Asana: Untapping a Freemium Reservoir

Inside their patient approach to monetizing 3M+ freemium accounts.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

I’ve wanted to dig into Asana since they hit the public markets at the end of September. They offer one of the most aggressive freemium plans I’ve ever seen, and the result, unsurprisingly, is a ton of free customers - 3.2M at the time of their IPO.

Rather than make rash decisions to monetize these users, they’ve taken a long-term approach, gradually expanding their product and making thoughtful packaging decisions. Today I want to unpack their strategy, and why I believe it will pay off with tons of free-to-paid conversions going forward.

I would love your feedback! If you enjoy this post, do me a favor and click the “like” button up top (the heart). That way I’ll know which topics are resonating most.

On to this week’s analysis.

For the unfamiliar, Asana is a project-management suite co-founded by Dustin Moskovitz, who also co-founded a little website called Facebook with his college roomie, who you may have heard of...

In stark contrast to Facebook’s rocketship growth, Asana has taken the slower route. Case in point, they have a strict rule to never increase headcount by more than double in a single year.

Moskovitz explained their approach in an interview with Forbes during their IPO roadshow.

“It takes time to build the snowball,” he says. “The goal was to be fast, but fast in the long run, not fast in the short run.”

Freemium has been key to their strategy since day one. The idea was to follow Dropbox’s Freemium playbook and use the free plan to get users hooked, then monetize them later with Premium upsells.

So far, it’s working. Their S-1 notes that between January 2018 and January 2020 free-to-paid conversion grew from 3.6% to 4.8%. Though 1.2% may not seem like much over two years, with 3.2M Freemium customers, it adds up.

To accelerate free-to-paid conversion, Asana could have throttled usage limitations on the Free plan or dropped the price of the Premium plan. Either would have boosted their conversion rate in the short run.

Instead, they chose a different path, one that aligns better with the long-term thinking that permeates their company and culture.

In 2018, they added a tier to their packaging grid, setting the foundation for future feature releases. From there, they’ve gradually honed a differentiation strategy where features build naturally from tier to tier, creating an intuitive upgrade path that allows customers to grow with Asana over time.

In the absence of usage limits, it’s critical that feature differentiation makes sense, and that features align with the value proposition of their plan. It took time to implement, but Asana has mastered this with their packaging strategy, and I believe their patience will pay off.

Let’s dig into how they did it.

Building the Foundation (2018-2020)

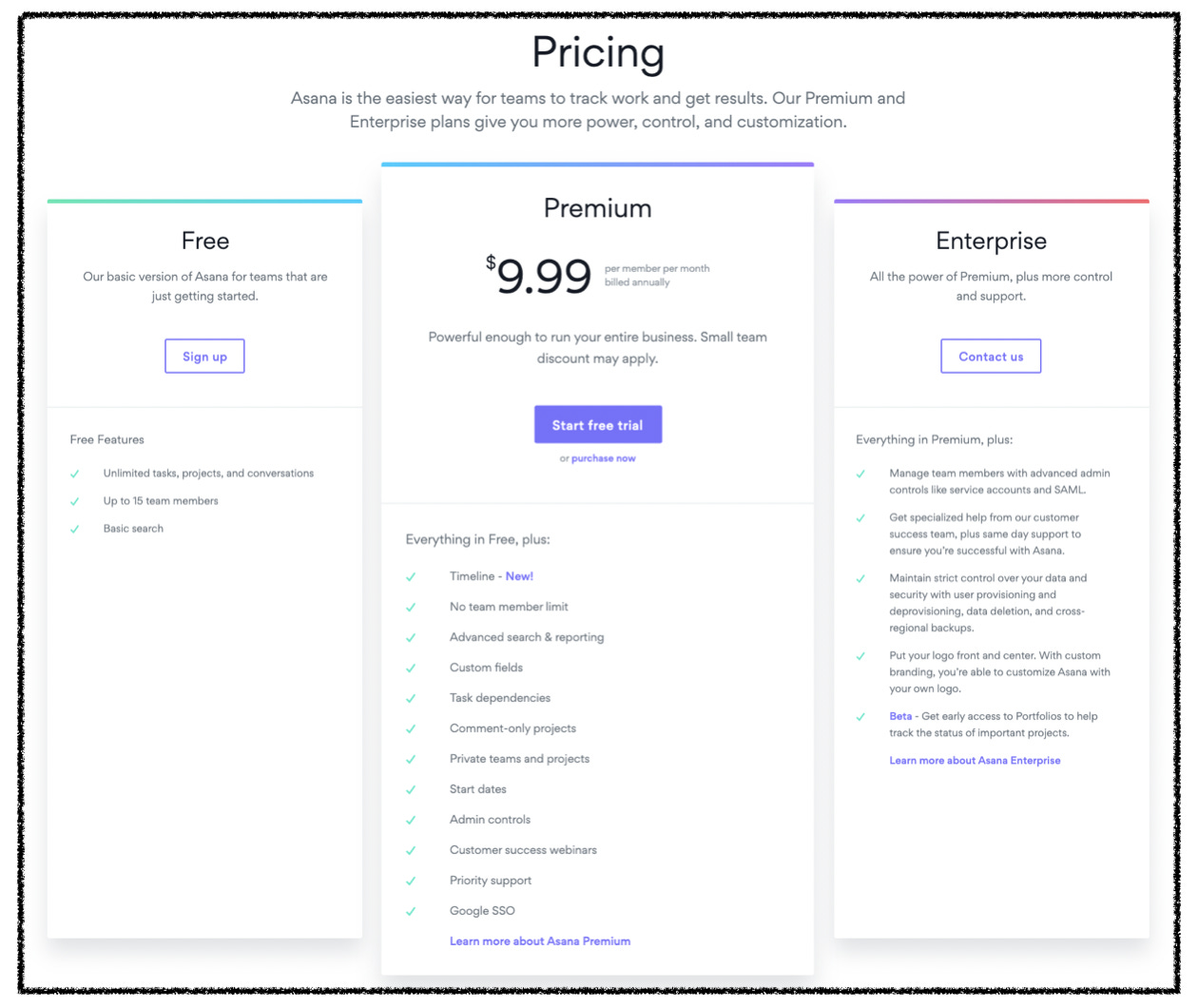

Throughout 2018, Asana’s pricing and packaging didn’t change much.

They offered a simple Good-Better-Best packaging model with a Free plan, a Premium plan, and an Enterprise plan.

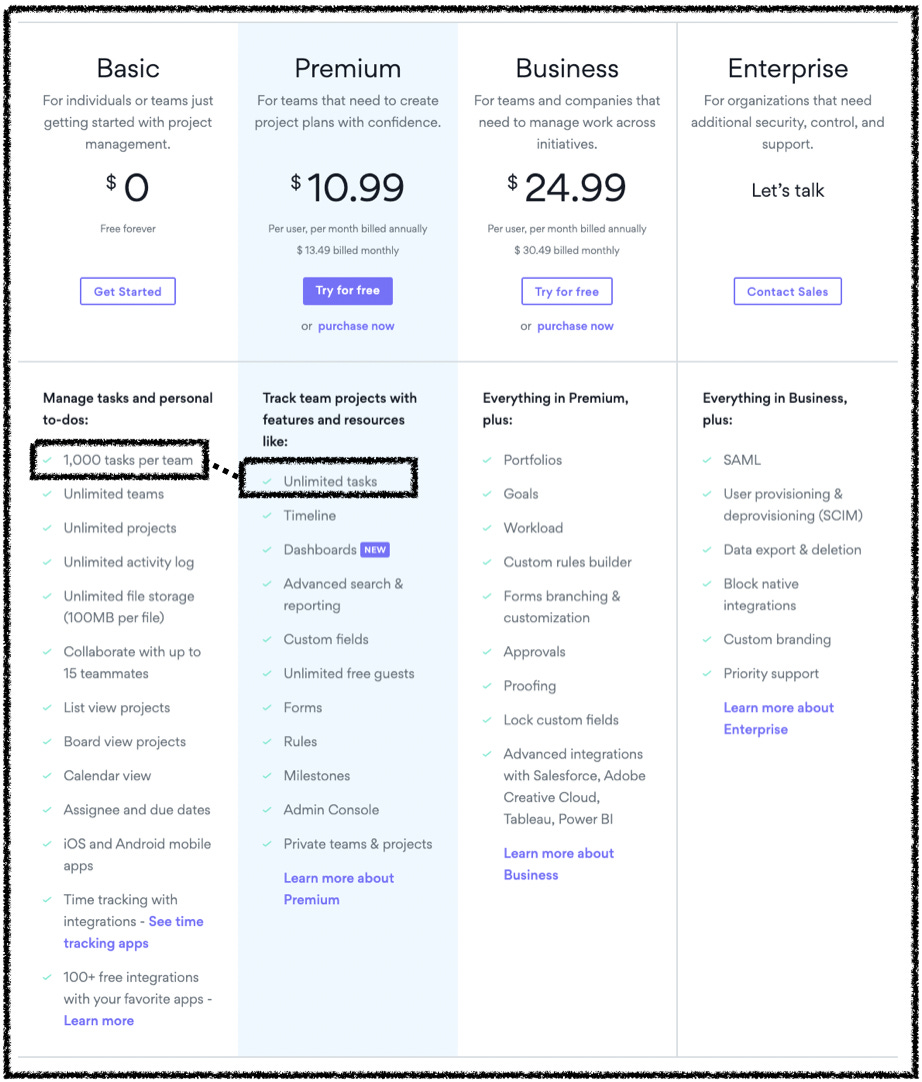

As you can see, Asana’s free plan is generous. While many freemium plans are throttled by limited users or aggressive usage limitations, Asana’s plan allows up to 15 team members, unlimited tasks, projects, and conversations.

It’s worth comparing their direct competitors to highlight just how much value they give away on a relative basis.

Note: Project Management is a crowded market with a long tail of competitors. Going beyond these big names, Asana’s Freemium plan compares favorably to ClickUp, Workfront, Trello, TeamGantt, Teamwork, and Notion as well.

It’s no wonder Asana has such a massive Freemium user-base. Among their top competitors, only Wrike offers a Freemium plan and they cap access at 5 users.

That said, giving away this much value means Asana is almost certainly cannibalizing their paid plans. That’s where recent changes to their packaging grid come in…

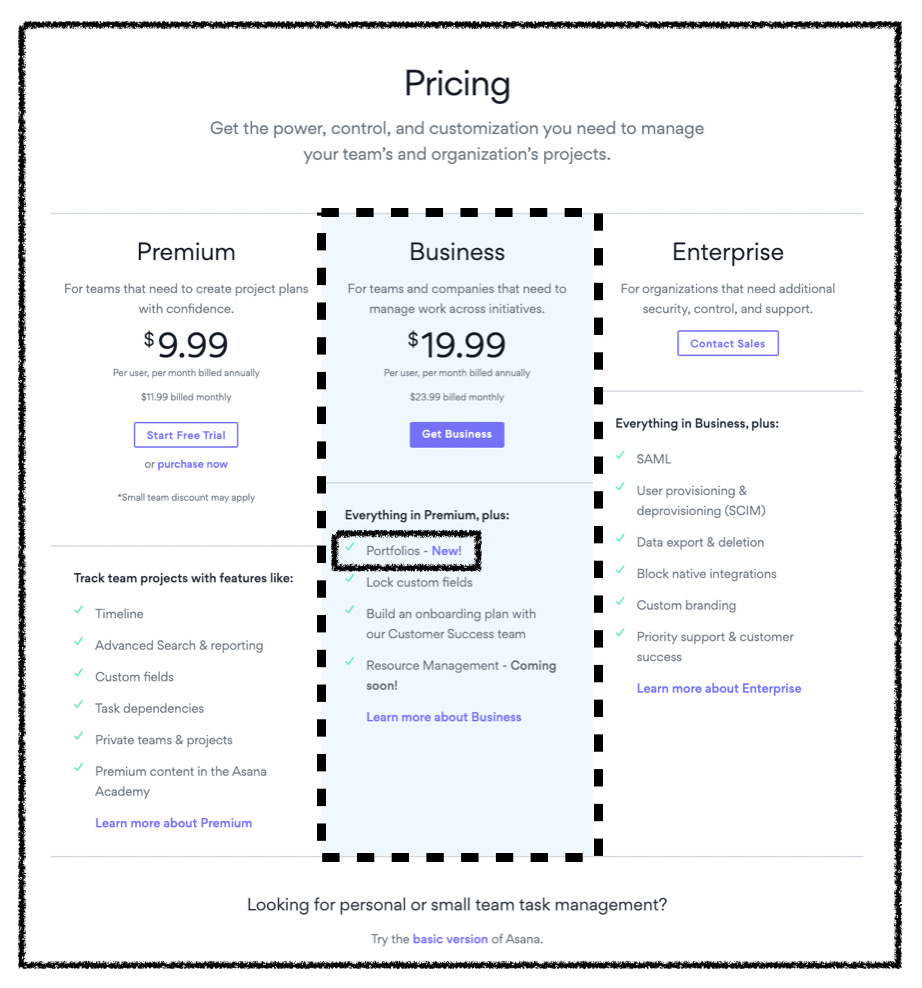

The first move they made was introducing a new tier, the Business plan, towards the end of 2018.

The Business plan’s launch was anchored by Portfolios, a new feature providing customers a holistic view of all their projects in one place. Beyond Portfolios, Asana really didn’t have much to differentiate Business from Premium. One of the features included above the fold on their pricing page is Resource Management, which wasn’t even live in the product yet!

By launching Portfolios within the Business plan, Asana increased the value associated with the feature. If they added Portfolios to Enterprise, they would have severely limited adoption, and if they added it to Premium, it would have fallen in line with the $9.99 per month price point, anchoring customers to lower value.

Portfolios also aligned perfectly with the thematic difference between Premium and Business. Notice the difference in copy between each plan:

Premium: For teams that need to create project plans with confidence.

Business: For teams and companies that need to manage work across initiatives.

This difference in value propositions makes it clear that while Premium is probably sufficient for smaller teams, the Business plan is ideal for larger organizations that need to foster cross-department collaboration and provide stakeholder visibility.

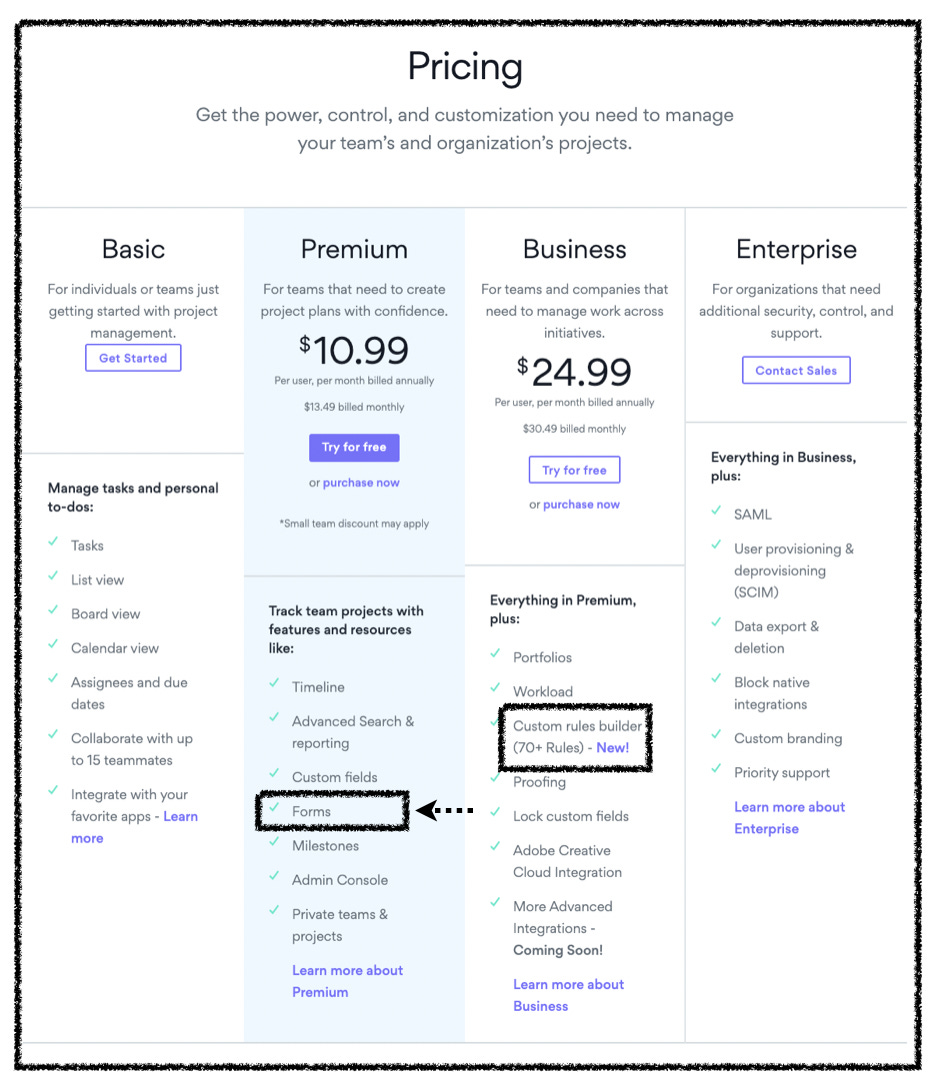

By October 2019, Asana had fleshed out the Business plan further, adding several new features, including Workloads, Forms, Proofing, and a native integration with Adobe Creative Cloud.

This added functionality gave Asana the confidence to raise prices on the Business plan from $19.99 to $24.99, along with a slight increase to the Premium plan as well.

The next month, November 2019, illustrates one of the coolest implications of Asana’s new packaging strategy: a trickle-down effect pushing Business features to Premium.

While Asana launched Custom Rules Builder in the Business plan, they also pushed Forms down to the Premium plan.

This trickle-down effect serves two purposes. First, it allows Asana to simultaneously drive upgrades from Basic to Premium and Premium to Business since each tier gets a new feature. Second, it gives Premium customers access to a feature that will later be expanded upon in the Business plan, planting the seeds for future upgrades.

The updates to their packaging model between 2018 and January 2020 might not seem like a huge deal, but they set the groundwork for a busy feature-release schedule in 2020, where the natural upgrade path starts to really take shape.

Filling in the Gaps (2020-Present)

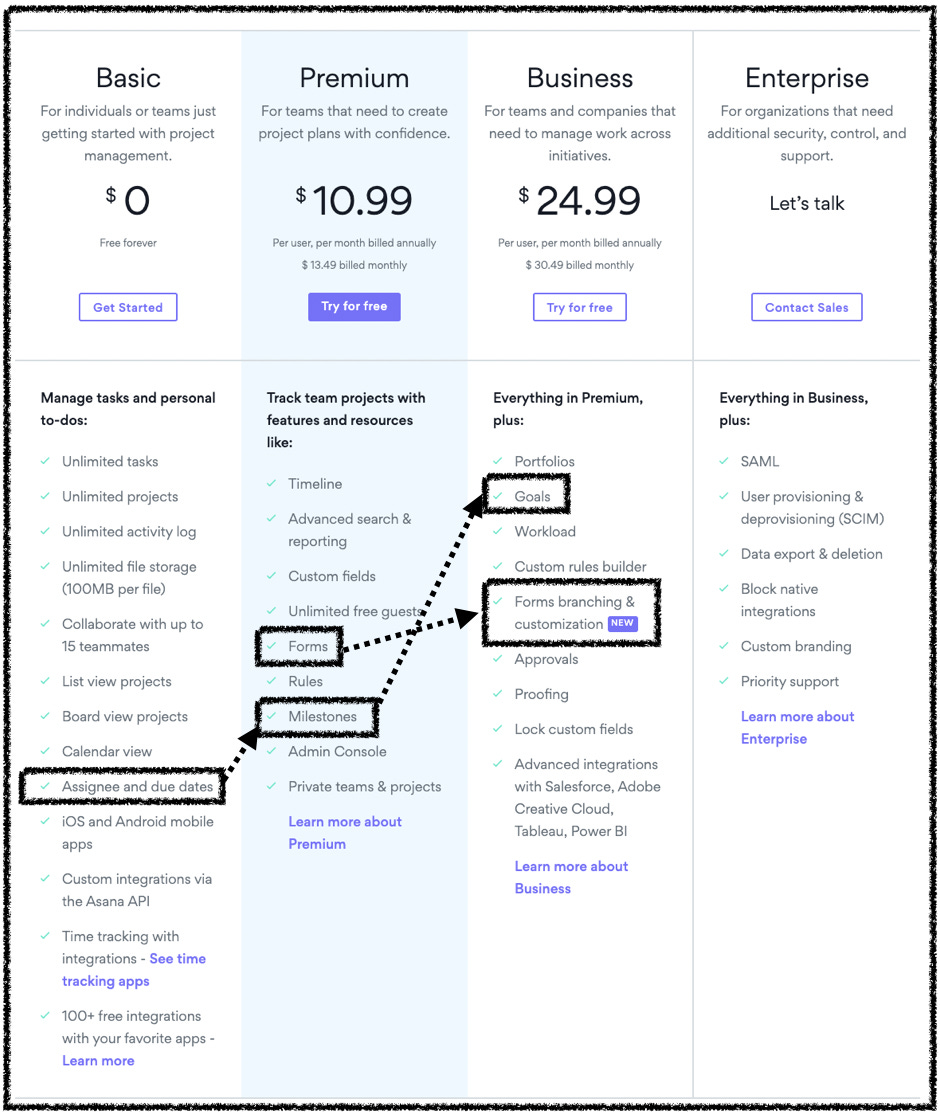

In February of this year, Asana launched several new features that bring their natural upgrade path into sharp focus.

Looking at the Premium plan, you can see the trickle-down effect in action. They added Rules as a feature in Premium, which naturally expands to Custom Rules Builder in Business.

They also added a Jira Cloud Integration to Premium but kept integrations with Tableau, Salesforce, and Adobe Creative Cloud to the Business plan. This makes sense since Jira helps power Project Management. Tableau, Salesforce, and Adobe Creative Cloud tie in broader use-cases, supporting the organization-wide value proposition of the Business plan.

They also launched Approvals in the Business plan - bolstering its value as a standalone feature. Given their playbook with Forms and Rules, it seems natural that in the future Approvals will trickle down to Premium, probably right before they release new advanced Approval functionality in Business.

In August of this year, they refined this thematic feature differentiation even further.

They expanded on Forms by adding Forms Branching & Customization to the Business plan, similar to the evolution of Rules to Custom Rules Builder.

They also added Assignee and Due Dates to the Basic plan. Due Dates naturally evolve to Milestones in Premium, which then evolve further to Goals in the Business plan. This progression lends itself to the high-level narrative for each plan.

Basic is for small teams that need basic project management functionality

Premium is for experienced teams that need to track projects accurately.

Business is for sophisticated organizations that need to tie projects to high-level initiatives.

This narrative is intuitive and makes it easy for the Asana sales team when working with prospects. It’s one thing to tell prospects what type of team each plan is meant for - it’s another to back it up with features that perfectly reflect that value.

Looking Forward

With their updated feature differentiation alone, I’d expect Asana to boost their free-to-paid conversion rate. However, last month, they added another axis to the equation, introducing a task limit on the free plan.

This may seem surprising, given their history of giving away so much value for free. However, the limit on Tasks is per team, and the Basic plan still offers Unlimited Teams. I’d imagine most Basic customers will upgrade to Premium before they hit the Task per Team limit due to the need for Premium features.

It’s also worth noting that it’s unclear how seriously Asana is taking this usage limitation. On the packaging grid below the fold, the Basic plan still has a checkmark next to Unlimited Tasks.

Whether they choose to implement usage limitations or not, they have the structure in place to drive free-to-paid upgrades regardless. Judging by their feature releases of late, it doesn’t seem like they’ll be slowing down any time soon either.

I, for one, am excited to hear the results of their first earnings call, where they may just prove that sometimes it pays to go slow.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the “like” button, that way I’ll know which posts are resonating the most!

If you have thoughts or feedback, I’d love to hear from you! You can find me on Twitter here.

This was an awesome read, thanks for breaking this down!

I love the visual path of a single feature that becomes more advanced with the plan. Instead of picking which features they want, they pick how advanced they want their features. Very cool concept. Great historical research I really liked that 👍