Millennial finance is so hot right now.

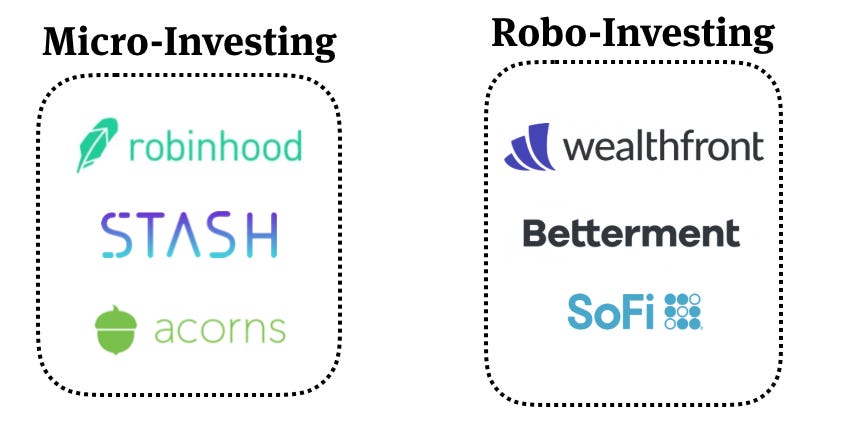

In the last decade, a slew of startups have emerged to serve millennials throughout their financial journey. Ranging from micro-investing to robo-investing, these companies are mobile-first, user-friendly, and positioned to bypass institutional gatekeepers.

The incumbents have noticed. Six years after Robinhood changed the game with zero-fees, Charles Schwab, TD Ameritrade, and E-TRADE followed suit. Broadly, there’s a sense of urgency to access young investors, and recent acquisitions validate the value associated with this end of the market. Last year, PayPal acquired Honey for $4B, and over the last couple weeks, Intuit acquired Credit Karma for $7B while Morgan Stanley acquired E-TRADE for $13B. The race is officially on for millennial investor attention.

While apps like Robinhood and Acorns have gained popularity as a low-risk path to active investing, Wealthfront and Betterment offer customizable passive investing strategies. It remains unclear if either product category helps millennials understand the market better. While micro-investing sells the ability to gain experience with low volume and little risk, it’s still relatively touchless for the most part. Robo-investing allows you to outsource investing decisions altogether.

Neither approach requires the intentionality to build a thoughtful retirement plan, which reminded me of something my dad encouraged me to do before I ever invested a single dollar in the stock market: paper trading.

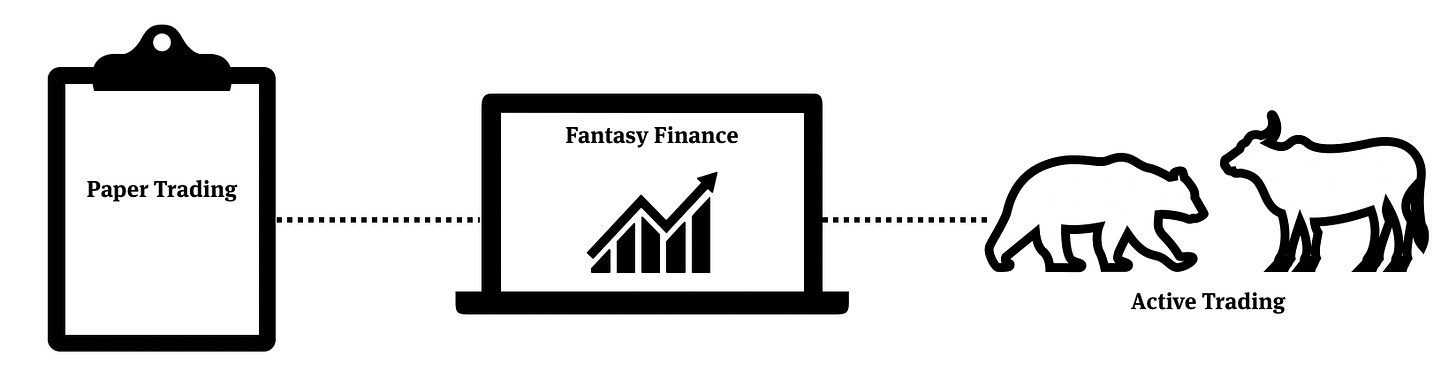

Paper trading is the act of logging trades without investing money, allowing you to simulate market moves. The idea is to log your fake buys and sells to practice trading before going live with real money. In theory, this is a great idea - in practice, it has limitations.

The problem with paper trading is twofold. First, there are no stakes. With no stakes, it’s easy to lose interest and/or make crazy trades you likely wouldn’t make in a realistic investing scenario. Second, it’s boring. Paper trading is a long-term, solitary activity with little excitement and zero (external) reward.

For years, professional advisors have cautioned investors that the stock market is not a game. But what if it could be? Maybe gamified investing could help both aspiring investors and investment professionals. It could solve both issues with paper trading by making it exciting and adding stakes, without exposing young, inexperienced investors to the market. What if there was a middle ground between paper-trading and actual trading?

That’s where Fantasy Finance comes in. As a hybrid between paper-trading and actual investing, Fantasy Finance could give young investors the practice they need to learn about the market, with limited stakes. There is one company that’s uniquely positioned for this opportunity - an old internet staple that’s become an afterthought in the portfolio of a telecom giant. That company is Yahoo.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Why Yahoo?

Despite their decline as a search giant, to this day Yahoo still excels in two verticals: finance and sports. Yahoo Finance is the most heavily-trafficked financial website in the world, garnering over 70 million visits per day. While the primary revenue stream is advertising, Yahoo recently released a premium subscription with additional features and expertise.

The other factor that makes Yahoo perfect for this opportunity, is their longstanding status as half of the duopoly dominating season-long fantasy sports. Yahoo has offered fantasy games longer than anyone and battles ESPN as the top platform year over year. A brief glance at the debate on the Fantasy Football subreddit makes a strong case for Yahoo as the better app. As a longtime fantasy player and user of both, I agree.

With Fantasy Finance, Yahoo could utilize existing data and infrastructure from their two best verticals to build the foundation for the product, and tweak as needed to make the rules and gameplay better suited to portfolio construction.

The Case for Fantasy Finance

We’ve already touched on some of the benefits of Fantasy Finance. First and foremost, it could drive interest in the market without allowing inexperienced investors to trade recklessly. In addition to the fury of action among financial institutions and startups angling for millennial access, several trends make the timing right.

First, business is cool. Shark Tank has brought transparency to entrepreneurship and investing, making both aspirational to a younger crowd. Millennials are just as likely to follow Gary Vee or Mark Cuban on social channels as traditional celebrities, and as professional athletes and rappers have become more focused on business ventures, they add a degree of social proof to the “business is cool” narrative.

Second, Finance is in an interesting place. Between crypto, the proliferation of ETFs, seemingly weekly tech IPOs and increasing legalization of cannabis and gambling, market conversations are not limited to P/E ratios and earnings reports anymore.

Perhaps the strongest point in the case for Fantasy Finance is how much millennials love gambling, especially when combined with competition among friends and colleagues. Daily Fantasy has acted as a social hedge and has ushered in a new era of acceptance for sports gambling, with 42 states making strides towards legalization.

Again, corporate America is taking notice. CBS just partnered with William Hill, America’s oldest sportsbook, to bolster their betting content, and Penn National (a casino operator) just acquired a 36% stake in Barstool Sports. As gambling continues to proliferate in the American psyche, there will be even more content focused on the gambling side of sports, and media conglomerates will continue to get in on the action.

A major reason why is engagement. Simply put, gambling drives viewership, readership, and attention across all media channels. For instance, I have little incentive to watch a mid-season Cincinnati Reds game. That said, if I have money on the Cincinnati Reds, you better believe I will tune in.

Simply put, gambling adds stakes, giving viewers a reason to engage with more content than they otherwise would. This isn’t limited to TV. If I have money on the Reds, I’m going to read up on the team, their opponent, split stats, trends, and expert analysis and commentary.

Circling back to Fantasy Finance, if I join a league with some buddies where we’ve all thrown in $200, I’ll spend way more time on Yahoo Finance reading up on the securities in my portfolio. I may even subscribe to their Premium research product to get an egde. This brings us to the advantages of Yahoo pursuing this opportunity.

How would it help Yahoo?

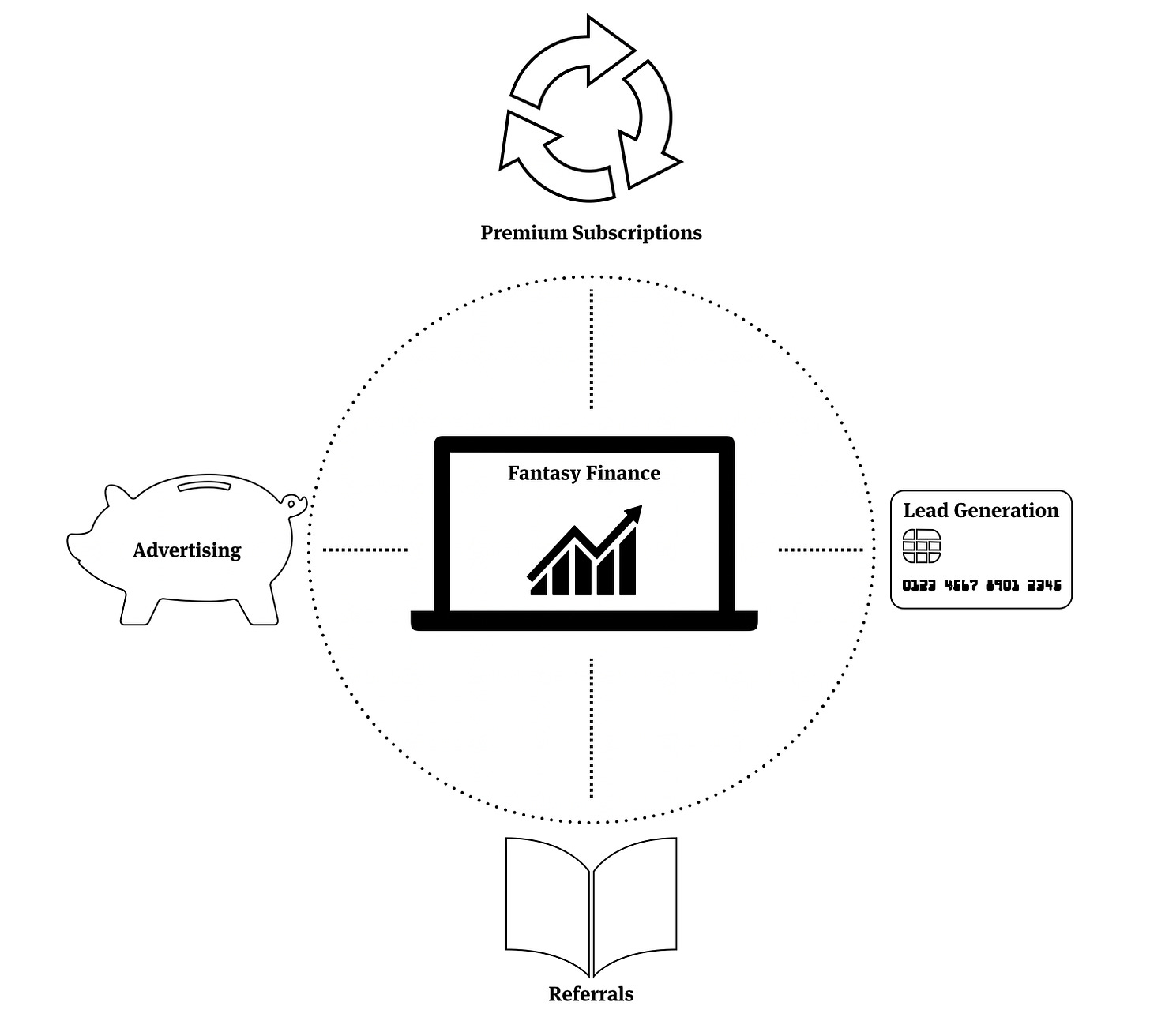

First, Fantasy Finance has the opportunity to increase engagement on Yahoo’s free properties. This means more traffic, deeper engagement, and more advertising revenue.

Second, Fantasy Finance could act as a sales funnel for their Premium subscription, opening it up to a market of non-professionals that wouldn’t otherwise be interested. Essentially, a Fantasy Finance product could act as an in-between product that drives more targeted advertising opportunities, and fuels subscriptions to the premium subscription.

Further, Fantasy Finance could open up new revenue streams. Yahoo could offer lead generation for financial services products, offer advertising within the gaming experience, develop new media properties and new advertising opportunities centered around Fantasy Finance analysis, and possibly open up a recruiting pipeline for financial services companies. There would likely be a new mobile app experience, adding another vehicle for advertising.

These are just first-order opportunities, and if Fantasy Finance really took off, there could be plenty of other ways to engage with and monetize the community, including possible content partnerships with Bloomberg, The Information and other media properties that would be interested in capturing the attention of active players.

All of this sounds great, but if Fantasy Finance is such a lay-up, wouldn’t Yahoo have done it already?

The Case Against Fantasy Finance

Fantasy Finance might sound like a good idea on paper, but in reality, there are limiting factors that could hold it back. First and foremost, finance is not sports.

Live sports has almost single-handedly propped up the cable industry for the last decade and remains the most compelling reason to keep your cable bundle. The crown jewel of live sports is NFL football, which is also the most popular season-long fantasy game.

Another challenge is game-play. Daily fantasy has emerged as both a secondary game for devoted season-long players and the primary fantasy game for those that prefer immediate gratification (or devastation). It makes sense. Only one person can win a season-long league, but on DraftKings, you can win money every night. While Yahoo holds a firm grip on traditional fantasy games, its 2015 launch of a daily competitor to DraftKings and Fanduel gained little traction.

The rise of daily fantasy has bridged the gap between Fantasy Sports and the sportsbook and has been hugely influential in the widespread adoption of gambling as big business. As gambling continues to grow more popular, it’s very possible that the trend towards daily games and one-off bets will grow even more as betting the sportsbook becomes easier.

This shift towards daily fantasy and low-touch gambling does not bode well for Fantasy Finance as a season-long game. On the other end, a daily Fantasy Finance game would likely bring with it perverse incentives. Day-trading is widely advised against, and promoting day-to-day trades is not the best way to introduce young, inexperienced investors to the market.

The Verdict

Despite the inherent limitations, there’s already a company pursuing Fantasy Finance. The company is called Invstr, and they currently tout over 500k users without the starting advantages of a fantasy gaming infrastructure and millions of active monthly visitors.

While Fantasy Finance certainly has some hurdles to clear, if I’m Yahoo - I’m pursuing it. At the end of the day, they’d be leveraging their two best content assets and marketing to a huge active audience. At the very least they should sample their readers to gauge the appetite for a finance-themed fantasy game. If it’s a hit, it would bring new life and attention to a company that hasn’t released a successful new product in over a decade.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the “like” button, that way I’ll know which posts are resonating the most!

If you have thoughts or feedback, I’d love to hear it!

Lastly, if you’re enjoying Good Better Best and have friends or colleagues who would enjoy a weekly packaging case study, I’d be thrilled if you shared this with them!