of GTM professionals.

The increased SaaS fee for each plan is warranted given the additional functionality, and better pricing on credits.

Expansion

The biggest driver behind account expansion at Clay is credits. A quick refresher on the 3 principles for a solid value metric:

Easy to understand

Aligned with customer needs

Grows with the customer

Credits checks all three boxes. Importantly, if a customer is consistently exceeding their credit limit, it’s a sign that they’re getting value out of Clay’s product, and should probably upgrade to a higher credit threshold.

Recap ☑️

Clay’s pricing strategy is a well-oiled machine.

It combines a smart approach to buyer personas, usage-based monetization, and plan differentiation through features, all tied together by a flexible credit model. By avoiding per-user pricing and offering thoughtful plan segmentation, Clay is enabling teams to scale their usage effortlessly.

This model didn’t happen overnight. Clay’s pricing has evolved over time, with each update carefully explained in detailed memos. It’s this level of thoughtfulness that makes Clay stand out. I look forward to following along to see what comes next.

Thanks for tuning in and see you next week! If you enjoyed this post, share it with a friend.