🔻 SaaS Pricing Tracker 🔻

💻 Notion added a toggle to incorporate Notion AI into all plans and price points.

🎥 Vimeo ran a test on two different value metrics: storage vs. videos per plan.

🎚️ Amplitude adjusted plan positioning and added AI-Powered Recommendations.

🔍 Algolia revised its pricing page copy and design, and added new AI features.

🪟 Miro added videos to the description of two plans.

PS. I spotted these updates using PricingSaaS. Try it for free to track competitors and stay ahead of the curve.

Welcome new subscribers, and happy Friday!

This post is the first in a 4-part series with the team at Maple Street Advisors, so buckle up.

I met Pat Meegan during my time at ProfitWell, and we’ve kept in touch ever since. Pat and the Maple Street team work with PE-backed SaaS companies to optimize their pricing strategy.

Our goal with this series is to provide a go-to guide for pricing research from data collection through implementation. We’re breaking the posts down as follows:

Guide to Pricing Research, Part I (Externally Sourced Data)

Guide to Pricing Research, Part II (Internally Sourced Data)

How to Turn Insights into Recommendations

Q&A with to break down Pricing Change Implementation

Today, we’re going to start with externally sourced data, which is one of the most common ways to conduct pricing research. There are many questions to answer around data collection, including:

What questions should I ask?

What survey methodology should I use?

What vendor should I work with?

Importantly, there’s no silver bullet. The most important part of data collection is ensuring you’re gathering data across several axes.

Let’s get to it.

PS. Take the Maple Street Pricing Strategy Assessment to identify pricing opportunities at your company.

Quantitative Research Surveys

Perhaps the most popular way to collect pricing data is through a quantitative market research project. These projects typically take the form of surveys, and can be executed through a range of methodologies. Depending on the methodology you find most appropriate, different vendors may be a better fit.

To start, here are some of the methodologies Pat and I have used most frequently, and how to use them:

Survey Methodologies

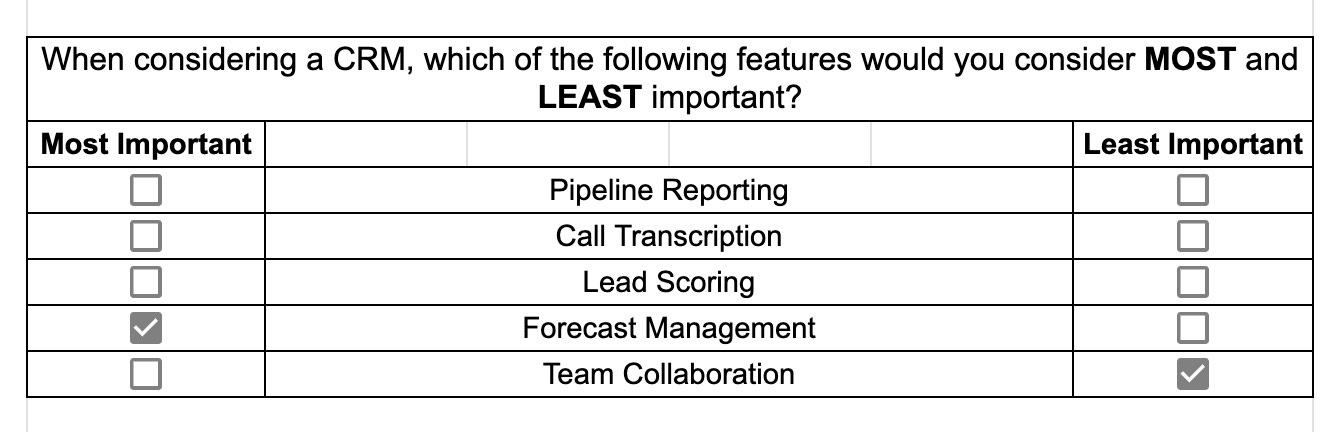

Relative Preference (MaxDiff): Relative Preference questions force a respondent to make tradeoffs to show what they value. These questions can be helpful when looking to innovate your packaging strategy and determine which features are most and least important to your market. Here is an example:

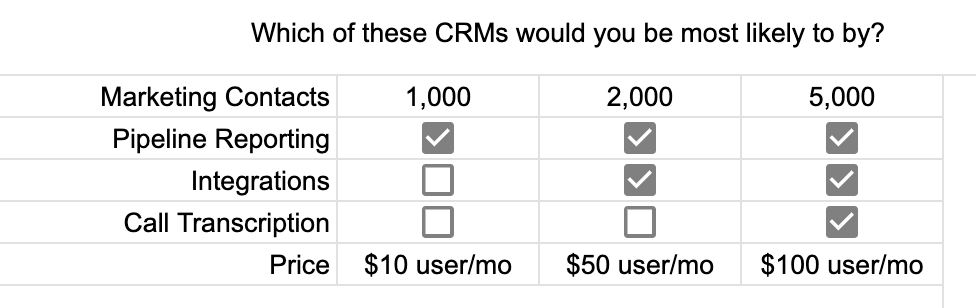

Conjoint: Conjoint analysis is a survey methodology that helps identify what buyers care about by breaking a product down into its features and components, and presenting buyers with different combinations to identify their preferences. Sticking with the CRM example, here’s what that might look like:

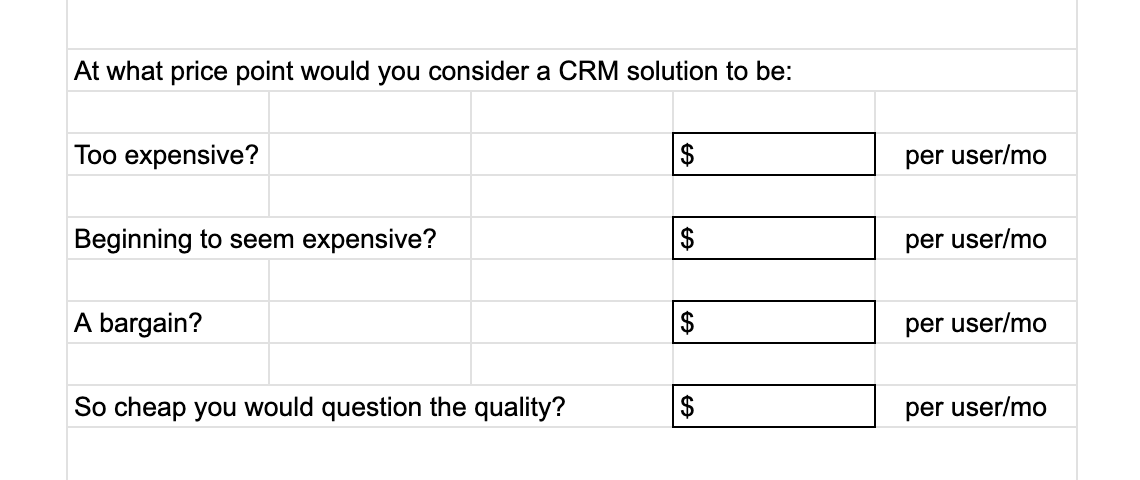

Van Westendorp (Price Sensitivity): VWD is a way to gauge price sensitivity by asking a sequence of four questions that help respondents contextualize price points. The sequence typically looks something like this:

Gabor Granger: GG is a way to measure price sensitivity by asking prospective buyers if they would purchase a product at a specific price, then moving the price up or down based on their response. The process ends once a respondent identifies the highest price they would pay for the product. This is a solid way to gauge pricing sensitivity when you’re not confident in the results you would get from the open-ended nature of VWD.

Depending on your chosen methodologies, you may want to leverage different survey vendors. I recently sampled trusted members of my network, and found that four market research and survey tools popped up most frequently: Qualtrics, QuestionPro, Sawtooth, and Conjointly. Here’s a quick overview of each.

Survey Vendors

Qualtrics: Widely considered the best multi-use platform, but can get pricey. That said, they will discount heavily if you push them. Qualtrics offers lots of flexibility, but their conjoint tools are relatively basic. Since they’re widely considered the market leader, and most customers aren’t looking for much complexity, their support function is pretty basic, and lacks strategic guidance.

QuestionPro: QuestionPro primarily offers “managed panel,” which means a member of their team runs data collection so you don’t have to. In theory, this sounds good, but survey typos and errors can lead to a lengthy QA process. QuestionPro has the same pricing model as Qualtrics, but cheaper. Their support team is also available 24/7 and very responsive. If you’re strapped for budget, and have less complicated survey needs — QuestionPro is a solid option.

SawTooth: Arguably the most robust conjoint platform, SawTooth can be clunky for MaxDiff and VWD. Conveniently, you can redirect Qualtrics to Sawtooth for conjoint and redirect back to Qualtrics — which many customers do. The support team goes above and beyond, and practically offers lightweight consulting. They’re knowledgeable about both their own tool and survey methodologies, so they can offer ideas in tricky situations.

Conjointly: Conjointly, as is apparent in its name, is an effective tool for Conjoint, but also offers a wide range of methodologies. The platform can save and create multiple scenarios to compare at once, and has solid simulator depth like Sawtooth. Conjointly also makes it easy to collaborate on surveys with your team and clients, similar to Qualtrics.

As hinted above, vendor choice will likely depend on a few factors:

Your product, and what type of methodology makes sense

Your team, and their sophistication running these types of surveys

Your market, and the persona you are looking to reach.

Regardless of the methodologies and vendors you choose, there are some general research design principles to keep top of mind.

Research Design Principles

Reduce Ambiguity: The last thing you want to do after collecting data is try to interpret what the answers actually mean. Using clear language, and asking precise questions is the best way to combat this.

It’s especially easy for ambiguity to creep in with price sensitivity questions.

For example:

❌ How much would you pay per month for this CRM? (ambiguous)

✅ How much would you pay per user per month for this CRM? (precise)

Like to Like Comparison: Similarly, if you’re asking respondents to make choices between features, value propositions, pain points and other preferences, the comparison should make sense. In many pricing studies, the survey compares features. This can go awry when you start comparing features or functionality that have no business being compared against each other.

For instance, if we return to the CRM example, comparing Attribution Reporting to Customer Support in the same question is weird because customers typically don’t need to choose between those two things.

You’d be better off having two different question categories around “Reporting” and “Services,” each with multiple options. An alternative is to use the conjoint methodology, which allows you to capture preferences for these variables within a wider package.

Substantive Samples: Depending where you look, you will likely find different answers for what constitutes a statistically significant sample. If you took a stats course in college, you may remember N=30 as the threshold for statistical significance. When performing quantitative research surveys, you don’t have certainty that the respondents you’re hearing from actually fit your profile. With that in mind, I’d encourage you to add a buffer, and target 30-50 responses for every subset you are looking to collect.

If you are performing direct interviews with customers and prospects that you know fit your profile, I would be comfortable with a smaller sample size. In those circumstances, I’d still try to collect as many responses as possible, but you should be able to derive tangible insights from 10-15 responses.

Survey Fatigue: Survey fatigue is real, and can happen for a number of reasons:

Too many questions

Too much reading and/or poorly worded questions

Poor survey flow

In general, survey fatigue happens when you make respondents work too hard — so make it easy on them. You can do this by using precise language, implementing an intuitive flow to your survey that doesn’t require mental gymnastics, and aiming for a completion time in the 10-12 minute range.

Anonymity vs Branding: This question came up regularly at ProfitWell. Should the survey be branded or anonymous? I lean towards branded because, again, it removes ambiguity. Companies have reputations in the market that influence a prospect’s willingness to pay, and including the brand with the product they’re evaluating helps the respondent give a more honest assessment.

QA Rigorously: Surveys are ripe for human error. I can’t stress the important of QA enough. Spell-check is important, but it’s even more important to pressure-test your survey logic to ensure it will route respondents correctly. At ProfitWell, we would have multiple people test each survey to ensure it was working properly. Missing this step can lead to faulty data, frustrated respondents, and wasted money.

Qualitative Research

Another way to gather pricing insights is through qualitative interviews. The tradeoff here is depth over volume. These conversations will go much deeper than the typical quantitative research survey, but because of that, you won’t be able to reach as many people.

I’ve found qualitative interviews to be a more impactful research method for vertical SaaS companies, enterprise solutions, and organizations that either have a lot of complexity in their sales process, or a difficult target customer to reach through market panels. In any case, I’d recommend complimenting quantitative efforts with a modest sample of qualitative interviews to pressure-test your findings.

Benefits of qualitative interviews include:

Room for Nuance: In a conversation, there’s room for so much more flexibility and nuance than in the course of a survey. This allows you to share context to the questions you’re asking, and gather more granular feedback from the person you’re speaking with.

Deeper Insights: Similarly, qualitative research allows you to get more detailed insights by clarifying answers through follow up questions. While in many cases, you have to take survey responses at face value, qualitative interviews allow you to dig deeper into the underlying motivations behind those responses.

Flexibility: Unlike a survey, qualitative interviews are infinitely flexible. If you find an answer interesting, you can veer off script and continue asking questions on that topic for as long as you like. While you want to maintain some sense of uniformity to ensure you can compare responses, I’d embrace going off script if you sense the answers could reveal meaningful insights.

Validity: Perhaps the biggest benefit of qualitative interviews is that you know exactly who you are talking to, and have full confidence that you are actually getting feedback from a potential customer. One of the weaknesses of quantitative research is that you’re at the mercy of the market panel provider, and it’s not always clear if you’re talking to real prospects. Qualitative interviews are a great hedge against that.

Survey Design

If you have already built out a quantitative research survey, you can repurpose many of those questions for qualitative interviews. That said, one of the biggest benefits of qualitative interviews is the ability to surface nuanced answers, which often arise through open-ended questions. Some key principles to keep in mind:

Talk to the right people: If you’re looking for product feedback, it makes sense to interview users, but when looking to gather pricing learnings, you need to speak with people who actually make spending decisions.

Don’t mention pricing in outreach: Whether you’re interviewing customers or prospects, I’d position the call as a chance to provide feedback on the product, and share perspective on the market. If you’re reaching out to customers, you can likely get a warm intro, but for cold outreach, I would consider language like this:

Hey FIRST NAME,

I head up product at [Your Company]. We want to learn from the best companies in [Your Market], and candidly, [Their Company] is at the top of our list.

I’d love to ask you some questions to better understand what you want out of an [Your Market] solution. I’m not in sales, and promise not to try to push you down our funnel. I’d simply love to get your perspective on the market.

Would you be open to a quick call over the coming weeks?

Questions to ask:

recently shared a bank of questions for these exact types of conversations. It’s a great list, and I’d highly recommend taking a look. The biggest thing I’d encourage is to enter these calls with an open mind and a willingness to go off-script. If you hear an interesting nugget, follow it through, and push for more, by asking “Tell me more about that” or “Can you play that out another beat?”Outsourcing Interviews

In general, I would highly encourage you to conduct qualitative interviews internally. These conversations can reveal important insights, and allow you to get closer to your buyers to understand their needs and values.

That said, if you truly feel your team can’t carve out bandwidth for these interviews, there are partners that can help.

On-Demand Expert Interviews: Gerson Lehrman Group, Tegus, and AlphaSense would be examples of this. GLG has an “insight network” of experts across a wide range of industries, and offers access to these people through qualitative interviews, focus groups, workshops, and discussion panels. They can help surface insights on market dynamics, price metrics across a given market, general price sensitivity sentiment, customer and/or product value drivers, competitor perception, and more.

Outsourced Interviews: CatalystMR would be an example of this. These guys will actually run interviews for you if you code the survey and give them the information they need. They’ve got a manual data collection team to support this data format.

That’s all for today. Thanks for reading! Tune in next time for our guide on using internal data to make pricing decisions.

Whenever you’re ready, there are a few ways I can help you:

PricingSaaS Software: AI-powered pricing alerts for PLG SaaS companies.

PricingSaaS Services: Rapid research and ongoing support for growing SaaS companies.

Pricing Coaching: Schedule a call with me to talk through your pricing challenges and determine the best course of action.