Welcome to Good Better Best!

This week, we launched our Q4 2024 AI Benchmarks report. While monetization is still lagging functionality, both have risen consistently throughout the year.

The biggest discovery from this report is that AI capabilities are infiltrating all corners of the organization — not just content. Today, I’ll highlight the top 5 capabilities we’re seeing, including their rate of adoption, monetization maturity, and directional pricing.

Let’s get to it.

🚨 SaaS Product and Pricing News

Ramp reorganized the pricing page.

Ahrefs adjusted the price for additional users.

Mixpanel changed usage limits on the free plan.

Autodesk offered a limited time discount on AutoCAD.

Miro introduced a Layers feature to the free plan.

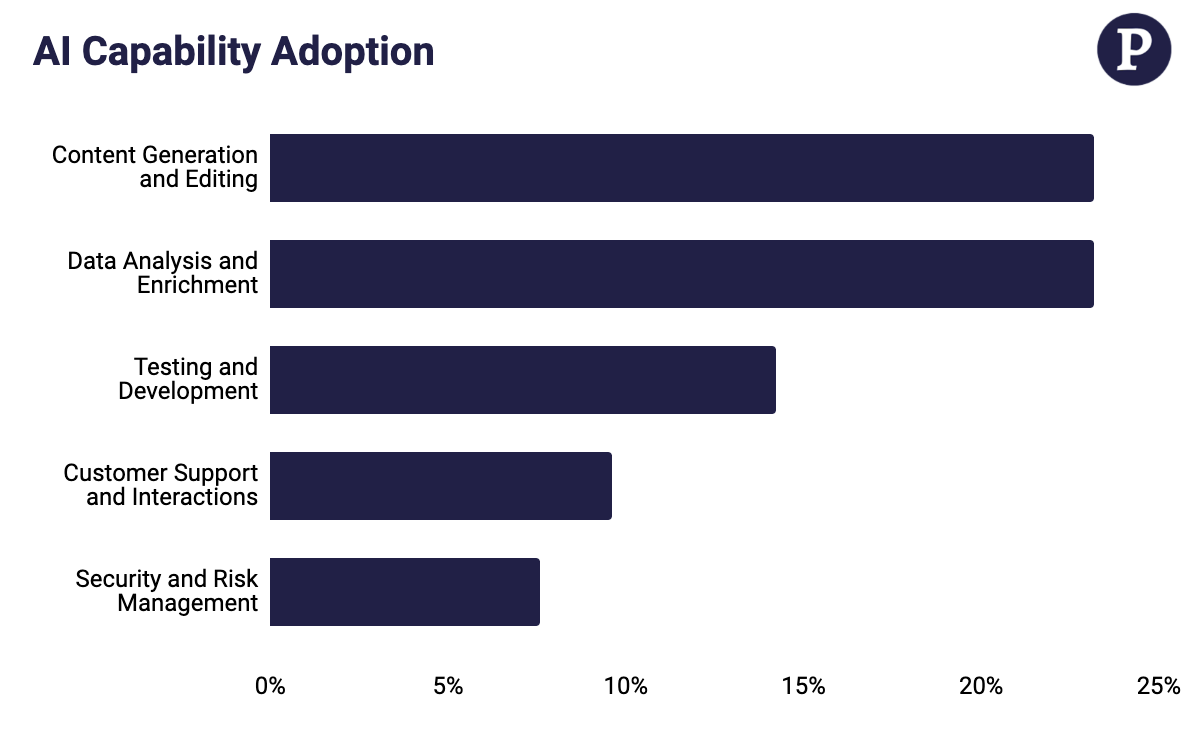

AI Capability Adoption

Since Generative AI arrived on the scene, there’s been a bear sentiment that the only use-case is content tools. While GenAI has objectively transformed content creation, we’re finding that there are use cases popping up far and wide beyond brainstorming content.

In our latest report, we shared the 5 most common capabilities, and the rate of adoption across the PricingSaaS 500 Index:

While Content Generation and Editing is still at the top, its clear generative AI functionality is driving value across the rest of the org, including product teams, customer facing teams, and engineering teams.

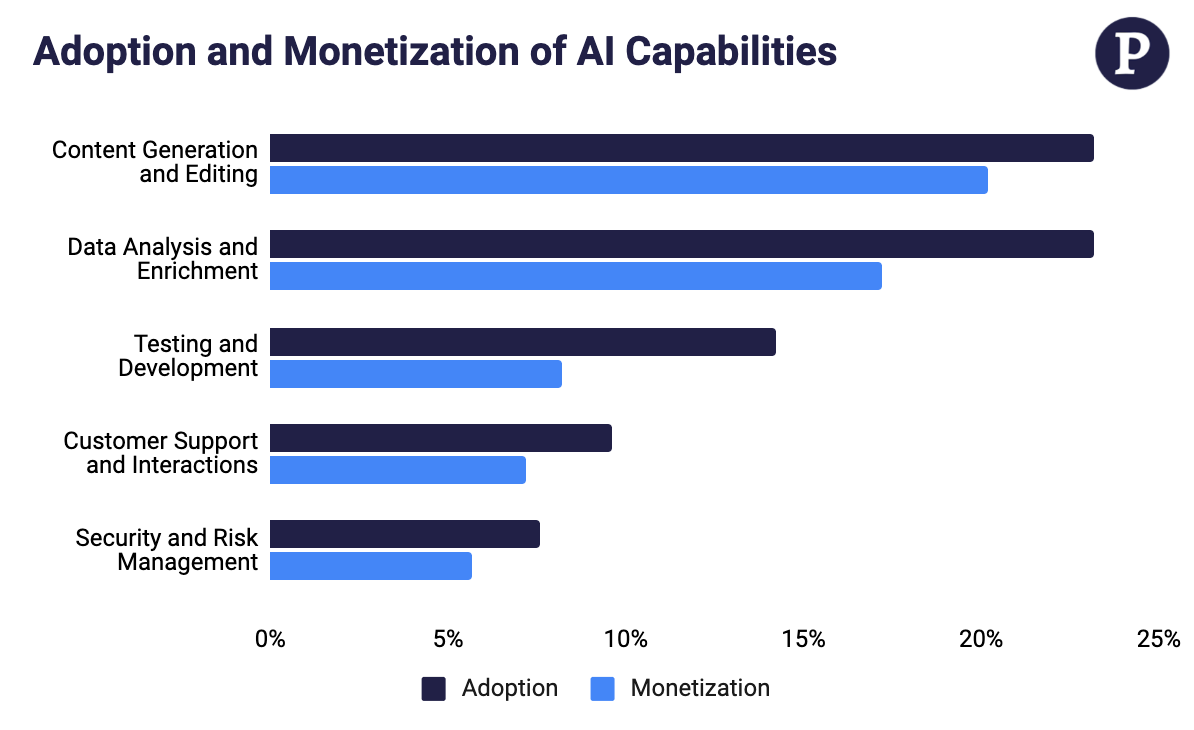

Monetization Maturity

When looking at monetization maturity, we’re comparing the number of companies that are offering these capabilities to the number of them that are actively monetizing these features. By actively monetizing, we mean charging for usage, an add-on, or integrating these features into paid plans.

Content Generation and Editing still leads the way here. While 23% of the companies in the PricingSaaS 500 Index offer this capability, 87% of those companies are actively monetizing. This include writing tools, media generation, suggestions, and content summaries. For example, Canva’s AI-powered design tools.

Of the companies offering AI capabilities that support Data Analysis and Enrichment, Customer Support & Interactions, and Security and Risk Management, ~75% are monetizing these use cases. Examples include:

Pendo Top User Journeys (Data Analysis and Enrichment)

Intercom’s Fin AI Agent (Customer Support & Interactions)

GitLab Duo Enterprise (Security and Risk Management)

The laggard is Testing and Development. Of the companies offering these capabilities, only 57% are actively monetizing. This includes Assisted Development, Test Automation, and Documentation and Explanation. For example, Github’s AI coding assistant.

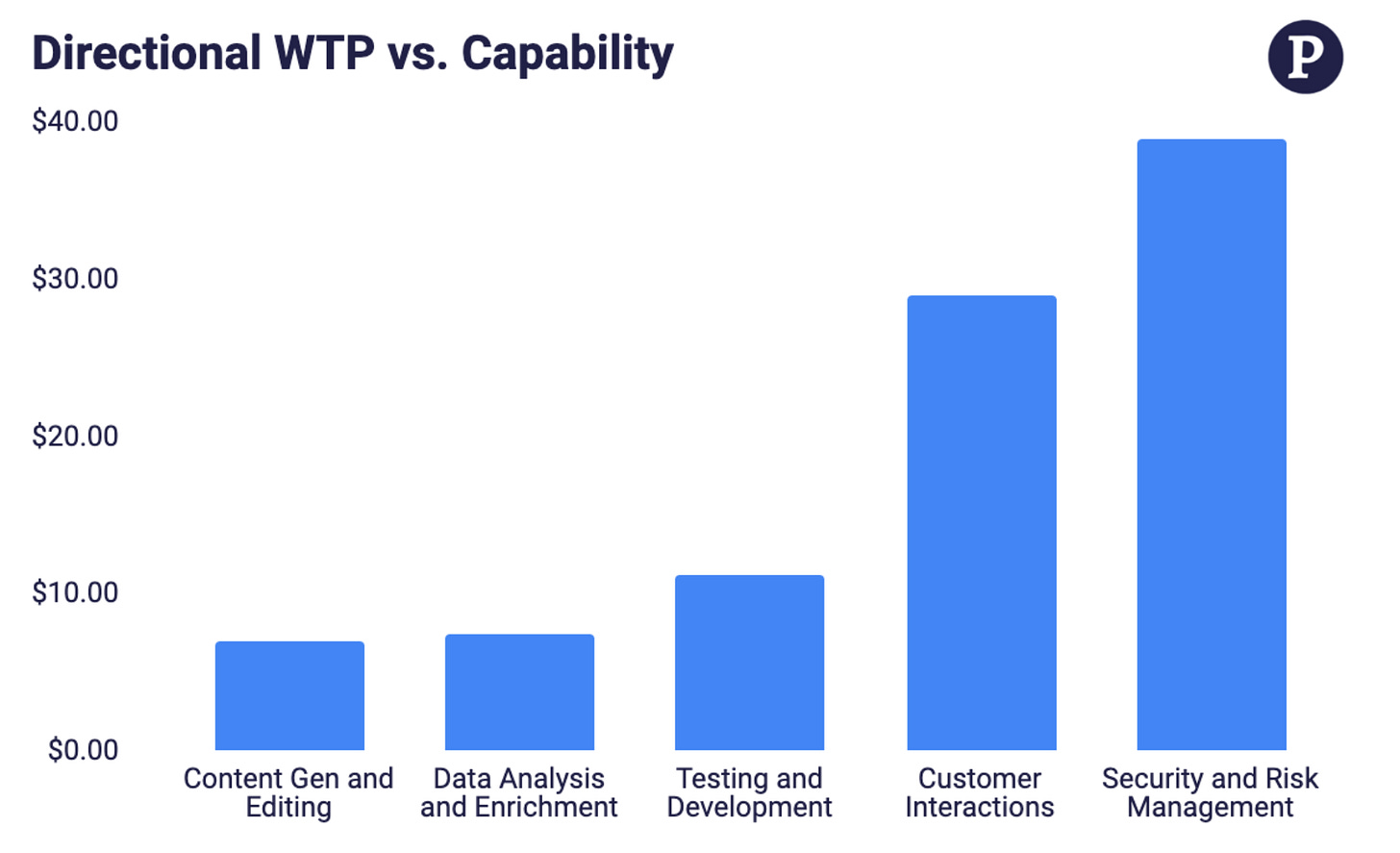

Directional Pricing

Admittedly, we have limited data here, but willingness to pay for these capabilities is beginning to emerge.

Content Generation and Editing appears on the lower end, which is unsurprising given the extent to which this capability has been commoditized in the market.

An important factor to consider is how far these capabilities go towards actually “doing” a job. For instance, Customer Interactions may not seem like it should garner high willingness to pay — we’ve been dealing with obnoxious AI chatbots for years.

But if these products are able to replace a human by scheduling sales calls or resolving support tickets, the value equation will change quickly.

Thanks for tuning in! Grab the full report to dig into the data and examples.