AMC's Niche Streaming Strategy

How they're escaping the streaming wars by prioritizing depth over breadth.

SaaS Pricing is hard. PricingSaaS is your cheat code.

Monitor competitors, track real-time benchmarks, discover new strategies, and more.

Happy Sunday y’all!

I planned on writing a digest this week but ended up going deep on AMC. I love their hyper-focused approach as an alternative to mainstream streaming services and think they’re building a fascinating mix of products for niche audiences.

Assuming they continue cranking out high-quality IP within their given verticals, I like their chances to build a small-scale streaming empire. I’d also be all-in on a period-piece themed streaming service anchored by Mad Men. Just sayin’….

I would love your feedback! If you enjoy this post, do me a favor and click the “like” button up top (the heart). That way I’ll know which topics are resonating most.

On to this week’s analysis.

If you were looking to start a new business today and deciding on a market, streaming might be your last choice. Between Netflix, Amazon, HBO, and recently Apple, there’s an endless battle for quality IP that will capture new subscribers.

Going head-to-head with these companies is a fool’s errand. Amazon and Apple are trillion-dollar behemoths, and Netflix, with 195M subscribers worldwide, uses their scale advantages to take tons of swings on original content and license popular titles like The Office and Seinfeld as filler to keep subscribers hooked.

As a result, it’s hard to pull eyeballs away from the incumbents. Quibi’s fate is a brutal example, and they had $2B in funding to help…

However, Disney and AMC are proving there may be a different way to succeed. In the context of mainstream streaming services that offer wide-ranging content across formats and genres, the alternative is going niche.

An Embarrassment of Niches

Rather than fight for sheer subscriber volume with a wide range of content, niche streamers serve a unique audience with a clear value proposition.

The most well-known example is Disney+.

Calling Disney+ “niche” may sound funny since they just crossed 60M subscribers. However, the spirit of their service is aligned around a singular value proposition, it just happens to be a big one: The best stories in the world. All in one place.

Even so, Disney+ is at a different scale within the niche streaming category. That’s what happens when you’re the most successful media brand of all time. However, another company quietly following the niche streaming playbook is AMC Networks.

While you may know them for developing prestige series like Breaking Bad, Mad Men, and The Walking Dead, AMC’s streaming investments are paving the way to a bright future beyond cable. Last month, their horror-focused streaming service, Shudder, crossed 1 million subscribers.

Like Netflix, the service combines licensed titles with original content to serve horror fans with a hyper-focused combination of old and new.

Beyond Shudder, AMC offers four other subscriptions across various niches:

Acorn TV: Offering a wide selection of shows from the UK

UMC: Urban Movie Channel, focusing on Black TV and Film

Sundance Now: True Crime, Thrillers, and Dramatic series

IFC Films Unlimited: Independent films

These streaming services operate very differently than Netflix. Brett Sappington, VP at Media & Tech consultancy Interpret, draws a parallel to retail.

Services like Netflix, Amazon Prime, and Hulu’s primary objective is to include enough good content to satisfy everyone’s general needs. They need to own the big needs, they need to be the big-box stores. Shudder and other niche services survive in the same way specialty stores survive today: They need to be close to their audience, know their customers, and give them what they want.

There are also a couple key differences in how AMC and Netflix price and package their services.

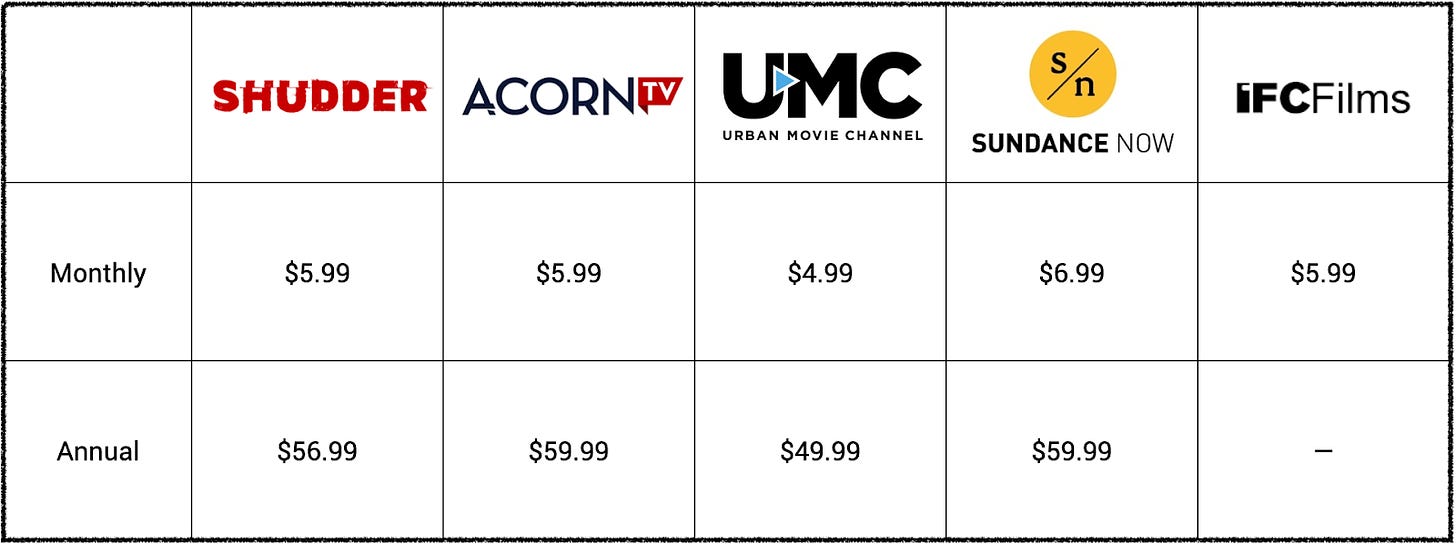

First, AMC’s niche subscriptions have a lower monthly cost:

Each service is priced well-below Netflix’s monthly cost of $12.99, clearly positioning them as complementary subscriptions. This makes perfect sense since AMC claims over 80% of their subscribers also subscribe to a mainstream streaming service.

The other big difference is how AMC approaches free.

A little while back, I wrote about a new Freemium development at Netflix, specifically a faux-free model offering non-subscribers access to select originals. As a reminder, they offer the first episode of select original series (e.g., Stranger Things, Gracie and Frankie) and the entirety of select feature films (typically well past their release date).

This approach allows them to get their premium original content in front of new viewers without cannibalizing revenue or devaluing their product. Alternatively, offering a free trial gives viewers a free pass to binge a series or new feature without subscribing.

It seems like Netflix has seen this play out a few too many times. Last week they scrapped 30-day trials across all geos, and eliminated free trials entirely in the United States. Given the maturity of their US market, this seems like a necessary step to prevent revenue cannibalization. Outside of the US, they likely realized that 30 days is too long to allow viewers free access, especially in quarantine when bingeing multiple series in a week can be commonplace...

In contrast, each of AMC’s streaming services utilizes a 7-day free trial as a way to get viewers familiar with the service. In their case, I believe this is the right play.

First of all, AMC’s titles aren’t as well known, especially their originals. Prospective subscribers evaluating Shudder have good reason to be skeptical of shows and movies that they’ve never heard of. With a 7-day trial period, they have enough time to check out some of the originals and scan the list of licensed titles, but not enough time to binge the entire catalog.

Second, their streaming products are designed to serve a smaller, more passionate audience who are already interested in their specific genre. Given the natural selection bias of the people that would be exploring their streaming services in the first place, it makes sense to give them time to explore.

In theory, a niche streaming service should have stronger retention than mainstream streaming services. Since the value proposition is more specific, subscribers have a better idea of what to expect upfront and are less likely to subscribe for a one-off feature or series. The free trial allows AMC to push prospective subscribers over the line, where they have a good chance of retaining them for the long haul.

Can Niche Streaming Actually Work?

Given the rampant competition in streaming, it’s hard to be bullish on new, smaller services. However, subscriber growth is trending in the right direction for AMC. In 2018, the company forecasted 4M streaming subscriptions by 2022, but with recent growth, they’re on track to hit 4M subscribers by the end of 2020.

Their strategy reminded me of a key takeaway from Understanding Michael Porter (Note: Highly recommend this book if you, like me, want to understand Porter’s concepts without reading thousands of pages). Porter believes the most common error in competition is trying to be the best. He considers this mindset to be a self-destructive, zero-sum race to the bottom. Instead, he urges companies to compete to be unique.

As long as AMC continues serving subscribers with high-quality IP, I’m optimistic they’ll continue their recent success. The beauty of the internet is that everybody can find their niche, and there’s no reason that shouldn’t extend to streaming as long as the product is solid.

While it’s unlikely they will grab massive subscription volume for any of their individual streaming services, if AMC can serve each of their niche audiences with unique value, they may just prove that there’s room in streaming for the little guys.

Enjoying Good Better Best?

If you enjoyed this post, I’d love it if you hit the “like” button, that way I’ll know which posts are resonating the most!

If you have thoughts or feedback, I’d love to hear from you! You can find me on Twitter here.