A Guide to Feature Launch Monetization

Plus: GTM moves from Segment, LaunchDarkly, and Streamyard.

Welcome back to Good Better Best.

Today, we’ve got a framework for monetizing features at launch, along with 3 GTM moves from some of the top players in SaaS:

Segment went multi-product

LaunchDarkly consolidated packages

Streamyard removed its pricing page

Let’s get to it!

PS. If you missed it, check out the PricingSaaS Q1 Benchmarks Report to check out the most interest pricing moves in Q1, and patterns in AI and usage-based pricing.

Sit Down with a True Pricing Expert

Today’s post is brought to you by Blue Rocket, a boutique pricing consultancy that works with some of the biggest players in SaaS.

Blue Rocket is led by Jason Kap, a SaaS pricing legend who spent 12 years leading pricing and licensing at Microsoft.

Jason has been generous enough to offer his time to let GBB readers:

Share specific pricing challenges and desired goals

Get feedback from someone who has transformed pricing at scale

Learn more about Blue Rocket’s pricing transformation philosophy

Having seen Jason’s work firsthand, I can’t recommend this enough.

A Guide to Feature Launch Monetization

One of our deeply held beliefs at PricingSaaS is that any feature launch should consider pricing in lockstep.

In his career as a CPO, John fell in love with the intersection of pricing and product. As a pricing consultant, I loved helping SaaS leaders monetize new products and fix poor pricing for existing products. Our mutual interest in solving this problem is why PricingSaaS exists.

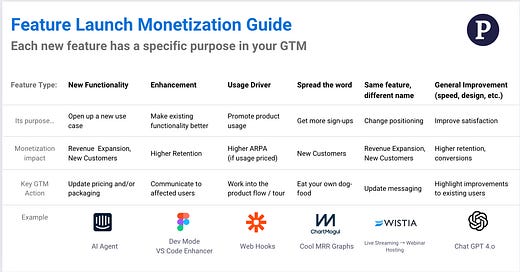

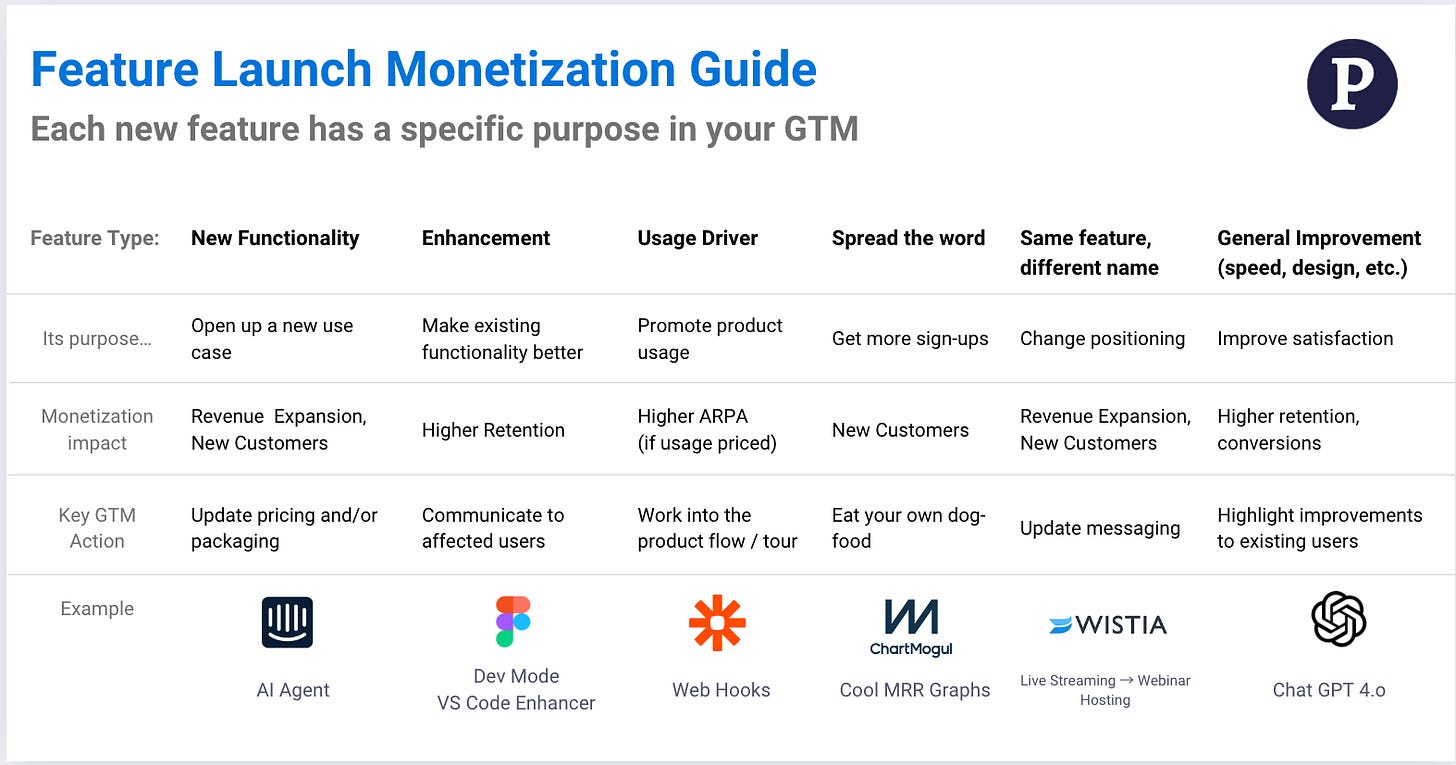

Below, we’ve created a simple framework for releasing various feature types, along with the purpose, impact on monetization, and key GTM action involved.

If you would like more frameworks and guides like this one, shoot me a DM and let me know what topics would be most interesting to you.

📆 This week in SaaS GTM

1️⃣ Segment went multi-product [view update]

Segment revised its pricing page to direct to two different products:

Connections

CDP (Customer Data Platform)

From a high-level, Connections is a product for engineers allowing them to track and organize events across 400+ apps. CDP allows marketers to view a holistic customer profile, segment audiences, and craft workflows to drive value from this data.

These two personas are quite different. Developers notoriously hate talking to sales. Segment clearly understands this, and offers freemium options for Connections. CDP, on the other hand, is purely sales-led.

Making the pricing page multi-product allows Segment to tailor the right experience to each persona, and benefit from bundle economics if folks are interested in both. Bundling in B2B lends itself to a Sales-Led approach, and unsurprisingly, ~40% of LinkedIn members who work for Segment are in a Sales role.

2️⃣ LaunchDarkly simplified their packaging [view update]

On first glance at this update, it seems LaunchDarkly introduced a Freemium plan, however — they offered the ability to get started for free previously.

What they really did is consolidated two plans: Starter ($8/mo) and Pro ($16/mo) into a single plan called Foundation ($12/mo).

I like this move for a few reasons:

Previously, there wasn’t a huge difference between features and usage on the Starter and Pro plans.

I’m skeptical there was a notable difference in the customer cohorts who bought each, and the positioning for each plan reflects that.

The Freemium plan has hard usage limits, which are much easier to see on the pricing page now.

Lastly, LaunchDarkly is used by engineers, who (once again) generally don’t like talking to sales reps. Putting PLG front and center makes a ton of sense, and each plan has a clear persona and purpose going forward.

3️⃣ Streamyard removed its pricing page [view update]

Bold move! Streamyard now has a collection of product pages, with CTAs scattered throughout, encouraging visitors to get started for free.

Streamyard offers a bunch of use cases, and a live-streaming user may have a different willingness to pay than a customer using it primarily for webinars. In theory, this could build an argument for use-case specific pricing.

The challenge is that use-case specific pricing usually requires salespeople, and Streamyard has a 3:1 ratio of Engineering to Sales headcount (at least on LinkedIn). For now, it seems they’re using the website exclusively to drive new users into their free funnel — I’ll be watching to see what they do next.

PS. If you work at Streamyard, there’s a link on the Business page pointing to the plans page, which no longer exists.

Thanks for tuning in and see you next week!

Good Better Best is a weekly newsletter that reaches 5,500 SaaS leaders, operators, and investors. Shoot me a note if you are interested in reaching our audience.